Global Anti-Static Film Market Expected to Reach USD 723.2 Million by 2033 - IMARC Group

Global Anti-Static Film Market Statistics, Outlook and Regional Analysis 2025-2033

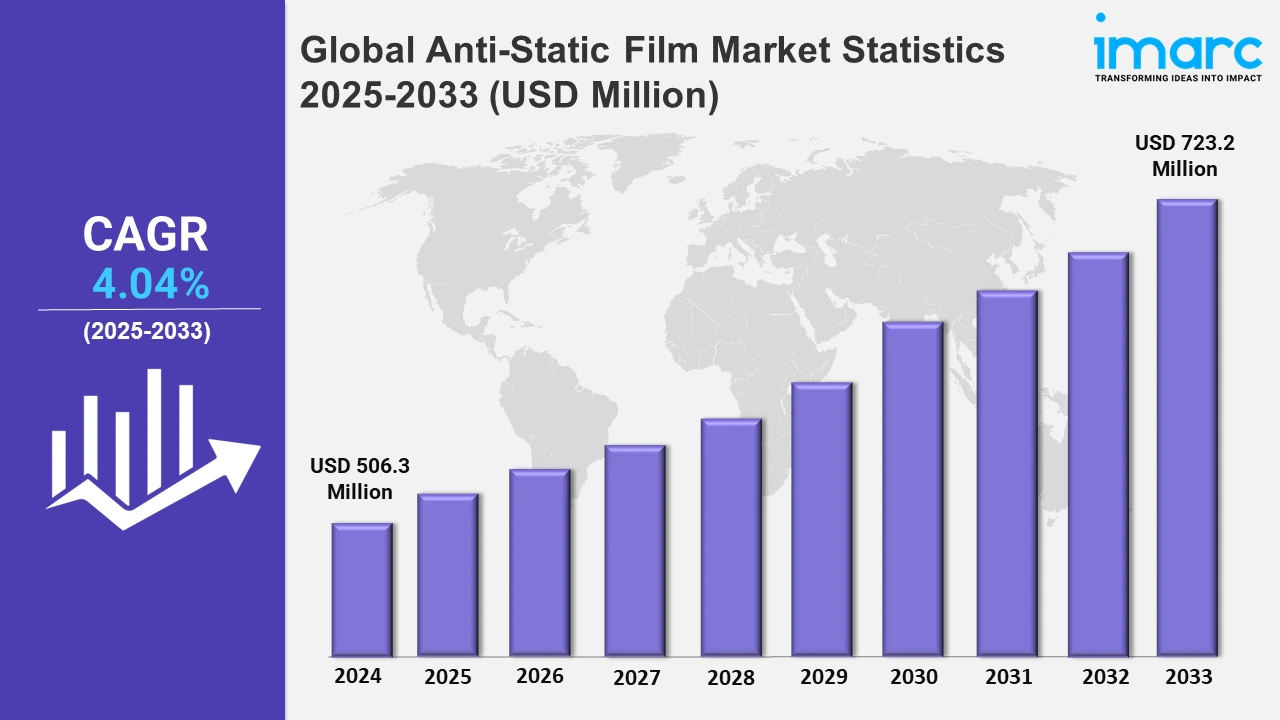

The global anti-static film market size was valued at USD 506.3 Million in 2024, and it is expected to reach USD 723.2 Million by 2033, exhibiting a growth rate (CAGR) of 4.04% from 2025 to 2033.

To get more information on this market, Request Sample

The growing demand for effective static management in industrial applications has prompted the development of high-voltage static eliminators with adaptive ionization. These technologies provide excellent performance, increasing efficiency and precision in industrial operations, especially in areas that need rigorous static control. For example, in October 2019, Fraser, a leading industrial static control specialist, launched a powerful 33 kV static eliminator.

Moreover, as the need for advanced packaging solutions grows, firms are expanding their portfolios to include anti-static and electrostatic dissipative (ESD) compositions. These advancements, together with multi-layer extrusion and lamination capabilities, improve active packaging and barrier film technologies for sensitive product protection. For instance, in March 2019, Transcendia, one of the producers of plastic products in U.S., acquired Purestat Engineered Technologies to add anti-static electrostatic dissipative formulations and multi-layer extrusion as well as lamination capabilities to its portfolio. Furthermore, anti-static film providers in the consumer electronics and semiconductor sectors are shifting their attention to high-performance packaging solutions to fulfill the increased need for sensitive component protection. As electronic equipment becomes smaller and more advanced, the demand for dependable electrostatic discharge (ESD) protection increases. In accordance with this, OEMs and electronics manufacturers are looking for unique and high-quality anti-static films to protect components throughout transportation, handling, and storage. Additionally, the aftermarket for anti-static films offers considerable revenue prospects as organizations continue to upgrade older devices with improved packaging options. For example, the worldwide shift to proficient semiconductor production has increased the demand for high-performance anti-static films in Asia-Pacific. Companies, such as Samsung and TSMC, are rapidly using higher quality anti-static films in their manufacturing processes to safeguard cutting-edge semiconductors against electrostatic harm, maintaining the integrity and dependability of their high-technology products.

Global Anti-Static Film Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia-Pacific accounted for the largest anti-static film market share, owing to the widespread product adoption in the electronics and packaging industries and extensive research and development (R&D) activities.

North America Anti-Static Film Market Trends:

Anti-static films are becoming more popular in North America as electronics and semiconductor production expands. Companies, such as Intel and Texas Instruments, are increasing their output of sensitive components, which is raising the adoption of protective packaging solutions. For example, 3M has created high-performance anti-static coatings to satisfy the special needs of the region's thriving electronics and automotive industries, notably advanced manufacturing.

Europe Anti-Static Film Market Trends:

In Europe, the industry is benefiting from an increase in automotive electronics and electric vehicle (EV) production. Volkswagen and BMW utilize anti-static coatings to safeguard sensitive electronic components found in EV batteries and autonomous car systems. The region's focus on sustainable and advanced automotive technology has resulted in a greater need for ESD-protective packaging solutions to protect high-tech systems in electric and connected automobiles.

Asia-Pacific Anti-Static Film Market Trends:

Asia-Pacific holds the largest share of the market, owing to the rapid expansion of electronics and semiconductor industries, especially in China. Major corporations, such as Samsung and TSMC, require specialized anti-static packaging solutions to protect sensitive semiconductor components during manufacture and transport.

Latin America Anti-Static Film Market Trends:

The industry in Latin America is developing as the automobile sector expands. Countries, such as Mexico, are developing as significant centers for electronics assembly and automotive components manufacture, thereby driving up demand for low-cost anti-static films. Companies, including Foxconn, are expanding their operations, necessitating the use of anti-static coatings to guarantee the safe handling of sensitive components, particularly for the region's electronics assembly lines.

Middle East and Africa Anti-Static Film Market Trends:

The Middle East and Africa region is witnessing expansion because of elevating investments in smart infrastructures and innovative manufacturing activities. The UAE and South Africa are investing in high-tech electronics and renewable energy solutions, and anti-static coatings play an important role in preserving electronic components. For example, Dubai's emphasis on smart cities and the integration of modern electronics has resulted in increased demand for anti-static packaging materials.

Top Companies Leading in the Anti-Static Film Industry

Some of the leading anti-static film market companies include Achilles Corporation, Klöckner Pentaplast, Nan Ya Plastics Corporation, Toyobo Co. Ltd., Wiman Corporation, among many others. For example, in April 2022, Klöckner Pentaplast announced its plan to expand the PET facility in Beaver, West Virginia. This was done to boost sustainable innovation product portfolios in the pharmaceutical, consumer health, and food packaging markets.

Global Anti-Static Film Market Segmentation Coverage

- On the basis of the type of material, the market has been bifurcated into polyethylene (PE), polyethylene terephthalate (PET), and polyvinyl chloride (PVC), wherein polyethylene (PE) represents the most preferred segment, as it is widely employed in the packaging of electronic components and sensitive devices because they are inexpensive, long-lasting, and provide critical static damage prevention.

- Based on the application, the market is categorized into electronics and semiconductor, manufacturing, healthcare and life sciences, automotive, and others, amongst which electronics and semiconductor dominate the market due to the elevating demand for protecting sensitive components from electrostatic discharge during storage, handling, and transit preserving the quality of high-value electronic components.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 506.3 Million |

| Market Forecast in 2033 | USD 723.2 Million |

| Market Growth Rate 2025-2033 | 4.04% |

| Units | Million USD |

| Type of Materials Covered | Polyethylene (PE), Polyethylene Terephthalate (PET), Polyvinyl Chloride (PVC) |

| Applications Covered | Electronics and Semiconductor, Manufacturing, Healthcare and Life Sciences, Automotive, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Achilles Corporation, Klöckner Pentaplast, Nan Ya Plastics Corporation, Toyobo Co. Ltd., Wiman Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

.webp)

.webp)