Global Autonomous Crop Management Market Expected to Reach USD 7.8 Billion by 2033 - IMARC Group

Global Autonomous Crop Management Market Statistics, Outlook and Regional Analysis 2025-2033

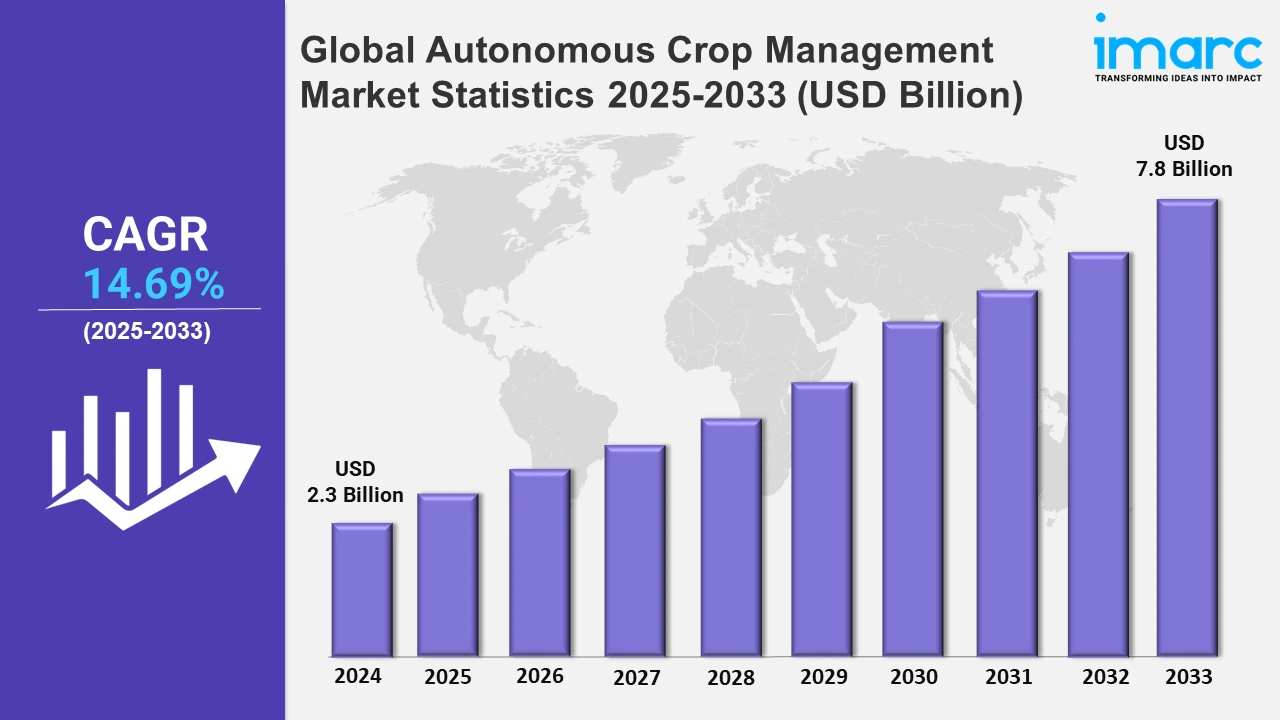

The global autonomous crop management market size was valued at USD 2.3 Billion in 2024, and it is expected to reach USD 7.8 Billion by 2033, exhibiting a growth rate (CAGR) of 14.69% from 2025 to 2033.

To get more information on this market, Request Sample

The integration of artificial intelligence (AI) and the Internet of Things (IoT) is driving the market expansion. These advanced technologies can process massive amounts of data collected in real-time and enable precise decision-making, such as optimizing irrigation schedules, assessing soil conditions, detecting crop diseases, and applying fertilizers with high precision, thereby catalyzing the demand for autonomous crop management systems. They also help farmers increase agricultural yields, eliminate resource waste, and promote sustainable farming methods. For instance, in February 2022, Croptracker, Inc. released 'Harvest Quality Vision 3.0' to make predicting the size of harvested produce easier and more precise. It uses off-the-shelf laser detection and ranging (LiDAR) technology found in iPads and iPhones to scan fruits of different sizes and shapes and deliver extremely accurate findings in seconds.

Moreover, farmers are increasingly adopting precision agriculture approaches as they recognize the benefits of data-driven and site-specific farming strategies for increasing agricultural output. Autonomous systems enable tailored applications of agricultural inputs, such as water, fertilizer, and pesticides, based on real-time data analysis and crop requirements. This optimizes resource use, lowers environmental impact, increases crop quality, etc. For instance, in February 2022, Naïo Technologies introduced its newest robot during the World Ag Expo 2022. Orio is a multi-crop/multi-task autonomous and high-precision robot built for large vegetable production operations. It is completely electric and helps growers reduce their environmental impact. Besides this, agricultural labor shortages are becoming increasingly common in various regions worldwide. This scarcity of skilled workers is encouraging the agricultural sector to seek automated solutions. Farmers can streamline a variety of labor-intensive chores, reducing reliance on human labor. Furthermore, input optimization through autonomous crop management improves resource efficiency and reduces costs. Also, firms are proposing self-driving systems that will help to reduce these issues. For example, in August 2023, New Holland introduced a new tractor class called 'T4 Electric Power', which has utility electric and has autonomous functions. It can address the growing total cost of ownership and labor scarcity challenges, while also committing to assisting individuals in developing more sustainable agriculture practices. Apart from this, many governments are promoting modern agricultural practices through policies and incentives, including tax cuts and subsidies, to encourage the adoption of autonomous crop management systems.

Global Autonomous Crop Management Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America represents the largest regional market, owing to the surging integration on AI and ML and the inflating need for enhanced crop productivity.

North America Autonomous Crop Management Market Trends:

North America dominates the overall market. Both the U.S. and Canada are facing agricultural labor shortages, which is prompting farmers to adopt autonomous technologies to maintain productivity. For instance, in the U.S., companies like FarmWise have developed automated weeding robots to address this issue. Moreover, the regional governments are promoting precision agriculture through funding and policies. In Canada, programs supporting digital farming technologies have facilitated the adoption of autonomous systems.

Europe Autonomous Crop Management Market Trends:

In Europe, key players across the market emphasize sustainability, driven by the EU's Green Deal. For instance, countries like Germany and the Netherlands deploy robotic weeders, such as those by Ecorobotix, to reduce pesticide use. Europe's stringent environmental regulations and push for organic farming encourage the adoption of sustainable technologies. The region also fosters collaboration between governments and private firms to drive eco-friendly agricultural automation.

Asia-Pacific Autonomous Crop Management Market Trends:

Asia-Pacific's autonomous crop management trend focuses on adapting technologies for smallholder farms. For example, Japan's Kubota develops compact robotic tractors tailored for smaller plots, addressing labor shortages and aging farmer populations. In China and India, drones by companies like DJI are utilized for affordable crop monitoring and pest control. Asia Pacific’s large agricultural base drives the adoption of cost-effective and versatile autonomous solutions.

Latin America Autonomous Crop Management Market Trends:

In Latin America, the trend centers on yield optimization using autonomous systems, particularly in large-scale farms in Brazil and Argentina. Companies like Solinftec provide AI-powered crop management platforms to enhance soybean and corn productivity. Latin America's focus on export-driven agriculture pushes farmers to adopt drones, sensors, and robotics to ensure competitive yields. The region benefits from partnerships promoting precision agriculture technologies.

Middle East and Africa Autonomous Crop Management Market Trends:

Farmers across the Middle East and Africa prioritize water-efficient autonomous crop management solutions. With arid climates, countries like Israel utilize AI-powered irrigation systems from companies like Netafim to minimize water use. Drones and sensors are employed in African nations like Kenya to manage irrigation and monitor crop health.

Top Companies Leading in the Autonomous Crop Management Industry

Some of the leading autonomous crop management market companies include Agrivi, Conservis LLC, Cropin Technology Solutions Private Limited, Croptracker, Inc., CropX Inc., EasyFarm, FarmERP (Shivrai Technologies Pvt. Ltd.), International Business Machines Corporation, Proagrica (RELX Group), Raven Industries, Inc. (CNH Industrial), Topcon Corporation., among many others. For instance, in July 2024, CropIn, a Bengaluru-based agritech startup, collaborated with Google Gemini to launch a real-time GenAI-powered agri intelligence platform that will assist customers in managing farms internationally by predicting yields, disease, and other vital information.

Global Autonomous Crop Management Market Segmentation Coverage

- On the basis of the solution, the market has been bifurcated into software and services (professional services and managed services), wherein software represents the largest segment as it provides farmers with actionable insights and automated decision-making. Additionally, it also enables precise and efficient crop management practices.

- Based on the deployment, the market is categorized into on-premises and cloud-based, amongst which on-premises accounted for the largest market share as it provides farmers with full control over their data and operations and ensures data privacy and security.

- On the basis of the application, the market has been divided into crop tracking and management, weather tracking and forecasting, irrigation management, labor and resource tracking, and others. Among these, crop tracking and management represented the largest segment as farmers seek to optimize yields, detect early signs of diseases or nutrient deficiencies, and make data-driven decisions for targeted interventions to ensure healthy and high-quality crops.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 2.3 Billion |

| Market Forecast in 2033 | USD 7.8 Billion |

| Market Growth Rate 2025-2033 | 14.69% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Autonomous Crop Management Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Solutions Covered |

|

| Deployments Covered | On-premises, Cloud-based |

| Applications Covered | Crop Tracking and Management, Weather Tracking and Forecasting, Irrigation Management, Labor and Resource Tracking, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Agrivi, Conservis LLC, Cropin Technology Solutions Private Limited, Croptracker Inc., CropX Inc., EasyFarm, FarmERP (Shivrai Technologies Pvt. Ltd.), International Business Machines Corporation, Proagrica (RELX Group), Raven Industries Inc. (CNH Industrial), Topcon Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)