Global Application Security Market Expected to Reach USD 34.8 Billion by 2033 - IMARC Group

Global Application Security Market Statistics, Outlook and Regional Analysis 2025-2033

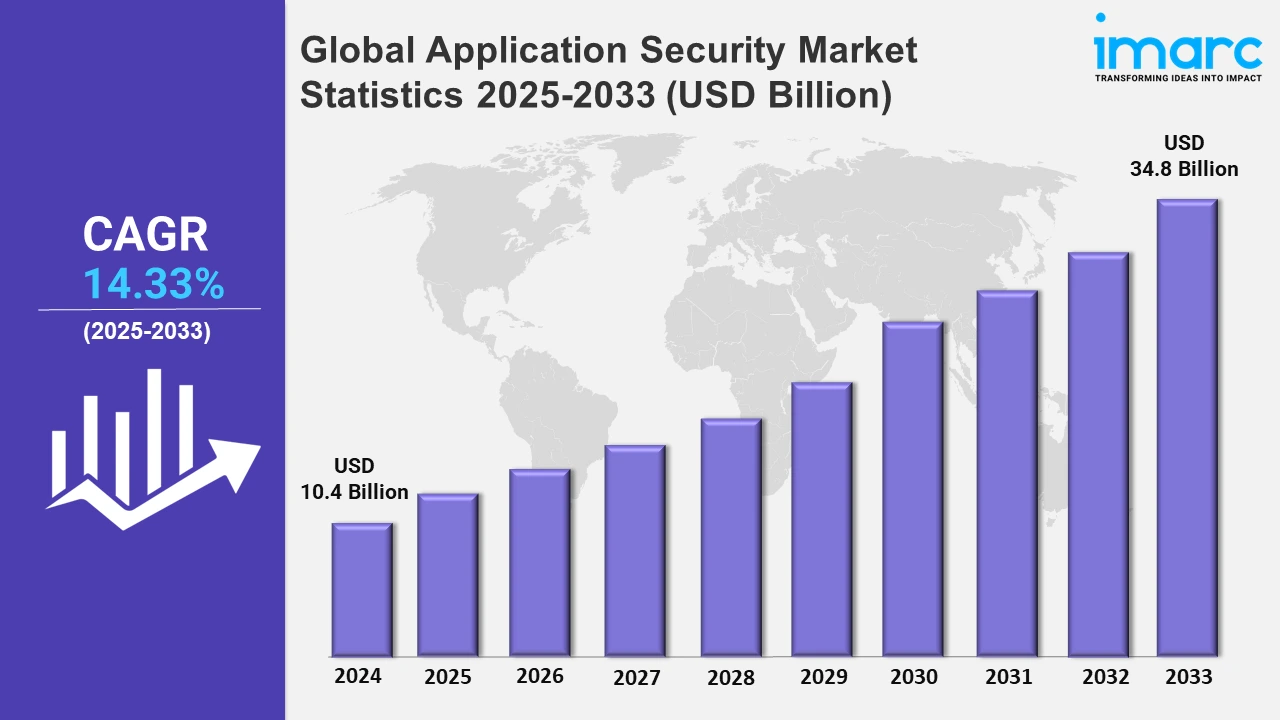

The global application security market size was valued at USD 10.4 Billion in 2024, and it is expected to reach USD 34.8 Billion by 2033, exhibiting a growth rate (CAGR) of 14.33% from 2025 to 2033.

To get more information on this market, Request Sample

AI-powered mobile application security solutions are rapidly managing the complex issues of changing digital economies. These developments focus on improving cybersecurity through localized and proficient testing capabilities, which is compatible with global initiatives to safeguard digital transformation across different industries and nations. For example, in November 2024, Appknox, a global leader in mobile application security, recently announced its official launch in Saudi Arabia at Blackhat MEA 2024, introducing AI-driven solutions designed to address the unique challenges of the Kingdom’s digital economy.

Moreover, the rising emphasis on incorporating sophisticated techniques, such as agentless scanning and code security, reflects the growing desire for complete solutions that expedite application protection. These advancements enable DevOps and security teams to successfully protect cloud environments and production systems. For instance, in June 2024, Datadog, Inc., the monitoring and security platform for cloud applications, announced new additions to its security product portfolio, including agentless scanning, data security, and code security, which allows DevOps and security teams to easily secure their code, cloud environments and production applications. Furthermore, application security suppliers are working on integrating new testing technologies, such as dynamic and interactive application security testing (DAST and IAST), to fulfill the growing need for comprehensive cybersecurity across sectors. This approach is consistent with the requirement to handle regulatory compliance and reduce vulnerabilities throughout the application lifecycle. Additionally, the growth of cloud-based application security solutions is generating new revenue streams for vendors as enterprises migrate to cloud infrastructures for scalability and efficiency. Also, companies are increasingly choosing advanced automated security testing technologies over old human methods due to their speed and accuracy. For example, in North America, the need for cloud-based application security solutions has increased, with organizations, such as IBM and Oracle, providing innovative cloud-integrated technologies to protect important applications. These developments are relevant to industries, including BFSI and healthcare, which prioritizes compliance and data security.

Global Application Security Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest application security market share, on account of the region's early adoption of advanced cybersecurity solutions, which was fueled by the high frequency of cyberattacks on key infrastructure and sensitive data.

North America Application Security Market Trends:

Artificial intelligence integration is driving development in the application security industry in North America, which is exhibiting a clear dominance in the regional market. For example, in 2023, IBM introduced AI-powered technologies that improve threat detection, in line with the region's emphasis on intelligent security solutions for complex infrastructures. Moreover, leading players like Fortinet, Checkmarx, Rapid7, and Veracode are gaining popularity in the market, offering a range of products to mitigate threats like SQL injection, cross-site scripting (XSS), and insecure API vulnerabilities.

Europe Application Security Market Trends:

Europe prioritizes compliance-driven application security owing to rigorous rules, such as GDPR. Synopsys increased its solutions in Germany in 2020, meeting the regulatory compliance needs of European enterprises while also offering comprehensive application protection. Besides this, the introduction of end-to-end security solutions, including vulnerability management, real-time protection, and compliance tools, by players, such as Checkmarx, Fortinet, Veracode, and Synopsys, will continue to bolster the market across Europe over the forecasted period.

Asia-Pacific Application Security Market Trends:

Asia-Pacific has a growing demand for mobile application security. In 2022, Checkmarx collaborated with Indian enterprises to combat mounting mobile app vulnerabilities, which were spurred by the region's rapidly increasing smartphone usage and digital transformation. Furthermore, stricter data protection regulations in countries like India and China are further driving the demand for secure application solutions.

Latin America Application Security Market Trends:

Latin America prioritizes cloud-based security deployment. Oracle launched cloud-integrated application security solutions in Brazil in 2021, responding to the region's rising demand for scalable, economical, and secure software protection in expanding cloud infrastructures. Moreover, as Latin America continues to digitize its economy, the market is expected to grow rapidly, driven by the need for stronger protection against cyber threats and the increasing focus on regulatory compliance.

Middle East and Africa Application Security Market Trends:

To prevent the rise in cyberattacks, the Middle East and Africa region focuses on web application firewalls (WAF). In 2023, NTT Ltd. deployed bespoke WAF solutions in South Africa, reflecting the region's emphasis on protecting essential internet services. Besides this, with stringent regulations in countries like the UAE and Saudi Arabia, organizations are prioritizing secure application solutions to mitigate risks and ensure compliance with emerging data protection laws.

Top Companies Leading in the Application Security Industry

Some of the leading application security market companies include Black Duck Software, Inc., Capgemini, Checkmarx Ltd, Cisco Systems, Inc., Cloudflare, Inc., Contrast Security, International Business Machines Corporation, NTT DATA, Inc., Open Text Corporation, Qualys, Inc., Rapid7, and Veracode, among many others. For example, in July 2021, Rapid7, Inc., a leading provider of security analytics and automation, announced the acquisition of IntSights Cyber Intelligence Ltd., a leader in contextualized external threat intelligence and proactive threat remediation, to expand its product portfolio.

Global Application Security Market Segmentation Coverage

- On the basis of the component, the market has been bifurcated into solution and services, wherein solution represents the most preferred segment. These solutions are increasingly being used to safeguard applications against vulnerabilities, improving compliance, security, and operational efficiency across sectors.

- Based on the type, the market is categorized into web application security and mobile application security, amongst which web application security dominates the market. This industry is being pushed by expanding digitization, increased cyberattacks, and the demand for powerful solutions to protect websites from cyber threats.

- On the basis of the testing type, the market has been divided into static application security testing (SAST), dynamic application security testing (DAST), interactive application security testing (IAST), and runtime application self-protection (RASP). Among these, static application security testing (SAST) exhibits a clear dominance in the market fueled by its ability to assure secure coding standards, lowering risks prior to application release.

- Based on the deployment mode, the market is bifurcated into on-premises and cloud-based, wherein on-premises dominate the market. Organizations use this mode to satisfy regulatory requirements while providing strong security measures in their private IT environments.

- On the basis of the organization size, the market is segmented into large enterprises and small and medium-sized enterprises. Currently, large enterprises account for the majority of the total market share. These organizations make significant investments in application security to protect sensitive data, ensure compliance, and reduce cyber risks.

- Based on the industry vertical, the market is categorized into BFSI, healthcare, IT and telecom, manufacturing, government and public sector, retail and e-commerce, and others, amongst which IT and telecom dominate the market. Rising cyber risks and regulatory compliance are driving the implementation of enhanced application security techniques in the IT and telecom industry.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 10.4 Billion |

| Market Forecast in 2033 | USD 34.8 Billion |

| Market Growth Rate 2025-2033 | 14.33% |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Solution, Services |

| Types Covered | Web Application Security, Mobile Application Security |

| Testing Types Covered | Static Application Security Testing (SAST), Dynamic Application Security Testing (DAST), Interactive Application Security Testing (IAST), Runtime Application Self-Protection (RASP) |

| Deployment Modes Covered | On-premises, Cloud-based |

| Organization Sizes Covered | Large Enterprises, Small and Medium-sized Enterprises |

|

Industry Verticals Covered |

BFSI, Healthcare, IT and Telecom, Manufacturing, Government and Public Sector, Retail and E-Commerce, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Black Duck Software, Inc., Capgemini, Checkmarx Ltd, Cisco Systems, Inc., Cloudflare, Inc., Contrast Security, International Business Machines Corporation, NTT DATA, Inc., Open Text Corporation, Qualys, Inc., Rapid7, Veracode, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Application Security Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)