Global Automotive Hypervisor Market Expected to Reach USD 2,584.1 Million by 2033 - IMARC Group

Global Automotive Hypervisor Market Statistics, Outlook and Regional Analysis 2025-2033

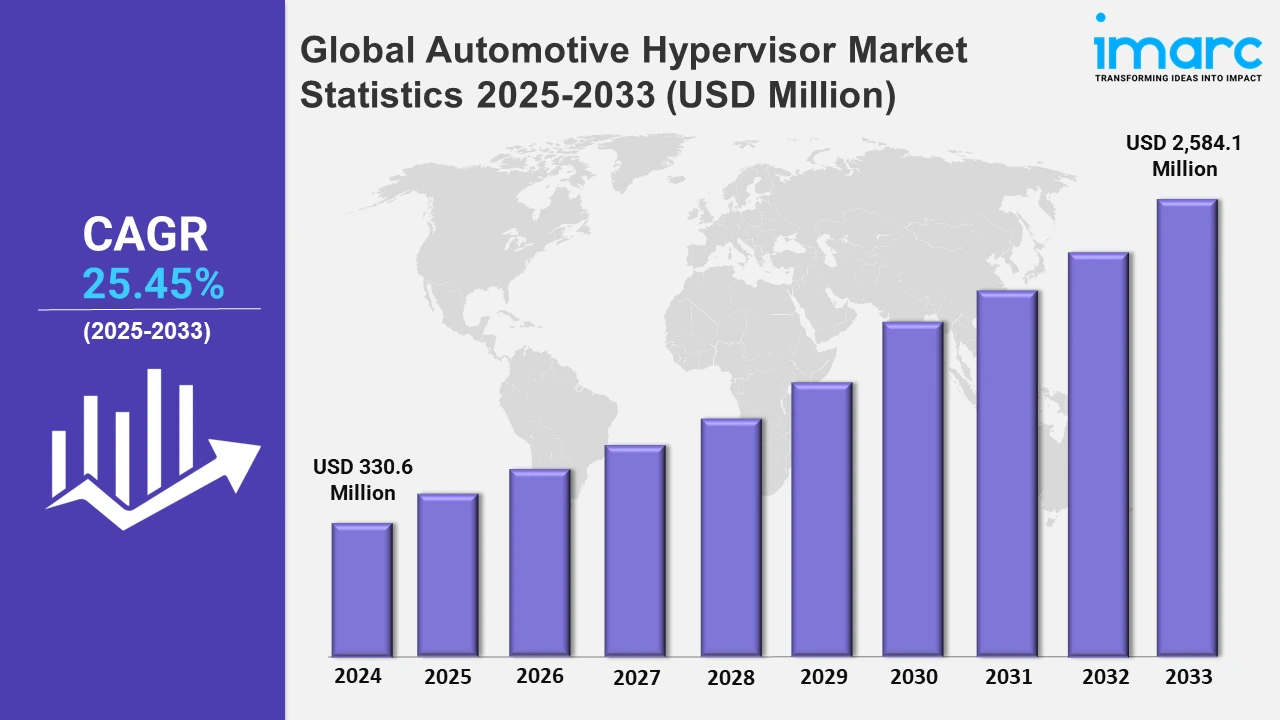

The global automotive hypervisor market size was valued at USD 330.6 Million in 2024, and it is expected to reach USD 2,584.1 Million by 2033, exhibiting a growth rate (CAGR) of 25.45% from 2025 to 2033.

To get more information on this market, Request Sample

The increased demand for over-the-air (OTA) upgrades to improve vehicle performance, correct security vulnerabilities, and introduce new features is driving the market expansion. For instance, in March 2024, Ather Energy unveiled Atherstack 6, its largest over-the-air (OTA) software update. The update included 'Ather Messaging on Dashboard.' Ather also planned to launch a new mobile app aiming at merging multiple scooter capabilities. In line with this, car hypervisors make OTA updates easier by compartmentalizing software components. Updates can be applied to non-critical systems without disrupting safety-critical operations.

Hypervisors enable the consolidation of multiple functions on a single hardware platform, reducing complexity and cost. Additionally, as EVs increasingly adopt features like ADAS, infotainment, and connectivity, hypervisors help to ensure efficient and secure operation by isolating critical safety systems from non-essential ones. This supports improved vehicle performance, energy efficiency, and streamlined system management. Besides this, the growing focus on enhanced safety and security on account of the rising number of interconnected vehicles is escalating the market demand.

Global Automotive Hypervisor Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific accounted for the largest market share due to the rising demand for optimal software solutions for enhanced driving experience.

North America Automotive Hypervisor Market Trends:

The growing inclination towards electric vehicles is inflating the need for robust electronic architectures where hypervisors play a key role in consolidating systems. For instance, according to IEA, in the United States, new electric car registrations reached 1.4 million in 2023. EVs rely heavily on advanced software to manage battery systems, optimize energy usage, control autonomous driving features, and enhance infotainment systems.

Europe Automotive Hypervisor Market Trends:

The increasing adoption of connected and autonomous vehicles, stringent safety regulations, and the push for advanced driver-assistance systems (ADAS) are among the key factors bolstering the market. Additionally, rising investments in autonomous driving technologies by companies like Volkswagen and BMW across Germany are stimulating the market. France and the UK also contribute significantly, with Renault and Jaguar Land Rover incorporating hypervisor solutions to improve vehicle virtualization.

Asia Pacific Automotive Hypervisor Market Trends:

The Asia Pacific dominates the overall market owing to the rapid expansion of the EV market and cost-effective production in countries like China, Japan, and South Korea. Major players like Hyundai and BYD are implementing hypervisors to manage complex software systems in EVs. The region’s focus on 5G adoption, especially in China, also supports advancements in connected vehicles requiring hypervisor.

Latin America Automotive Hypervisor Market Trends:

The Latin America automotive hypervisor market is witnessing significant growth due to increasing investments in automotive manufacturing and the gradual adoption of smart vehicle technology. Countries like Brazil and Mexico are becoming production hubs, and manufacturers are leveraging hypervisors for improved safety and user experience.

Middle East and Africa Automotive Hypervisor Market Trends:

The Middle East and Africa automotive hypervisor market is emerging with a focus on premium vehicles and government-driven smart city initiatives. For example, the UAE’s smart transportation goals encourage automakers to integrate connected and autonomous systems, supported by hypervisors for real-time management of software components.

Top Companies Leading in the Automotive Hypervisor Industry

Some of the leading automotive hypervisor market companies include BlackBerry Limited, Green Hills Software, IBM Corporation, OpenSynergy GmbH (Panasonic Holdings Corporation), Siemens AG, Wind River Systems Inc. (Aptiv Plc, Intel Corporation), among many others. In April 2024, Green Hills Software integrated its software solutions with NXP Semiconductors' open S32 CoreRide platform to help OEMs and Tier 1s construct software defined vehicles (SDVs).

Global Automotive Hypervisor Market Segmentation Coverage

- On the basis of the type, the market has been bifurcated into type 1 hypervisor and type 2 hypervisor, wherein type 1 hypervisor represented the largest segment as it runs directly on the hardware of the vehicle without the need for an underlying operating system.

- Based on the level of automation, the market is categorized into semi-autonomous and fully autonomous, amongst which semi-autonomous accounted for the largest market share as these vehicles are equipped with advanced driver-assistance systems (ADAS) that provide features like adaptive cruise control, lane-keeping assistance, and automated parking, which further requires hypervisor.

- On the basis of the vehicle type, the market has been divided into passenger cars, light commercial vehicles, and heavy commercial vehicles. Among these, passenger cars represented the largest segment. Automotive hypervisors are employed in passenger cars for managing software related to infotainment systems, advanced driver-assistance systems (ADAS), in-car connectivity, and comfort features, further driving the segment growth.

- Based on the vehicle class, the market is bifurcated into mid-priced, luxury, and economy vehicles, wherein luxury accounted for the largest market share. Hypervisors are used in luxury vehicles to manage complex software ecosystems while ensuring a seamless and premium user experience.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 330.6 Million |

| Market Forecast in 2033 | USD 2,584.1 Million |

| Market Growth Rate 2025-2033 | 25.45% |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Type 1 Hypervisor, Type 2 Hypervisor |

| Level of Automations Covered | Semi-Autonomous, Fully Autonomous |

| Vehicle Types Covered | Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles |

| Vehicle Classes Covered | Mid-Priced, Luxury, Economy Vehicles |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | BlackBerry Limited, Green Hills Software, IBM Corporation, OpenSynergy GmbH (Panasonic Holdings Corporation), Siemens AG, Wind River Systems Inc. (Aptiv Plc, Intel Corporation), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)