Global Bath Soap Market Expected to Reach USD 35.0 Billion by 2033 - IMARC Group

Global Bath Soap Market Statistics, Outlook and Regional Analysis 2025-2033

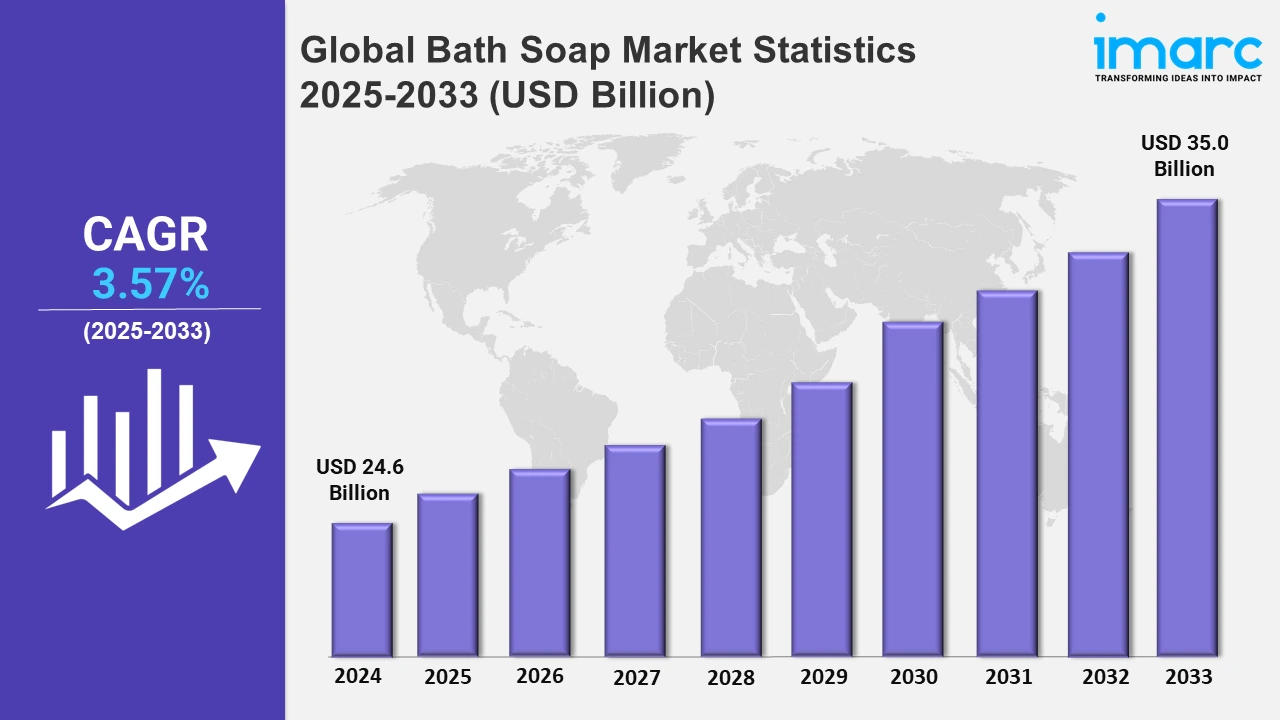

The global bath soap market size was valued at USD 24.6 Billion in 2024, and it is expected to reach USD 35.0 Billion by 2033, exhibiting a growth rate (CAGR) of 3.57% from 2025 to 2033.

To get more information on this market, Request Sample

In bath soap industry, price optimization is becoming majorly significant in emerging countries, with businesses reducing pricing of the product in several categories like soaps, to take advantage of decreasing raw costs. This approach attempts to advance market competitiveness, broaden consumer reach, and boost revenue. For example, in October 2023, Unilever reduced prices of their products in India in some categories, laundry and soap, to pass on the benefits of lower commodity prices, compete with local entrants, and increase volumes. They can cater to a larger consumer base and potentially gain a competitive edge in India's highly competitive consumer goods sector by offering affordable products in these essential segments. This pricing strategy aimed to boost sales volumes and enhance competitiveness, particularly against local market players.

Similarly, businesses are extending their traditional segments by utilizing established brand awareness, with the goal of acquiring growth in wide range of categories of the consumer goods industry. Also, companies are escalating their product portfolios to fulfill changing customer demands. For instance, in May 2023, Colgate-Palmolive announced to diversify oral care under the Palmolive brand, which is known for personal care and household products, the company aimed to broaden its product segment and enter markets beyond traditional oral care. This move replicates a strategic response to evolving consumer preferences and market opportunities, thereby allowing Colgate-Palmolive to tap into additional categories of the consumer goods industry. At the same time, bath soap industry manufacturers are progressively focusing on organic, eco-friendly, and natural formulations to cater customer demand for sustainable products. Moreover, companies are developing chemical-free and biodegradable soaps packed in recyclable materials as consumers become more conscious of the hazardous consequences of synthetic substances. Besides this, there is a rising demand for luxury and therapeutic bath soaps that address skin-specific issues like sensitivity and dryness. For example, Lush Cosmetics is catalyzing the demand for organic and cruelty-free bath soaps in North America by offering handcrafted soaps prepared with fresh, natural ingredients, adding fruits, essential oils, and herbs. Consequently, these products are gaining traction among customers who value sustainable consumption and high-quality skincare, thereby helping to boost the region's growing natural bath product sector.

Global Bath Soap Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America, Europe, Asia-Pacific, Latin America, and the Middle East and Africa. According to the report, Asia-Pacific accounted for the largest bath soap market share, on account of the elevating population, the inflating levels of urbanization, and the rising consumer disposable incomes.

North America Bath Soap Market Trends:

In North America, the market is experiencing a developing trend for environmentally friendly bath soaps. Alongside, consumers are gradually choosing natural products and packaging manufactured from recyclable resources. For instance, brands, such as Dr. Bronner's, have grown in recognition by producing fair-trade and organic soap products, which connect with customers growing demand for cruelty-free and eco-friendly personal care products and environmental concerns.

Europe Bath Soap Market Trends:

The industry in Europe is growing, owing to the elevating number of consumers looking for quality and handcrafted soaps. There is an increasing demand for handmade, organic, and custom soaps across region. For example, L'Occitane emphasizes natural ingredients, such as shea butter and lavender, appealing to elite customers who demand high-quality and genuine bath experiences, particularly in the skincare-centric market.

Asia-Pacific Bath Soap Market Trends:

Asia-Pacific dominates the overall market as antibacterial and health-focused soaps are becoming successively popular within the region because of their rising health awareness and hygiene concerns. Along with this, countries, such as China and India, are seeing an increase in demand for soaps that provide skin protection and hygiene advantages. For example, Dove has launched products, particularly for sensitive skin, defining the company's role in improving skin health and cleanliness throughout the region.

Latin America Bath Soap Market Trends:

In Latin America, there is a strong preference for low-cost and family-sized bath soaps designed for everyday usage. Brands, such as Palmolive and Protex, dominate the industry by providing high-volume and low-cost goods. Simultaneously, these soaps are popular in countries, including Brazil and Mexico, where value for money is an important factor in purchasing decisions, particularly in more price-sensitive markets.

Middle East and Africa Bath Soap Market Trends:

Skin-nourishing and luxury bath soaps are gaining traction throughout the Middle East and Africa, owing to the region's strong cultural preference for high-end cosmetic goods. Soaps with natural oils, such as argan and olive oil, are very popular, while Hammam soaps, known for their therapeutic benefits, have become widespread in both personal care routines and spa experiences, thereby emphasizing the value of satisfaction in skincare.

Top Companies Leading in the Bath Soap Industry

Some of the leading bath soap market companies include Procter and Gamble, Unilever, Colgate Palmolive, among many others. For example, in October 2023, Unilever cut product prices in India in a few categories, such as soaps and laundry, to pass on the benefits of lower commodity prices, boost volumes, and compete with local entrants. This pricing strategy aimed to boost sales volumes and enhance competitiveness, particularly against local market players.

Global Bath Soap Market Segmentation Coverage

- On the basis of the product type, the market has been bifurcated into premium products and mass products, wherein mass products represent the most preferred segment. These products provide fundamental washing and hygienic advantages, which are designed to influence to a wider range of consumers due to their low cost and accessibility. Thus, making them household staples worldwide.

- On the basis of the form, the market has been divided into solid bath soaps and liquid bath soaps. Among these, solid bath soaps exhibit a clear dominance in the market on account of their enduring popularity and various advantages. These bars are a traditional and familiar alternative for customers, providing a tactile and sensory experience when used.

- Based on the distribution channel, the market is bifurcated into supermarkets and hypermarkets, convenience stores, pharmacies, specialty stores, online, and others. Supermarkets and hypermarkets provide a wide range of soap brands in one location, attracting mass-market customers, whereas convenience stores cater to those customers who want to make quick purchases. Pharmacies specialize in medicinal and organic soaps. Premium and specialized soaps are available at specialty stores. Online platforms offer ease and access to a diverse range of brands and products.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 24.6 Billion |

| Market Forecast in 2033 | USD 35.0 Billion |

| Market Growth Rate 2025-2033 | 3.57% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Premium Products, Mass Products |

| Forms Covered | Solid Bath Soaps, Liquid Bath Soaps |

| Distribution Channels Covered | Supermarkets and hypermarkets, Convenience stores, Pharmacies, Specialty Stores, Online, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Procter and Gamble, Unilever, Colgate Palmolive, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Bath Soap Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)