Global Biobanking Market Expected to Reach USD 101.1 Billion by 2033 - IMARC Group

Global Biobanking Market Statistics, Outlook and Regional Analysis 2025-2033

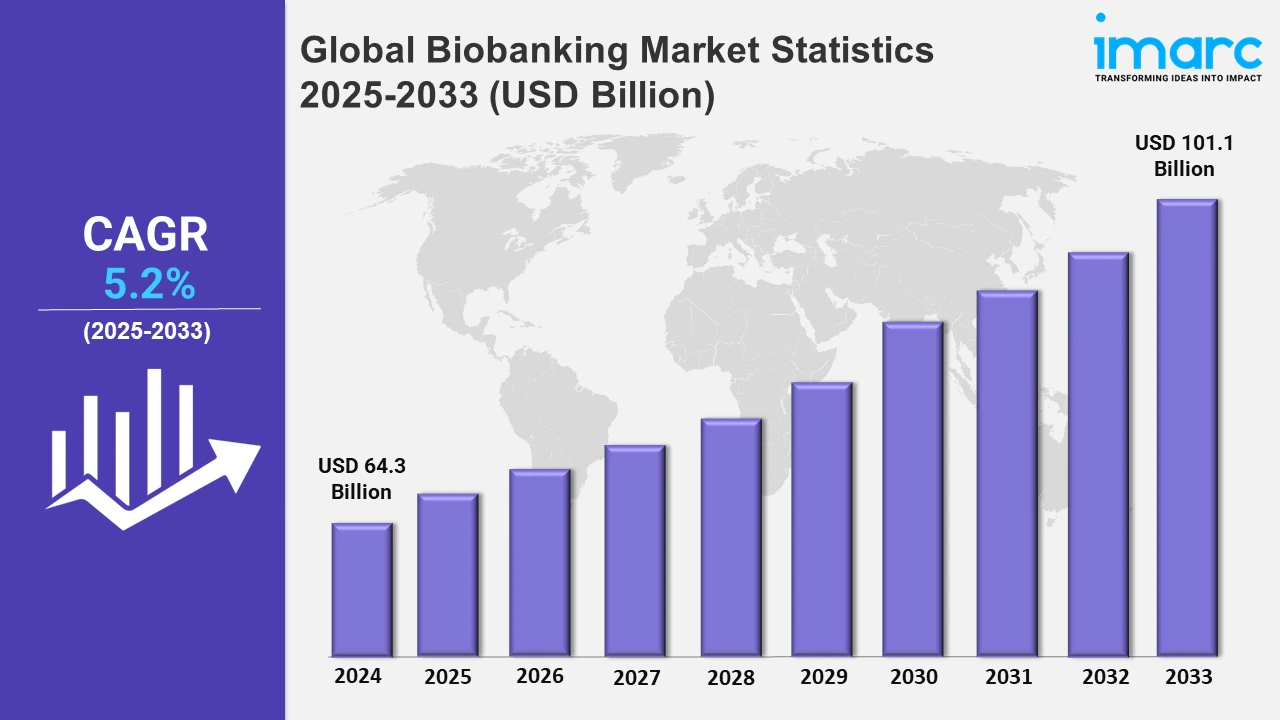

The global biobanking market size was valued at USD 64.3 Billion in 2024, and it is expected to reach USD 101.1 Billion by 2033, exhibiting a growth rate (CAGR) of 5.2% from 2025 to 2033.

To get more information on this market, Request Sample

Recently, infectious illnesses and chronic conditions including heart disease, cancer, and diabetes are becoming more common worldwide, which is creating the need for research into their causes, progression, and potential treatments. It has been revealed by industry estimates that the United States lose nearly 944,800 Americans lives to heart disease and stroke every single year. The country also receives around 1.7 million cancer diagnosis of American citizens each year which claims the lives of over 600,000 people. This data has increased the need for proper knowledge of the cause leading to the diseases. Thus, there is a hike in demand for biobanks that provide this research by offering large collections of biological samples, essential for understanding the genetic, environmental, and lifestyle factors contributing to chronic diseases. By using biobanks to collect and analyze diverse genetic data, researchers can identify specific genetic variations linked to diseases, allowing for more accurate diagnosis, prognosis, and treatment plans. Additionally, as medical professionals realize the importance of genetic information in predicting disease outcomes, biobanks become an indispensable tool in clinical settings.

There is a rising focus from the patients as well as from healthcare organizations towards more personalized medicine, which involves modifying medical therapy based on individual genetic, environmental, and lifestyle characteristics. This technique depends primarily on large, diverse, and well-managed biobanks that contain human biological samples, including DNA, tissue, and blood, for research into medication response, genetic biomarkers, and disease susceptibility. The requirements for better biological samples are increasing with the industry's transition towards precision medicine in the healthcare sector. For instance, as part of the initiative "Healthy China 2030," China plans to spend RMB 60 billion (approximately JPY 1.1 trillion) on precision medicine through 2030. For biobanks to share well-documented patient samples with academics and pharmaceutical companies, these enable them to produce personalized medicines that are safer and more effective than traditional ones that apply the one size fits all principle. For instance, OM1 launched its new AI-based platform in April 2023 to provide personalized information regarding clinical trials, use, risk, treatment, and diagnosis. The platform Dubbed PhenOM has been calibrated using OM1’s longitudinal health history database that included data from over 300 million patients.

Global Biobanking Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Europe accounted for the largest market share on account of its robust biobanking infrastructure, significant government and industry investments, and strong regulatory standards.

Europe Biobanking Market Trends:

The Europe biobanking market is driven due its robust academic-industry partnerships, government-funded biobank projects, and well-established healthcare infrastructure, Europe leads the world's biobanking market. Several financing programs of the EU is directing nearly €60 billion to innovation, prevention, healthcare infrastructure, and health digitization by 2027. Nations like Sweden, Germany, and the United Kingdom also have extensive biobank networks that house large, sophisticated biobanks which are focused on genetics, chronic disease research and individualized treatment planning. Also, the countries have a strict regulatory structure to guarantee that standards are met in all the collections, storage, and usage of samples. The country has also made major investments in biotechnology and pharmaceutical research and development (R&D) to support its leadership in biobanking services.

North America Biobanking Market Trends:

North America is a prominent market due to advanced healthcare systems, high adoption of biobank-supported genomic research, and substantial investments in biotechnology. The U.S. is a leading market in the region, supported by its extensive pharmaceutical R&D ecosystem and demand for precision medicine.

Asia-Pacific Biobanking Market Trends:

The Asia Pacific market is growing rapidly, driven by increasing healthcare investments, rising prevalence of chronic diseases, and advancements in genomic research. Countries like China, Japan, and India are expanding biobanking infrastructure, focusing on genetic diversity for global research initiatives.

Latin America Biobanking Market Trends:

Latin America is emerging as a potential market, with increasing government and private sector initiatives to establish biobanks. The region’s focus lies in rare disease studies and improving healthcare accessibility to advance medical research.

Middle East and Africa Biobanking Market Trends:

The Middle East and Africa biobanking market is gradually expanding, supported by improving healthcare systems and growing awareness of biobanking’s role in disease management. Efforts in UAE and South Africa are notable for their focus on genetic research in diverse populations.

Top Companies Leading in the Biobanking Industry

Some of the leading biobanking market companies Brooks Automation Inc., Bay Biosciences LLC, Boca Biolistics, Ctibiotech, Cureline Inc., Firalis, Greiner Bio-One International GmbH, Hamilton Company, Merck KGaA, ProteoGenex Inc., Thermo Fisher Scientific Inc., and VWR Corporation (Avantor Inc.), among many others.

- In June 2024, CTIBIOTECH initiated a new project, SAFESKIN3D, with the collaboration of SANOFI. The initiative produces flexible 3D bioprinted human skin models, comprising epidermis, dermis, hypodermis, and muscle layers, to predict the reactogenicity of vaccines, especially the new generation of messenger RNA (mRNA) vaccines.

Global Biobanking Market Segmentation Coverage

- On the basis of the specimen type, the market has been categorized into blood products, solid tissue, cell lines, nucleic acid, and others, wherein blood products represent the leading segment. They are extensively employed in a number of industries, such as genetic research, pharmaceutical development, and illness diagnosis. They are a popular option for biobank repositories because they are simpler to collect, store, and process than other specimen kinds.

- Based on the biobank type, the market is bifurcated into population-based biobanks and disease-oriented biobanks, amongst which disease-oriented biobanks dominate the market. In the era of precision medicine, they are vital for researching the causes of diseases and creating tailored treatments. The increasing need for research on uncommon and chronic diseases is fulfilled by their emphasis on gathering and examining disease-specific samples.

- On the basis of the application, the market has been divided into therapeutics and research. Among these, research accounts for the majority of the market share. The extensive use of biobanked samples in genomics, drug discovery, and translational medicine is responsible for its leading share. The need for biobank-supported investigations is further fueled by rising public and commercial sector financing for medical research.

- Based on the end user, the market is segregated into academic institutions and pharma and biotech companies. Among these, academic institutions account for the majority of the market share. Since biobanks are essential to the advancement of both fundamental and applied medical research, they are significant users. These organizations depend on biobank components to fund clinical trials, epidemiology, and genetics research.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 64.3 Billion |

| Market Forecast in 2033 | USD 101.1 Billion |

| Market Growth Rate 2025-2033 | 5.2% |

| Units | Billion USD |

| Segment Coverage | Specimen Type, Biobank Type, Application, End User, Region |

| Region Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Brooks Automation Inc., Bay Biosciences LLC, Boca Biolistics, Ctibiotech, Cureline Inc., Firalis, Greiner Bio-One International GmbH, Hamilton Company, Merck KGaA, ProteoGenex Inc., Thermo Fisher Scientific Inc. and VWR Corporation (Avantor Inc.) |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Biobanking Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

.webp)

.webp)