Global Aquafeed Market Size to Reach USD 376.0 Billion by 2033 - IMARC Group

Global Aquafeed Market Statistics, Outlook and Regional Analysis 2025-2033

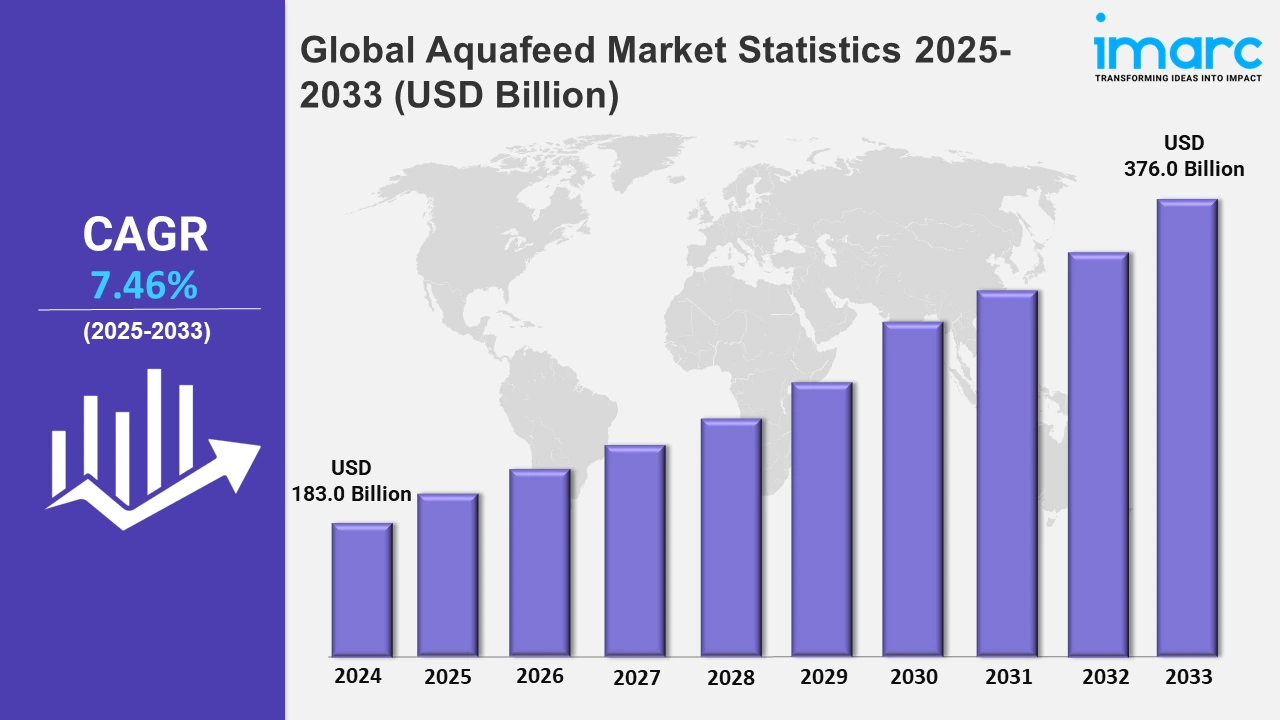

The global aquafeed market size was valued at USD 183.0 Billion in 2024, and it is expected to reach USD 376.0 Billion by 2033, exhibiting a growth rate (CAGR) of 7.46% from 2025 to 2033.

To get more information on the this market, Request Sample

The growing attention to sustainable practices and precise nutrition in the aquafeed sector has strengthened considerable advancements in this field and driven the aquafeed market growth. In addition, leading companies are investing in new technologies to enhance production processes, improve nutrient retention, and lower environmental impact. For instance, in April 2024, Swiss technology firm Bühler partnered with Premier Tech to launch the CHRONOS OMP-2090. This bagging station is automated, is aimed specifically at the aquafeed industry, and optimizes efficiency, safety, and precision for handling non-free-flowing, powdery substances. Furthermore, this system aligns with stringent food and human safety standards, demonstrating how automated solutions are pushing productivity in aquafeed. At the same time, in June 2024, Skretting introduced AmiNova, an innovative formulation designed to create an optimal digestible amino acid profile, thereby enhancing nutrient absorption in fish feed while reducing nitrogen emissions. Its advancements reflect a shift toward sustainable, high-precision nutritional approaches within aquaculture. In contrast, supporting these strides, in October 2024, the Sustainable Fisheries Partnership unveiled the Feed Solutions Toolkit, which offers more than 80 tools to help seafood companies address environmental challenges in aquafeed. This toolkit supports retailers' efforts toward sustainable feed production with backing from the Walmart Foundation, underscoring an industry-wide focus on minimizing climate and biodiversity risks.

Moreover, these developments reflect an increasing awareness of the impact that feed production has on aquatic ecosystems, stimulating stakeholders across the industry to integrate sustainable solutions into their processes. In addition, regional efforts also indicate a clear commitment to environmentally responsible practices. In June 2023, the European Commission announced the Energy Transition Partnership at the "Joining Forces for the Energy Transition in EU Fisheries and Aquaculture" conference. This initiative serves as a centralized platform for stakeholders across the EU, facilitating collaboration and information sharing to promote a climate-neutral fisheries and aquaculture sector by 2050. Also, with significant investments, such as Canada's US$6 Billion pledge to support aquaculture, this partnership highlights the collective global movement toward an eco-conscious future, thereby setting a precedent for environmental accountability in the industry.

Global Aquafeed Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, Argentina, Colombia, Chile, Peru, and others), and Middle East and Africa (Turkey, Saudi Arabia, Iran, the United Arab Emirates, and others). According to the report, Asia Pacific dominates the aquafeed market, driven by rising demand for aquaculture products, population growth, and expanding middle-class income, fueling consumption of high-quality protein sources.

North America Aquafeed Market Trends:

In North America, the aquafeed market is trending towards sustainable and high-quality feed formulations, driven by the growing popularity of salmon and trout farming. Furthermore, the region is also embracing plant-based proteins to reduce dependency on fish meal. For example, U.S. feed producers are increasingly integrating soy protein concentrates, aligning with sustainability goals and consumer preferences for responsibly sourced seafood.

Asia Pacific Aquafeed Market Trends:

The region’s aquaculture sector benefits from favorable climatic conditions, extensive coastlines, and government initiatives promoting sustainable fish farming practices in the Asia Pacific. Besides this, key industry players are expanding their capacities to meet regional needs. For instance, in October 2024, De Heus inaugurated its fifth production site in Purwodadi, Central Java, Indonesia, enhancing its aquafeed production capacity to meet local demand. This expansion provides tailored, high-quality feed solutions to support sustainable livestock and aquaculture farming contributes to local economic development. Consequently, the company’s investment underlines the significance of the Asia-Pacific market in global aquaculture feed production.

Europe Aquafeed Market Trends:

Europe's aquafeed market is leading with innovations in organic and non-GMO feed formulations, as demand for organic aquaculture products rises. Also, the region focuses on probiotics to enhance fish health and growth efficiency. For instance, Norway's salmon farms are incorporating probiotic-rich feeds to reduce antibiotic reliance, meeting EU regulations, and supporting environmentally friendly aquaculture practices.

Latin America Aquafeed Market Trends:

In Latin America, the focus is on cost-effective, high protein aquafeeds to support the rapidly expanding tilapia and shrimp farming sectors. In contrast, with regional reliance on soybean meals, innovations are blending local ingredients to reduce costs. For example, Brazil's shrimp industry is integrating cassava-based feeds, lowering expenses, and tapping into locally available resources while maintaining nutrition quality for growth.

Middle East and Africa Aquafeed Market Trends:

The Middle East and Africa are seeing rising interest in fortified aquafeeds to support fish immunity, essential in warmer climates with higher disease risks. Moreover, this trend includes incorporating vitamins and minerals into feeds for tilapia and catfish farming. For example, Egyptian tilapia farms are adding vitamin-enriched feeds to combat environmental stresses, which is enhancing survival rates and supporting the sector's resilience.

Top Companies Leading in the Aquafeed Industry

Some of the leading aquafeed market companies have been mentioned in the report.

Global Aquafeed Market Segmentation Coverage

- On the basis of the species, the market has been bifurcated into carps, marine shrimps, tilapias, catfishes, marine fishes, salmons, freshwater crustaceans, trout, and others, wherein carps represent the most preferred segment. Carps are omnivorous and can adapt to a variety of feed types. Their aquafeed often includes plant-based ingredients like soybean meal, along with a moderate amount of protein and fats. Tilapia feed is generally plant-based with a balanced protein-to-fat ratio.

- Based on the ingredients, the market is categorized into soybean, corn, fish meal, fish oil, additives, and others, amongst which soybean dominates the market. It is rich in essential amino acids and is often included as an alternative or supplement to fishmeal. It is highly digestible and commonly used in feeds for herbivorous and omnivorous fish.

- On the basis of the additives, the market has been divided into vitamins and minerals, antioxidants, feed enzymes, and others. Among these, vitamins and minerals exhibit a clear dominance in the market. They are essential nutrients that are added to aquafeed to promote health, growth, and development. Vitamins like A, D, and E, and minerals like zinc and selenium, are often included. These are crucial for metabolic processes, immune function, and bone development. Feed enzymes, such as protease, amylase, and phytase, are added to improve the digestibility of nutrients.

- Based on the product form, the market is bifurcated into pellets, extruded, powdered, and liquid, wherein pellets dominate the market. These pellets are easy to handle and can be made to float or sink, depending on the feeding habits of the species. Pellets are often used for larger fish and come in various sizes to match the size of the fish being farmed.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 183.0 Billion |

| Market Forecast in 2033 | USD 376.0 Billion |

| Market Growth Rate (2025-2033) | 7.46% |

| Units | Billion USD, Million Tons |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Species Covered | Carps, Marine Shrimps, Tilapias, Catfishes, Marine Fishes, Salmons, Freshwater Crustaceans, Trout, Others |

| Ingredients Covered | Soybean, Corn, Fish Meal, Fish Oil, Additives, Others |

| Additives Covered | Vitamins and Minerals, Antioxidants, Feed Enzymes, Others |

| Product Forms Covered | Pellets, Extruded, Powdered, Liquid |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, China, Japan, India, South Korea, Australia, Indonesia, Germany, France, United Kingdom, Italy, Spain, Russia, Brazil, Mexico, Argentina, Colombia, Chile, Peru, Turkey, Saudi Arabia, Iran, United Arab Emirates |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Aquafeed Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)