Global Biochar Market Expected to Reach USD 6.3 Billion by 2033 - IMARC Group

Global Biochar Market Statistics, Outlook and Regional Analysis 2025-2033

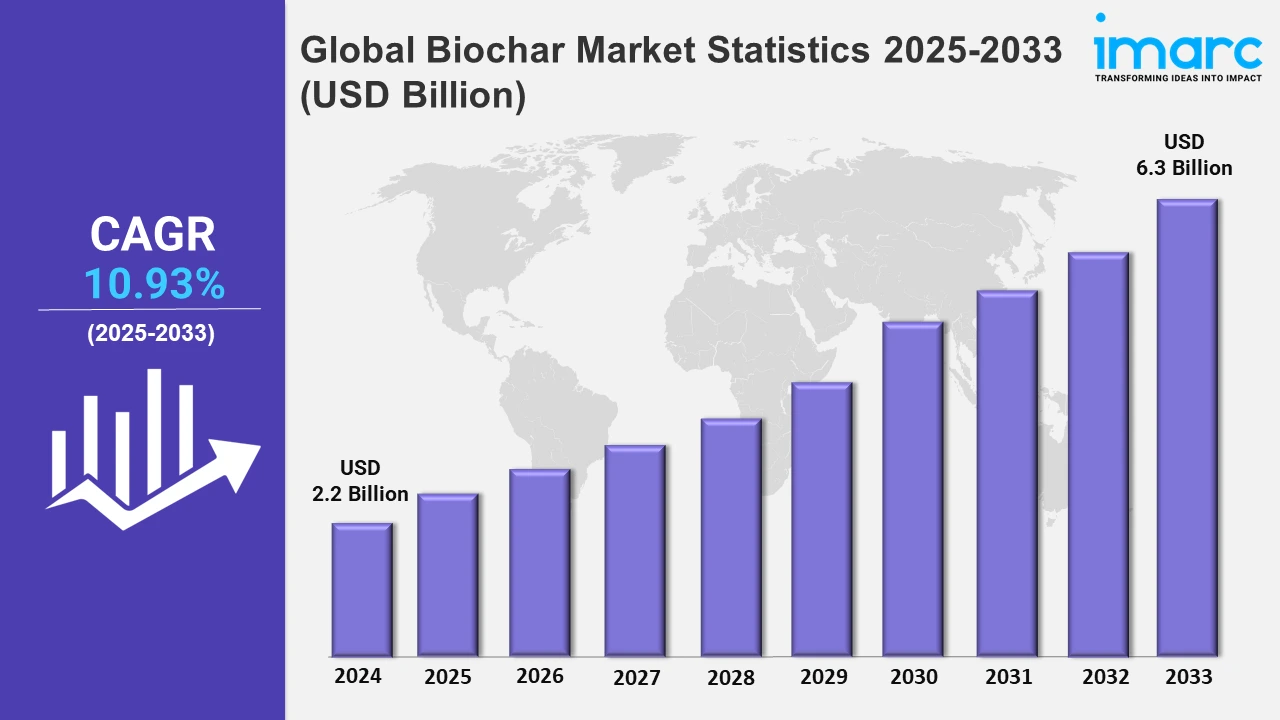

The global biochar market size was valued at USD 2.2 Billion in 2024, and it is expected to reach USD 6.3 Billion by 2033, exhibiting a growth rate (CAGR) of 10.93% from 2025 to 2033.

To get more information on this market, Request Sample

The biochar market is experiencing prominent growth because of increasing demand for sustainable agricultural practices and carbon removal technologies. In addition, it is produced through pyrolysis of organic waste, which has enhanced soil health and improved crop productivity. Governments and private entities globally are advocating for biochar applications, especially in agriculture, due to their potential to generate additional revenue streams through carbon credits. In India, Samunnati's launch of a Carbon Incubator Facility in September 2024 exemplifies this trend. This facility empowers Farmer Producer Organizations (FPOs) to integrate biochar projects, promoting sustainable farming by transforming farm residues into soil-enhancing carbon, thus contributing to enhanced crop yields and creating an income avenue through carbon credits. Such initiatives align with the global push towards sustainable practices in the agricultural sector, further accelerating biochar adoption among smallholder farmers.

Moreover, large-scale biochar production facilities are supporting significant carbon removal goals worldwide. For instance, in October 2024, BluSky Carbon Inc. commenced biochar production at its Warren, Arkansas facility, AR1, under a US$ 105 Million, ten-year supply agreement. Equipped with Vulcan Heavy pyrolysis units, AR1 is set to produce 40,000 tons of biochar annually, underscoring the growing commitment to carbon reduction. Meanwhile, this large-scale facility enables BluSky to cater to the rising demand for biochar as a tool for achieving carbon neutrality. Parallel developments in Europe demonstrate a strategic approach to enhancing biochar adoption. In September 2024, a German climate tech firm introduced a comprehensive support service for biochar-based CO2 removal projects, collaborating with digital monitoring, reporting, and verification firms to streamline carbon dioxide removal solutions across the continent. Furthermore, these initiatives reflect Europe’s dedication to integrating advanced digital support systems, thereby enabling biochar projects to contribute meaningfully to carbon reduction goals. This alignment of agricultural innovation, government policy support, and digital technology integration is setting the biochar market on a path to becoming a pivotal player in the global carbon removal ecosystem.

Global Biochar Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America. According to the report, North America accounted for the largest biochar market share, driven by its robust focus on sustainable practices and advanced technological capabilities. Overall, these efforts align with regional policies that prioritize carbon capture technologies, thereby securing North America's leadership in the market.

North America Biochar Market Trends:

The region's emphasis on carbon-neutral initiatives has positioned biochar as a valuable solution for carbon sequestration in North America. Also, strategic collaborations between corporations and environmental agencies amplify this growth. For instance, in May 2024, SUEZ and First Climate partnered with Microsoft on a three-year contract in North America, supplying 36,000 biochar carbon removal credits. This biochar, produced by Carbonity from forest residues, highlights North America's commitment to sustainable carbon storage solutions. This reflects the region's proactive stance in reducing carbon emissions while fostering innovation.

Europe Biochar Market Trends:

The market in Europe for biochar is witnessing strong growth due to its integration in sustainable agriculture practices and carbon reduction initiatives. With growing governmental support, especially in Germany and France, biochar is being widely used to improve soil health and enhance crop yields. For instance, German farmers are increasingly adopting biochar to reduce soil emissions, boosting demand in the agricultural sector.

Asia Pacific Biochar Market Trends:

The market in Asia Pacific for biochar is driven by increased awareness of soil health and the need for sustainable waste management. Countries like China and Japan are promoting biochar to counter soil degradation and boost agricultural productivity. For example, China is exploring biochar's use in organic farming, which helps retain soil nutrients and supports environmental sustainability.

Middle East and Africa Biochar Market Trends:

In the Middle East and Africa, biochar's role in combating soil salinity and water retention challenges is growing. With arid climates, countries like Israel are researching biochar's ability to retain moisture, crucial for agriculture in water-scarce areas. This trend showcases biochar’s potential to enhance crop resilience in challenging environments.

Latin America Biochar Market Trends:

In Latin America, the market is driven by deforestation concerns and efforts to restore degraded land. Brazil and Argentina, in particular, are integrating biochar into forestry and agricultural practices to increase soil fertility and store carbon. For example, biochar is being utilized in Brazil to revitalize soil post-deforestation, enhancing sustainability and supporting reforestation efforts.

Top Companies Leading in the Biochar Industry

Some of the leading biochar market companies include Agri-tech Producers, Diacarbon Energy Inc., Cool Planet, Pacific Biochar, Phoenix Energy, Biomacon GmbH, Vega Biofuels, Terra Char, Avello Bioenergy, Genesis Industries, Interra Energy Services, Element C6, Carbon Gold Ltd., and Biochar Solution Ltd., among many others. In February 2024, Pacific Biochar was recognized as the global leader in durable carbon removal deliveries, as per CDR.FYI’s 2023 report. The company contributed 21% of the total global volume for durable carbon removal, achieving the highest ranking across all categories, including biochar.

Global Biochar Market Segmentation Coverage

- On the basis of the feedstock type, the market has been bifurcated into woody biomass, agricultural waste, animal manure, and others, wherein woody biomass represents the most preferred segment. It is driven by the forestry industry's byproducts, such as logging residues and wood processing waste. Sustainable forestry practices also contribute to the abundance of woody biomass, thereby making it a preferred choice for biochar production.

- Based on the technology type, the market is categorized into slow pyrolysis, fast pyrolysis, gasification, hydrothermal carbonization, and others, amongst which slow pyrolysis dominates the market. This method is favored for its capability to maximize carbon retention and minimize emissions, which makes it environmentally friendly. Slow pyrolysis benefits from its adaptability to various feedstock types, including woody biomass and agricultural waste, offering a wide range of applications in soil improvement.

- On the basis of the product form, the market has been divided into coarse and fine chips, fine powder, pellets, granules and prills, and liquid suspension. These larger-sized particles are gaining traction owing to their suitability for soil improvement and mulching in agriculture and landscaping.

- Based on the application, the market is bifurcated into farming, gardening, livestock feed, soil, water and air treatment, and others, wherein farming dominates the market. This is fueled by the need for sustainable agriculture practices. Biochar enhances soil fertility, nutrient retention, and water-holding capacity, resulting in improved crop yields and reduced fertilizer requirements.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 2.2 Billion |

| Market Forecast in 2033 | USD 6.3 Billion |

| Market Growth Rate 2025-2033 | 10.93% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Feedstock Types Covered | Woody Biomass, Agricultural Waste, Animal Manure, Others |

| Technology Types Covered | Slow Pyrolysis, Fast Pyrolysis, Gasification, Hydrothermal Carbonization, Others |

| Product Forms Covered | Coarse and Fine Chips, Fine Powder, Pellets, Granules and Prills, Liquid Suspension |

| Applications Covered | Farming, Gardening, Livestock Feed, Soil, Water and Air Treatment, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Agri-tech Producers, Diacarbon Energy Inc, Cool Planet, Pacific Biochar, Phoenix Energy, Biomacon GmbH, Vega Biofuels, Terra Char, Avello Bioenergy, Genesis Industries, Interra Energy Services, Element C6, Carbon Gold Ltd, Biochar Solution Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Biochar Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)