Global Agrochemicals Market Expected to Reach USD 394.8 Billion by 2033 - IMARC Group

Global Agrochemicals Market Statistics, Outlook and Regional Analysis 2025-2033

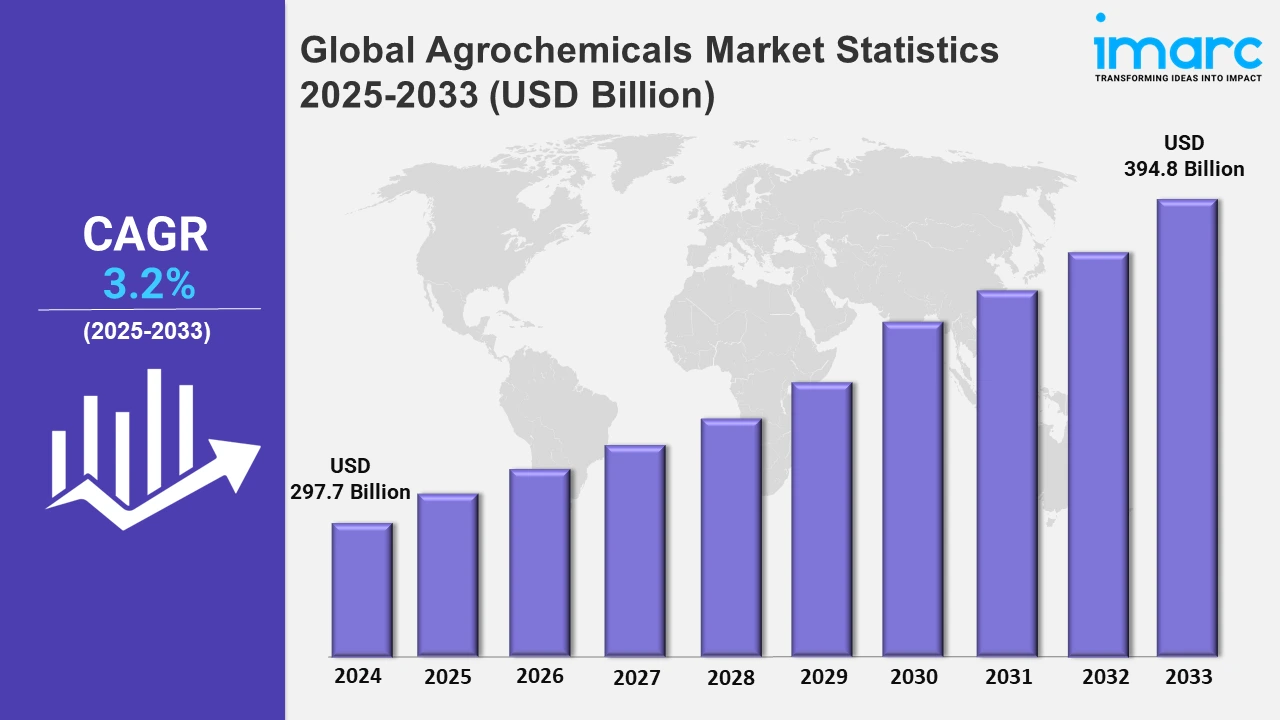

The global agrochemicals market size was valued at USD 297.7 Billion in 2024, and it is expected to reach USD 394.8 Billion by 2033, exhibiting a growth rate (CAGR) of 3.2% from 2025 to 2033.

To get more information on this market, Request Sample

At present, the increasing requirement for sustainable agricultural practices is impelling the growth of the market. Farmers and agribusinesses are seeking eco-friendly products that can enhance crop productivity while minimizing environmental impact. They are also looking for effective agrochemicals which provide comprehensive crop protection. As a result, companies are launching various products with enhanced functionality. For instance, in 2024 Best Agrolife launched under patent Nemagen insecticide, which is a highly effective broad-spectrum insecticide with a unique combination of Chlorantraniliprole, Novaluron, and Emamectin Benzoate. Besides this, biopesticides and biofertilizers are in high demand due to their ability to improve plant health while maintaining soil quality. This segment is driven by a combination of technological advancements and the commitment of the agricultural sector to sustainability. These biological products help to reduce the dependency on synthetic chemicals, thereby promoting long-term soil fertility and minimizing environmental damage. Technological advancements and the dedication of the agricultural sector to sustainability are supporting the market growth. These organic products assist in decreasing reliance on artificial chemicals, thus supporting sustainable soil fertility and reducing harm to the environment. Research and development (R&D) efforts are pushing the boundaries of the efficacy of biopesticides.

The use of digital agriculture and precision farming is leading to an increased need for more specific agrochemical items. Farmers can utilize these technologies to enhance the efficiency of chemical applications, minimizing wastage and guaranteeing precise amounts are delivered to intended areas. Modern technologies like drones, satellite images, and high-tech sensors allow for the accurate use of fertilizers and pesticides by providing up-to-date information. This method based on data reduces environmental harm and boosts crop production by utilizing advanced agrochemicals that work well with precision farming techniques. Enhanced farmer education and training initiatives are encouraging the responsible and efficient utilization of agrochemicals. Besides this, businesses, charities, and government agencies are working together to offer training that assists farmers in learning about optimal methods for applying and managing practices. These efforts guarantee that farmers can attain improved results with little impact on the environment, promoting an eco-friendlier approach to farming.

Global Agrochemicals Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific accounted for the largest market share on account of the increasing development of sustainable formulations, rising focus on improving crop yield, and heightened use of digital agriculture and precision farming.

North America Agrochemicals Market Trends:

The market in North America is driven by the adoption of eco-friendly products, such as biopesticides and biofertilizers. Individuals and regulatory bodies are increasingly prioritizing environmental safety, encouraging agrochemical companies to develop solutions that minimize ecological impact. This focus aligns with stringent regulations that limit the use of synthetic chemicals and demand lower residue levels in food products. Technological advancements, including the integration of precision agriculture, are influencing the agrochemicals market in the region. Precision farming technologies enable farmers to apply pesticides and fertilizers more accurately, reducing waste and improving efficiency.

Asia-Pacific Agrochemicals Market Trends:

The growing need for improved crop yields is contributing to the market growth in the Asia Pacific region. Population increment and the rise in food need are main factors driving countries to improve agricultural efficiency in order to guarantee food security. This is resulting in a higher use of agrochemicals, such as fertilizers, pesticides, and herbicides, throughout the area. The importance of sustainability is becoming increasingly crucial. Authorities in the Asia Pacific region are increasingly focusing on sustainable farming methods to reduce the negative environmental effects of conventional agrochemicals. Therefore, biopesticides and biofertilizers are becoming more popular. These items, derived from nature, enhance soil quality, minimize pollution, and provide successful pest and weed management. Businesses are putting money into creating and releasing eco-friendly products that satisfy farmers' requirements and adhere to regulations. In 2024, BASF Agricultural Solutions Malaysia launched Belanty® Fungicide, an innovative rice fungicide powered by Revysol® Active. It offers enhanced protection against sheath blight and dirty panicle disease and improves the yield productivity when combined with Seltima®.

Europe Agrochemicals Market Trends:

The agrochemicals market in Europe is characterized by a strong emphasis on sustainability, regulatory compliance, and innovation. The region's stringent environmental regulations and policies aimed at reducing chemical residues in food are supporting the market growth. This is leading to the development and adoption of more sustainable agrochemical products, including biopesticides, biofertilizers, and organic herbicides. The focus is on solutions that minimize environmental impact while maintaining effective crop protection and yield enhancement.

Latin America Agrochemicals Market Trends:

The agrochemicals market in Latin America is experiencing steady growth, driven by the region's expansive agricultural sector and the critical need to boost productivity to meet both domestic and global food demand. Sustainability and environmental concerns are increasingly influencing the agrochemical landscape in Latin America. Regulatory bodies are tightening controls on the use of traditional chemical pesticides and fertilizers due to their impact on ecosystems and human health.

Middle East and Africa Agrochemicals Market Trends:

The agrochemicals market in the Middle East and Africa (MEA) is driven by the need to boost agricultural productivity and ensure food security in a region characterized by diverse climate and challenging agricultural conditions. The market trends indicate a strong push towards efficient crop protection and nutrient management solutions to maximize yields in arid and semi-arid environments. Besides this, governments and agricultural organizations are becoming increasingly aware about the need for environment friendly practices.

Top Companies Leading in the Agrochemicals Industry

Some of the leading AGROCHEMICALS market companies include BASF SE, Bayer AG, Corteva Inc., Dow Inc., FMC Corporation, Nufarm Ltd, Nutrien Ltd, Syngenta Group, The Archer-Daniels-Midland Company, Yara International ASA, among many others. In October 2024, Bayer AG presented its novel insecticide called Plenexos at the 29th Brazilian Congress of Entomology (CBE 2024). This product is the company's first formulation using the ketoenol chemical group.

Global Agrochemicals Market Segmentation Coverage

- On the basis of the fertilizer type, the market has been categorized into nitrogen fertilizer, phosphatic fertilizer, potassic fertilizer, and others, wherein nitrogen fertilizer represent the leading segment. Nitrogen fertilizers play a crucial role in stimulating plant growth by providing an essential nutrient required for important processes like photosynthesis and protein synthesis. They improve leaf growth and plant strength, resulting in higher crop production and better quality. Nitrogen fertilizers are commonly utilized in both industrial farming and backyard gardening to enhance the growth of crops, such as corn, wheat, and rice, which rely heavily on nitrogen for increased yields.

- Based on the pesticide type, the market is classified into fungicides, herbicides, insecticides, and others, amongst which herbicides dominate the market. Herbicides are used to control or eliminate unwanted weeds and invasive plants that compete with crops for nutrients, water, and sunlight. By preventing or reducing weed growth, herbicides help optimize crop yields and enhance agricultural productivity. They are applied in various settings, including large-scale farming, home gardens, and public spaces like parks and roadsides. Herbicides come in selective and non-selective types, allowing targeted weed control without harming desired plants or complete vegetation clearing.

- On the basis of the crop type, the market has been divided into cereals and grains, oilseeds and pulses, fruits and vegetables, and others. Among these, cereals and grains account for the majority of the market share. Cereals and grains are staple foods consumed worldwide, providing essential nutrients like carbohydrates, proteins, fiber, vitamins, and minerals. They serve as the primary source of energy in many diets and are used to produce a wide variety of food products such as bread, pasta, rice dishes, and breakfast cereals. Popular grains include wheat, rice, corn, oats, barley, and millet. Besides human consumption, cereals and grains are also used as animal feed, contributing to livestock nutrition and the production of meat, milk, and eggs.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 297.7 Billion |

| Market Forecast in 2033 | USD 394.8 Billion |

| Market Growth Rate 2025-2033 | 3.2% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Fertilizer Types Covered | Nitrogen Fertilizer, Phosphatic Fertilizer, Potassic Fertilizer, Others |

| Pesticide Types Covered | Fungicides, Herbicides, Insecticides, Others |

| Crop Types Covered | Cereals and Grains, Oilseeds and Pulses, Fruits and Vegetables, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | BASF SE, Bayer AG, Corteva Inc., Dow Inc., FMC Corporation, Nufarm Ltd, Nutrien Ltd, Syngenta Group, The Archer-Daniels-Midland Company, Yara International ASA etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Agrochemicals Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

.webp)

.webp)