Global Agricultural Tires Market Expected to Reach USD 12.6 Billion by 2033 - IMARC Group

Global Agricultural Tires Market Statistics, Outlook and Regional Analysis 2025-2033

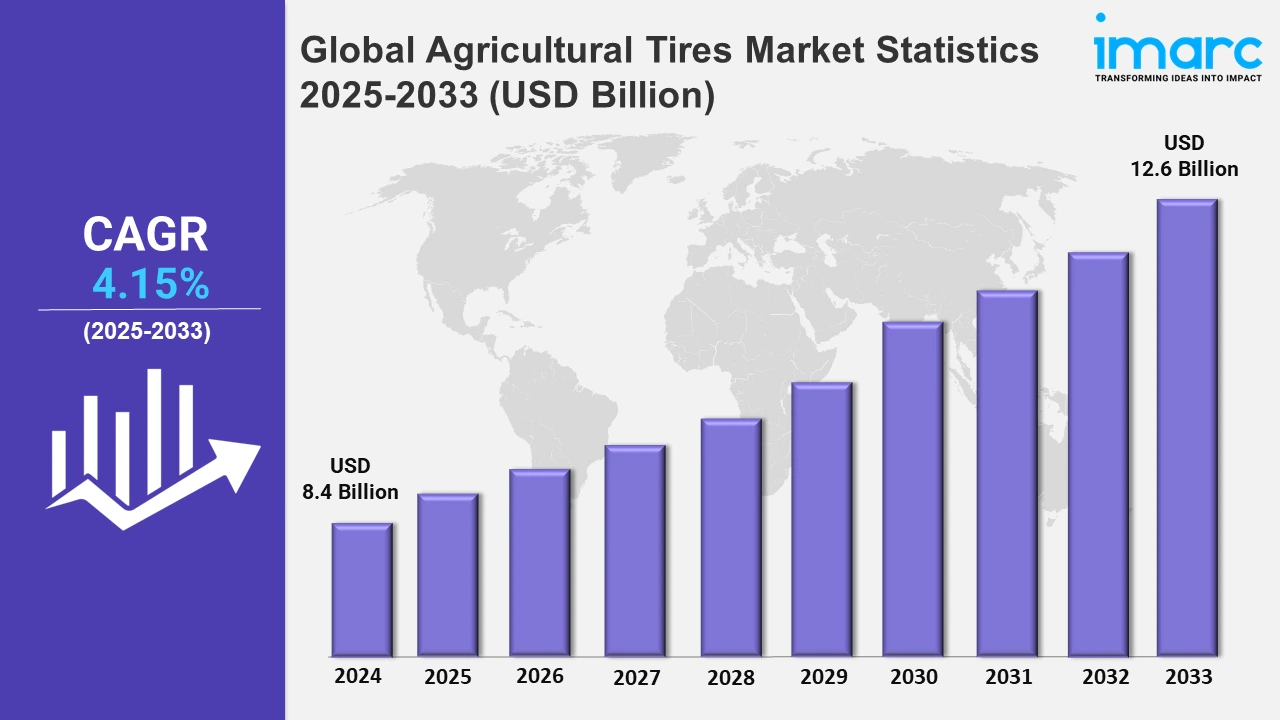

The global agricultural tires market size was valued at USD 8.4 Billion in 2024, and it is expected to reach USD 12.6 Billion by 2033, exhibiting a growth rate (CAGR) of 4.15% from 2025 to 2033.

To get more information on this market, Request Sample

The agricultural tires market is experiencing significant growth due to the increasing demand for advanced, durable, and sustainable tire solutions tailored to modern farming challenges. In contrast, farmers are increasingly prioritizing tires that offer enhanced load capacity, superior traction, and extended durability, all while aligning with sustainable agricultural practices. Furthermore, this trend is further propelled by manufacturers investing in research and development to introduce innovative tire designs. For instance, BKT launched four advanced agricultural tires Agrimax Procrop, Spargo SB, Proharvest, and Ridemax Frost in November 2024. These tires are specifically designed for diverse farming applications, such as sprayers, row crops, orchards, and winter conditions. They cater to the evolving needs of precision farming and mechanized agriculture with features like improved load capacity and enhanced traction. At the same time, in April 2024, Hercules Tires introduced the AG-TRAC F-2, a durable agricultural tire designed for 2WD front tractors, which offers flotation, traction, and steering precision. Thus boosting productivity across varied farm terrains.

In line with this, technological advancements in the agricultural tire segment continue to drive the market forward. Moreover, the rising adoption of innovative technologies in tire manufacturing ensures improved performance, reduced soil compaction, and compatibility with modern machinery. On the contrary, manufacturers are keenly focusing on regional requirements to meet specific agricultural challenges. For instance, Alliance Tire Group (Yokohama Group) launched the AGRI STAR II, incorporating its cutting-edge Stratified Layer Technology in November 2024. This innovation is tailored for the advanced requirements of modern tractors, which is enhancing durability and agricultural efficiency. The AGRI STAR II builds on the brand's strong legacy of flotation and IF & VF tires, addressing the need for high-performance solutions that reduce downtime and improve overall operational efficiency. Furthermore, these developments collectively underscore the market’s focus on delivering high-quality, performance-driven tires that support the growing mechanization and sustainability goals in agriculture.

Global Agricultural Tires Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America dominates the agricultural tires market due to its advanced farming practices and large-scale mechanization.

North America Agricultural Tires Market Trends:

North America is the leading region in the market due to its advanced farming practices and significant investments in agricultural technology. Also, the region's extensive farmland and diverse crops require high-performing machinery, driving demand for durable and efficient tires. Furthermore, manufacturers are consistently innovating to cater to these needs. For example, in August 2024, Firestone Ag introduced the Bridgestone VX, VT, and VX-R tractor tires in the U.S. and Canadian markets. These tires incorporate advanced tread technology, triple-defense rubber, and VF capabilities, enhancing durability, traction, and soil protection.

Europe Agricultural Tires Market Trends:

In Europe, the shift toward environmentally friendly farming practices is promoting demand for tires with reduced rolling resistance. In addition, countries like Germany are prioritizing low-emission farming, encouraging the use of fuel-efficient tires. For instance, radial tires with optimized tread designs are gaining traction due to their ability to support heavy equipment while minimizing soil disruption.

Asia Pacific Agricultural Tires Market Trends:

Asia Pacific is witnessing rapid growth in demand for affordable and versatile agricultural tires, which is driven by small-scale farming and mechanization. In contrast, India stands out as a key market, with rising tractor usage across rural areas. For example, Bias-ply tires, known for their cost-effectiveness and durability on varied terrains, are widely preferred in this price-sensitive region.

Latin America Agricultural Tires Market Trends:

In Latin America, expanding agriculture bases businesses and increased exports of crops like soybeans are fueling demand for high-load capacity tires. Brazil, a global agricultural powerhouse, is adopting advanced machinery equipped with radial tires that provide enhanced traction and durability. Also, this trend supports heavy-duty applications in large-scale farms spread across challenging landscapes.

Middle East and Africa Agricultural Tires Market Trends:

In the Middle East and Africa, limited arable land is driving innovations in tire technology for irrigation and desert farming. South Africa exemplifies this trend, with rising demand for tires suited to pivot irrigation systems and sandy terrains. Meanwhile, specialized tires designed for multi-functional equipment enable efficient farming in harsh climatic conditions.

Top Companies Leading in the Agricultural Tires Industry

Some of the leading agricultural tires market companies include Apollo Tyres Limited, Balkrishna Industries Limited (BKT), Bridgestone Corporation, CEAT Ltd. (RPG Group), Continental AG, JK Tyre & Industries Ltd., MRF Limited, Specialty Tires of America Inc., Sumitomo Rubber Industries Ltd., TBC Corporation (Michelin), The Carlstar Group LLC, Titan International Inc., Trelleborg AB, and Yokohama Off-Highway Tires America Inc. (Yokohama Rubber Company), among many others. In March 2024, Bridgestone Americas (Bridgestone) introduced an improved Regency Plus bias tire portfolio for Firestone Ag. The Regency Plus bias tire will help farmers enhance their crop yield with extensive, cost-effective options for a variety of applications, including fronts and implements, plus solutions for utility, light construction, and lawn and garden equipment.

Global Agricultural Tires Market Segmentation Coverage

- On the basis of the product, the market has been bifurcated into bias tires and radial tires, wherein bias tires represent the most preferred segment. Bias tires are known for their robust construction and durability and are specifically designed to withstand the rugged terrain and harsh conditions commonly encountered in agriculture.

- Based on the application, the market is categorized into tractors, harvesters, forestry, irrigation, trailers, and others, wherein tractors represent the most preferred segment. Tractors are the workhorses of modern agriculture, indispensable for various farming activities such as plowing, tilling, planting, and harvesting.

- On the basis of the distribution, the market has been divided into OEM and aftermarket. Among these, aftermarket exhibits a clear dominance in the market. Aftermarket tires can be tailored to suit various agricultural applications, be it for tractors, harvesters, or other specialized machinery.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 8.4 Billion |

| Market Forecast in 2033 | USD 12.6 Billion |

| Market Growth Rate 2025-2033 | 4.15% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Products Covered | Bias Tires, Radial Tires |

| Applications Covered | Tractors, Harvesters, Forestry, Irrigation, Trailers, Others |

| Distributions Covered | OEM, Aftermarket |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Apollo Tyres Limited, Balkrishna Industries Limited (BKT), Bridgestone Corporation, CEAT Ltd. (RPG Group), Continental AG, JK Tyre & Industries Ltd., MRF Limited, Specialty Tires of America Inc., Sumitomo Rubber Industries Ltd., TBC Corporation (Michelin), The Carlstar Group LLC, Titan International Inc., Trelleborg AB, Yokohama Off-Highway Tires America Inc. (Yokohama Rubber Company), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)