Global Almond Milk Market Expected to Reach USD 36.7 Billion by 2033 - IMARC Group

Global Almond Milk Market Statistics, Outlook and Regional Analysis 2025-2033

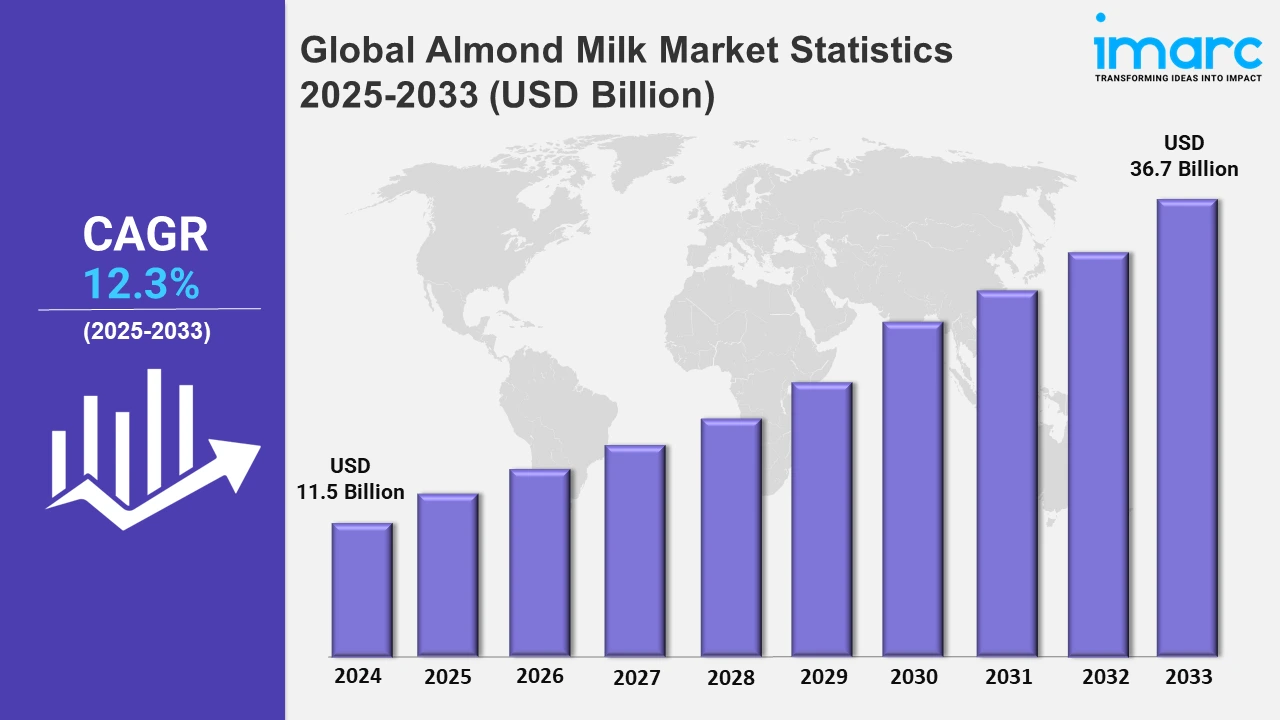

The global almond milk market size was valued at USD 11.5 Billion in 2024, and it is expected to reach USD 36.7 Billion by 2033, exhibiting a growth rate (CAGR) of 12.3% from 2025 to 2033.

To get more information on this market, Request Sample

The introduction of almond milk reflects an increasing demand for health-conscious beverage options. With its low-calorie and nutrient-rich profile, almond milk is gaining traction among consumers prioritizing wellness, signaling the rising appeal of plant-based alternatives in the beverage market. For example, in September 2024, Glico unveiled its health and wellness portfolio in Southeast Asia with the launch of Japan’s best-selling almond milk in Singapore.

Moreover, the expanding use of almond milk in beauty products demonstrates its popularity beyond beverages, with plant-based skincare collections emphasizing cruelty-free techniques. This meets consumer needs for environmentally responsible, nutritious, and multi-functional beauty products. For instance, in October 2022, ESW Beauty brand launched its newest collection of plant-based milk sheet masks to expand its cruelty-free beauty line. The masks, such as avocado banana milk, blueberry coconut milk, matcha almond milk, and vanilla oat milk, feature almond milk as a key ingredient. Furthermore, almond milk producers are working on innovation to meet the rising demand for diverse, healthy, and environmentally friendly beverages. This includes developing fortified choices rich in vitamins, minerals, and protein to appeal to health-conscious customers. Brands are also prioritizing sustainable sourcing and production processes to lower their carbon footprint. The growing popularity of almond milk in smoothies, lattes, and baking is creating new income opportunities for retailers and food service operators. For example, in Europe, firms, such as Alpro, Oatly, and Innocent Drinks, are launching fortified almond milk versions targeted to certain nutritional needs, including high-calcium and low-sugar alternatives. These products are popular not just among individual customers but also in cafes and restaurants as alternatives to typical dairy milk, promoting sustainable consumption practices.

Global Almond Milk Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia-Pacific accounted for the largest almond milk market share, on account of the new players entering the market through strategic initiatives, such as new launches or collaborations.

North America Almond Milk Market Trends:

The almond milk industry in North America is growing as plant-based diets are gaining popularity. Companies, such as Califia Farms, indicate increased demand, owing to customer preference for non-dairy alternatives, which is fueled by lactose intolerance and veganism trends. According to the National Institutes of Health, approximately 65% of the human population has a reduced ability to digest lactose after infancy, with significant numbers in the United States. Continuous product innovations and marketing efforts are propelling the market in North America.

Europe Almond Milk Market Trends:

In Europe, almond milk is favored owing to its clean label and organic possibilities. Alpro's debut of organic almond milk coincides with rising consumer demand for natural, minimally processed, and sustainable food items in important regions, such as Germany and the U.K.

Asia-Pacific Almond Milk Market Trends:

The almond milk market in Asia-Pacific benefits from rising health consciousness, particularly in the cities of India and China. Products, such as So Good Almond Milk, meet the need for healthier beverage options with fewer calories. This is exhibiting a clear dominance in the market. Furthermore, according to a report by the United Nations Food and Agriculture Organization (UN FAO), India has around 500 million vegetarians and around five million being strict vegans in 2020. Moreover, the entry of new players through strategic activities like new launches or collaborations is acting as a significant growth-inducing factor.

Latin America Almond Milk Market Trends:

In Latin America, almond milk sales are increasing as vegan diets become more prevalent in countries including Brazil. Brands such as Silk promote almond milk as a sustainable and animal-friendly option, appealing to the region's environmentally aware younger demographic.

Middle East and Africa Almond Milk Market Trends:

Due to the high prevalence of lactose intolerance in the Middle East and Africa, almond milk is becoming increasingly popular. Brands, such as Alpro and target, Gulf Cooperation Council (GCC) countries, highlight their compatibility with lactose-intolerant consumers seeking dairy-free alternatives.

Top Companies Leading in the Almond Milk Industry

Some of the leading almond milk market companies include Blue Diamond Growers, Califia Farms LLC, Daiya Foods Inc., Earth's Own Food Company Inc., Hain Celestial Group, Hiland Dairy Foods, Malk Organics LLC, Pacific Foods of Oregon LLC, Sanitarium, SunOpta Inc., and The WhiteWave Foods Company, among many others. For example, in January 2023, Califia Farms LLC, a prominent, premium plant-based beverage brand, expanded its award-winning line of dairy-free products with the introduction of United States Department of Agriculture (USDA) certified organic almond milk and almond milk to meet the needs of consumers seeking products with fewer ingredients, yet at an accessible price point.

Global Almond Milk Market Segmentation Coverage

- Based on the type, the market is categorized into plain and flavored, amongst which flavored dominates the market driven by consumer demand for flavor and diversity. A comprehensive flavor assortment, including vanilla, chocolate, and seasonal favorites, appeals to a wide range of age groups.

- On the basis of the category, the market has been bifurcated into organic and conventional, wherein organic represents the most preferred segment due to improved consumer awareness of health and environmental sustainability. Organic items are considered healthier alternatives, devoid of synthetic pesticides, hormones, and genetically engineered creatures.

- On the basis of the packaging type, the market has been divided into carton, glass, and others. Among these, glass exhibits a clear dominance in the market. Cartons are lightweight, making them cost-effective for shipping and minimizing the overall carbon imprint.

- Based on the application, the market is bifurcated into beverages, frozen desserts, personal care, and others, wherein beverages dominate the market, on account of the growing consumer preference for plant-based drinks for health and nutritional reasons.

- On the basis of the distribution channel, the market is segmented into hypermarkets and supermarkets, convenience stores, online stores, and others. Currently, hypermarkets and supermarkets account for the majority of the total market share. The growth is driven by their extensive reach, convenience, and ability to offer a wide variety of products.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 11.5 Billion |

| Market Forecast in 2033 | USD 36.7 Billion |

| Market Growth Rate 2025-2033 | 12.3% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Plain, Flavored |

| Categories Covered | Organic, Conventional |

| Packaging Types Covered | Carton, Glass, Others |

| Applications Covered | Beverages, Frozen Desserts, Personal Care, Others |

| Distribution Channels Covered | Hypermarkets and Supermarkets, Convenience Stores, Online Stores, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Blue Diamond Growers, Califia Farms LLC, Daiya Foods Inc., Earth's Own Food Company Inc., Hain Celestial Group, Hiland Dairy Foods, Malk Organics LLC, Pacific Foods of Oregon LLC, Sanitarium, SunOpta Inc., The WhiteWave Foods Company, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)