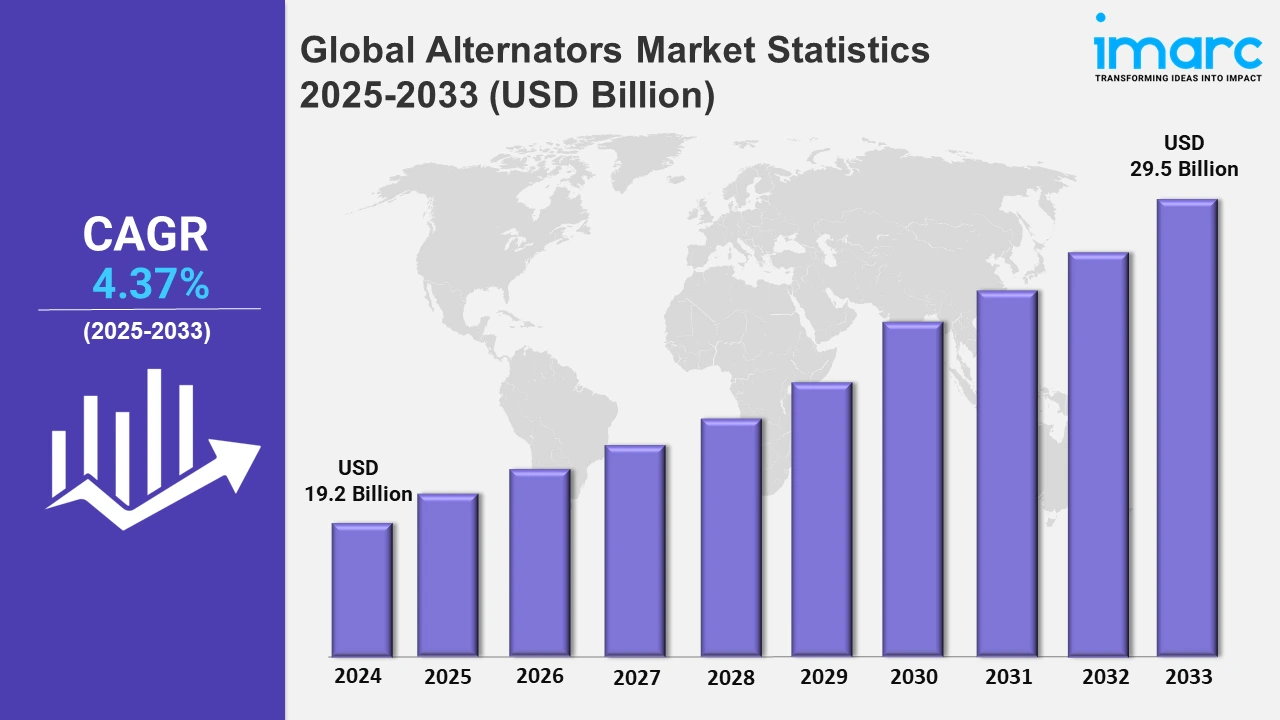

Global Alternators Market Expected to Reach USD 29.5 Billion by 2033 - IMARC Group

Global Alternators Market Statistics, Outlook and Regional Analysis 2025-2033

The global alternators market size reached USD 19.2 Billion in 2024, and it is expected to reach USD 29.5 Billion by 2033, exhibiting a growth rate (CAGR) of 4.37% during 2025 to 2033.

To get more information on the this market, Request Sample

In the alternators market, the advancements in energy management technology are driving significant trends, thereby showcasing improvements in power density, charging efficiency, and system integration. On the contrary, the rising demand for more efficient power systems for various applications, such as marine, RVs, military, and commercial vehicles, has pushed companies to innovate. Also, the push toward dual alternator control and better charging capabilities to support high-power battery systems. For instance, Revatek's launch in October 2024 of the altion max alternator regulators reflects this trend. These regulators offer 20-35% faster charging rates, dual battery bank support, and compatibility across 12-48V systems, thereby emphasizing the importance of universal adaptability. The inclusion of features like Wi-Fi connectivity and OLED displays indicates an industry shift towards smarter, user-friendly interfaces that provide real-time data and greater operational control. In addition, high output and cooling efficiency have become focal points in alternator development. ARCO Marine’s May 2024 launch of the ARCO Zeus A275L and A225S alternators highlights these advancements, aiming to deliver maximum power density while running 8-20% cooler than competing products. Such innovations are essential for ensuring durability and reliability, particularly in sectors where energy demands are intensive. These trends demonstrate the increasing importance of robust energy solutions that cater to diverse needs, from recreational vehicles to military applications. The role of varied housing options also suggests a move towards customizable solutions, appealing to a broad range of consumers with specific performance requirements.

Moreover, regional manufacturers are expanding their reach and diversifying their offerings to cover a wider array of vehicles and machinery. WAI Europe's recent October 2024 expansion, which included 26 new alternators for automotive and agricultural applications, underlines this strategic growth. This development strengthens the company's presence in both passenger and commercial vehicle segments, including brands such as Audi, Porsche, and John Deere. Furthermore, the focus on enhancing alternator coverage for passenger cars, SUVs, and agricultural machinery signals a broadening of the market, driven by increased demand for reliable, high-performance electrical components in Europe and beyond. This trend not only supports a wide range of end-users but also contributes to the evolution of energy-efficient vehicle systems.

Global Alternators Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include Asia-Pacific, Europe, North America, the Middle East and Africa, and Latin America. According to the report, North America dominates the alternator market due to a combination of strong automotive manufacturing, advanced technological innovation, and a focus on enhancing vehicle performance.

North America Alternators Market Trends:

The established automotive industry drives demand for high-performance electrical systems in both consumer and commercial vehicles in North America, accounting it to the largest region for alternators. The introduction of cutting-edge solutions supports this trend. In June 2024, American Power Systems (APS) launched a dual alternator bracket kit specifically for 2022+ Toyota land cruiser 300 vehicles with 3.5L twin-turbo engines, designed for 12-, 24-, or 48-volt high output alternators. Furthermore, this innovation boosts power for onboard equipment while requiring minimal changes to original equipment, illustrating the emphasis on flexible, powerful vehicle components.

Europe Alternators Market Trends:

In Europe, the market is shaped by a strong push towards renewable energy and sustainable practices. Countries like Germany are leading the shift with investments in wind and solar energy, requiring high-efficiency alternators for consistent power output. The transition towards electric vehicles (EVs) and hybrid technology is also propelling alternator demand as manufacturers strive for optimized charging systems in modern vehicles.

Asia-Pacific Alternators Market Trends:

The region is witnessing significant growth driven by the rapid expansion of the automotive and industrial sectors, particularly in China and India. In addition, enhanced power generation capabilities are fueling demand for advanced alternators to support infrastructure projects and renewable energy initiatives. For example, China’s focus on sustainable energy and smart grid integration is boosting the need for high-capacity alternators to maintain reliable power systems.

Middle East and Africa Alternators Market Trends:

In the Middle East and Africa, the market is experiencing growth due to infrastructure development and the need for a reliable energy supply. In countries like Saudi Arabia, large-scale projects, such as NEOM, are increasing the demand for advanced alternators that can support both conventional and renewable energy systems. The focus on improving backup power solutions to support grid stability is further driving market interest in this region.

Latin America Alternators Market Trends:

The growth in Latin America is fueled by expanding industrialization and the rising energy demands in key economies like Brazil. This demand is paired with investments in mining and oil exploration, requiring robust alternators to ensure steady power for operations. Brazil’s efforts to balance its energy mix with renewables and conventional power sources are contributing to the demand for advanced alternator technology.

Top Companies Leading in the Alternators Industry

Some of the leading alternators market companies include Cummins Inc. (Stamford-Avk), Mecc Alte SpA, Leroy-Somer, Inc., Valeo Service SAS, DENSO Europe BV, and Hyundai Electric & Energy Systems Co., Ltd., among many others. In May 2024, DENSO Europe BV and EAV partnered to develop a super-efficient, connected, and actively cooled eCargo bike named EAV2Cool. The EAV2Cool features a 1.4m³ rear compartment that can be maintained at a temperature of between 2°C - 5°C for 10 hours in 30°C heat.

Global Alternators Market Segmentation Coverage

- On the basis of the type, the market has been bifurcated into electro-magnet (induction) alternators, permanent magnet alternators, and other alternators, wherein permanent magnet alternators represent the most preferred segment. Permanent magnet alternators are well-suited for variable-speed applications, making them ideal for wind turbines, where they can capture energy more efficiently over a wide range of wind speeds.

- Based on the voltage, the market is categorized into 220V-440V alternators, more than 440V alternators, and less than 220V alternators, amongst which 220V-440V alternators dominate the market. The demand for 220V-440V voltage alternators is particularly strong due to their versatile range of applications, effectively serving both industrial and commercial sectors.

- On the basis of the rated power, the market has been divided into <1kW, 1 kW-5 kW, 5 kW-50 kW, <50KW-500 kW, 500KW-1500 kW, 1500KW-5000 kW, and >5000KW. Among these, 1500kW-5000 kW exhibits a clear dominance in the market. The utility sector, where these high-capacity alternators are often integrated into power plants for grid electricity generation.

- Based on the application, the market is bifurcated into industrial applications, automotive and transportation, power generation, standby power, and others, wherein industrial applications dominate the market. The industrial sector serves as a significant market driver for the alternators industry, given the critical need for consistent and reliable power in manufacturing, processing, and operations.

- On the basis of the speed, the market is segmented into low speed alternators, medium speed alternators, high speed alternators, and ultra high-speed alternators. Currently, high speed alternators account for the majority of the total market share. High speed performance automotive applications, including electric and hybrid vehicles, are increasingly adopting high-speed alternators to optimize fuel efficiency and overall performance.

- On the basis of the weight, the market has been bifurcated into low weight alternators, medium weight alternators, and high weight alternators, wherein low weight alternators represent the most preferred segment. These low-weight alternators are also increasingly used in aerospace applications, where weight is a critical factor affecting fuel consumption and overall performance.

- On the basis of the end-use sector, the market has been bifurcated into industrial, commercial, and residential, wherein industrial represents the most preferred segment. In manufacturing plants, a continuous power supply is critical for running machinery and automated systems, making alternators a key component. The growth of heavy industries, such as steel, cement, and chemicals, which require high-power alternators for their energy-intensive processes, also contributes to market expansion.

- Based on the fuel used, the market is categorized into fossil fuel and natural, amongst which natural dominates the market. These generators are particularly popular in sectors that require eco-friendly options, such as healthcare, data centers, and public utilities.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 19.2 Billion |

| Market Forecast in 2033 | USD 29.5 Billion |

| Market Growth Rate 2025-2033 | 4.37% |

| Units | Billion USD, Million Units |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Electro-Magnet (Induction) Alternators, Permanent Magnet Alternators, Other Alternators |

| Voltages Covered | 220V-440V Alternators, More than 440V Alternators, Less than 220V Alternators |

| Rated Powers Covered | <1kW, 1 KW-5 KW, 5 KW-50 KW, <50KW-500 KW, 500KW-1500 KW, 1500KW-5000 KW, >5000KW |

| Applications Covered | Industrial Application, Automotive and Transportation, Power Generation, Standby Power, Others |

| Speeds Covered | Low Speed Alternators, Medium Speed Alternators, High Speed Alternators, Ultra High-Speed Alternators |

| Weights Covered | Low Weight Alternators, Medium Weight Alternators, High Weight Alternators |

| End-Use Sectors Covered | Industrial, Commercial, Residential |

| Fuels Used Covered | Fossil Fuel, Natural |

| Regions Covered | Asia-Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Cummins Inc. (Stamford-Avk), Mecc Alte SpA, Leroy-Somer, Inc., Valeo Service SAS, DENSO Europe BV, Hyundai Electric & Energy Systems Co., Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)