Global Automotive Adhesives Market Expected to Reach USD 13.5 Billion by 2033 - IMARC Group

Global Automotive Adhesives Market Statistics, Outlook and Regional Analysis 2025-2033

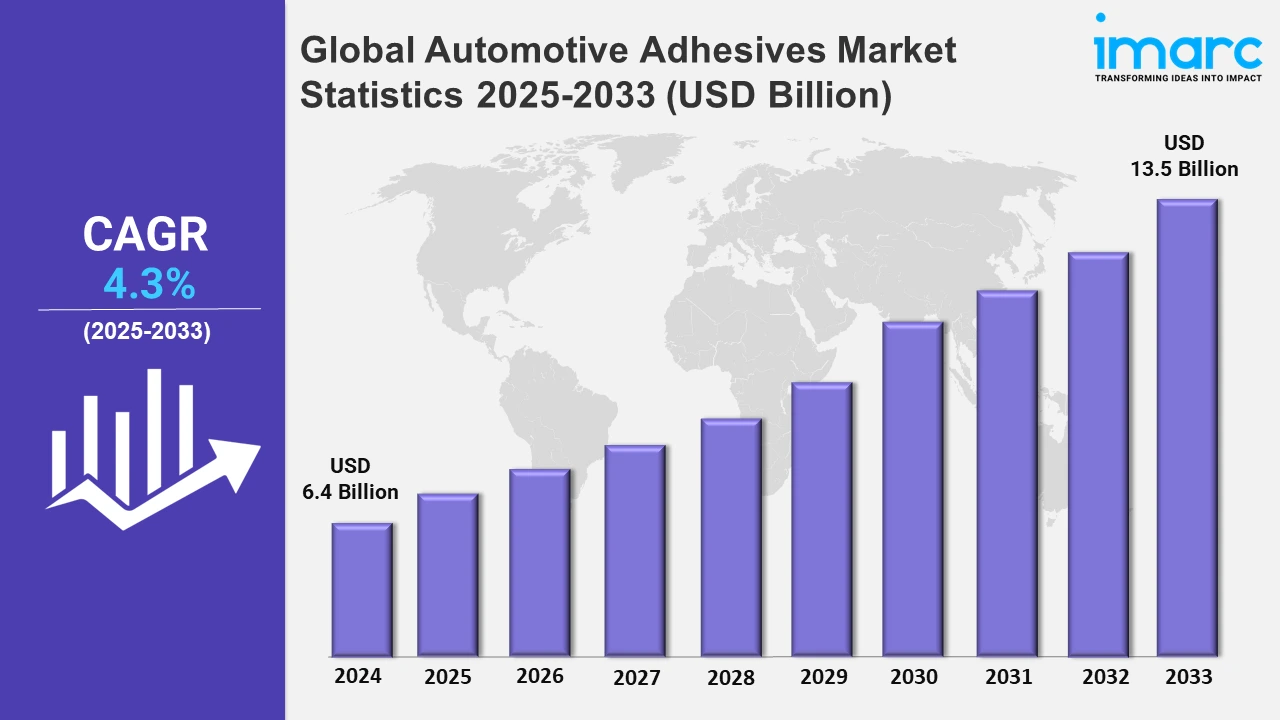

The global automotive adhesives market size was valued at USD 6.4 Billion in 2024, and it is expected to reach USD 13.5 Billion by 2033, exhibiting a growth rate (CAGR) of 4.3% from 2025 to 2033.

To get more information on this market, Request Sample

The automotive adhesives market is experiencing significant growth globally, due to amplified demand for lighter and high fuel-efficient vehicles, which in turn calls for advanced bonding solutions. To achieve this goal, auto manufacturers are using light metals, such as aluminum and composites, making the vehicle fuel efficient. Adhesives offer superior alternatives to mechanical fastening methods. They do not add any weight while bonding dissimilar materials efficiently which are making the vehicle perform with improvement. The rising focus on electric vehicles (EVs) is another significant driver of demand for automotive adhesives. EVs require special adhesives for battery assembly, thermal management, and structural integrity to ensure durability and safety. For instance, in November 2024, DuPont launched its BETAFORCE™ Elastic Structural Adhesive, a cutting-edge solution for EV battery assembly. This innovation enhances thermal management, structural integrity, and sustainability, marking a pivotal advancement in electric vehicle technology and manufacturing efficiency. Furthermore, with governments worldwide offering incentives and subsidies to motivate for EV adoption, the need for innovative adhesives tailored to these vehicles continues to grow. The shift toward autonomous vehicles (AV’s) and connected vehicles (CV’s) is improving the development of new adhesives with high capabilities for noise and vibration dampening into cabins for comfort and safety.

The growing trend of vehicle customization and aesthetic enhancement is also boosting the market, as adhesives play a critical role in assembling advanced interior and exterior components with precision. Adhesives contribute to noise reduction and improved aerodynamics, meeting consumer expectations for quieter and more efficient vehicles. For example, in May 2024, Dynamat launched its Xtreme Self-Adhesive Sound Deadener, featuring advanced aluminum-backed butyl material, offering superior noise insulation, heat resistance, and enhanced acoustic performance, ideal for optimizing car audio and reducing road noise effectively. Moreover, stringent safety standards in the automotive industry are encouraging manufacturers to use adhesives that provide superior crash resistance and impact absorption, further driving market adoption. Advancements in adhesive technologies, including high-strength and heat-resistant formulations, are catering to the evolving demands of modern vehicles, from luxury models to commercial fleets. The Asia-Pacific (APAC) region is intensely benefiting from growing automobile production and local urbanization, making for a high demand for adhesives to solve problems concerning local manufacturing. After-sales services include repairs and refurbishments. These services contribute towards the hike in demand for car adhesives as quality fixes ensure longer lifespans for vehicles. These interlinked drivers are collectively driving sustained growth in the global automotive adhesives market, reflecting the industry's move toward more sustainable, efficient, and consumer-centric solutions.

Global Automotive Adhesives Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific accounted for the largest market share on account of increasing automobile production and urbanization driving adhesive demand.

North America Automotive Adhesives Market Trends:

Advanced automotive manufacturing capabilities and high demand for lightweight, fuel-efficient vehicles drive the North America automotive adhesives market to the top. Escalating electric vehicle (EV) adoption and environmental regulations to use adhesives are improving vehicle efficiency. Major players in the U.S. and Canada invest in innovative adhesive technologies for enhanced safety and performance. Increased automotive production and after-sales services boost the market further in the region.

Asia-Pacific Automotive Adhesives Market Trends:

The Asia-Pacific automotive adhesives market is booming due to the rapid industrialization and urbanization in the region and the dominance of the region in automobile manufacturing. Countries such as China, Japan, and India are significant automotive hubs, demanding huge volumes of adhesives used in vehicle assembly and customization. For example, in April 2024, ThreeBond's epoxy adhesive applications transformed vehicle lightweighting by enabling stronger bonds for advanced materials like carbon fiber and aluminum, enhancing fuel efficiency, structural integrity, and sustainability in modern automotive design and performance. Moreover, amplifying adoption of lightweight materials to enhance fuel efficiency in accordance with stringent environmental regulations escalate the demand for advanced adhesives. High disposable incomes and increases in middle-class populations in such regions are promoting sales which are driving growth for markets. Moreover, accelerating electricity vehicle production and uptake of the region boosts demand in specialized adhesives with battery systems and lightweighted structures. Advances in technological capabilities and investment in infrastructure improvements boost the productivity and suitability of automotive adhesives for production and applications while strengthening the market position.

Europe Automotive Adhesives Market Trends:

The Europe automotive adhesives market is driven by the regional focus on sustainability and low-weight vehicle manufacturing, both of which are aimed to sustain stringent environmental regulations. The rise of electric vehicles (EVs) along with advanced adhesive technologies supports vehicle efficiency and durability. Various major automobile manufacturers are placing adhesives into new vehicles in Germany, France, and Italy for safety performance. Research and innovation of adhesives with higher strengths and heat resistance further propel growth of the market in this region.

Latin America Automotive Adhesives Market Trends:

The Latin America automotive adhesives market benefits from amplifying vehicle production and increasing demand for cost-effective, fuel-efficient solutions. Adhesives are highly adopted to support lightweight vehicle manufacturing and reduce emissions. Rising investments in infrastructure and the automotive industry in countries like Brazil and Mexico also boost demand for innovative bonding technologies. The growing after-sales services in this region, such as vehicle repairs, are also responsible for the steady growth of automotive adhesives.

Middle East and Africa Automotive Adhesives Market Trends:

Middle East and Africa automotive adhesives market is driven by urbanization, infrastructure development, and accelerating demand for automobiles. The requirement of low weight and fuel-efficient automobiles to counter environmental degradation helps in the consumption of adhesives in automobile production. Intensifying investments in automobiles, especially in countries like South Africa and the UAE, aids the growth of the region's market. Usage of adhesives in maintenance and repair activities also enhances the regional market.

Top Companies Leading in the Automotive Adhesives Industry

Some of the leading automotive adhesives market companies include 3M Company, Avery Dennison Corporation, BASF SE, Bostik SA (Arkema S.A.), Covestro AG, Dow Inc., DuPont de Nemours Inc., H.B. Fuller Company, Henkel AG & Co. KGaA, Huntsman Corporation, Illinois Tool Works Inc., Nitto Denko Corporation, PPG Industries Inc., Sika AG, Solvay S.A., among many others.

- In June 2024, 3M introduced the Finesse-it™ Robotic Paint Repair System, streamlining automotive assembly by automating paint defect repairs. This innovation reduces labor challenges and enhances quality, reflecting 3M's commitment to advanced solutions for manufacturing, repair, and sustainable vehicle design in the evolving automotive industry.

- In April 2024, Huntsman Corporation unveiled SHOKLESS™ polyurethane foam systems, enhancing EV battery safety with advanced impact and thermal protection. These lightweight, moldable solutions provide flexibility and efficiency, addressing key challenges in the growing electric vehicle market.

Global Automotive Adhesives Market Segmentation Coverage

- On the basis of the technology, the market has been categorized into hot melt, solvent based, water based, pressure sensitive, and others. The uses of hot melt adhesives in the automotive world are numerous since they involve fast-setting adhesives with high bonding properties, making them highly suitable in assembly and structural applications. They form strong and resilient, extreme environmental factors, allowing guarantees about good performance in automotive conditions. Aqueous-based adhesives usually find applications for interior parts and bonding lightweight material mainly because they are environmentally friendly with low VOC. Pressure-sensitive adhesives provide instant bonding solutions for trims, labels, and tapes offering high versatility for a variety of automotive applications. Other technologies, such as ultraviolet (UV)-curable and reactive adhesives are providing solutions, especially customized to the state-of-the-art manufacturing process and innovative designs of the new vehicles, meeting the ever-changing needs of the industry.

- Based on the resin type, the market is classified into polyurethane, epoxy, acrylic, silicone, SMP, polyamide, and others., amongst which polyurethane dominates the market. It is predominantly used in the automotive adhesives market owing to enhanced flexibility, durability, and bonding strength. Polyurethane adhesives ensure excellent resistance to harsh conditions, and hence, the products find their applications for various vehicle components. This versatility of bonding dissimilar materials like metals and plastics makes the products highly prevalent in the modern automotive sector. Also, these adhesives assist in light-weight construction, supporting the emphasis on fuel efficiency and high performance from the automotive industry.

- On the basis of the vehicle type, the market has been categorised into passenger vehicles, light commercial vehicles, and heavy commercial vehicles. Among these, passenger vehicle accounts for the majority of the market share. These are significant in the automotive adhesives market, as this segment has a high production volume and is witnessing amplification in consumer demand for lightweight and fuel-efficient cars. In passenger vehicles, adhesives play a vital role in boosting structural integrity, noise reduction, and safety features.

- Based on the application, the market is segregated into body in white (BIW), powertrain, paint shop, and assembly, wherein body in white (BIW) represent the leading segment. BIW is critical in the automotive adhesives market due to its role in ensuring the structure and safety of the vehicle. Adhesives are widely used in BIW processes to bond components such as panels and frames, replacing traditional mechanical fasteners. This not only reduces the weight of the vehicle but also enhances its crash resistance and overall structural integrity. Further, the move to lightweight construction and the growing use of dissimilar materials all add to the expanding utilization of adhesives.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 6.4 Billion |

| Market Forecast in 2033 | USD 13.5 Billion |

| Market Growth Rate 2025-2033 | 4.3% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Hot Melt, Solvent Based, Water Based, Pressure Sensitive, Others |

| Resin Types Covered | Polyurethane, Epoxy, Acrylic, Silicone, SMP, Polyamide, Others |

| Vehicle Types Covered | Passenger Vehicles, Light Commercial Vehicles, Heavy Commercial Vehicles |

| Applications Covered | Body in White (BIW), Powertrain, Paint Shop, Assembly |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | 3M Company, Avery Dennison Corporation, BASF SE, Bostik SA (Arkema S.A.), Covestro AG, Dow Inc., DuPont de Nemours Inc., H.B. Fuller Company, Henkel AG & Co. KGaA, Huntsman Corporation, Illinois Tool Works Inc., Nitto Denko Corporation, PPG Industries Inc., Sika AG, Solvay S.A., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Automotive Adhesives Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)