Global Automotive Lighting Market Expected to Reach USD 56.1 Billion by 2033 - Driven by Growing Vehicle Customization Trends

Global Automotive Lighting Market Statistics, Outlook and Regional Analysis 2025-2033

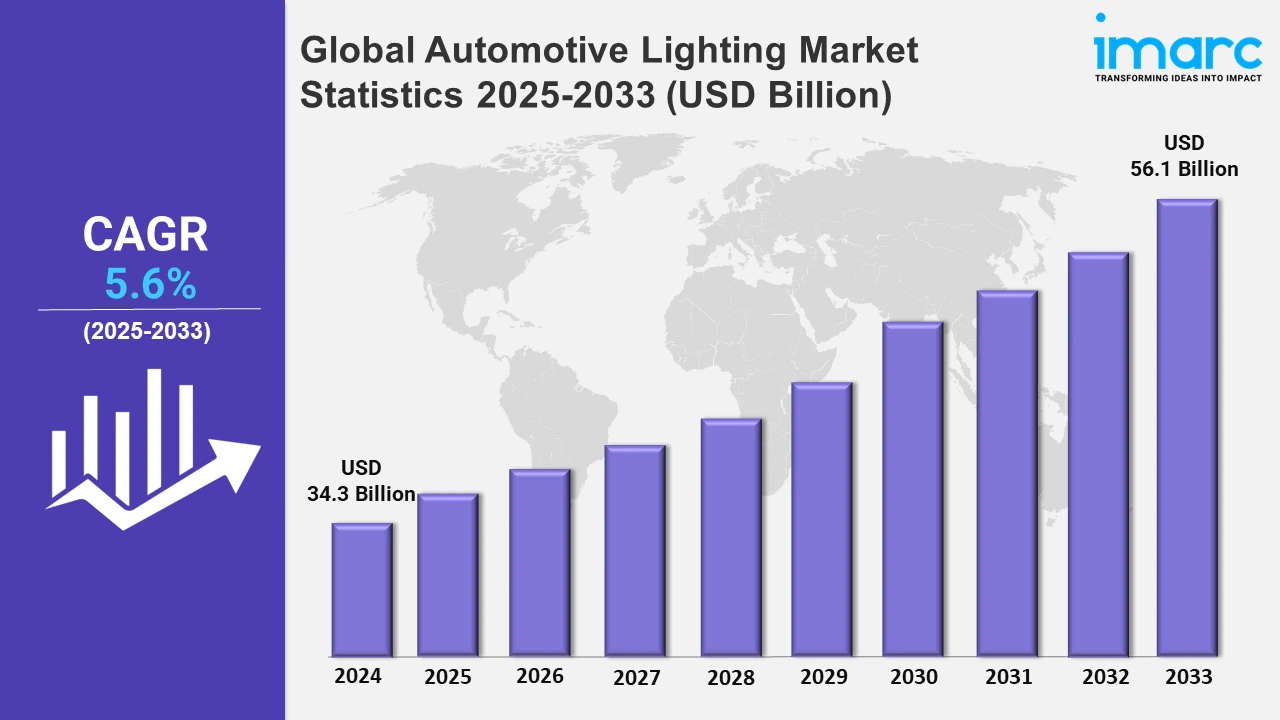

The global automotive lighting market size was valued at USD 34.3 Billion in 2024, and it is expected to reach USD 56.1 Billion by 2033, exhibiting a growth rate (CAGR) of 5.6% from 2025 to 2033.

To get more information on this market,Request Sample

The growing emphasis on vehicle safety is significantly driving the automotive lighting market. Regulatory bodies across regions are implementing stringent safety standards mandating advanced lighting systems in vehicles. Features like adaptive headlights, daytime running lights, and automatic high beams are being incorporated to enhance road visibility and reduce accidents, especially in low-light conditions. Concurrently, ongoing advancements in technologies like matrix light-emitting diode (LED) and laser lighting systems are providing superior illumination and improving driver response times. These innovations enhance safety and add to the aesthetic appeal, creating a dual benefit for manufacturers and consumers, which is further strengthening the market demand. Besides this, the integration of intelligent lighting systems with driver-assistance features, such as pedestrian detection and lane departure warning, emphasizes the role of lighting in comprehensive vehicular safety. Consequently, as consumer awareness about road safety increases and governments worldwide prioritize accident reduction, the demand for high-performance automotive lighting systems continues to grow, bolstering the market growth.

In addition to this, the surge in electric vehicles (EVs) and autonomous vehicles (AVs) is revolutionizing the automotive lighting market. In 2023, nearly 14 million new electric cars were registered worldwide, increasing the total on the roads to 40 million, which heightened the demand for specialized automotive lighting solutions. EV manufacturers prioritize energy-efficient lighting solutions, such as LED and OLED technologies, to optimize battery performance. Simultaneously, AVs rely on advanced lighting systems, including light detection and ranging (LiDAR)-based lights and adaptive illumination, for enhanced communication and navigation in diverse driving conditions. Customizable and dynamic lighting designs are also gaining traction as they offer brand differentiation and improve passenger experience in these futuristic vehicles. Furthermore, governments globally are offering incentives for EV adoption, indirectly boosting the demand for innovative lighting solutions tailored for these vehicles. As EVs and AVs redefine mobility with a focus on sustainability and automation, their reliance on cutting-edge lighting technologies ensures steady growth in the automotive lighting market, catering to both the functional and aesthetic requirements of next-generation vehicles.

Global Automotive Lighting Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific accounted for the largest market share due to rising vehicle production, EV adoption, safety regulations, and demand for LED/ organic light-emitting diode (OLED) technologies.

North America Automotive Lighting Market Trends:

The North American automotive lighting market is driven by the increasing adoption of advanced safety technologies and regulatory mandates for adaptive lighting systems. In line with this, the rising popularity of electric and AVs is boosting the demand for energy-efficient LED solutions. Consumers prioritize durability and aesthetics, leading to greater integration of premium lighting technologies in vehicles.

Asia-Pacific Automotive Lighting Market Trends:

The Asia-Pacific automotive lighting market is driven by expanding automotive production and increasing consumer demand for advanced vehicle technologies. Rapid urbanization and rising disposable incomes have boosted sales of passenger vehicles, prompting manufacturers to adopt energy-efficient LED and OLED lighting systems. The region's significant investments in electric and autonomous vehicles further fuel demand for innovative lighting solutions, such as adaptive and matrix LED systems. Stringent safety regulations in countries like Japan, China, and India encourage the integration of advanced safety-oriented lighting technologies. Besides this, the trend of vehicle personalization and premium aesthetics enhances the adoption of customizable and dynamic lighting systems. In March 2024, Marelli's innovative Light Domain Controller centralizes lighting software, enhancing safety and driving experiences for next-gen vehicles, successfully deployed in China's EV market with advanced "MCU LESS" technology.

Europe Automotive Lighting Market Trends:

Europe's market thrives on stringent safety and environmental regulations promoting energy-efficient automotive lighting, such as matrix LEDs and OLEDs. The region's robust automotive industry emphasizes innovation, while high EV adoption supports advanced lighting integration. Moreover, aesthetic customization trends further contribute to the market growth, meeting consumer demand for luxury and personalization.

Latin America Automotive Lighting Market Trends:

The Latin American market experiences growth due to rising automotive production and increased consumer focus on vehicle safety. Economic development boosts demand for affordable LED lighting systems. In confluence with this, regional manufacturers are incorporating basic adaptive lighting technologies to comply with evolving safety standards and meet cost-conscious consumer preferences, which is aiding in market expansion.

Middle East and Africa Automotive Lighting Market Trends:

The MEA automotive lighting market benefits from increasing vehicle sales, particularly in luxury and commercial segments. Urbanization drives demand for advanced lighting systems in premium cars. Apart from this, government initiatives for improved road safety and the rising adoption of LED technologies contribute to the gradual modernization of the regional automotive lighting landscape, creating a positive outlook for market expansion.

Top Companies Leading in the Automotive Lighting Industry

Some of the leading automotive lighting market companies include Continental AG, HELLA GmbH & Co. KGaA (Faurecia SE), Hyundai Mobis (Hyundai Motor Group), Koito Manufacturing Co. Ltd., Koninklijke Philips N.V., LG Electronics Inc., Lumax Industries Limited, Marelli Holdings Co. Ltd., Osram Licht AG (ams AG), Robert Bosch GmbH, Samsung Electronics Co. Ltd., Stanley Electric Co. Ltd., Valeo, among many others.

- In October 2024, Hyundai Mobis unveiled an advanced LED lamp for stoplights and tail lights, featuring a 160° dispersion angle, surpassing the 120° of its 2021 HLED. Enhanced with diffusion agents and red wavelength, it ensures improved visibility, targeting North American sales.

Global Automotive Lighting Market Segmentation Coverage

- On the basis of the technology, the market has been categorized into halogen, Xenon/HID, LED, wherein LED represents the leading segment due to its energy efficiency, superior illumination, and longer lifespan compared to halogen and Xenon/HID. Its adoption is driven by increased demand for advanced safety features, premium aesthetics, and its compatibility with emerging technologies like adaptive and matrix lighting systems in modern vehicles.

- Based on the vehicle type, the market is classified into passenger vehicle, and commercial vehicle, amongst which passenger vehicle dominates the market owing to their higher production and sales volume globally. Increased consumer demand for advanced safety and aesthetic features, particularly in premium and EVs, drives the adoption of innovative lighting solutions, making passenger vehicles the leading segment in the automotive lighting market.

- On the basis of the sales channel, the market has been divided into original equipment manufacturers, aftermarket. Among these, original equipment manufacturers accounts for the majority of the market share as they integrate advanced lighting technologies during vehicle manufacturing, ensuring quality and seamless functionality. Rising consumer preference for factory-installed, high-performance lighting systems and the growing adoption of energy-efficient LEDs in new vehicle models strengthen OEMs' dominance in the automotive lighting segment.

- Based on the application, the market is segregated into front lighting/headlamps, rear lighting, side lighting, interior lighting. Among these, front lighting/headlamps accounts for the majority of the market share due to their critical role in vehicle safety and visibility. Advanced technologies like adaptive headlights and matrix LEDs enhance driver experience by improving illumination in varying conditions.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 34.3 Billion |

| Market Forecast in 2033 | USD 56.1 Billion |

| Market Growth Rate 2025-2033 | 5.6% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Halogen, Xenon/HID, LED |

| Vehicle Types Covered | Passenger Vehicle, Commercial Vehicle |

| Sales Channels Covered | Original Equipment Manufacturers, Aftermarket |

| Applications Covered | Front Lighting/Headlamps, Rear Lighting, Side Lighting, Interior Lighting |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Continental AG, HELLA GmbH & Co. KGaA (Faurecia SE), Hyundai Mobis (Hyundai Motor Group), Koito Manufacturing Co. Ltd., Koninklijke Philips N.V., LG Electronics Inc., Lumax Industries Limited, Marelli Holdings Co. Ltd., Osram Licht AG (ams AG), Robert Bosch GmbH, Samsung Electronics Co. Ltd., Stanley Electric Co. Ltd., Valeo, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Automotive Lighting Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)