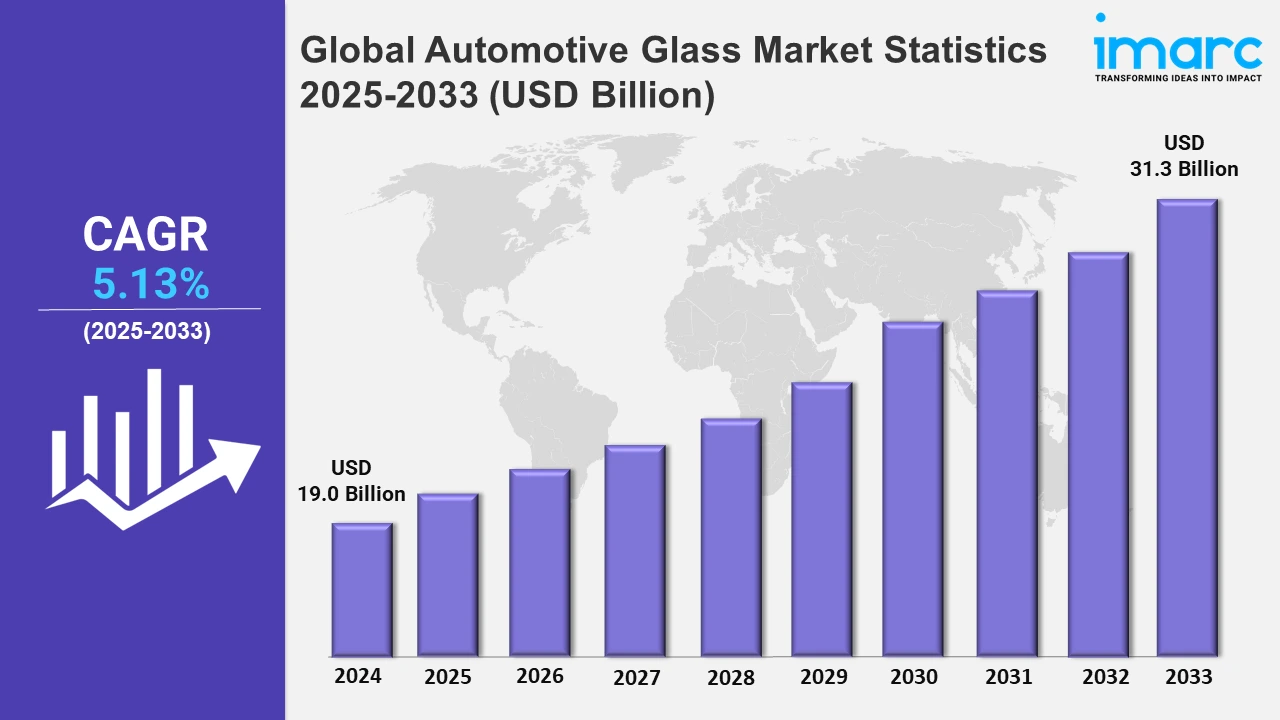

Global Automotive Glass Market Expected to Reach USD 31.3 Billion by 2033, with a 5.13% CAGR from 2025 to 2033 | IMARC Group

Global Automotive Glass Market Statistics, Outlook and Regional Analysis 2025-2033

The global automotive glass market size was valued at USD 19.0 Billion in 2024, and it is expected to reach USD 31.3 Billion by 2033, exhibiting a growth rate (CAGR) of 5.13% from 2025 to 2033.

To get more information on the this market, Request Sample

Collaborations between automotive glass manufacturers and vehicle component suppliers are on the rise as companies look for unique lightweight solutions to improve fuel efficiency and safety. Such collaborations use specialist expertise in advanced glass technologies to create long-lasting, efficient, and industry-compliant solutions. For example, in June 2022, Corning announced a collaboration with Hyundai Mobis to develop lightweight automotive glass solutions aimed at enhancing vehicle fuel efficiency and safety. The partnership aims to leverage Corning's expertise in advanced glass technologies to produce durable and lightweight automotive glass that meets stringent industry standards.

Investment in proficient production facilities in some of the prominent regions is an increasing trend in the automotive glass industry. Companies are expanding production capacity to satisfy increased local demand by utilizing cutting-edge technology to provide high-quality and market-specific glass solutions. For example, in August 2022, Saint-Gobain inaugurated a new automotive glass production facility in China, reinforcing its presence in the Asia Pacific region. The state-of-the-art facility is equipped with advanced manufacturing technologies to produce high-quality automotive glass products tailored to meet the specific needs of the Chinese market. Furthermore, automotive glass manufacturers in the Asia Pacific are expanding their product lines to meet vehicle performance and environmental requirements. Companies such as AGC Inc. and Fuyao Glass are focusing on manufacturing lightweight and high-strength glass that meets fuel economy regulations. Furthermore, the replacement and aftermarket automotive glass industries have tremendous revenue potential due to the region's rising automobile market. Consumers are increasingly preferring advanced, laminated, and tempered glass items over regular ones due to their increased durability and safety features. The expanding demand for high-performance automotive glass in China and Japan is spurred by the significant presence of major manufacturers such as Toyota, Hyundai, and Nissan, which are constantly innovating their vehicle lines to suit local customer expectations for safer and more affordable components.

Global Automotive Glass Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); North America (the United States and Canada); Latin America (Brazil, Mexico, Argentina, Colombia, Chile, Peru, and others); and the Middle East and Africa (Turkey, Saudi Arabia, Iran, United Arab Emirates, and others). According to the report, Asia Pacific accounted for the largest market share on account of the elevating economic support from the government and investments in road construction, leading to an increase in vehicle production and usage of automotive glass.

Europe Automotive Glass Market Trends:

The goal for fuel efficiency is driving up demand for lightweight laminated glass in Europe. For example, BMW incorporates innovative glass technology into their electric vehicles to increase energy efficiency while adhering to strict emissions rules.

Asia Pacific Automotive Glass Market Trends:

The market in Asia Pacific is being driven by rising demand for vehicles due to population growth and economic development, particularly in China and India, where automobile industries are expanding. For example, according to the World Counts, the Asia Pacific region’s population is projected to grow from 4.64 billion people in 2020 to 5.267 billion people in 2050.

North America Automotive Glass Market Trends:

The adoption of smart glass technologies, such as electrochromic windows, is increasing. Tesla's usage of smart panoramic roofs with auto-dimming features demonstrates North America's emphasis on innovation for driver comfort and energy management.

Latin America Automotive Glass Market Trends:

In Latin America, the rise in automobile ownership, particularly in Brazil, has increased the need for robust and heat-resistant glass. Local producers are investing in glass that can resist severe temperatures while still meeting clarity and safety regulations.

Middle East and Africa Automotive Glass Market Trends:

Due to extreme climate conditions in the Middle East and Africa, the tendency is toward UV-resistant and shatterproof glass. Premium manufacturers in the UAE use similar elements in luxury automobiles to protect passengers from direct sunlight and assure safety.

Top Companies Leading in the Automotive Glass Industry

Some of the leading automotive glass market companies include AGC Inc., Central Glass Co., Ltd., Corning Incorporated, Fuyao Glass Industry Group Co., Ltd., Gentex Corporation, Guardian Industries Holdings (Koch Industries), Magna International Inc., Nippon Sheet Glass Co., Ltd., Saint-Gobain Sekurit, Schott AG, Sisecam, Vitro Inc., Webasto Group, and Xinyi Glass Holdings Limited, among many others. For example, in May 2024, Asahi India Glass (AIS) announced a partnership with INOX Air Products to procure green hydrogen for its upcoming float glass facility in Rajasthan. This initiative aims to produce sustainable automotive glass while reducing carbon emissions.

Global Automotive Glass Market Segmentation Coverage

- On the basis of the glass type, the market has been bifurcated into laminated glass, tempered glass, and others, wherein laminated glass represents the most preferred segment. The segment is being pushed by rising safety and security needs in automotive and architectural applications. Its shatter-resistant nature protects against break-ins, accidents, and natural disasters.

- Based on the material type, the market is categorized into IR PVB, metal coated glass, tinted glass, and others, amongst which IR PVB dominates the market. The infrared-blocking polyvinyl butyral (IR PVB) segment is driven by the growing need for energy-efficient vehicle solutions.

- On the basis of the vehicle type, the market has been divided into passenger cars, light commercial vehicles, trucks, buses, and others. Among these, passenger cars exhibit a clear dominance in the market on account of the growing consumer requirement for safety, comfort, and appealing design in their vehicles.

- Based on the application, the market is bifurcated into windshield, sidelite, backlite, rear quarter glass, sideview mirror, rearview mirror, and others, wherein windshield dominates the market. The segment is being pushed by an increased emphasis on safety and visibility in automobile design.

- On the basis of the end-user, the market is segmented into OEMs and aftermarket suppliers. Currently, OEMs account for the majority of the total market share. This segment is driven by the elevating need for high-quality and long-lasting automotive glass that adheres to stringent safety and quality criteria established by original equipment manufacturers and regulatory authorities.

- Based on the technology, the market is bifurcated into active smart glass (suspended particle glass, electrochromic glass, and liquid crystal glass) and passive glass (thermochromic and photochromic), wherein passive glass dominates the market. The escalating demand for cost-effective and durable glass options in the automotive sector is acting as a significant growth-inducing factor.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 19.0 Billion |

| Market Forecast in 2033 | USD 31.3 Billion |

| Market Growth Rate 2025-2033 | 5.13% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Glass Types Covered | Laminated Glass, Tempered Glass, Others |

| Material Types Covered | IR PVB, Metal Coated Glass, Tinted Glass, Others |

| Vehicle Types Covered | Passenger Cars, Light Commercial Vehicles, Trucks, Buses, Others |

| Applications Covered | Windshield, Sidelite, Backlite, Rear Quarter Glass, Sideview Mirror, Rearview Mirror, Others |

| End-Users Covered | OEMs, Aftermarket Suppliers |

| Technologies Covered |

|

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico, Argentina, Colombia, Chile, Peru, Turkey, Saudi Arabia, Iran, United Arab Emirates |

| Companies Covered | AGC Inc., Central Glass Co., Ltd., Corning Incorporated, Fuyao Glass Industry Group Co., Ltd., Gentex Corporation, Guardian Industries Holdings (Koch Industries), Magna International Inc., Nippon Sheet Glass Co., Ltd., Saint-Gobain Sekurit, Schott AG, Sisecam, Vitro Inc., Webasto Group, Xinyi Glass Holdings Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Automotive Glass Market:

- Asia Pacific Automotive Glass Market Report

- Europe Automotive Glass Market Report

- India Automotive Glass Market Report

- United States Automotive Glass Market Report

- Japan Automotive Glass Market Report

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

.webp)

.webp)