Global Bio-Implants Market Expected to Reach USD 265.4 Billion by 2033 - IMARC Group

Global Bio-Implants Market Statistics, Outlook and Regional Analysis 2025-2033

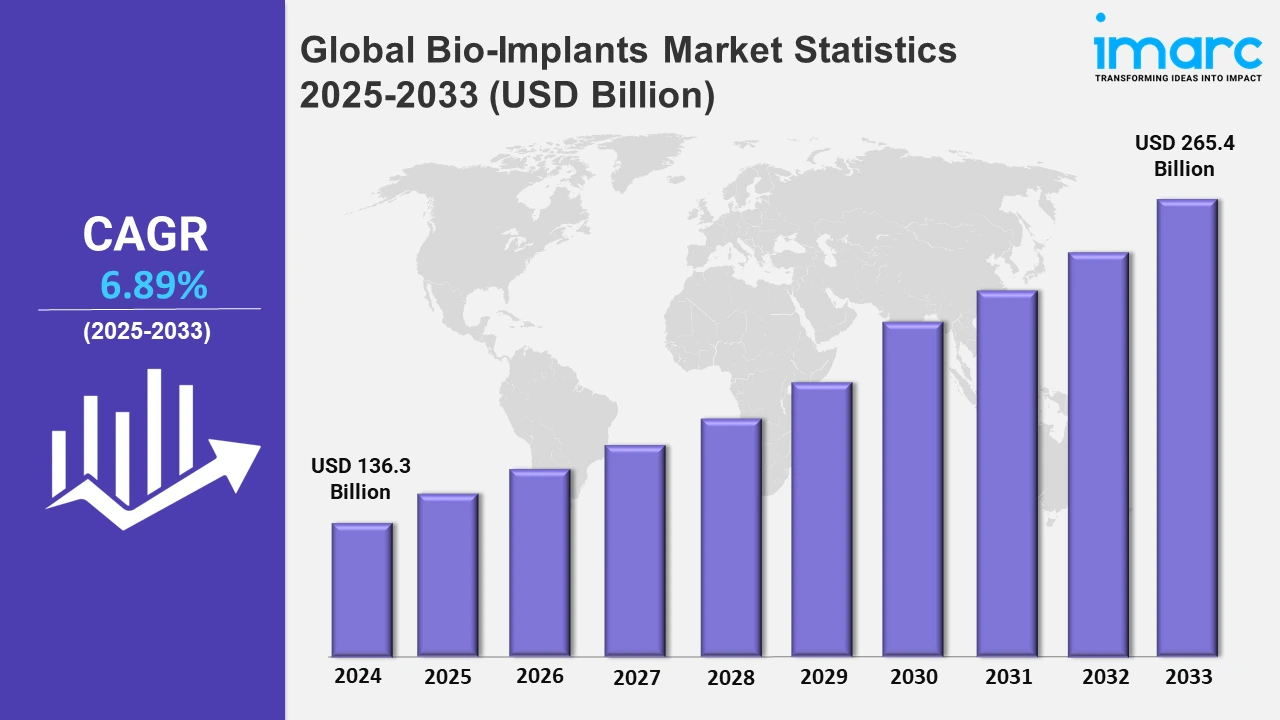

The global bio-implants market size was valued at USD 136.3 Billion in 2024, and it is expected to reach USD 265.4 Billion by 2033, exhibiting a growth rate (CAGR) of 6.89% from 2025 to 2033.

To get more information on this market, Request Sample

The bio-implants market is driven by the increasing aging global population, a growing incidence of chronic diseases, and upgradation in medical technology. With an aging world, the demand for bio-implants, such as orthopedic, dental, and cardiovascular implants, grows steadily. Older patients are more liable to diseases such as degenerative joint disorders, fractures, and tooth disorders all of which necessitate implants to regain normal functions. Projections by the United Nations show that the percentage of population aged 60 years and above will double between 2024 and 2074, increasing to 20.7%. In the same years, population aged over 80 will grow by more than threefold. This demographic shift will greatly increase the demand for bio-implants, as older populations are more likely to have surgery involving implants. Similarly, the increased prevalence of chronic diseases, including cardiovascular disease, diabetes, and osteoarthritis, is increasing the demand for surgical interventions involving implants.

In addition, technological innovations in biomaterials, like titanium, ceramics, and bioresorbable polymers, have led to more durable and biocompatible implants with better patient results and reduced chances of complications. This way to new materials along with innovative designs represents an important direction in the growth of the market. With the growth in minimally invasive surgeries, there is an increasing demand for specific implants such as stents and pacemakers, which are used with smaller and more accurate devices. This move toward less invasive procedures has appealed to both healthcare providers and patients due to quicker recovery times and decreased risk of infection. In addition to these drivers, key trends shape the bio-implants market. One of the trends here is the use of 3D printing technology in implant manufacture, where very customized and patient-specific implants have been introduced, especially within orthopedic and dental application contexts. This will offer a perfect fit in every subject's case, thus providing a better outcome of surgeries in general. At the same time, smart technologies are being integrated into implants. Smart bio-implants have sensors that can monitor health parameters, transmit data to healthcare providers, and even adapt to the condition of the patient, meaning more personalized and responsive care. Another trend is an increased focus on regenerative medicine, where bio-implants are being developed in support of tissue regeneration - bone or cartilage growth, for example. This kind of implant helps trigger natural healing, reducing surgery repetitions and improving long-term outcomes. This is also expanding healthcare access in emerging economies, thus resulting in market growth as more patients get access to advanced implant technologies.

Global Bio-implants Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America; Asia-Pacific; Europe; Latin America; and the Middle East and Africa. According to the report, North America accounted for the largest market share due to its advanced healthcare infrastructure, which supports the adoption of innovative medical technologies like bio-implants and their integration into clinical practice.

North America Bio-implants Market Trends:

The North America bio-implants market is growing steadily due to the advances in technology, the growing population of the elderly, and an increased number of patients suffering from chronic conditions such as cardiovascular diseases, arthritis, and osteoporosis. According to the American Heart Association, the prevalence of coronary disease, heart failure, stroke, atrial fibrillation, and total cardiovascular disease is likely to grow during 2050 while clinical cardiovascular disease is expected to affect 45 million adults, and more than 184 million adults are affected by CVD, including hypertension with a percentage of over 61% in the population. The United States dominates the market due to its advanced healthcare infrastructure, huge research investments, and an important presence of leading medical device manufacturing companies. Innovations such as 3D printing and biocompatible materials allow for the development of bespoke and more effective implants and thus increase adoption rates. The focus on bio-minimally invasive treatments within Canada and access of people to health services are significantly affecting the growth of market trends. The support for reimbursement schemes is also augmenting the uptake of bio-implants. With increasing traveling cases for medical tourism around special procedures in dental implants, orthopedic implants, or cardiac implants, North America puts a premium on regulating policies that make bio-implants of the best possible quality and safety, thereby catapulting the market toward further development.

Asia Pacific Bio-implants Market Trends:

The Asia Pacific bio-implants market is growing, due to chronic diseases and geriatric patient population are increasingly prevailing here. More expenditure in the healthcare sector with increasing access to better health infrastructure in China and India contributes to this. A better region in terms of progress, especially in technology aspects for bio-implant technologies, such as 3D printing and biocompatibility of materials. Growing medical tourism, especially in the orthopedic and dental sectors, adds more strength to the market. A positive government initiative and the presence of the emergence of local manufacturers also play a significant role in developing the bio-implants industry in the region quickly.

Europe Bio-implants Market Trends:

The market in Europe is highly inclined toward advanced implant technologies, along with increasing awareness about minimally invasive procedures. The region benefits from robust healthcare infrastructure and significant investment in research and development, particularly in countries like Germany and the UK. Regulatory support for biocompatible and innovative materials fosters market growth. Rising cases of orthopedic and cardiovascular conditions, coupled with an aging population, fuel demand. Additionally, collaborations between leading medical device manufacturers and healthcare providers drive the adoption of sophisticated bio-implant solutions in Europe.

Latin America Bio-implants Market Trends:

The Latin America bio-implants market is growing in line with the increasing access to healthcare and a growing prevalence of lifestyle-related conditions such as cardiovascular diseases. Countries like Brazil and Mexico are experiencing high demand for orthopedic and dental implants, driven by expansion in medical tourism. Incentives for local production and government investment in the healthcare infrastructure are improving accessibility to the market. Innovations in implant materials and techniques along with an increased awareness about advanced treatments contribute to market growth. Affordability and improving reimbursement policies attract a larger patient base in this region.

Middle East and Africa Bio-implants Market Trends:

The bio-implants market in the Middle East and Africa is gaining pace as the prevalence of chronic diseases increases, and access to advanced healthcare improves. Countries like the UAE and Saudi Arabia are investing big in medical infrastructure, generating a demand for orthopedic and cardiovascular implants. Increased medical tourism and modern treatment options bring in more patients from outside the country. The efforts of government awareness campaigns toward improving the health sector contribute to further growth. The high price tags still prevail. However, developments in implantable material and localized production are ensuring cost-effectiveness in these countries.

Top Companies Leading in the Bio-implants Industry

Some of the leading bio-implants market companies include Abbott Laboratories, Boston Scientific Corporation, Stryker Corporation, St. Jude Medical Inc., Medtronic Inc., Smith and Nephew, Wright Medical Group, Zimmer Biomet, Dentsply Sirona, Invibio Limited, Straumann, Danaher Corporation, Cardinal Health, Johnson & Johnson, B. Braun Melsungen, LifeNet Health, Inc., and Endo International plc, among many others.

- In November 2024, Zimmer Biomet was approved by the FDA to offer the Oxford Cementless Partial Knee allowed in the U.S. This implant has a titanium and hydroxyapatite coating for better bone growth, resulting in improved fixation and survival. The bio implant of the knee enhances knee movement and offers better surgical efficiency.

- In June 2024, at the 2024 Implant Solutions World Summit, Dentsply Sirona presented its innovations at the forefront of implant dentistry, such as the EV Implant Family designed with enhanced bone integration for that natural aesthetic. Advances presented included bio-implants, digital solutions, and regenerative.

Global Bio-implants Market Segmentation Coverage

- Based on the type of bio-implants, the market has been segmented into cardiovascular implants, dental implants, spinal bio-implants, orthopaedic implants, ophthalmic implants, and others, where orthopedic implants have captured the highest market share. Orthopedic implants are used majorly to treat osteoporosis, arthritis, and traumatic injuries. Due to the growing elderly population and the rising number of cases of sports injuries, these implants are increasingly essential for procedures such as joint replacement surgery, spinal fusions, and fracture repair. This is due to material science having witnessed improvements in areas such as biocompatible metals and hybrid materials, thus improving function and longevity, leading to widespread adoption. In addition, awareness about early diagnosis and treatment of musculoskeletal disorders, as well as relatively better access to healthcare services in emerging economies, drives the growth of this segment.

- On the basis of the material, the market is classified into metallic, ceramic, polymer, and biological, each catering to different needs in bio-implants. In terms of metallic materials, the most used materials are titanium and cobalt-chrome alloys as they are strong, durable, and biocompatible, thus widely applied in orthopedic, dental, and cardiovascular implants. Ceramic materials have been preferred for their wear resistance and inert properties, often used in dental and joint implants, such as alumina and zirconia. Polymer-based implants, like polyethylene and polylactic acid ones, are valued for flexibility, lightweight, and light on the pocket. Typically, it is used as a spinal and cranial implant. Biological materials have a structure that closely resembles a natural tissue of the human body, and it encourages recovery such as grafting procedures and reconstructive surgery.

- Based on the origin, the market is categorized into allograft, autograft, xenograft, and synthetic. Xenografts hold the largest market share and widely find applications in bone grafting procedures and even heart valve replacements. They have high availability, ease of processing, and structural similarity to human tissues. Therefore, they are preferred over autografts and allografts, usually limited by donor shortages and the risk of disease transmission. Xenografts offer an active biological scaffold that supports tissue regeneration and healing. For instance, porcine-derived heart valves are becoming more commonly used in cardiovascular surgeries due to their effectiveness and long-term durability. Innovation in the techniques of sterilization and preservation has advanced the safety and efficiency of the xenografts making it the dominating segment.

- On the basis of the mode of administration, the market is divided into surgical and non-surgical bio-implants. Schematics of surgical bio-implants are used for only complicated procedures, such as transplantation of organs, repositioning of joints, and fixing cardiovascular diseases, for which the surgeon needs precise positioning. Such implants are only needed for long-term treatments or permanent structural support. Non-surgical bio-implants are less invasive and are to be used for temporary or supplementary treatments such as drug-eluting stents or injectable scaffolds for tissue regeneration. With emerging technologies that allow for recovery time and fewer complications compared to the traditional surgical approach, non-surgical implants have increasingly become accepted. All of these two categories continue growing as innovative concepts are based on individual medical needs.

- Based on the end-user, the market has been classified as ambulatory surgical centers, clinics, hospitals, and others, wherein hospitals holding the largest market share. As the hospitals have comprehensive infrastructure with access to advanced technologies, and specialized healthcare professionals to perform complex surgeries. They cater to a high volume of procedures that involve bio-implants like joint replacements, organ transplants, and cardiac interventions. Many hospitals also partner with leading manufacturers of bio-implants to offer their patients the most advanced technologies in implantable devices. Additionally, patients opt for hospitals for such crucial surgeries as there are ICU and postoperative rehabilitation facilities available. Though ambulatory surgical centers and clinics are increasingly in demand as they are convenient and cost-effective, they cannot match the resources and infrastructure that hospitals have, hence making the latter the most important user segment.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 136.3 Billion |

| Market Forecast in 2033 | USD 265.4 Billion |

| Market Growth Rate 2025-2033 | 6.89% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types of Bio-Implants Covered | Cardiovascular Implants, Dental Implants, Spinal Bio-Implants, Orthopaedic Implants, Ophthalmic Implants, Others |

| Materials Covered | Metallic, Ceramic, Polymer, Biological |

| Origins Covered | Allograft, Autograft, Xenograft, Synthetic |

| Mode of Administrations Covered | Non-surgical, Surgical |

| End Users Covered | Ambulatory Surgical Centers, Clinics, Hospital, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Abbott Laboratories, Boston Scientific Corporation, Stryker Corporation, St. Jude Medical Inc, Medtronic Inc., Smith and Nephew, Wright Medical Group, Zimmer Biomet, Dentsply Sirona, Invibio Limited, Straumann, Danaher Corporation, Cardinal Health, Johnson & Johnson, B. Braun Melsungen, LifeNet Health, Inc, Endo International plc, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)