Global Aircraft Engine Market Expected to Reach USD 169.7 Billion by 2033 - IMARC Group

Global Aircraft Engine Market Statistics, Outlook and Regional Analysis 2025-2033

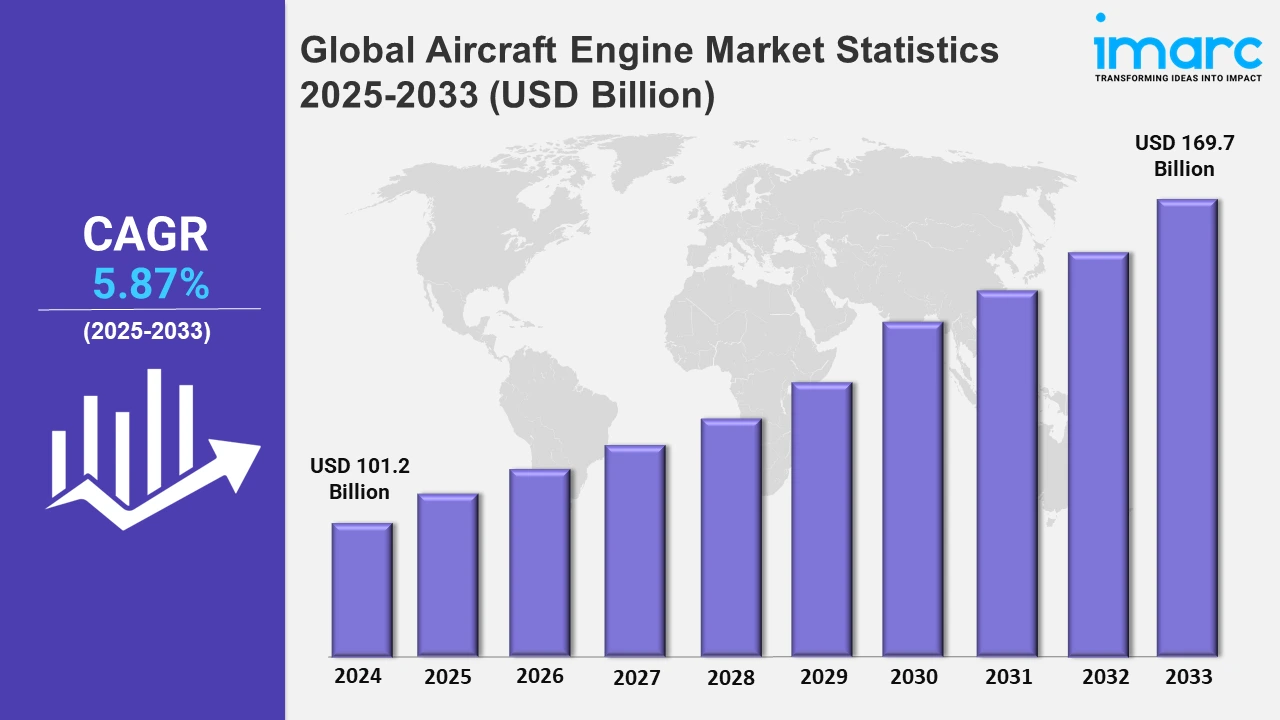

The global aircraft engine market size was valued at USD 101.2 Billion in 2024, and it is expected to reach USD 169.7 Billion by 2033, exhibiting a growth rate (CAGR) of 5.87% from 2025 to 2033.

To get more information on this market, Request Sample

The rising focus on advancing next-generation propulsion systems and reducing emissions is driving growth in the aircraft engine market. Major players are investing in R&D activities to develop eco-friendly engines that meet strict environmental regulations. Also, the increasing adoption of hydrogen-electric technologies is gaining widespread acknowledgment as an alternative to traditional fossil fuels. For example, in April 2024, ZeroAvia introduced advanced hydrogen-electric aviation components, including silicon carbide inverters and fuel cell systems. Moreover, in the aviation engine leasing and trading industry, companies seek to capitalize on developing market possibilities. For instance, in May 2024, Hanwha introduced Hanwha Aviation, a worldwide platform for aircraft and engine leasing and trading. The company aims to build a portfolio exceeding 1,000 assets within the next few years leveraging its expertise in aero-engines and asset management, with a strong focus on integrating next-generation technologies. This strategic move highlights the increasing demand for innovative engine solutions and efficient lifecycle management in the aviation sector.

Meanwhile, advancements in engine design and testing facilitate progress in this industry. The increased emphasis on self-reliance and the development of improved propulsion systems is most noticeable in emerging nations. For example, in January 2024, Hindustan Aeronautics Limited (HAL) commenced a cutting-edge design and testing facility at the Aero Engine Research and Development Centre in Bengaluru. This facility is dedicated to the development of HTFE-25 and HTSE-1200 engines, representing a key step toward India's aim of establishing technical independence in aerospace. This initiative highlights the worldwide trend of boosting indigenous capabilities and supporting innovation in the aviation engine industry by providing the ability to test various proficient engine components and systems.

Global Aircraft Engine Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America leads the aircraft engine market owing to potential investments in aviation technology, a strong presence of key manufacturers, and continuous improvements in engine efficiency.

North America Aircraft Engine Market Trends:

North America holds the largest share of the market, as the region has an enhanced aerospace industry and government initiatives promoting sustainable aviation. In September 2024, NASA and GE Aerospace formed a partnership under the HyTEC project to enhance hybrid-electric jet engine technology. This program uses a modified GE Passport engine and intends to lower fuel consumption and emissions by 5-10%, per sustainable aviation targets for narrow-body airliners by the 2030s. Such advancements highlight the region's emphasis on innovation, bolstering its market dominance by addressing environmental issues and meeting the rising need for efficient aviation engines.

Europe Aircraft Engine Market Trends:

To comply with stringent environmental requirements, Europe is focusing on fuel-efficient and sustainable airplane engines. The region is experiencing advancements in hybrid-electric propulsion systems. Companies such as Rolls-Royce are testing their UltraFan engine in the U.K., to cut fuel usage by 25%. Countries including France are making significant investments in sustainable aviation technologies, complying with the European Union's Green Deal initiatives.

Asia Pacific Aircraft Engine Market Trends:

Asia Pacific observes a higher need for innovative engines, fueled by a thriving aviation sector in nations such as China and India. Pratt & Whitney's GTF engine is gaining popularity because of its fuel economy, and it is powering several Airbus A320neo jets for Indian airlines. In addition, China's COMAC is incorporating revolutionary engines into its C919 airplane, demonstrating the region's rising emphasis on local manufacturing and technical self-reliance.

Latin America Aircraft Engine Market Trends:

Latin America is attempting to upgrade its regional fleet with efficient turboprop engines for short-haul flights. Brazilian airline Azul has increased its fleet with ATR 72 aircraft powered by Pratt & Whitney engines, which are intended for fuel economy and low emissions. Furthermore, these developments are consistent with the region's objective of increasing connection in distant places, particularly in nations such as Brazil and Colombia, where regional aviation is critical.

Middle East and Africa Aircraft Engine Market Trends:

The Middle East supports high-thrust engines for long-haul flights, powered by airline companies such as Emirates. General Electric's GE9X engine, which powers Boeing 777X aircraft, shows this trend in the UAE. In Africa, governments such as South Africa are adopting sustainable aviation and investing in biofuel-compatible engines to lower operational costs and emissions while catering to a growing market.

Top Companies Leading in the Aircraft Engine Industry

Some of the leading aircraft engine market companies include Barnes Group Inc., General Electric Company, Honeywell International Inc., IHI Corporation, Mitsubishi Heavy Industries Ltd., MTU Aero Engines AG, Raytheon Technologies Corporation, Rolls-Royce Holdings plc, Safran S.A., Textron Inc., among many others. In February 2024, Safran Turbine Airfoils, based in Rennes, Brittany, announced the establishment of its new manufacturing facility for turbine blades for both the M88 and LEAP engines. By 2027, the facility will increase its manufacturing capacity, boost decarbonization initiatives, and strengthen France's aerospace supply chain.

Global Aircraft Engine Market Segmentation Coverage

- Based on the component, the market has been segmented into fan, compressor, combustor, turbine, mixer, nozzle, and others, wherein turbine leads the market. The turbine helps in utilizing energy from the high-velocity emission gases.

- Based on the engine type, the market has been categorized into piston and turboprop engine, turbojet engine, turboshaft engine, and turbofan engine, amongst which turbofan engine dominates the market. This design focuses on fuel efficiency and noise reduction, making turbofan engines ideal for long-haul flights while reducing environmental effects.

- Based on the platform, the market has been divided into fixed wing and rotary wing. Among these, fixed wing exhibits a clear dominance in the market. Their capacity to travel long distances fast and effectively makes them critical to global connectivity.

- Based on the end user, the market has been classified into commercial aviation and military aviation, wherein commercial aviation dominates the market. Commercial aviation engines have been designed to handle the severe demands of everyday flights, with an emphasis on efficiency, dependability, and passenger comfort.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 101.2 Billion |

| Market Forecast in 2033 | USD 169.7 Billion |

| Market Growth Rate 2025-2033 | 5.87% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Fan, Compressor, Combustor, Turbine, Mixer, Nozzle, Others |

| Engine Types Covered | Piston and Turboprop Engine, Turbojet Engine, Turboshaft Engine, Turbofan Engine |

| Platforms Covered | Fixed Wing, Rotary Wing |

| End Users Covered | Commercial Aviation, Military Aviation |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Barnes Group Inc., General Electric Company, Honeywell International Inc., IHI Corporation, Mitsubishi Heavy Industries Ltd., MTU Aero Engines AG, Raytheon Technologies Corporation, Rolls-Royce Holdings plc, Safran S.A., Textron Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)