Global Ball Bearing Market Size to Reach USD 65.1 Billion by 2033 - IMARC Group

Global Ball Bearing Market Statistics, Outlook and Regional Analysis 2025-2033

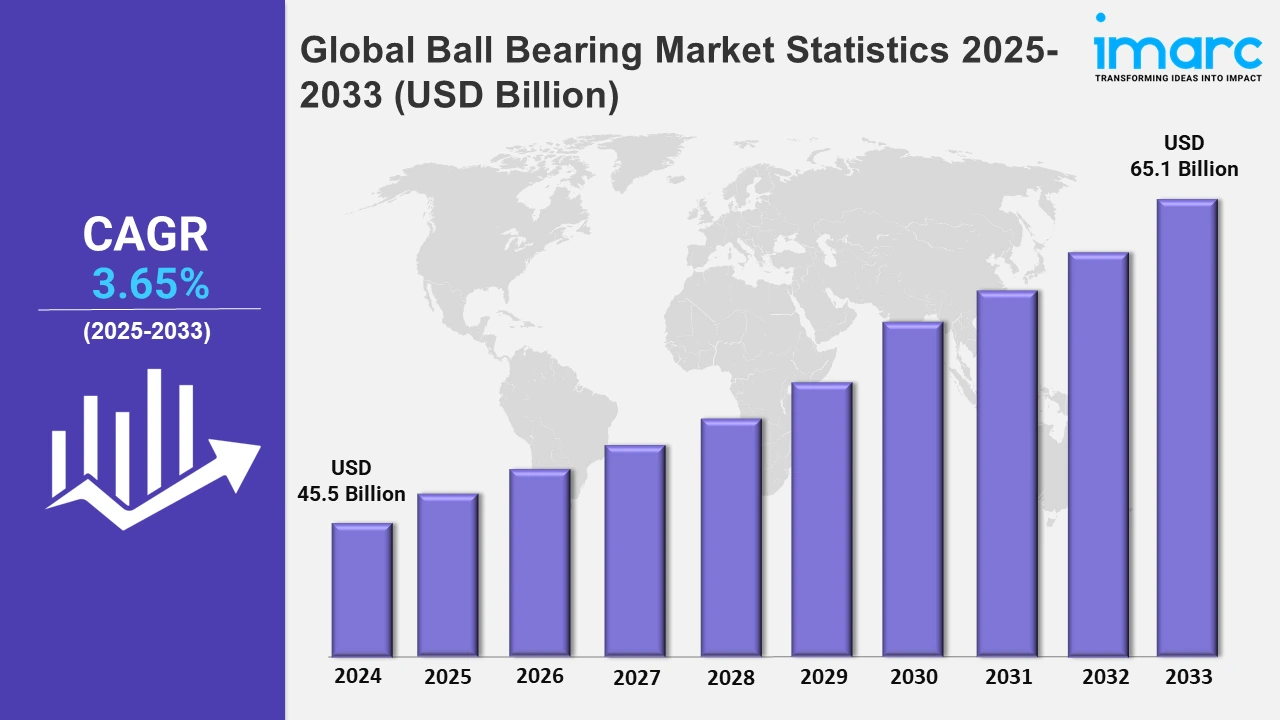

The global ball bearing market size was valued at USD 45.5 Billion in 2024, and it is expected to reach USD 65.1 Billion by 2033, exhibiting a growth rate (CAGR) of 3.65% from 2025 to 2033.

To get more information on the this market, Request Sample

The automotive industry is a major consumer of ball bearings, which are essential for reducing friction and enhancing performance in vehicles. There has been a growing demand for electric and autonomous vehicles. For instance, according to Statista, in 2019, there were around 31 million cars with some level of automation in operation around the world. By 2024, their number is predicted to surpass 54 million. This has further fueled the need for specialized ball bearings to meet performance, efficiency, and durability requirements in such vehicles.

Moreover, the rising renewable energy projects are propelling the market's demand. For instance, in July 2024, Adani Renewable Energy Forty One Ltd., a subsidiary of Adani Green Energy, launched a 250 MW wind power plant. The project is located in Khavda, Kutch, Gujarat. With the addition of this plant, Khavda's total operational capacity has reached 2,250 MW. Similarly, in October 2024, RES and Macquarie Asset Management's Aula Energy collaborated to promote the development of the 612MW Argoon wind farm in New South Wales (NSW). The project is located 20 kilometers north of Jerilderie and 30 kilometers south-west of Coleambally in the Renewable Energy Zone (REZ). The wind plant will generate enough clean energy to power 430,000 homes in New South Wales each year. Renewable energy projects, particularly wind energy, require large-scale bearings for turbines and other equipment. With increased investments in renewable energy globally, the demand for durable, high-load-bearing ball bearings has surged.

Global Ball Bearing Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include Asia Pacific, Europe, North America, Middle East and Africa, and Latin America. According to the report, Asia Pacific accounted for the largest market share due to the increasing infrastructure development. Apart from this, the increasing urbanization is contributing to the growth of the market. In addition, the rising demand for various electronic devices and appliances, such as tablets, smartphones, and computers, among individuals is supporting the growth of the market in the Asia Pacific region.

Asia Pacific Ball Bearing Market Trends:

The rising production of vehicles is impelling the growth of the market in the Asia Pacific region. For instance, according to an article published by the India Brand Equity Foundation, India's annual automobile production in FY23 was 25.9 million units. In June 2024, the total production of passenger vehicles*, three-wheelers, two-wheelers, and quadricycles was nearly 23,36,255. In FY24, the total production of passenger vehicles, commercial vehicles, three-wheelers, two-wheelers, and quadricycles was approximately 2,84,34,742 units.

Europe Ball Bearing Market Trends:

Investments in renewable energy, particularly wind energy, have increased the demand for ball bearings used in wind turbine systems. For instance, in August 2024, the European Investment Bank (EIB) launched a €5 billion initiative to help Europe's wind energy industry. Specialized bearings that can withstand extreme conditions and loads are essential for the efficient operation of wind turbines.

North America Ball Bearing Market Trends:

The automotive sector remains a significant consumer of ball bearings, with applications in engines. The rise of electric vehicles (EVs) in the region has further driven the need for specialized bearings designed for electric drivetrains. For instance, according to IEA, in 2023, new electric car registrations in the United States reached nearly 1.4 million, up more than 40% from 2022, further boosting the demand for ball bearings.

Middle East and Africa Ball Bearing Market Trends:

Rapid industrialization and significant infrastructure projects across the region have increased the demand for machinery and equipment, thereby boosting the need for ball bearings. For instance, the construction of new transportation networks and urban development projects in countries like the United Arab Emirates and Saudi Arabia have contributed to this demand.

Latin America Ball Bearing Market Trends:

The rich natural resources in Latin America drive significant mining and oil & gas activities, which further contribute to the demand for ball bearings. For example, Chile's mining industry, especially in copper extraction, uses heavy machinery with ball bearings. Similarly, Brazil's offshore oil exploration requires equipment dependent on high-quality bearings.

Top Companies Leading in the Ball Bearing Industry

Some of the leading ball bearing market companies include NTN Corporation, Timken, JTEKT, SKF, and Schaeffler Group, among many others. For instance, in September 2022, Timken, a leader in specialized bearings and industrial motion products, acquired GGB Bearing Technology, a branch of Enpro Industries. Similarly, in February 2020, JTEKT Group India showcased a host of made-in-India auto components at the Auto Expo Component 2020 in Pragati Maidan, Delhi. The company showcased a Toyota Prius cut section displaying column-type electric power steering, driveshaft hub unit, plug-tube gasket, ball-bearing for motor, etc.

Global Ball Bearing Market Segmentation Coverage

- On the basis of the application, the market has been bifurcated into automobile, general engineering, mining and construction, railways, aerospace and shipping, agriculture, and others, wherein automobile represented the largest segment. The rising demand for ball bearings in various automotive components, such as engines, transmissions, wheel hubs, steering systems, and suspension systems, is contributing to the growth of the market.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 45.5 Billion |

| Market Forecast in 2033 | USD 65.1 Billion |

| Market Growth Rate (2025-2033) | 3.65% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Applications Covered | Automobile, General Engineering, Mining and Construction, Railways, Aerospace and Shipping, Agriculture, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | NTN Corporation, Timken, JTEKT, SKF, Schaeffler Group etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Ball Bearing Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)