Global Biodegradable Packaging Market to Hit USD 178.0 Billion by 2033 | IMARC Group

Global Biodegradable Packaging Market Statistics, Outlook and Regional Analysis 2025-2033

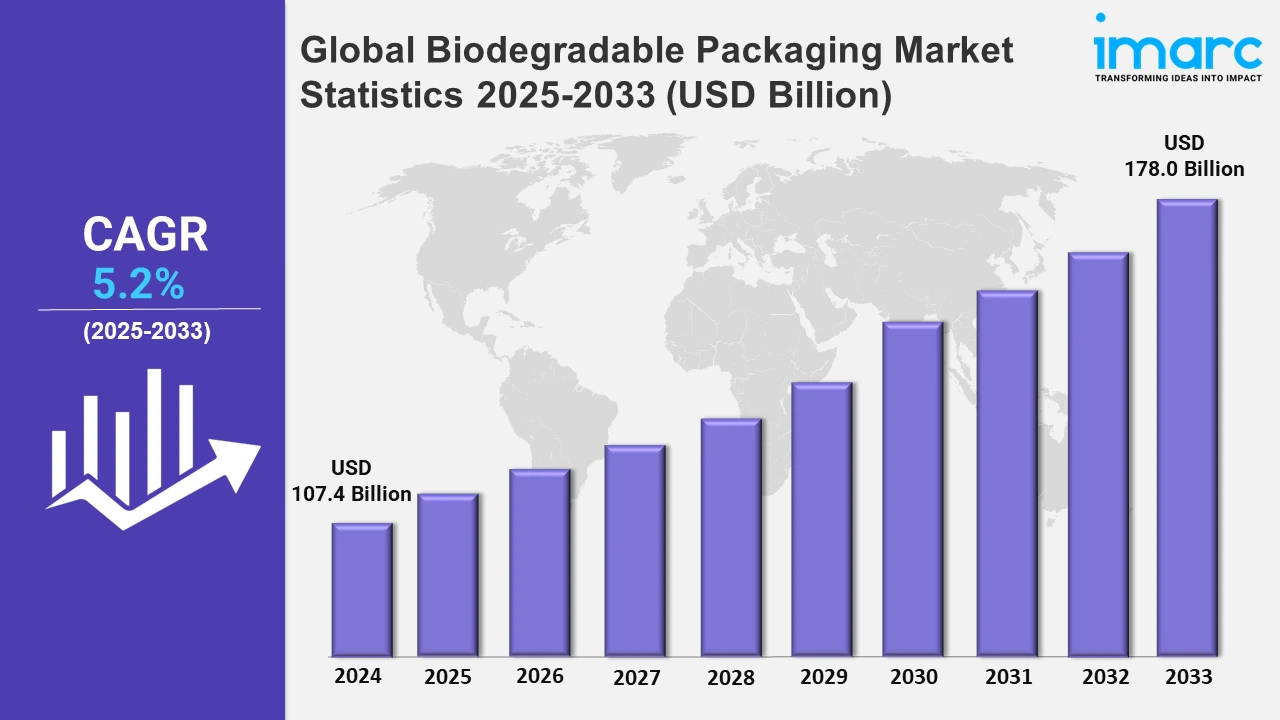

The global biodegradable packaging market size was valued at USD 107.4 Billion in 2024, and it is expected to reach USD 178.0 Billion by 2033, exhibiting a growth rate (CAGR) of 5.2% from 2025 to 2033.

To get more information on the this market, Request Sample

Sustainability has become part of the assessment criteria of retail organizations, frequently becoming a crucial consideration alongside pricing and quality. As a result, manufacturers find themselves in a position where using biodegradable packaging is no longer a choice but a need for market survival. One of the most important driving reasons is the increase in retailer demand for ecologically friendly packaging. According to a McKinsey & Company poll from 2021, 60% of customers prioritize sustainability in their purchase decisions, with more than 70% prepared to pay more for sustainable packaging. Similarly, in September 2024, Power Adhesives announced the launch of its biodegradable hot melt adhesive, said to be a ‘world first’ and designed for use by cartons, corrugated packaging, point of sale (POS) converters, and contract packers.

Moreover, personal care companies are increasingly using biodegradable ingredients and recyclable packaging in response to customer demand for sustainability. This trend stresses biodegradable components and renewable resources, in line with eco-friendly methods to decrease waste, extend product life cycles, and promote environmental goals in the personal care industry. For example, according to a 2022 Global Web Index (GWI) survey, 59% of worldwide customers choose personal care goods with sustainable or environmentally friendly packaging, particularly in North America and Europe. For instance, in August 2024, Colgate-Palmolive relaunched its bamboo toothbrush featuring a compostable handle that is 100% natural and biodegradable, made from sustainably grown bamboo, and comes in a recyclable paper-based tub and lid packaging. Furthermore, dairy manufacturers are increasingly using eco-friendly packaging to suit customer demand for sustainability. This trend includes technologies such as recyclable, biodegradable, and in-mold labeling (IML) alternatives that decrease plastic waste, improve recyclability, and minimize environmental effects, bringing dairy packaging into accordance with worldwide environmental standards and preferences. For example, in August 2024, Khyber Agro Pvt Ltd, a leading name in Kashmir’s dairy industry, unveiled its new 1 kg curd product in eco-friendly IML Bucket packaging. The biodegradable bucket packaging represents a key innovation aimed at reducing plastic waste, combining convenience for consumers with environmental responsibility.

Global Biodegradable Packaging Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa.

According to the report, Europe accounted for the largest market share due to the strict laws enacted against single-use plastics and other non-biodegradable materials.

North America Biodegradable Packaging Market Trends:

North America’s leading companies are increasingly turning to biodegradable solutions due to consumer and government regulations. For example, Starbucks and McDonald's are including biodegradable straws and packaging in response to California's stringent plastic reduction rules, which require a reduction in single-use plastic.

Asia-Pacific Biodegradable Packaging Market Trends:

Government restrictions on plastic are accelerating the introduction of biodegradable packaging in the Asia-Pacific region. China's prohibition on single-use plastics in key cities has led e-commerce giants such as Alibaba to employ biodegradable materials, which comply with the region's stringent environmental standards.

Europe Biodegradable Packaging Market Trends:

EU measures, such as the Circular Economy Action Plan, establish a strategic framework that promotes sustainable packaging. Consumer awareness and campaigning for environmental sustainability are extremely high in this region, enabling a favorable climate for market expansion. For example, in July 2024, Mondi Group, a prominent leader in sustainable packaging and paper, launched the latest addition to its popular portfolio of sustainable pre-made plastic bags, i.e., FlexiBag Reinforced, a range of innovative mono-PE-based and recyclable packaging solutions.

Latin America Biodegradable Packaging Market Trends:

In Latin America, rising environmental awareness and government measures promote sustainable packaging. Natura Cosmetics in Brazil employs biodegradable packaging as part of the "Green Protocol," which supports environmentally friendly retail practices to fulfill the rising demand for sustainable products.

Middle East and Africa Biodegradable Packaging Market Trends:

Environmental initiatives and policies promote alternatives to conventional plastic in the Middle East and Africa. Its "Single-Use Plastic Policy" has prompted shops such as Carrefour to implement biodegradable alternatives, addressing both governmental requirements and customer preferences for less plastic waste.

Top Companies Leading in the Biodegradable Packaging Industry

Some of the leading biodegradable packaging market companies include Amcor Plc, Berkley, BioPak, Ecovative Design LLC, Elevate Packaging, International Paper Company, Kruger Inc., Mondi plc, Ranpak, Smurfit Westrock plc, Tetra Pak International S.A., and Vegware Ltd, among many others. For example, in August 2023, Amcor PLC announced the North American introduction of curbside recyclable AmFiber Performance Paper packaging, which is part of the company's AmFiber range. How2Recycle has prequalified performance paper and satisfies the reliability criteria for curbside recycling, allowing companies to give customers more sustainable end-of-life packaging options.

Global Biodegradable Packaging Market Segmentation Coverage

- On the basis of the material type, the market has been bifurcated into plastic (starch-based plastics, cellulose-based plastics, polylactic acid (PLA), poly-3-hydroxybutyrate (PHB), polyhydroxyalkanoates (PHA), and others) and paper (kraft paper, flexible paper, corrugated fiberboard, and boxboard), wherein paper represents the most preferred segment. The paper segment is primarily driven by rising customer demand for environmentally friendly packaging options. Regulatory actions, such as the prohibition on single-use plastics, have pushed the industry toward paper-based substitutes.

- Based on the application, the market is categorized into food packaging, beverage packaging, pharmaceutical packaging, personal/homecare packaging, and others, amongst which food packaging dominates the market. In the food packaging industry, safety concerns about food contamination from non-biodegradable materials have increased the requirement for biodegradable packaging.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 107.4 Billion |

| Market Forecast in 2033 | USD 178.0 Billion |

| Market Growth Rate 2025-2033 | 5.2% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Material Types Covered |

|

| Applications Covered | Food Packaging, Beverage Packaging, Pharmaceutical Packaging, Personal/Homecare Packaging, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Amcor Plc, Berkley, BioPak, Ecovative Design LLC, Elevate Packaging, International Paper Company, Kruger Inc., Mondi plc, Ranpak, Smurfit Westrock plc, Tetra Pak International S.A., Vegware Ltd, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)