Global Autonomous Vehicle Market Expected to Reach USD 1,730.4 Billion by 2033 - IMARC Group

Global Autonomous Vehicle Market Statistics, Outlook and Regional Analysis 2025-2033

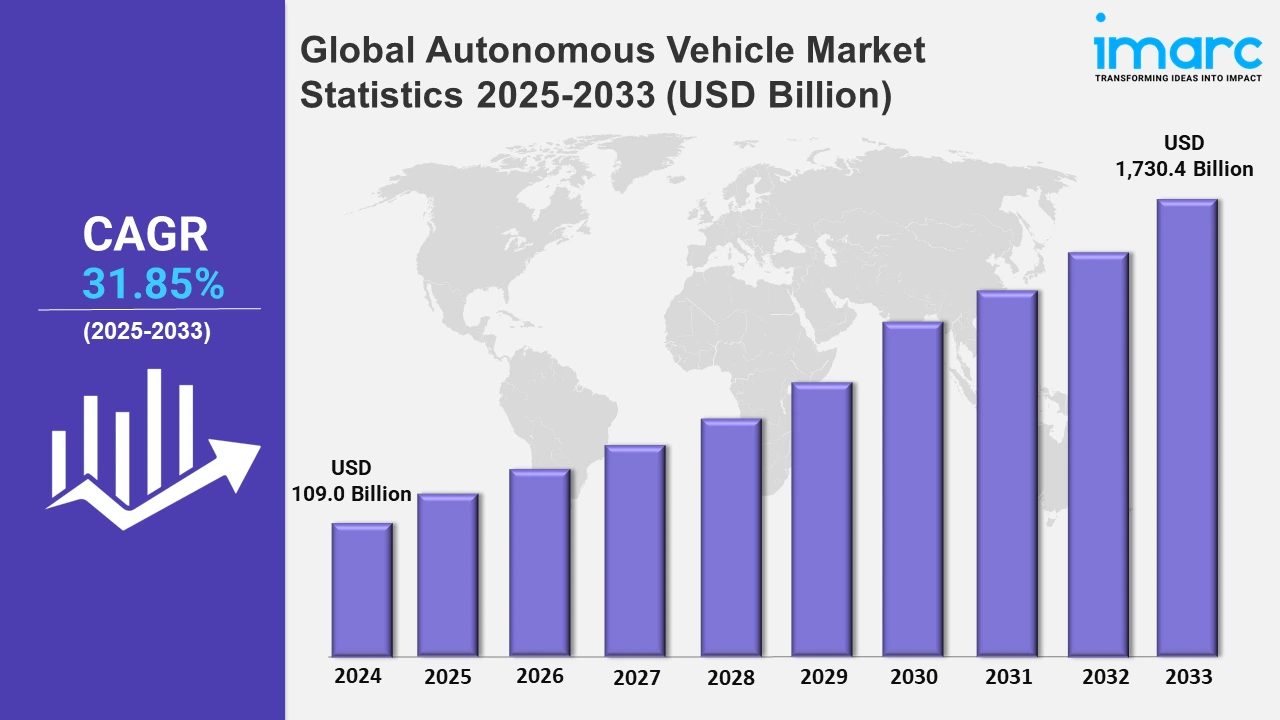

The global autonomous vehicle market size was valued at USD 109.0 Billion in 2024, and it is expected to reach USD 1,730.4 Billion by 2033, exhibiting a growth rate (CAGR) of 31.85% from 2025 to 2033.

To get more information on the this market, Request Sample

The autonomous vehicle market is driven by the growing demand for autonomous driving technology and sustainable energy solutions that have accelerated innovation within the automotive sector. In contrast, numerous industry players are investing in advanced technologies that support self-driving capabilities and efficient energy management. Also, the recent joint venture announcement in November 2024 from Nissan and Mitsubishi collaborated to launch an EV self-driving venture, which reflects this commitment. Their collaboration aims to enhance autonomous driving services while focusing on repurposing EV batteries for energy storage solutions. This strategy is poised to address the challenges related to EV battery disposal, thereby allowing for effective reuse in power storage and contributing to broader energy management initiatives. Therefore, such partnerships underscore a shift toward integrated energy solutions within the automotive landscape, where brands are looking to leverage existing resources to support both mobility and sustainable power needs. For example, in May 2024, Renault Group pushed forward with a Level 4 autonomous transportation initiative, collaborating with WeRide to introduce driverless electric minibuses and targeting Europe’s low-emission zones. This initiative focuses on low-carbon, autonomous public transport, aligning with the EU's stringent emission targets. Renault aims to solidify its stance in the sustainable mobility market by initiating real-world trials in diverse urban environments, thereby driving forward the adoption of autonomous vehicles in public transit systems. Besides this, the project reflects a broader trend of automakers diversifying their offerings to meet specific regional regulatory requirements and environmental goals, particularly as cities across Europe ramp up measures to reduce urban pollution.

Moreover, in November 2024, Volkswagen’s subsidiary Traton launched Level 4 autonomous trucks equipped with Plus's AI-based SuperDrive in Europe. This significant development comes after extensive testing phases, with fleet trials set to expand. Volkswagen aims to transform freight logistics on European roads by deploying these self-driving trucks, thereby presenting a substantial leap toward fully autonomous, AI-driven trucking. On the contrary, the introduction of autonomous trucks addresses labor shortages in the trucking industry and improves overall efficiency by reducing human error and optimizing route management. Consequently, these advancements highlight how leading automakers are responding to evolving transportation demands through regional innovations, reinforcing their position as frontrunners in both autonomous driving and sustainable solutions.

Global Autonomous Vehicle Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America dominates the market due to robust investments, advanced infrastructure, and a strong regulatory framework supporting innovation.

North America Autonomous Vehicle Market Trends:

In North America, major tech hubs and automotive firms drive research, while government initiatives encourage autonomous solutions to address road safety and traffic efficiency. This environment fosters rapid development, making North America a leader in the field. In May 2024, Hyundai and Plus showcased the XCIENT, the first Level 4 autonomous hydrogen fuel cell truck, at the ACT Expo in the U.S., underscoring North America's commitment to sustainable, autonomous freight solutions. This collaboration highlights the region's capability to integrate cutting-edge autonomous technology with eco-friendly power, further establishing its lead in autonomous vehicle advancements.

Asia Pacific Autonomous Vehicle Market Trends:

The region is seeing rapid advancements driven by investments in smart mobility, particularly in Japan and South Korea. In addition, the demand for driverless technology aligns with the focus on urban development and sustainable transport. Notably, Japan's initiatives with automated public transportation and partnerships with tech firms are boosting the sector. Also, regulatory support is fostering growth, positioning Asia Pacific as a key player.

Europe Autonomous Vehicle Market Trends:

Europe's market benefits from strong regulatory frameworks and tech innovation in countries like Germany. The push for eco-friendly solutions is enhancing autonomous vehicle development. German automotive giants are leading with collaborations in AI integration for better safety. The region's initiatives in cross-border trials and road infrastructure improvements are significant in propelling self-driving technologies forward, solidifying Europe's leadership in automation.

Latin America Autonomous Vehicle Market Trends:

In Latin America, the progress is gradual but promising, with Brazil making strides in public-private partnerships for autonomous vehicle testing. Infrastructure challenges exist, but the interest in innovative transport for urban areas is rising. Projects aimed at reducing traffic and pollution in major cities are driving experimentation with self-driving vehicles, highlighting a growing focus on adaptive, technology-based solutions.

Middle East and Africa Autonomous Vehicle Market Trends:

The UAE, particularly Dubai, is pioneering autonomous mobility with futuristic plans like autonomous taxis in the Middle East and Africa. Government support and investments in smart city projects are fueling advancements. While challenges remain in broader regional adaptation due to infrastructure gaps, strong pilot programs and partnerships with global tech firms showcase a proactive approach to integrating autonomous technology into local transport solutions.

Top Companies Leading in the Autonomous Vehicle Industry

Some of the leading autonomous vehicle market companies include AB Volvo, AUDI Aktiengesellschaft (Volkswagen Group), Bayerische Motoren Werke AG, Daimler AG, Ford Motor Company, General Motors, Tesla Inc., Toyota Motor Corporation, Uber Technologies Inc., and Waymo LLC (Alphabet Inc.), among many others. In March 2023, Ford Motor Company announced the establishment of Latitude AI, a wholly owned subsidiary focused on developing a hands-free, eyes-off-the-road automated driving system for millions of vehicles. Moreover, in May 2023, Toyota Motor Corporation launched a joint project to develop an autonomous light vehicle that will run on Komatsu's Autonomous Haulage System.

Global Autonomous Vehicle Market Segmentation Coverage

- On the basis of the component, the market has been bifurcated into hardware and software and services, wherein software and services represent the most preferred segment. The software and services segment includes sophisticated software algorithms, machine learning (ML) models, and artificial intelligence (AI) systems that enable self-driving vehicles to perceive their surroundings, interpret data, and make intelligent decisions.

- Based on the level of automation, the market is categorized into level 3, level 4, and level 5, amongst which level 3 dominates the market. Level 3 automation has advanced automation capabilities, but they still require human intervention in certain situations. Level 3 vehicles can handle most driving tasks autonomously, including acceleration, braking, and lane-keeping, under specific conditions and on predefined routes.

- On the basis of the application, the market has been divided into transportation and logistics and military and defense. Among these, transportation and logistics exhibit a clear dominance in the market. The transportation and logistics sector encompasses a wide range of applications, including autonomous delivery (AV) trucks, self-driving taxis and ride-sharing services, autonomous public transit, and automated long-haul freight transportation.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 109.0 Billion |

| Market Forecast in 2033 | USD 1,730.4 Billion |

| Market Growth Rate 2025-2033 | 31.85% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Hardware, Software and Services |

| Level of Automations Covered | Level 3, Level 4, Level 5 |

| Applications Covered | Transportation and Logistics, Military and Defense |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | AB Volvo, AUDI Aktiengesellschaft (Volkswagen Group), Bayerische Motoren Werke AG, Daimler AG, Ford Motor Company, General Motors, Tesla Inc., Toyota Motor Corporation, Uber Technologies Inc., Waymo LLC (Alphabet Inc.), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Autonomous Vehicle Market

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)