Global Automotive Infotainment Market Expected to Reach USD 41.2 Billion by 2033 - IMARC Group

Global Automotive Infotainment Market Statistics, Outlook and Regional Analysis 2025-2033

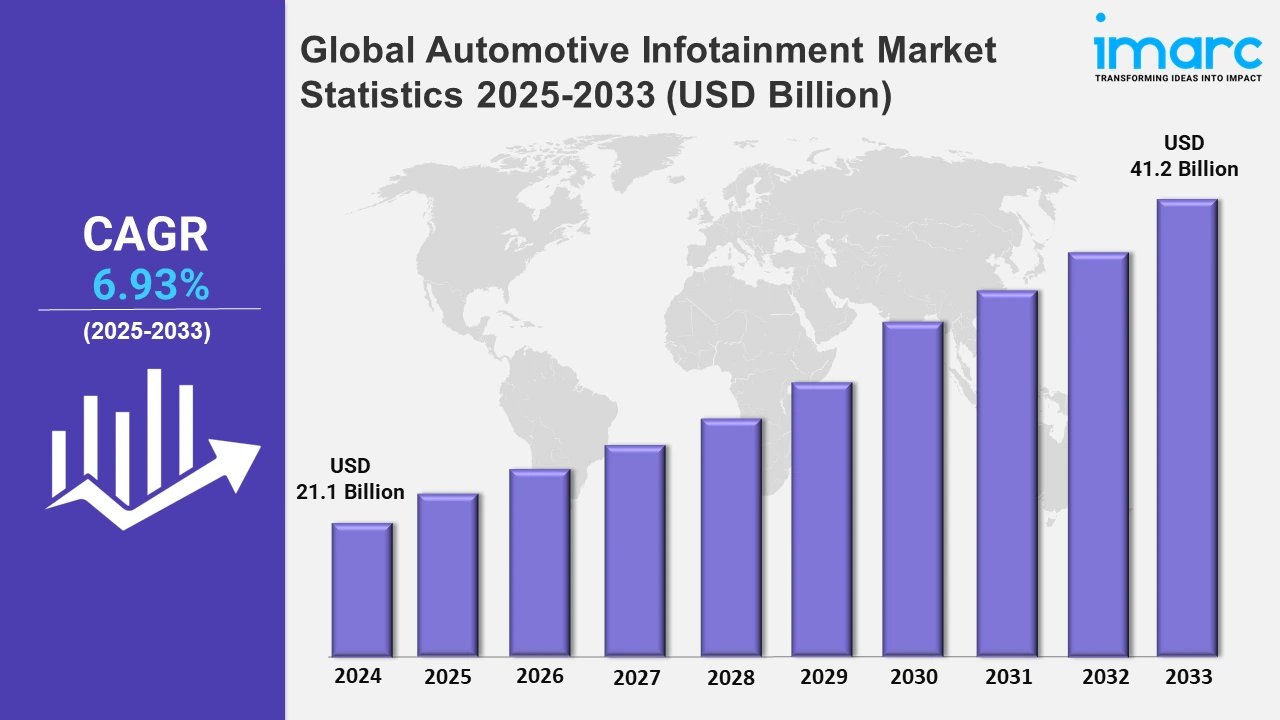

The global automotive Infotainment market size was valued at USD 21.1 Billion in 2024, and it is expected to reach USD 41.2 Billion by 2033, exhibiting a growth rate (CAGR) of 6.93% from 2025 to 2033.

To get more information on this market, Request Sample

The surge in electric vehicle (EV) sales is significantly propelling the growth of the automotive infotainment market. For instance, according to IEA, in 2023, about 14 million new electric cars were registered globally, bringing the total number on the road to 40 million, closely. Electric vehicle sales in 2023 were 3.5 million greater than in 2022, representing a 35% year-on-year growth. In 2023, there were over 250,000 new registrations every week, higher than the annual total in 2013, ten years before. Electric vehicles accounted for approximately 18% of all cars sold in 2023, up from 14% in 2022. EVs often come equipped with advanced infotainment systems that manage various vehicle functions, including battery monitoring, navigation, and entertainment, enhancing the overall driving experience. This integration is becoming a standard expectation among consumers, further driving demand.

Moreover, modern users expect vehicle connectivity and convenience on par with their other digital devices, leading to the integration of streaming services, social media, and internet connectivity in cars. This demand has prompted manufacturers to focus on creating immersive experiences with high-quality audio, advanced voice-guided navigation, and personalized content. Also, regulations focused on minimizing driver distraction impact the design and features of these systems, necessitating compliance with various global standards. This includes regulations on screen placement, user interface complexity, and hands-free operation. For instance, in July 2023, Uno Minda, an automotive technology business, launched its latest offering in the aftermarket area, an innovative infotainment system. In terms of entertainment, the system provides a full multimedia experience. Users can listen to their favorite music, podcasts, and audiobooks via a variety of sources, including FM radio, USB, and Bluetooth streaming. The device also includes video playback capabilities, allowing passengers to enjoy movies and videos on the go. Additionally, Uno Minda's infotainment system comprises excellent navigation features. It is packed with detailed maps that provide easy navigation and real-time information on routes, traffic conditions, and sites of interest. The technology also offers voice-guided navigation, which allows drivers to remain focused on the road while obtaining precise directions. Uno Minda considered safety when designing their infotainment system. It includes hands-free calling, which allows users to make and receive calls while driving.

Global Automotive Infotainment Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa (Turkey, Saudi Arabia, Iran, United Arab Emirates and others). According to the report, Asia Pacific accounted for the largest market share owing to the increasing smartphone penetration.

North America Automotive Infotainment Market Trends:

The resurgence in vehicle sales and production in North America has positively impacted on the market. For instance, total vehicle sales in the United States rose to 16 million in October from 15.80 million in September 2024. As more vehicles are sold, the demand for advanced infotainment systems rises correspondingly.

Europe Automotive Infotainment Market Trends:

Modern consumers seek vehicles equipped with sophisticated infotainment systems that offer seamless connectivity, navigation, and entertainment options. This demand is propelling manufacturers to integrate cutting-edge technologies into their vehicles. For instance, in May 2020, MG Motor introduced the facelifted version of their ZS SUV in the United Kingdom. The SUV features a larger 10.1-inch touchscreen entertainment system that is compatible with Android Auto and Apple CarPlay.

Asia Pacific Automotive Infotainment Market Trends:

The Asia Pacific area is experiencing significant expansion in the automotive infotainment market, owing mostly to the rapidly expanding automotive industries in China and India. This is powered by a growing middle class with more disposable cash and a strong preference for technologically advanced vehicles. The region's high smartphone penetration has raised consumer expectations for connected and integrated car technologies. Government attempts to promote smart transportation systems, particularly in Japan and South Korea, amplify this rise. The presence of key global and local firms in the region, who invest considerably in R&D, helps to drive market innovation and growth. Additionally, the increasing sales of electric vehicles are also propelling the market demand. For instance, India's EV sales reached 1.7 million units in FY 2024, representing a 42% year-over-year (YoY) increase.

Latin America Automotive Infotainment Market Trends:

Economic development in countries like Brazil, Mexico, and Argentina has led to increased disposable incomes, enabling more consumers to purchase vehicles. This surge in vehicle ownership boosts the demand for advanced infotainment systems that offer enhanced driving experiences.

Middle East and Africa Automotive Infotainment Market Trends:

Countries, such as the UAE and Saudi Arabia, are witnessing a growing interest in connected vehicles. Luxury car markets in the UAE are embracing connected features, including advanced infotainment systems and telematics services, catering to the affluent consumer base and aligning with the region's focus on modernization and smart city initiatives.

Top Companies Leading in the Automotive Infotainment Industry

Some of the leading automotive Infotainment market companies include Alps Alpine Co., Ltd, Continental AG, Denso Corporation, Garmin Ltd., HARMAN International, Marelli Holdings Co., Ltd., Mitsubishi Electric Corporation, Panasonic Corporation, Pioneer Corporation, Robert Bosch GmbH, and Visteon Corporation, among many others. For instance, in January 2024, Continental AG introduced the "Face Authentication Display," a two-stage access control system based on biometric user recognition that employs specialized camera systems installed externally on the vehicle's B-pillar and invisibly beneath the driver display panel.

Global Automotive Infotainment Market Segmentation Coverage

- On the basis of the product type, the market has been bifurcated into navigation unit, display audio, audio, and others, wherein audio represented the largest segment. Enhanced audio quality and immersive experiences are now expected in modern vehicles, driving manufacturers to invest in advanced audio technologies.

- Based on the vehicle type, the market is categorized into passenger cars and commercial vehicles, amongst which passenger cars accounted for the largest automotive infotainment market share due to the increasing demand for in-car connectivity and entertainment options.

- On the basis of the operating system, the market has been divided into QNX, LINUX, Microsoft, and others. Among these, LINUX represented the largest segment due to its flexibility, robustness, and open-source nature.

- Based on the installation type, the market is bifurcated into in-dash infotainment and rear-seat infotainment, wherein in-dash infotainment accounted for the largest market share. In-dash systems are increasingly becoming the hub for advanced driver-assistance systems (ADAS), providing critical information and alerts to the driver.

- On the basis of the sales channel, the market is segmented into OEM and aftermarket. OEM represented the largest segment primarily due to their integration during the vehicle manufacturing process.

- Based on the technology, the market is bifurcated into integrated, embedded, and tethered, wherein tethered accounted for the largest market share. As smartphone usage continues to grow, the demand for tethered infotainment solutions is expected to remain strong, especially in mid-range vehicles.

- On the basis of the connectivity, the market is segmented into Bluetooth, Wi-Fi, 3G, 4G and 5G. Bluetooth represented the largest segment due to its widespread adoption of wireless connectivity.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 21.1 Billion |

| Market Forecast in 2033 | USD 41.2 Billion |

| Market Growth Rate 2025-2033 | 6.93% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Navigation Unit, Display Audio, Audio, Others |

| Vehicle Types Covered | Passenger Cars, Commercial Vehicles |

| Operating Systems Covered | QNX, LINUX, Microsoft, Others |

| Installation Types Covered | In-Dash, Rear Seat Infotainment |

| Sales Channels Covered | OEM, Aftermarket |

| Technologies Covered | Integrated, Embedded, Tethered |

| Connectivities Covered | Bluetooth, Wi-Fi, 3G, 4G, 5G |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico, Turkey, Saudi Arabia, Iran, United Arab Emirates |

| Companies Covered | Alps Alpine Co., Ltd, Continental AG, Denso Corporation, Garmin Ltd., HARMAN International, Marelli Holdings Co., Ltd., Mitsubishi Electric Corporation, Panasonic Corporation, Pioneer Corporation, Robert Bosch GmbH, Visteon Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

.webp)

.webp)