Global Automotive Refinish Coatings Market Expected to Reach USD 15.6 Billion by 2033 - IMARC Group

Global Automotive Refinish Coatings Market Statistics, Outlook and Regional Analysis 2025-2033

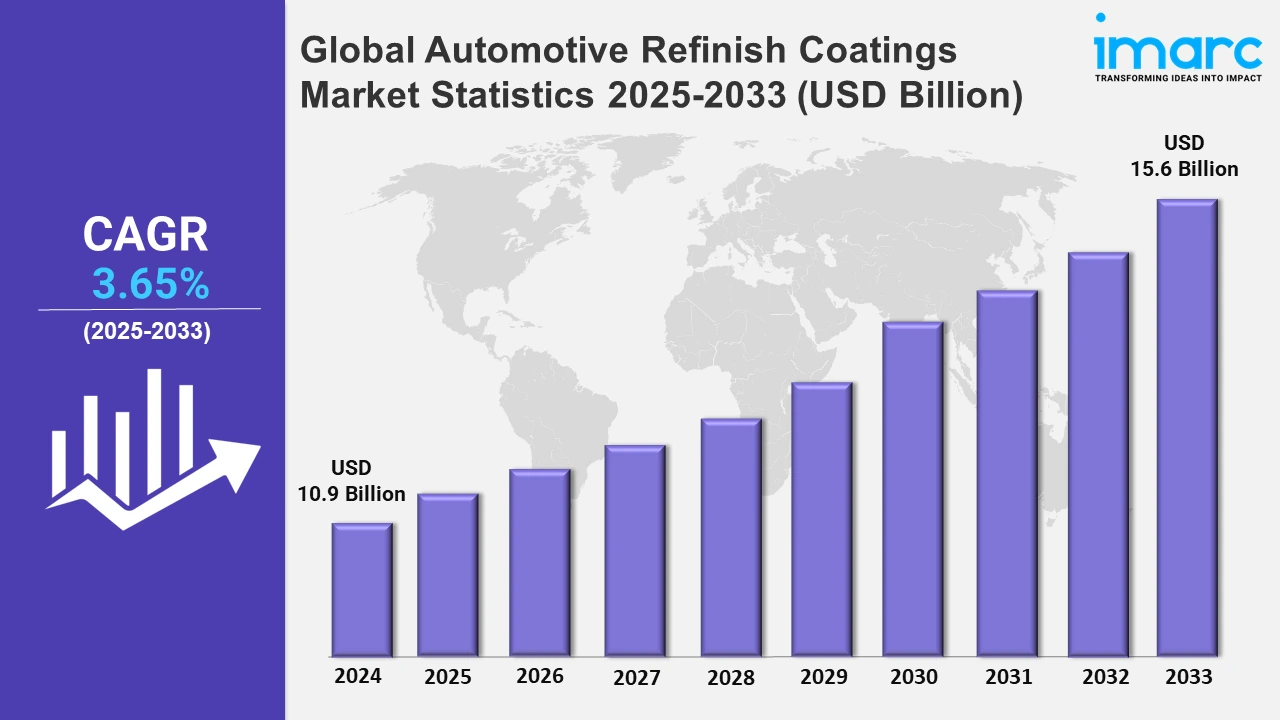

The global automotive refinish coatings market size was valued at USD 10.9 Billion in 2024, and it is expected to reach USD 15.6 Billion by 2033, exhibiting a growth rate (CAGR) of 3.65% from 2025 to 2033.

To get more information on the this market, Request Sample

The emergence of eco-friendly coatings made with low or no volatile organic compounds (VOCs) coincides with rising environmental consciousness and severe legislation. These coatings emit much less hazardous compounds, helping to enhance air quality and minimize environmental impact. For example, in September 2020, PPG Industries Inc. introduced waterborne coatings with reduced VOC content, aligning with environmental regulations and consumer preferences. PPG has also developed advanced color-matching technologies that enhance accuracy and efficiency for body shops.

Moreover, the automobile industry is experiencing a move toward proficient protective coatings that improve vehicle longevity and visual appeal. Consumer preference for long-lasting and high-performance solutions has led to the development of these coatings, which provide increased resistance to environmental factors, scratches, and pollutants. This tendency reinforces the industry's emphasis on innovation and high-quality vehicle maintenance. For example, in November 2021, 3M India announced the launch of ceramic coating for the Indian automotive and paint industry. The product was introduced to provide an enhanced solution for issues related to exterior car surfaces. For instance, Axalta Coating Systems' latest release of high-durability clearcoats, which provide better UV protection and scratch resistance, addresses the growing market need for long-lasting automotive finishes. Furthermore, automotive refinish coating manufacturers are investing in R&D to develop quicker curing materials that will decrease vehicle downtime. The need for speedier applications is consistent with the requirement for operational efficiency in body shops. The aftermarket for refinished coatings is a valuable income source, especially as vehicle ownership and maintenance rates climb. For example, in North America, prominent OEMs such as Ford, General Motors, and Tesla are integrating innovative coatings that enhance aesthetics and protection, meeting consumer expectations for high-quality and eco-friendly vehicle maintenance.

Global Automotive Refinish Coatings Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific accounted for the largest automotive refinish coatings market share on account of an increase in disposable incomes and urbanization.

North America Automotive Refinish Coatings Market Trends:

North America’s emphasis on eco-friendly coatings, prompted by rigorous environmental laws, has resulted in increased utilization of sustainable solutions, such as PPG Industries' low-VOC coatings, to fulfill compliance criteria while preserving performance and quality.

Asia Pacific Automotive Refinish Coatings Market Trends:

Growing personal vehicle ownership in emerging nations such as India and Indonesia contribute to the popularity of automotive refinish coatings in Asia Pacific. Companies are expanding operations to meet the growing demand for repair and repaint services. In September 2023, Nippon Paint Holdings Co., Ltd. announced the acquisition of shares of Nippon Paint (India) Private Limited (NPI) and Berger Nippon Paint Automotive Coatings Private Limited (BNPA), which are India-based paint manufacturers.

Europe Automotive Refinish Coatings Market Trends:

Due to stringent EU rules, there is a significant focus on innovation in water-based coatings in Europe. BASF SE's aqueous basecoats reflect the shift toward lowering solvent emissions while maintaining quality standards.

Latin America Automotive Refinish Coatings Market Trends:

Improved automotive aftermarket activities, particularly in Brazil, are propelling the market. Axalta's expansion into Latin America highlights how local demand for repair and touch-up coatings drives regional market growth.

Middle East and Africa Automotive Refinish Coatings Market Trends:

The Middle East and Africa region is expanding as the overall amount of premium automobile imports increases, necessitating high-quality refinishing options. Companies are targeting this market with specific offerings for premium automobile owners in places such as the UAE.

Top Companies Leading in the Automotive Refinish Coatings Industry

Some of the leading automotive refinish coatings market companies include 3M Company, Akzo Nobel N.V., Axalta Coating Systems, LLC, BASF SE, Berger Paints India Limited, Clariant AG, Dow Inc., Kansai Paint Co. Ltd., KCC Corporation, Nippon Paint Holdings Co., Ltd., PPG Industries Inc., and The Sherwin-Williams Company, among many others. In September 2024, at Automechanika 2024, BASF Coatings introduced its next generation of clearcoats, which employ BASF’s unique ChemCycling technology.

Global Automotive Refinish Coatings Market Segmentation Coverage

- On the basis of the resin type, the market has been bifurcated into polyurethane, alkyd, acrylic, and others, wherein polyurethane represents the most preferred segment. Polyurethane coatings are resistant to UV radiation, severe temperatures, and harsh weather conditions, ensuring that refinished automobiles retain their original appearance and protection for a longer period of time.

- Based on the product type, the market is categorized into primer, basecoat, activator, filler, topcoat, and others, amongst which basecoat dominates the market. Basecoat formulas contain colored pigments that impart the required hue to the vehicle's surface. This layer provides the foundation for the vehicle's final color and visual appeal.

- On the basis of the technology, the market has been divided into solvent-borne, water-borne, and UV-cured. Among these, solvent-borne exhibits a clear dominance in the market. These coatings often outperform some of their counterparts in terms of adhesion, corrosion resistance, and color retention.

- Based on the vehicle type, the market is bifurcated into passenger cars, commercial vehicles, and others, wherein passenger cars dominate the market. Passenger cars account for a significant fraction of the total automobile fleet, and they are vulnerable to a variety of external elements that can cause wear and tear, including accidents, weathering, and regular use.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 10.9 Billion |

| Market Forecast in 2033 | USD 15.6 Billion |

| Market Growth Rate 2025-2033 | 3.65% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Resin Types Covered | Polyurethane, Alkyd, Acrylic, Others |

| Product Types Covered | Primer, Basecoat, Activator, Filler, Topcoat, Others |

| Technologies Covered | Solvent-Borne, Water-Borne, UV-Cured |

| Vehicle Types Covered | Passenger Cars, Commercial Vehicles, others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | 3M Company, Akzo Nobel N.V., Axalta Coating Systems, LLC, BASF SE, Berger Paints India Limited, Clariant AG, Dow Inc., Kansai Paint Co. Ltd., KCC Corporation, Nippon Paint Holdings Co., Ltd., PPG Industries Inc., The Sherwin-Williams Company, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Automotive Refinish Coatings Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

.webp)

.webp)