Global Ammonia Market Expected to Reach USD 127.1 Billion by 2033 - IMARC Group

Global Ammonia Market Statistics, Outlook and Regional Analysis 2025-2033

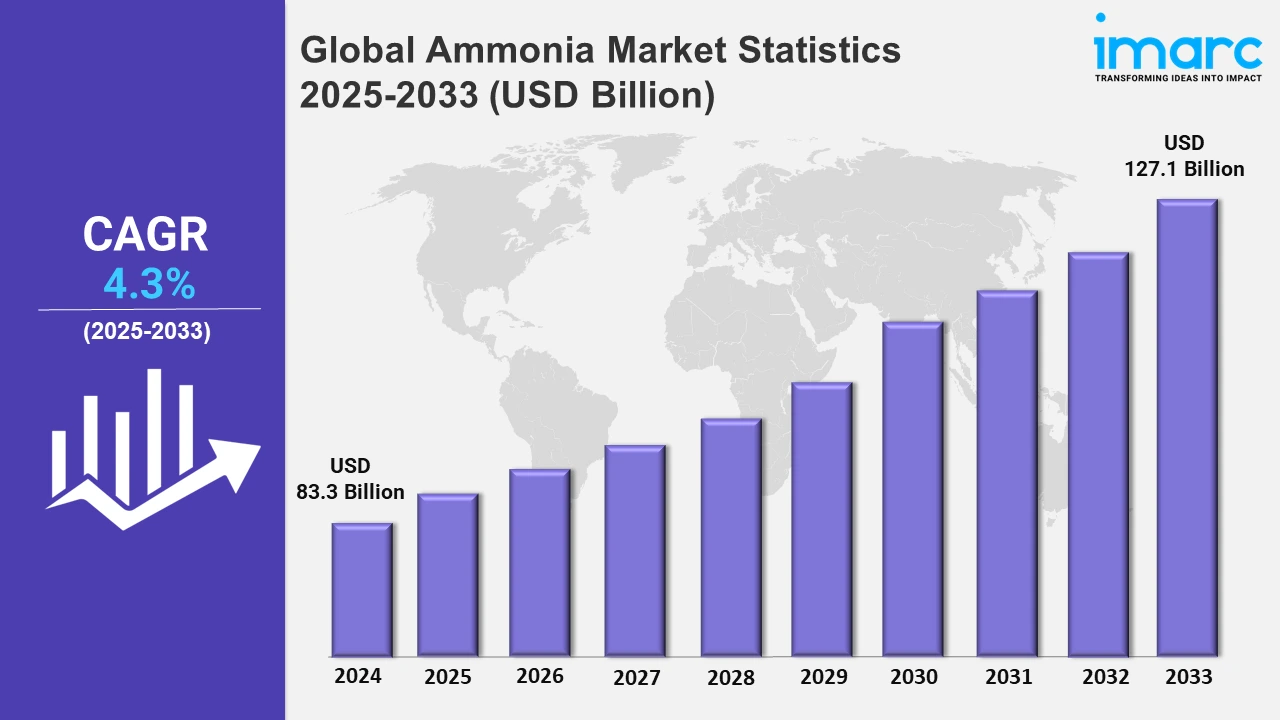

The global ammonia market size was valued at USD 83.3 Billion in 2024, and it is expected to reach USD 127.1 Billion by 2033, exhibiting a growth rate (CAGR) of 4.3% from 2025 to 2033.

To get more information on this market, Request Sample

The global ammonia industry is shifting towards green ammonia, pushed by the growing environmental concerns and stringent carbon emission restrictions. According to a research article published in May 2024, the European ammonia sector emits 36 million tons of carbon dioxide per year. Green ammonia is an ecologically friendly alternative to regular ammonia because it is manufactured utilizing renewable energy sources. As a result, major corporations are quickly investing in green ammonia production to lower their carbon footprints. For example, in July 2024, Aslan Energy Capital signed a Memorandum of Understanding to acquire 35,000 hectares of land in Mexico for the development of a solar-based green ammonia production facility. The first phase is expected to create around 600,000 tons of green ammonia per year.

Moreover, ammonia's critical function as a nitrogen source in fertilizer production is the primary factor driving the market growth. As the global population grows, so does food consumption, necessitating an increase in agricultural productivity. As a result, the demand for ammonia-based fertilizers increases. According to data from the Mosaic Company, a manufacturer of potash and phosphate for agricultural uses, more than 80% of ammonia generated is used as fertilizer. Major agricultural economies, especially Brazil and India, are making significant investments to increase fertilizer manufacturing capacity. This development underscores the steady need for ammonia, emphasizing its importance in promoting global agricultural sustainability and food security. Besides this, the ammonia market outlook implies that opportunities will develop as ammonia synthesis technology advances. The development of more effective and cost-efficient production techniques, including catalytic and electrochemical processes, is improving ammonia synthesis capabilities. Such developments help to reduce carbon emissions and energy usage. For instance, in March 2024, Jupiter Ionics secured US$9 Million to scale up its electrochemical green ammonia technology, which uses electrolysis to manufacture ammonia with zero carbon emissions. With major corporations quickly adopting such innovative technologies, the market sees increased sustainability and productivity. This trend indicates the industry's commitment to efficiency and innovation, which enhances competitiveness and growth in ammonia market share.

Global Ammonia Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia-Pacific represents the largest regional market for ammonia, due to the expanding agriculture industry, along with the strategic partnerships among key players. Moreover, major economies like India and China are the dominant regions that extensively leverage fertilizers to promote large-scale agriculture.

North America Ammonia Market Trends:

Ammonia is a vital component in nitrogen-based fertilizers, essential for enhancing crop yields. In the United States, approximately 90 million acres of corn and 87 million acres of soybeans are planted annually, necessitating substantial ammonia-based fertilizers to support these crops. Additionally, Nutrien Ltd. is expanding its ammonia production capabilities to support the agricultural sector, which remains the largest consumer of ammonia for nitrogen-based fertilizers. This, in turn, will continue to bolster the regional market over the forecasted period.

Europe Ammonia Market Trends:

The transition towards sustainable energy sources has led to investments in low-carbon ammonia production, which is augmenting the market across Europe. For example, in June 2024, Yara International opened Europe's largest green hydrogen and ammonia plant in Norway's southern town of Porsgrunn, thereby underscoring the growing emphasis on cleaner ammonia production methods.

Asia Pacific Ammonia Market Trends:

Asia Pacific dominates the ammonia market, owing to the rising urbanization, the inflating industrialization levels, and increased agricultural demand. Major markets, like Japan, South Korea, India, and China, are experiencing tremendous expansion as a result of the increasing use of ammonia in fertilizers, which is propelling vast agricultural sectors. According to the International Energy Agency, China is the largest producer of ammonia, accounting for 30% of total production. Furthermore, Asia Pacific's expanding chemical industrial sector increases ammonia use. Tactical investments, collaborations, and technological advancements in ammonia synthesis production capacity strengthen the region's competitive landscape, cementing its dominating position in the global market. For example, in December 2023, Mitsubishi Corporation, SK Innovation, and Amogy collaborated to strengthen the ammonia supply chain in East Asia, specifically South Korea and Japan.

Latin America Ammonia Market Trends:

Ammonia is a fundamental component in nitrogen-based fertilizers, essential for enhancing crop yields. In Brazil, the agriculture sector has seen significant growth due to the increasing demand for agrochemicals to boost soybean production. This surge in agricultural activities has elevated the demand for ammonia-based fertilizers. Moreover, in July 2024, Aslan Energy Capital signed MoU to acquire 35,000 hectors of land in Mexico for developing solar-based green ammonia production facility. The first phase is projected to produce around 600,000 tons of green ammonia per year. The capacity is planned to double in phase two in 2030.

Middle East and Africa Ammonia Market Trends:

Ammonia is extensively used in industrial refrigeration systems. In countries like South Africa, the food and beverage industry relies on ammonia-based refrigeration for large-scale cooling, ensuring the preservation of perishable goods. Furthermore, QAFCO, one of the world's largest ammonia producers, continues to expand its capacity, benefiting from Qatar's natural gas reserves.

Top Companies Leading in the Ammonia Industry

Some of the leading ammonia market companies include AB Achema, Acron Group, BASF SE, CF Industries Holdings, Inc., JSC Togliattiazot, Koch Fertilizer, LLC, Mitsui Chemicals, Inc, Nutrien, OCI, Orica Limited, Qatar Fertiliser Company, Saudi Basic Industries Corporation (SABIC), and Yara International ASA, among many others. For instance, in May 2024, Yara Clean Ammonia and Greenko ZeroC, a subsidiary of India's AM Green, agreed to deliver renewable ammonia from AM Green's Kakinada facility in India. The offtake agreement and term sheet secure up to 50% of renewable ammonia supply from Phase 1 of AM Green's production plant, which is scheduled to produce and export ammonia in 2027. This ammonia will be used to produce low-emission fertilizer, as well as to decarbonize power, shipping, and other energy-intensive industries.

Global Ammonia Market Segmentation Coverage

- On the basis of the physical form, the market has been bifurcated into liquid, powder, and gas, wherein liquid represented the largest segment due to its widespread utilization in chemical manufacturing, agriculture sector, and industrial refrigeration.

- Based on the application, the market is categorized into MAP and DAP, urea, nitric acid, ammonium sulfate, ammonium nitrate, and others. Monoammonium phosphate (MAP) and diammonium phosphate (DAP) are critical applications of ammonia that are extensively used as fertilizers and provide vital nutrients like phosphorus and nitrogen to crops. Moreover, urea is a crucial ammonia derivative that plays a critical role in the fertilizer market. Nitric acid is produced from ammonia and is a chief chemical in numerous industrial processes. It is principally leveraged in the manufacturing of fertilizers, especially ammonium nitrate, and in the synthesis of dyes, explosives, and plastics.

- On the basis of the end use industry, the market has been divided into agrochemical, industrial chemical, mining, pharmaceutical, textiles, and others. Among these, agrochemical represented the largest segment due to its integral demand in fertilizer production.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 83.3 Billion |

| Market Forecast in 2033 | USD 127.1 Billion |

| Market Growth Rate 2025-2033 | 4.3% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Physical Forms Covered | Liquid, Powder, Gas |

| Applications Covered | MAP and DAP, Urea, Nitric Acid, Ammonium Sulfate, Ammonium Nitrate, Others |

| End Use Industries Covered | Agrochemical, Industrial Chemical, Mining, Pharmaceutical, Textiles, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | AB Achema, Acron Group, BASF SE, CF Industries Holdings, Inc., JSC Togliattiazot, Koch Fertilizer, LLC, Mitsui Chemicals, Inc, Nutrien, OCI, Orica Limited, Qatar Fertiliser Company, Saudi Basic Industries Corporation (SABIC), Yara International ASA, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Ammonia Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)