Global Aviation IoT Market Expected to Reach USD 62.7 Billion by 2033 - IMARC Group

Global Aviation IoT Market Statistics, Outlook and Regional Analysis 2025-2033

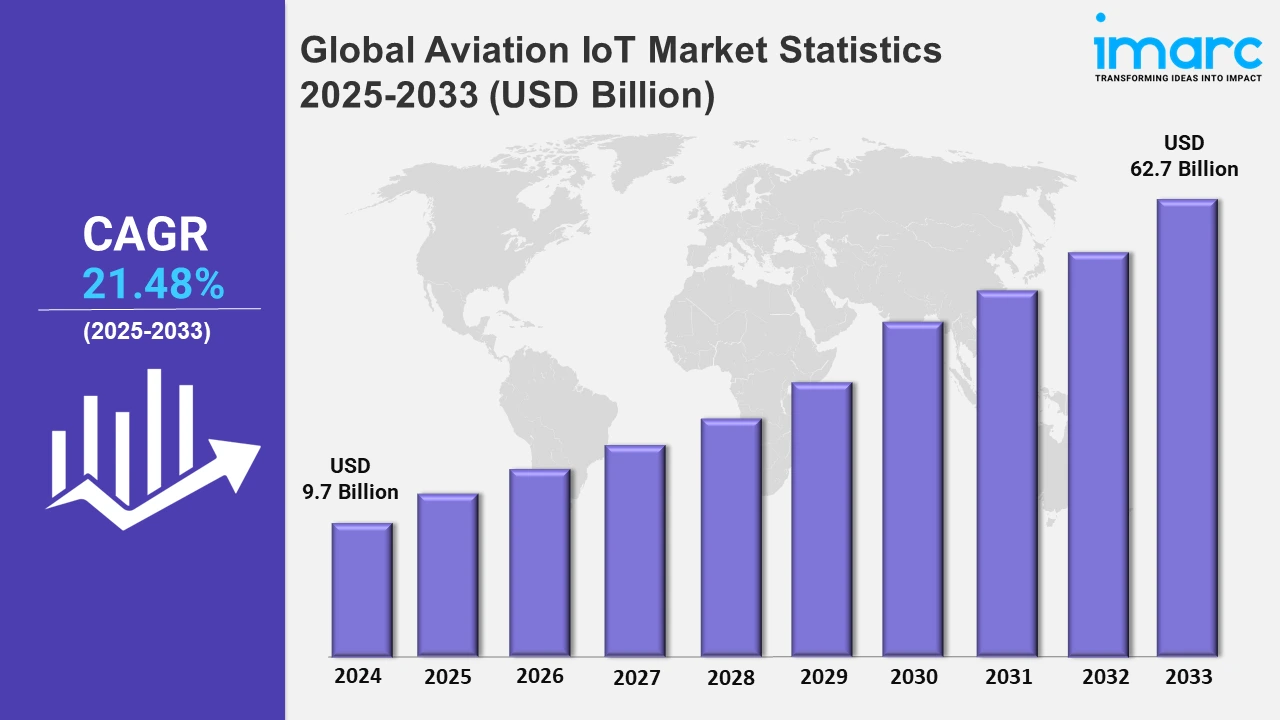

The global aviation IoT market size was valued at USD 9.7 Billion in 2024, and it is expected to reach USD 62.7 Billion by 2033, exhibiting a growth rate (CAGR) of 21.48% from 2025 to 2033.

To get more information on this market, Request Sample

The aviation IoT market is growing, driven by the widespread integration of real-time data and analytics to optimize operations and improve passenger experiences. The development of IoT-enabled devices, the growing use of AI-driven analytics, and the elevating need for predictive maintenance and operational efficiency are the key drivers propelling the market. Besides this, significant investments in IoT technologies for increased safety and better asset management are also catalyzing the market. With airlines, airports, and logistics providers seeking innovative solutions, the deployment of IoT gateways and digital platforms has gained momentum as a critical driver of the aviation sector's technological evolution. For instance, in March 2024, OnAsset Intelligence launched the SENTRY 600 FlightSafe, the first aircraft-installed IoT gateway. Real-time visibility of cargo, unit load devices (ULDs), and aircraft assets is made possible by this state-of-the-art innovation. It also integrates with ground systems to improve operational efficiency and monitoring for shippers, airlines, and logistics providers. Apart from this, in December 2024, Hyderabad Airport introduced India's first AI-powered digital twin platform with a predictive operation center. Leveraging IoT and real-time data from over 40 parameters, this platform enhances operational efficiency, passenger satisfaction, and safety. These advancements demonstrate the growing focus on using IoT and AI to build intelligent, networked aviation ecosystems.

In line with these advancements, the launch of an AI-powered digital twin platform at Hyderabad's Rajiv Gandhi International Airport by GMR Airports in December 2024 was another significant event. This platform integrates real-time IoT data and analytics for more effective operations, thereby supporting the recently launched Airport Predictive Operation Centre (APOC). It facilitates advanced crowd management, improved security protocols, reduced wait times, and superior passenger experiences. These developments are in line with the aviation industry's emphasis on increasing efficiency and sustainability and represent a growing trend of implementing IoT and AI technology to solve operational difficulties. The significance of IoT in aviation is highlighted by driving factors such as growing air traveler traffic, the implementation of smart airport projects, the growing need for predictive analytics, etc.

Global Aviation IoT Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. These regions focus on integrating digital technologies into the aviation industry and enhancing the productivity of the workforce.

North America Aviation IoT Market Trends:

In the North America aviation IoT industry, high investments in smart technology and advanced infrastructure are driving the growth. In the U.S., airports like Dallas-Fort Worth have implemented IoT-powered predictive maintenance systems, thereby enhancing operational efficiency. The rise of smart airports and focus on passenger experience through real-time tracking of luggage and flights highlight regional innovation. The expansion of the industry is also aided by IoT-enabled autonomous cars for airport operations.

Europe Aviation IoT Market Trends:

Authorities in Europe emphasize sustainability in aviation IoT, integrating energy-efficient IoT systems in airports. For instance, Schiphol Airport in the Netherlands uses IoT sensors for energy management, reducing environmental impact. The region's focus on compliance with emissions regulations propels adoption. Smart luggage tracking and predictive analytics for aircraft maintenance further improve efficiency. European Union policies drive IoT adoption, fostering advancements in safety and operational transparency.

Asia Pacific Aviation IoT Market Trends:

Asia Pacific's aviation IoT market is growing rapidly due to the expanding air traffic and new airport projects. Singapore’s Changi Airport employs IoT for seamless baggage handling and passenger flow management, offering a benchmark for smart airport solutions. Increasing smartphone penetration enables enhanced passenger experiences through real-time notifications. IoT integration in fleet management helps address operational challenges, reflecting the region's focus on technological advancement.

Latin America Aviation IoT Market Trends:

Latin America leverages IoT to optimize airport operations and enhance passenger experiences amid infrastructural constraints. In Brazil, São Paulo-Guarulhos Airport uses IoT-enabled check-in kiosks and security monitoring for improved services. The adoption of IoT in fleet tracking helps reduce delays and improves safety.

Middle East and Africa Aviation IoT Market Trends:

The Middle East and Africa focus on IoT for luxury and efficiency in aviation. Dubai International Airport utilizes IoT-based biometric gates for seamless passenger boarding. In Africa, IoT adoption supports cargo tracking in regions like Kenya, enhancing trade efficiency. Smart systems for monitoring aircraft health and optimizing routes address operational challenges. Rapid infrastructure development in the Gulf region underpins IoT innovations in aviation.

Top Companies Leading in the Aviation IoT Industry

Some of the leading aviation IoT market companies include Accenture plc, Aeris Communications Inc., Amadeus IT Group SA, Cisco Systems Inc., Honeywell International Inc., Huawei Technologies Co. Ltd., International Business Machines Corporation, Microsoft Corporation, SITA, Tata Communications, Tech Mahindra, and Wind River Systems Inc., among many others. Honeywell strengthened its partnership with SmartSky, focusing on enhancing in-flight connectivity services for customers.

Global Aviation IoT Market Segmentation Coverage

- On the basis of the application, the market has been bifurcated into ground operations, passenger experience, aircraft operations, and asset management. Aviation IoT optimizes ground operations through real-time tracking, enhances passenger experiences with personalized services, improves aircraft operations via predictive maintenance, and streamlines asset management by ensuring efficient monitoring of equipment and resources.

- Based on the end use, the market is categorized into airport, airline operators, MRO, and aircraft OEM. Aviation IoT revolutionizes airports, airline operators, MROs, and aircraft OEMs by optimizing operations, enhancing passenger experiences, improving predictive maintenance, and enabling smarter aircraft manufacturing through real-time data sharing and advanced analytics.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 9.7 Billion |

| Market Forecast in 2033 | USD 62.7 Billion |

| Market Growth Rate 2025-2033 | 21.48% |

| Units | Billion USD |

| Segment Coverage | Application, End Use, Region |

| Region Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Accenture plc, Aeris Communications Inc., Amadeus IT Group SA, Cisco Systems Inc., Honeywell International Inc., Huawei Technologies Co. Ltd., International Business Machines Corporation, Microsoft Corporation, SITA, Tata Communications, Tech Mahindra, Wind River Systems Inc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)