Global Aquaculture Market Expected to Reach 122.9 Million Tons by 2033 - IMARC Group

Global Aquaculture Market Statistics, Outlook and Regional Analysis 2025-2033

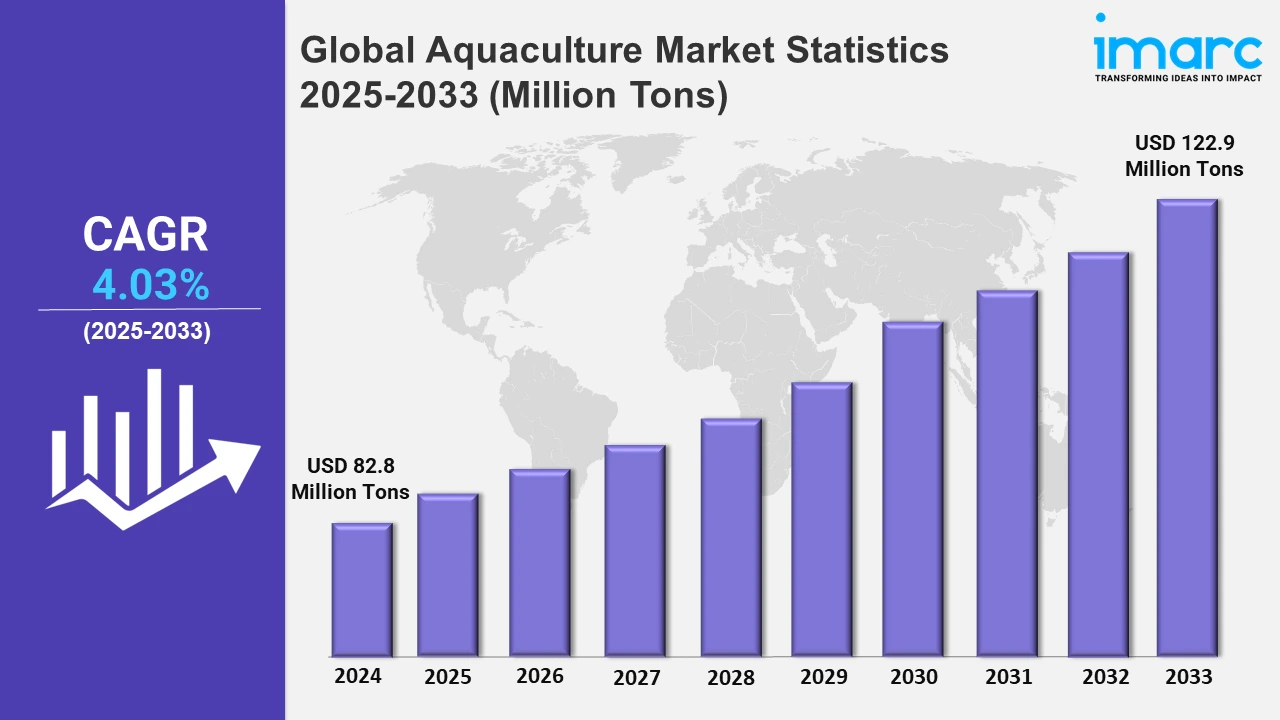

The global aquaculture market size reached 82.8 Million Tons in 2024, and it is expected to reach 122.9 Million Tons by 2033, exhibiting a growth rate (CAGR) of 4.03% from 2025 to 2033.

To get more information on this market, Request Sample

Innovative floating fish culture methods promote sustainable aquaculture, increase local fish biodiversity, and improve livelihoods. These technologies enable effective fish farming in natural water bodies, balancing environmental protection and enhanced productivity for small-scale fishermen. For example, in October 2024, in a significant stride toward sustainable aquaculture, Gauhati University’s Aquaculture and Biodiversity Centre (ABC) introduced an advanced floating fish culture cage, an initiative set to enhance local fish biodiversity and support livelihoods in Assam.

Moreover, collaborative efforts in aquaculture are encouraging the adoption of climate-resilient systems, notably in salmon farming. Advanced technology and collaborations aim to improve sustainability while increasing efficiency, in line with the worldwide push for ecologically responsible food systems to fulfill expanding seafood demand. For instance, in April 2024, Cognizant announced its new partnership with Cermaq Group AS. Cermaq Group AS is a global salmon producer leading the shift of systems to better and more climate-safe food. Furthermore, aquaculture suppliers are implementing advanced sustainable procedures to accommodate growing global seafood demand while also addressing environmental issues. They attempt to comply with severe environmental requirements, such as the Aquaculture Stewardship Council (ASC) guidelines. Additionally, the rising market for value-added aquaculture goods offers farmers the possibility to increase revenue streams. Consumers are increasingly choosing organic and sustainably produced fish that have undergone stringent quality assurance methods. For example, shrimp farming in the Asia Pacific has witnessed an increase in the use of biofloc technology, notably in India and Vietnam. This invention allows better output while maintaining water quality, which is consistent with sustainable aquaculture aims. Key organizations, such as Minh Phu Seafood Corporation and Avanti Feeds, use similar technology to broaden their export reach, particularly in areas with demanding environmental criteria, such as the EU and the U.S.

Global Aquaculture Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Norway, Spain, Russia, United Kingdom, France, Italy, Greece, Netherlands, Ireland, Denmark, Germany, and others); Asia Pacific (China, Indonesia, India, Vietnam, Philippines, South Korea, Japan, Thailand, Malaysia, Australia, and others); Latin America (Chile, Brazil, Ecuador, Mexico, and others); and the Middle East and Africa (Egypt, Turkey, Saudi Arabia, and others). According to the report, Asia Pacific accounted for the largest aquaculture market share, on account of the extensive and well-developed activities in countries, such as China, India, Vietnam, and Indonesia.

North America Aquaculture Market Trends:

The North America region prioritizes sustainable aquaculture methods, particularly recirculating aquaculture systems (RAS). For example, Atlantic Sapphire in the U.S. uses RAS technology to grow salmon on land, reducing environmental impact and providing year-round output.

Europe Aquaculture Market Trends:

Europe promotes organic certification for aquaculture goods. Countries, such as Norway and Ireland, are leaders in certified organic salmon farming, driven by consumer demand for eco-labeled fish and stringent EU sustainability rules.

Asia Pacific Aquaculture Market Trends:

Asia Pacific dominates shrimp production, with Vietnam and India utilizing advanced equipment, such as biofloc systems to increase productivity while reducing disease concerns. In 2023, India's shrimp exports were almost 800,000 metric tons.

Latin America Aquaculture Market Trends:

Latin America excels at tilapia farming, with Brazil and Colombia specializing in value-added products, such as fillets and ready-to-cook foods for export. Brazil's tilapia output increased by 12% in 2023, driven by worldwide demand.

Middle East and Africa Aquaculture Market Trends:

To maximize water utilization, the Middle East and Africa region has implemented integrated aquaculture, which combines fish farming with agriculture. For instance, Egypt uses integrated systems to boost fish yield while also assisting irrigation in desert regions, addressing food security concerns.

Top Companies Leading in the Aquaculture Industry

Some of the leading aquaculture market companies include Blue Ridge Aquaculture, Cermaq Group AS, Charoen Pokphand Foods PCL, Cooke Aquaculture, Grieg Group, Leroy, Maruha Nichiro Corporation, Mowi, SalMar ASA, Stehr Group, and Tassal Group, among many others. For example, in August 2023, Aquaculture of Texas Inc. announced its merger agreement with Yotta Acquisition Corp. This is the country’s inaugural transaction employing a special-purpose acquisition company in the seafood sector.

Global Aquaculture Market Segmentation Coverage

- On the basis of the fish type, the market has been bifurcated into freshwater fish, molluscs, crustaceans, and others, wherein freshwater fish represents the most preferred segment. These fish are among the most popular for aquaculture due to their rapid growth rates, relative simplicity of aquaculture, and ability to develop in a variety of environmental situations.

- Based on the environment, the market is categorized into fresh water, marine water, and brackish water, amongst which fresh water dominates the market. Fresh water environments, which include rivers, lakes, and ponds, provide ideal homes for a variety of aquatic creatures that are commonly bred for commercial reasons.

- Based on the distribution channel, the market is bifurcated into traditional retail, supermarkets and hypermarkets, specialized retailers, online stores, and others, wherein traditional retail dominates the market. Traditional retail helps to drive aquaculture demand, acting as a foundation for industry growth.

| Report Features | Details |

|---|---|

| Market Size in 2024 | 82.8 Million Tons |

| Market Forecast in 2033 | 122.9 Million Tons |

| Market Growth Rate 2025-2033 | 4.03% |

| Units | Million Tons |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Fish Types Covered | Freshwater Fish, Molluscs, Crustaceans, Others |

| Environments Covered | Fresh Water, Marine Water, Brackish Water |

| Distribution Channels Covered | Traditional Retail, Supermarkets and Hypermarkets, Specialized Retailers, Online Stores, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | China, Indonesia, India, Vietnam, Philippines, South Korea, Japan, Thailand, Malaysia, Australia, Chile, Brazil, Ecuador, Mexico, Norway, Spain, Russia, United Kingdom, France, Italy, Greece, Netherlands, Ireland, Denmark, Germany, Egypt, Turkey, Saudi Arabia, United States, Canada |

| Companies Covered | Blue Ridge Aquaculture, Cermaq Group AS, Charoen Pokphand Foods PCL, Cooke Aquaculture, Grieg Group, Leroy, Maruha Nichiro Corporation, Mowi, SalMar ASA, Stehr Group, Tassal Group, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Aquaculture Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)