Global Automotive Speedometer Cable Market Expected to Reach USD 3,152.2 Million by 2033 - IMARC Group

Global Automotive Speedometer Cable Market Statistics, Outlook and Regional Analysis 2025-2033

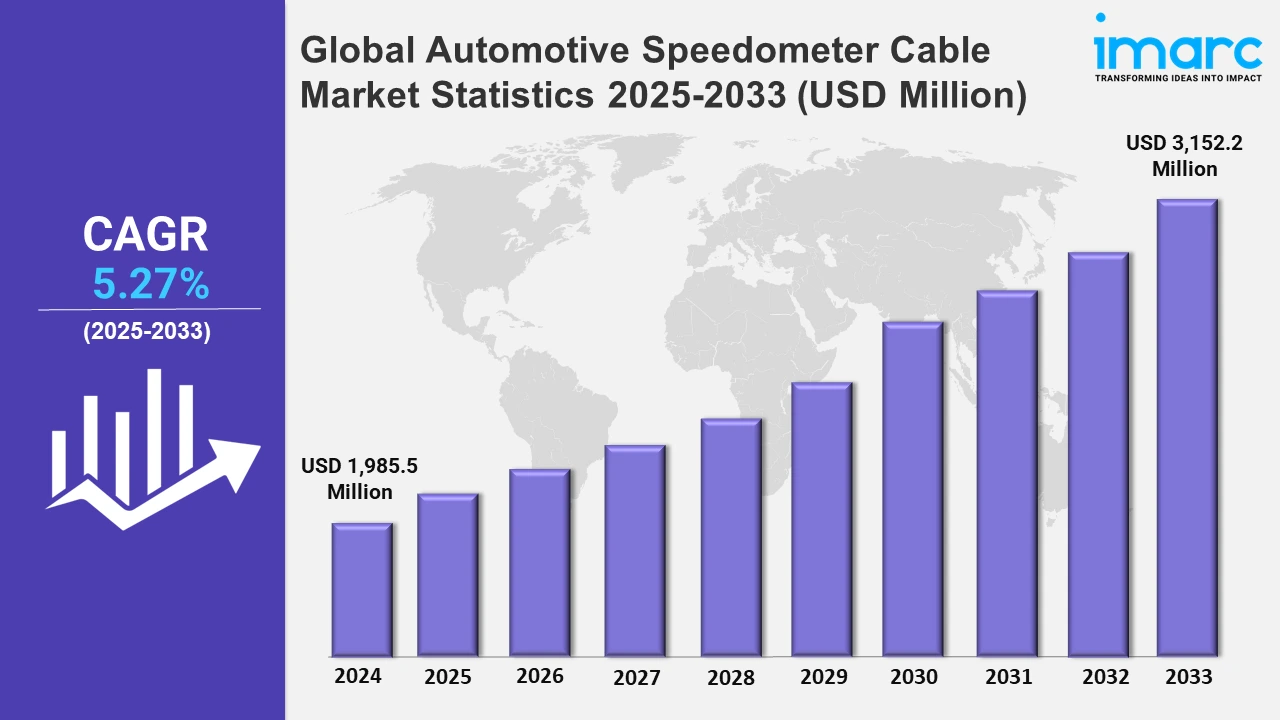

The global automotive speedometer cable market size was valued at USD 1,985.5 Million in 2024, and it is expected to reach USD 3,152.2 Million by 2033, exhibiting a growth rate (CAGR) of 5.27% from 2025 to 2033.

To get more information on this market, Request Sample

The automotive industry is embracing modern electronic speedometers with wide compatibility and configurable ratios. These advancements meet the demands of current automobiles by providing improved accuracy and integration with multiple speed sensors, indicating a trend toward more adaptive and economical instrumentation systems. For example, in May 2023, Speedy Cables (London) Ltd. introduced a fully electronic speedometer with mechanical counter movement adjustment to sort any ratio and works with most speed sensors.

Moreover, the industry is supporting innovation through specific electric vehicle events. These platforms allow manufacturers to showcase breakthroughs in electric passenger vehicles, motorbikes, and scooters, demonstrating the industry's commitment to sustainable mobility and technical growth. For instance, in February 2022, Silco Automotive Solution LLP organized an electric motor vehicle show in India to provide an opportunity for electric vehicle manufacturers to showcase their innovative products, which include electric passenger cars, motorcycles, and scooters. Furthermore, to achieve vehicle efficiency regulations, car speedometer cable producers prioritize the production of lightweight and durable materials. This is consistent with emerging standards stressing lower emissions and fuel use. Additionally, the aftermarket sector provides considerable income prospects for manufacturers due to the increasing replacement demands in older vehicles. Also, customers choose stainless steel speedometer cables because they are more durable than standard rubber wires. For example, the presence of major automotive firms, such as Tata Motors, Toyota, and Hyundai, is driving up demand for long-lasting speedometer cables in Asia-Pacific. These firms are incorporating improved speedometer cables into their cars to enhance durability and performance, particularly under high-use circumstances. This trend reflects the region's growing emphasis on improving the overall dependability and efficiency of cars in both urban and rural settings.

Global Automotive Speedometer Cable Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia-Pacific accounted for the largest automotive speedometer cable market share, on account of the presence of well-established manufacturing infrastructure and investments from key players.

North America Automotive Speedometer Cable Market Trends:

The market in North America is witnessing a growth in demand for long-lasting and high-performance cables, particularly stainless-steel varieties, as heavy-duty trucks are being used in construction and logistics. For example, ATP Automotive, a well-known American company, provides durable stainless steel speedometer cables that can survive rigorous working circumstances, responding to the specific needs of the trucking sector.

Europe Automotive Speedometer Cable Market Trends:

In Europe, there is an emphasis on sustainability and lightweight materials in vehicle speedometer cables. Manufacturers are using recyclable plastic materials to meet rigorous environmental standards. Metzger GmbH, for example, in Germany, manufactures lightweight plastic speedometer cables that improve fuel efficiency while still meeting the European Union's emissions objectives, highlighting the region's dedication to environmentally responsible automotive solutions.

Asia-Pacific Automotive Speedometer Cable Market Trends:

Asia-Pacific holds the largest share of the market, owing to the rapid urbanization and growth in inexpensive vehicle classes, resulting in an increase in demand for cost-effective speedometer cables, notably in China and India. Local producers, such as China's Tayoma Engineering Industries, produce large quantities of rubber speedometer cables to serve the developing local aftermarket sector and the region's expanding automobile industry.

Latin America Automotive Speedometer Cable Market Trends:

The market in Latin America is driven by the demand for replacement parts as the vehicle fleet ages. For instance, Brazil has an extensive used vehicle market, which drives up demand for aftermarket speedometer cables. R.S. International, for example, supplies rubber and plastic cables and offers cost-effective repair solutions to the region's budget-conscious consumers.

Middle East and Africa Automotive Speedometer Cable Market Trends:

The Middle East and Africa region has difficult topography and intense weather conditions, needing long-lasting vehicle speedometer wires. Stainless steel variations are highly sought after due to their durability. In South Africa, for example, Speedy Cables provides high-quality stainless steel speedometer cables for off-road and utility vehicles, assuring dependable operation in tough conditions.

Top Companies Leading in the Automotive Speedometer Cable Industry

Some of the leading automotive speedometer cable market companies include ATP Automotive, R.S. International, Silco Automotive Solution LLP, and Speedy Cables (London) Ltd., among many others. For example, in March 2021, ATP Automotive released 25 new cable, flex plate, and flywheel categories, which expands coverage on mid and late-model applications.

Global Automotive Speedometer Cable Market Segmentation Coverage

- On the basis of the type, the market has been bifurcated into stainless steel material, rubber material, and plastic material. Stainless steel cables offer durability and high resistance to wear, making them ideal for heavy-duty vehicles. Rubber cables are popular for their flexibility and cost-effectiveness, while plastic cables provide lightweight solutions for modern automobiles that balance price with performance and cater to a wide range of automotive needs.

- Based on the application, the market is categorized into OEM and aftermarket. OEM cables assure accurate compatibility and excellent quality, adhering to vehicle manufacturer standards. The aftermarket segment meets replacement demands by providing numerous alternatives for various vehicle models and cost-effective repair and maintenance solutions and generating considerable market demand.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 1,985.5 Million |

| Market Forecast in 2033 | USD 3,152.2 Million |

| Market Growth Rate 2025-2033 | 5.27% |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Stainless Steel Material, Rubber Material, Plastic Material |

| Applications Covered | OEM, Aftermarket |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | ATP Automotive, R.S. International, Silco Automotive Solution LLP, Speedy Cables (London) Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)