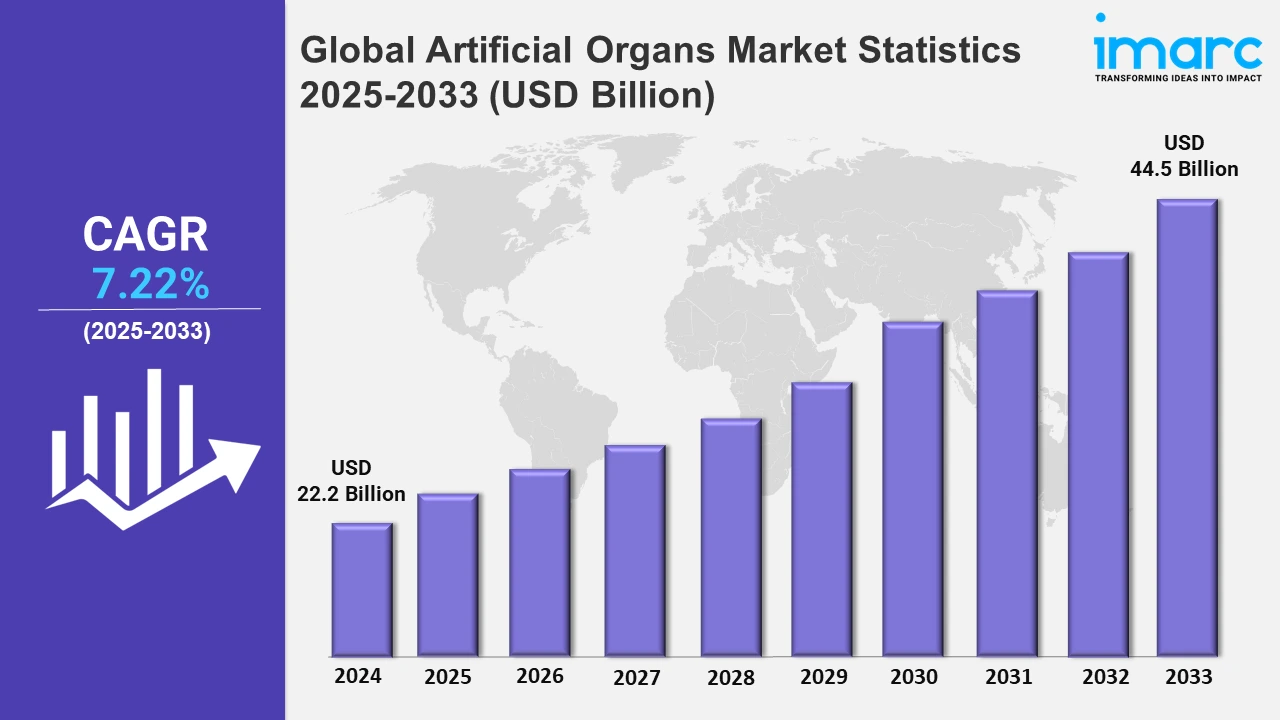

Global Artificial Organs Market Expected to Reach USD 44.5 Billion by 2033 - IMARC Group

Global Artificial Organs Market Statistics, Outlook and Regional Analysis 2025-2033

The global artificial organs market size was valued at USD 22.2 Billion in 2024, and it is expected to reach USD 44.5 Billion by 2033, exhibiting a growth rate (CAGR) of 7.22% from 2025 to 2033.

To get more information on the this market, Request Sample

The rising occurrence of chronic diseases, such as cancer, diabetes, hypertension, stroke, heart disease, respiratory diseases, arthritis, obesity, and oral diseases, is catalyzing the demand for artificial organs. For instance, according to the World Health Organization (WHO), in 2022, there were nearly 20 million new cancer diagnoses and 9.7 million fatalities. Approximately one in every five people develops cancer over their lives. Similarly, as per the American Cancer Society, in 2024, the United States is expected to see nearly 2,001,140 new cancer cases and 611,720 cancer deaths. As chronic diseases eventually lead to organ failure, there is a rise in the demand for artificial organs. As a result, bionic plants are used as an alternative that provides life-saving treatments while reducing dependency on organ donors.

Innovations in the field of 3D bioprinting are crucial in organ transplanting as it is used for developing artificial organs. 3D bioprinting is gaining traction due to its capability to minimize the risk of organ rejection. In addition, the integration of artificial intelligence (AI) in artificial organs is transforming the global trends for artificial devices. Moreover, many countries are focusing on a tool that provides a customized assessment of organ and donor suitability. This tool can be very helpful in making effective decisions about organ retrieval while assisting patients in deciding if they should accept donor organs or wait for better options. Besides this, the growing focus on bioprinting organs and tissues, recellularization strategies, cellular repair or regeneration, and new functional biomaterials for the next generation of vaccines is offering a favorable market outlook. For instance, in June 2024, CTIBIOTECH, a pioneer in the development and production of biological tests on human tissues, launched the new SAFESKIN3D initiative in collaboration with SANOFI. This ground-breaking research intends to create flexible 3D bioprinted human skin models that can predict the reactogenicity of vaccines, particularly the next generation of messenger RNA (mRNA) vaccines. These factors are further accelerating the adoption of artificial organ technologies across multiple industries. Furthermore, the surging demand for bioprinting organs and tissues for pre-surgical planning and experimentation is also creating a positive market outlook. For instance, in July 2024, MGM University in Maharashtra, India, inaugurated Stratasys' J850 digital anatomy 3D printer at the Rukmini Auditorium. The 3D printer, installed at the university's Innovation, Incubation, and Research Centre (IIRC), is the first of its kind in Maharashtra. Moreover, it is widely used to create anatomical models and biomedical and biocompatible materials, allowing for experimentation in surgery. This technology can be useful for pre-surgical planning prior to surgery.

Global Artificial Organs Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. According to the report, North America accounts for the largest market share, owing to the rising number of transplant surgeries. For instance, in September 2022, the Organ Procurement and Transplantation Network (OPTN) announced that the United States conducted one million organ transplants.

North America Artificial Organs Market Trends:

The increasing need for artificial organs due to the increased frequency of organ failure is providing a positive market outlook in North America, accounting it to be the largest region for artificial organs. Furthermore, the presence of well-developed healthcare facilities, as well as the local presence of numerous significant biotechnology and medical device businesses, is driving market expansion, particularly in the U.S. Aside from that, the growing number of donors, combined with the region's increasing demand for kidney transplantation, is driving market expansion.

Europe Artificial Organs Market Trends:

Europe’s aging population is a significant driver for the artificial organs market. For instance, in January 2023, the EU population was estimated at 448.8 million, with more than one-fifth (21.3%) of the population being 65 years or older. Older individuals are more likely to experience organ failure, necessitating alternatives such as artificial hearts, lungs, and kidneys.

Asia Pacific Artificial Organs Market Trends:

The Asia Pacific region is witnessing a significant rise in chronic diseases, such as diabetes, cardiovascular diseases, and kidney disorders, leading to higher demand for artificial organs. For instance, according to an article published by Deccan Herald, roughly 10% of the people in India suffer from chronic kidney disease (CKD).

Latin America Artificial Organs Market Trends:

Latin America faces a significant organ donation gap, with demand for organs far exceeding the available supply. Countries like Mexico and Argentina have long waiting lists for organ transplants. For instance, according to Statista, in 2023, nearly 20,000 patients were on the transplant waiting list in Mexico. This drives the adoption of artificial hearts, liver support systems, and other artificial organ technologies as life-saving alternatives.

Middle East and Africa Artificial Organs Market Trends:

The increasing incidence of chronic illnesses such as diabetes, cardiovascular diseases, and kidney disorders is a significant driver for the artificial organs market in the Middle East and Africa. For instance, countries like Saudi Arabia and South Africa have seen a sharp rise in end-stage renal disease (ESRD), fueling demand for artificial kidneys.

Top Companies Leading in the Artificial Organs Industry

Some of the leading artificial organs market companies include Abiomed, Inc., HeartWare International, Inc., Edwards Lifesciences Corp, Boston Scientific Corporation, and Cochlear Limited, among many others. For instance, in March 2022, Edwards Lifesciences Corp. announced that the U.S. Food and Drug Administration (FDA) approved the MITRIS RESILIA valve, a tissue valve replacement specifically designed for the mitral location of the heart. The MITRIS RESILIA valve has a saddle-shaped sewing cuff that resembles the asymmetric shape of the native mitral valves. It also has a low-profile frame that prevents stent posts from blocking the left ventricular outflow path and is visible under fluoroscopy, allowing for potential future transcatheter procedures for patients.

Global Artificial Organs Market Segmentation Coverage

- On the basis of the type, the market has been bifurcated into artificial kidney, artificial heart, artificial pancreas, cochlear implants, and others, wherein artificial kidney represents the largest segment due to the increasing number of patients needing renal replacement therapy (RRT). Moreover, the growing number of lifestyle diseases, such as diabetes, hypertension, and metabolic syndrome, is catalyzing the demand for artificial kidneys.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 22.2 Billion |

| Market Forecast in 2033 | USD 44.5 Billion |

| Market Growth Rate 2025-2033 | 7.22% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Artificial Kidney, Artificial Heart, Artificial Pancreas, Cochlear Implants, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Abiomed, Inc., HeartWare International, Inc., Edwards Lifesciences Corp, Boston Scientific Corporation, Cochlear Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

.webp)

.webp)