Global Avalanche Photodiode Market Expected to Reach USD 230.2 Million by 2033 - IMARC Group

Global Avalanche Photodiode Market Statistics, Outlook and Regional Analysis 2025-2033

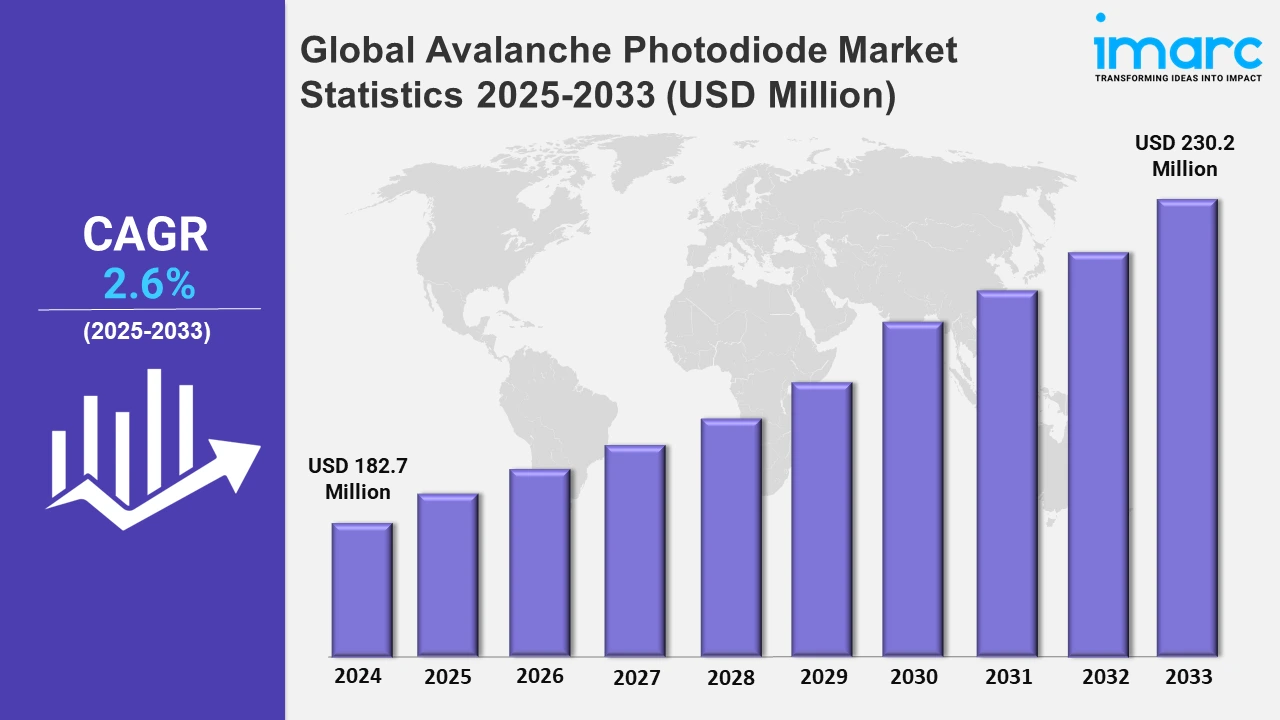

The global avalanche photodiode market size was valued at USD 182.7 Million in 2024, and it is expected to reach USD 230.2 Million by 2033, exhibiting a growth rate (CAGR) of 2.6% from 2025 to 2033.

To get more information on this market, Request Sample

The global avalanche photodiode market is experiencing notable growth, driven by advancements in telecommunications, especially the rapid deployment of 5G networks. As high-speed optical communication becomes a cornerstone for industries worldwide, the demand for efficient photodiodes with superior sensitivity and low noise performance is rising. For instance, in January 2024, Phlux Technology unveiled The Aura Family, a new product line for ultra-sensitive avalanche photodiode diode. This advanced series is primarily designed for laser rangefinders, LiDAR, and optical fiber test equipment. Moreover, these devices are essential in optical receivers, enabling seamless data transmission in dense network environments. Furthermore, increasing adoption of fiber optic technology across data centers and broadband networks is boosting market growth. Technological innovations, including enhanced wafer processing and III/V material integration, are further improving photodiode efficiency, making them indispensable for modern communication systems.

In addition to telecommunications, the market is being fueled by the growing need for avalanche photodiodes in medical imaging and industrial automation. For instance, in March 2024, Beckman Coulter Life Sciences received FDA 510(k) clearance to market its DxFLEX Clinical Flow Cytometer in the U.S. Renowned for its exceptional sensitivity and resolution, the compact DxFLEX simplifies multicolor flow cytometry by utilizing advanced avalanche photodiode (APD) detector technology over traditional photomultiplier tubes (PMTs). Moreover, the high-speed and precise light detection capabilities of such diodes make them ideal for advanced diagnostic imaging equipment, such as CT scanners and spectroscopy systems. In addition, industrial sectors, including aerospace, defense, and automotive, are also leveraging photodiodes for lidar, range-finding, and other sensing applications. Moreover, expanding applications in quantum computing and scientific research present new growth avenues, as these fields demand cutting-edge photodetection technologies. Furthermore, the increasing focus on renewable energy and smart city projects, particularly in Asia Pacific, is also driving the adoption of photodiodes in energy monitoring and security systems.

Global Avalanche Photodiode Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific accounted for the largest market share due to robust electronics manufacturing, growing telecommunications infrastructure, and rising technological adoption.

Asia Pacific Avalanche Photodiode Market Trends:

Asia Pacific leads the global avalanche photodiode market due to the rapid growth of its telecommunications and electronics sectors. The region's significant investment in 5G infrastructure, coupled with the expanding use of optical fiber networks, drives demand for high-performance photodiodes. For instance, as per industry reports, telecom operators in Asia Pacific are set to invest USD 259 billion in network infrastructure between 2023 and 2030, with a substantial focus on 5G technology. This investment is poised to transform the region’s digital landscape, positioning 5G as a key catalyst for economic growth and technological innovation. Additionally, the presence of major semiconductor manufacturers and a robust consumer electronics industry in countries like China, Japan, and South Korea further enhances its market dominance. Moreover, government initiatives supporting technological innovation and increasing adoption of photodiodes in medical imaging and industrial applications also contribute to Asia Pacific's leadership in this market.

North America Avalanche Photodiode Market Trends:

North America remains a key market for avalanche photodiodes due to its advanced telecommunications infrastructure and strong adoption of fiber optic technology. The region's thriving aerospace and defense sectors, along with significant investments in medical imaging systems, further drive demand for high-performance photodiodes across various industries.

Europe Avalanche Photodiode Market Trends:

Europe's avalanche photodiode market benefits from the region's focus on technological innovation and renewable energy initiatives. Moreover, the widespread adoption of photodiodes in scientific research, industrial automation, and automotive applications underscores Europe's role as a significant contributor to the market, supported by robust manufacturing capabilities and government funding.

Latin America Avalanche Photodiode Market Trends:

In Latin America, growing investments in telecommunication networks and the rising penetration of broadband services are driving the demand for avalanche photodiodes. Furthermore, the region's expanding healthcare infrastructure and increasing adoption of optical sensors in industrial processes also contribute to steady market growth.

Middle East and Africa Avalanche Photodiode Market Trends:

The MEA market for avalanche photodiodes is fueled by expanding telecommunications networks and the adoption of advanced technologies in security and surveillance. Increased investments in smart city projects and the region's focus on enhancing industrial automation are further boosting demand for photodiode applications across various sectors.

Top Companies Leading in the Avalanche Photodiode Industry

Some of the leading avalanche photodiode market companies include Excelitas Technologies Corp., First Sensor AG (TE Connectivity), Global Communication Semiconductors LLC, Hamamatsu Photonics K.K., Kyoto Semiconductor Co. Ltd., Laser Components (Photona GmbH), Lumentum Operations LLC, Luna Innovations, OSI Systems Inc., Renesas Electronics Corporation, SiFotonics Technologies Co. Ltd., among many others. In November 2024, Excelitas Technologies Corp. announced the launch of an advanced version of its InGaAs avalanche photodiode, C30645 / C30662. These diodes leverage advancements in Excelitas’ III/V wafer growth and processing architecture to achieve superior noise performance. The optimized design enhances Signal-to-Noise Ratios (SNR), enabling extended range with the same laser output power.

Global Avalanche Photodiode Market Segmentation Coverage

- On the basis of the material, the market has been categorized into silicon, germanium, InGaAs, and other materials, wherein silicon materials represent the leading segment. This is attributed to their exceptional efficacy in detecting light across near-infrared and visible wavelengths. Their elevated integration abilities and cost-efficiency position them as a preferable choice for applications in various sectors including medical devices, consumer electronics, and telecommunications. Additionally, rapid innovations in silicon processing technologies are further improving their dependability and performance, fortifying their market dominance.

- Based on the sales channel, the market is classified into OEMs and aftermarket, amongst which OEMs dominate the market. This segment is driven by its ability to integrate these components seamlessly into high-performance systems. Their robust supply chain networks and emphasis on quality assurance provide end-users with reliable, application-specific solutions. The increasing demand for customized photodiodes in industries such as aerospace and defense reinforces OEM dominance.

- On the basis of the end user, the market has been divided into aerospace and defense, telecommunication, healthcare, and others. Among these, telecommunication accounts for the majority of the market share. This dominance is fueled by the rising adoption of optical fiber networks and 5G technology. These photodiodes' ability to deliver high-speed data transmission and superior sensitivity supports the demand for advanced telecommunication infrastructure. Expanding broadband connectivity in emerging markets is further amplifying the segment's growth trajectory.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 182.7 Million |

| Market Forecast in 2033 | USD 230.2 Million |

| Market Growth Rate 2025-2033 | 2.6% |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Materials Covered | Silicon Materials, Germanium Materials, InGaAs Materials, Others |

| Sales Channels Covered | OEMs, Aftermarket |

| Applications Covered | Aerospace and Defense, Telecommunication, Healthcare, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Excelitas Technologies Corp., First Sensor AG (TE Connectivity), Global Communication Semiconductors LLC, Hamamatsu Photonics K.K., Kyoto Semiconductor Co. Ltd., Laser Components (Photona GmbH), Lumentum Operations LLC, Luna Innovations, OSI Systems Inc., Renesas Electronics Corporation, SiFotonics Technologies Co. Ltd, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

.webp)

.webp)