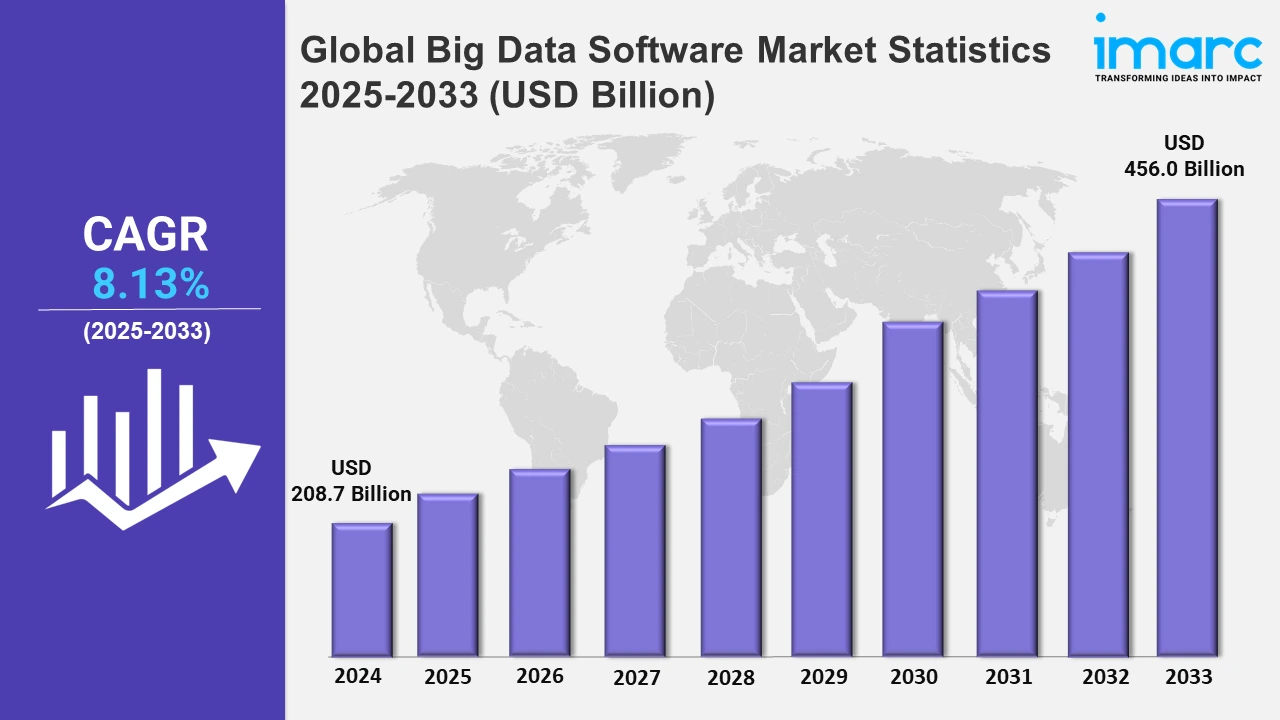

Global Big Data Software Market to Reach USD 456.0 Billion by 2033 | IMARC Group

Global Big Data Software Market Statistics, Outlook and Regional Analysis 2025-2033

The global big data software market size was valued at USD 208.7 Billion in 2024, and it is expected to reach USD 456.0 Billion by 2033, exhibiting a growth rate (CAGR) of 8.13% from 2025 to 2033.

To get more information on the this market, Request Sample

The rising number of IoT devices is boosting the implementation of edge computing. For instance, according to Statista, the global number of Internet of Things (IoT) devices is expected to nearly double from 15.9 billion in 2023 to more than 32.1 billion by 2030. In 2033, China will have the most IoT devices, with over 8 billion consumer devices. These devices produce substantial amounts of data at the edge of the network. Edge computing offers a more scalable and efficient approach to manage the expanding volume and speed of the data generated. As the number of IoT devices continues to increase, the demand for big data software tools designed for edge computing is likely to surge.

Moreover, the integration of AI and ML technologies with big data platforms enables organizations to uncover deeper insights from their data. Big Data software with embedded AI and ML capabilities supports advanced analytics, enabling predictive and prescriptive insights for more informed decisions. For instance, in September 2024, Zoho updated its self-service BI and analytics platform, Zoho Analytics, with over 100 features centered on artificial intelligence (AI) and machine learning (ML). The platform receives a significant upgrade with seamless OpenAI integration. This enables firms to gain deeper insights and make more data-driven decisions. Additionally, for sectors such as finance, retail, and telecommunications, real-time data analysis is critical for immediate decision-making and customer engagement. Big Data platforms are evolving to include stream processing and real-time analytics capabilities, allowing businesses to respond instantly to changes in data patterns and consumer behavior. Big Data platforms are evolving to include stream processing and real-time analytics capabilities, allowing businesses to respond instantly to changes in data patterns and consumer behavior. For instance, in October 2024, SingleStore, a database that enables users to transact, analyze, and search petabytes of data in milliseconds, acquired BryteFlow, a data integration platform. This increases SingleStore's ability to consume data from a variety of sources, including SAP, Oracle, Salesforce, and many more. SingleStore's customers, who are already accustomed to sub-second query times, can now operationalize data from their CRM and ERP systems at scale and in real time, allowing for more insights for immediate action, faster adoption of real-time analytics, and new use cases for generative AI.

Global Big Data Software Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (the United Kingdom, Germany, Italy, Spain, France, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Vietnam, and others); Latin America (Brazil, Mexico, Argentina, Colombia, Chile, and others); and the Middle East and Africa (Saudi Arabia, United Arab Emirates, South Africa, and others). According to the report, North America accounted for the largest big data software market share. The rapid expansion of digitalization, IoT devices, and social media platforms has led to unprecedented data generation. This massive volume of data requires sophisticated software to manage, analyze, and derive insights, fueling the demand for big data solutions.

North America Big Data Software Market Trends:

There has been a significant increase in data breaches and cyber threats across countries in North America. For instance, according to an article published by AAG, in 2021, 1 in 2 internet users in the United States experienced account breaches. Similarly, according to Statista, 2023 was a year of data breaches for U.S. government agencies. In 2023, 100 instances of private data leakage were reported, an increase from 74 in 2022. This drives the need for big data software with advanced security features. These solutions help organizations detect anomalies, identify vulnerabilities, and strengthen data governance, making cybersecurity a significant growth driver.

Europe Big Data Software Market Trends:

Organizations across industries are prioritizing data-driven strategies to improve decision-making, enhance customer experiences, and drive competitive advantage. This trend is fueling investments in Big Data solutions that can process and analyze vast amounts of data for actionable insights. Moreover, stringent data privacy regulations in Europe, like GDPR, have heightened awareness around data governance and compliance. This has led to increased investments in Big Data solutions that emphasize secure data handling, storage, and analytics in compliance with regulatory requirements.

Asia Pacific Big Data Software Market Trends:

The widespread use of smartphones, IoT devices, and social media platforms has led to an exponential increase in data generation. For instance, according to Statista, in 2023, smartphone penetration in India reached 71%, and it is expected to reach 96% by 2040. This surge creates a demand for advanced Big Data analytics to process and derive actionable insights from diverse data sources.

Latin America Big Data Software Market Trends:

Governments in the region are investing in digital infrastructure and promoting data-driven economies. For instance, Brazil's advanced level of AI adoption, with 63% of data and analytics-using businesses utilizing AI, underscores the country's commitment to leveraging data analytics for economic growth. This is further driving the demand for big data software in the region.

Middle East and Africa Big Data Software Market Trends:

Governments and enterprises across the MEA region are actively pursuing digital transformation to enhance operational efficiency and service delivery. This shift generates vast amounts of data, necessitating robust Big Data solutions for effective analysis and decision-making.

Top Companies Leading in the Big Data Software Industry

Some of the leading big data software market companies include Amazon Web Services, Inc., Cloudera, Inc., Dell Inc., Informatica Inc., International Business Machines Corporation, Microsoft Corporation, Mu Sigma, Oracle Corporation, SAP SE, SAS Institute, Splunk Inc. (Cisco Systems, Inc.), and Teradata Corporation, among many others. For instance, in May 2024, Informatica, a leader in enterprise cloud data management, launched new product developments aimed at democratizing generative AI (GenAI) across the organization by providing safe, instantaneous access to data insights. CLAIRE GPT is the first GenAI-powered data management assistant grounded by enterprise metadata intelligence leveraging core IDMC capabilities.

Global Big Data Software Market Segmentation Coverage

- On the basis of the software type, the market has been bifurcated into database, data analytics and tools, data management, data applications, and core technologies, wherein database exhibits a clear dominance in the market. The continuous influx of data from multiple sources, including IoT, social media, mobile devices, and e-commerce, is increasing the need for advanced database software.

- Based on the deployment type, the market is categorized into on-premise and cloud, amongst which on-premise holds the majority of the total market share. On-premises software can offer lower latency and higher performance for data-intensive applications that require rapid processing, such as real-time analytics and high-frequency trading, further driving the market’s growth.

- On the basis of the industry, the market has been divided into banking, discrete manufacturing, professional services, process manufacturing, federal/central government, and others. Among these, banking currently represents the largest market share. The increasing sophistication of cybercrime and fraud in banking has created a strong demand for big data software capable of real-time monitoring and anomaly detection.

- Based on the end-use, the market is bifurcated into large enterprises and SMEs, wherein large enterprises account for the majority of the global market share. As customer expectations rise, large enterprises use big data analytics to deliver personalized experiences.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 208.7 Billion |

| Market Forecast in 2033 | USD 456.0 Billion |

| Market Growth Rate 2025-2033 | 8.13% |

| Units | Billion USD |

| Segment Coverage | Software Type, Deployment Type, Industry, End-Use, Region |

| Region Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Vietnam, Brazil, Mexico, Argentina, Colombia, Chile, Saudi Arabia, United Arab Emirates, South Africa |

| Companies Covered | Amazon Web Services, Inc., Cloudera, Inc., Dell Inc., Informatica Inc., International Business Machines Corporation, Microsoft Corporation, Mu Sigma, Oracle Corporation, SAP SE, SAS Institute, Splunk Inc. (Cisco Systems, Inc.), Teradata Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)