Global Agricultural Adjuvant Market Expected to Reach USD 6.6 Billion by 2033 - IMARC Group

Global Agricultural Adjuvant Market Statistics, Outlook and Regional Analysis 2025-2033

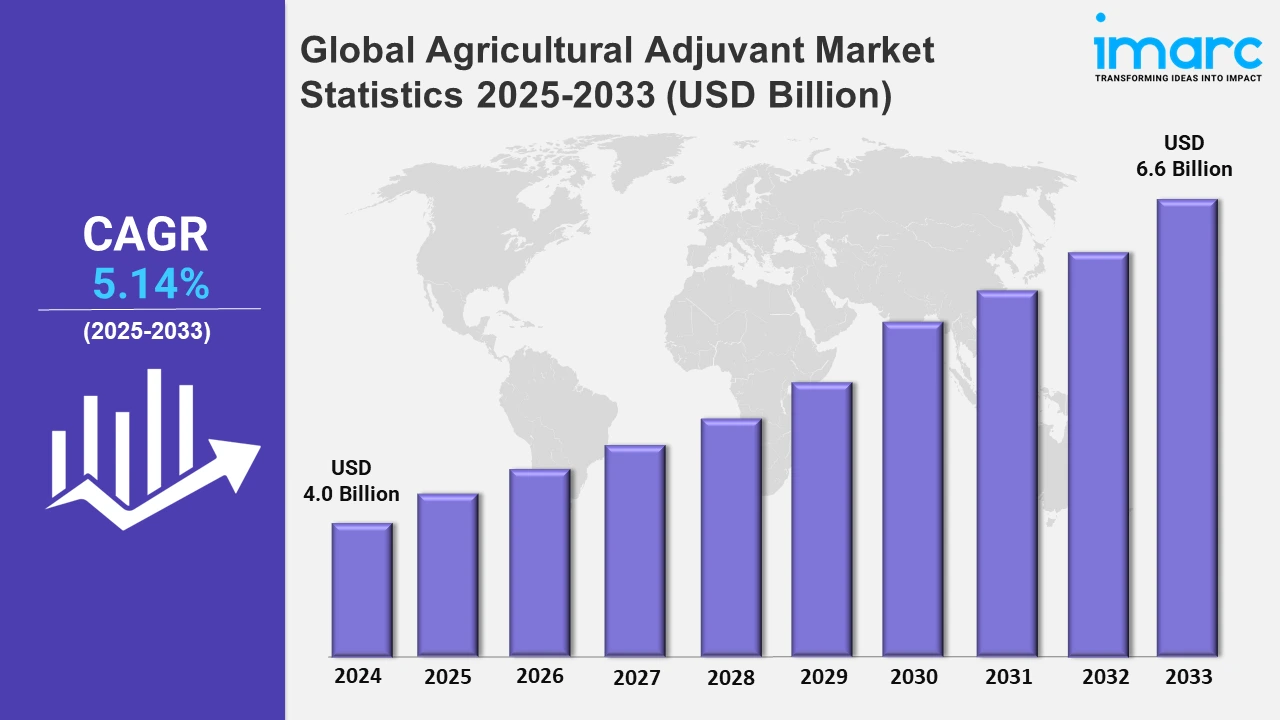

The global agricultural adjuvant market size was valued at USD 4.0 Billion in 2024, and it is expected to reach USD 6.6 Billion by 2033, exhibiting a growth rate (CAGR) of 5.14% from 2025 to 2033.

To get more information on the this market, Request Sample

The increasing shift towards sustainable agriculture is significantly contributing to the market. For instance, in February 2024, Cargill introduced a new program to help Australian canola growers implement sustainable agricultural practices. Cargill SustainConnect offers financial incentives for farmers. Such programs not only promote sustainable farming but also boost the demand for advanced agricultural inputs, including adjuvants, which enhance the efficacy of fertilizers and pesticides while minimizing their environmental impact.

Moreover, the agricultural adjuvant market is gaining momentum as industry leaders continue to innovate with products that enhance the efficacy of crop protection solutions, particularly in the biological segment. For example, in May 2024, BASF launched its Agnique BioHance adjuvant line, specifically designed to improve the performance of biological pesticides. These adjuvants have demonstrated remarkable results in controlling a wide range of plant pathogens, including downy mildew, powdery mildew, gray mold, and late blight. Trials indicate that incorporating just 0.5% to 1.0% of Agnique® BioHance can achieve pest control outcomes on par with, or even better than, traditional chemical pesticides. Besides this, the rapid adoption of precision agriculture techniques is strengthening the market. For instance, according to IMARC, the global precision agriculture market size reached US$ 8.5 Billion in 2023. Looking forward, IMARC Group expects the market to reach US$ 20.2 Billion by 2032, exhibiting a growth rate (CAGR) of 9.9% during 2024-2032. Precision agriculture utilizes advanced technologies, such as GPS, sensors, and drones, to enable site-specific farming and tailored crop management. Adjuvants play a crucial role in precision agriculture by enhancing the performance and efficiency of agrochemical applications. They aid in accurate delivery and targeted deposition of pesticides, herbicides, and fertilizers, maximizing their effectiveness and minimizing wastage.

Global Agricultural Adjuvant Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. According to the report, Asia Pacific accounted for the largest agricultural adjuvant market share. Asia Pacific is home to a significant agricultural industry, with a large and diverse range of crops cultivated in the region. The region's extensive agricultural activities, including the production of cereals, oilseeds, fruits, vegetables, and other crops, drive the demand for effective crop protection and management solutions, including adjuvants.

North America Agricultural Adjuvant Market Trends:

The increasing consumption of pesticides across the region is significantly contributing to the market's growth. For instance, in 2022, North America recorded an average pesticide consumption of 9.2 kg per hectare of agricultural land. This substantial usage underscores the necessity for adjuvants to optimize pesticide performance and ensure effective pest control.

Europe Agricultural Adjuvant Market Trends:

European governments provide subsidies and incentives for sustainable agricultural practices. For instance, in August 2024, the UK government revised its Sustainable Farming Incentive (SFI). Such policies encourage farmers to adopt adjuvants, thereby driving market growth.

Asia Pacific Agricultural Adjuvant Market Trends:

The rapid population growth and changing dietary preferences in the Asia Pacific have increased food production demand, accounting it to be the largest region for agricultural adjuvants. For instance, according to Statista, India's yearly population growth rate grew by 0.1 percentage points (+14.71 %) in 2023 compared to the previous year. The surge necessitates higher agricultural productivity and efficiency, thereby driving the adoption of adjuvants to optimize crop yields and protect against pests and diseases.

Latin America Agricultural Adjuvant Market Trends:

Stringent environmental regulations in Latin America promote the use of adjuvants that reduce chemical usage and minimize environmental impact. For instance, the Brazilian government has implemented policies encouraging the adoption of sustainable agricultural practices, including the use of eco-friendly adjuvants.

Middle East and Africa Agricultural Adjuvant Market Trends:

Several MEA countries are implementing policies and programs to promote the development of agricultural infrastructure. For instance, in July 2024, the United Arab Emirates (UA) Ministry of Agriculture and Food Security announced to contribute 10 million shekels (US $2.7 million) to improve agriculture and agricultural infrastructure in Israel's Arab community. These initiatives encourage the use of agricultural adjuvants to improve crop protection and productivity.

Top Companies Leading in the Agricultural Adjuvant Industry

Some of the leading agricultural adjuvant market companies include Akzo Nobel N.V., Croda International PLC, Corteva Agriscience, Evonik Industries Ag, Solvay SA, Huntsman International LLC, Nufarm Limited, Helena Agri-Enterprises, LLC, Wilbur-Ellis Holdings, Inc., and Brandt Consolidated, Inc., among many others. For instance, Corteva Agriscience, a global agricultural solutions company, collaborated with EPL Bio Analytical Services, a Canadian agricultural laboratory. The collaboration aimed to create new adjuvant technologies to enhance crop protection and management. The alliance aimed to bring innovative adjuvant solutions to market by combining Corteva's agrochemical experience with EPL's expertise in agricultural product analysis and evaluation, giving farmers improved tools for effective and sustainable crop production.

Global Agricultural Adjuvant Market Segmentation Coverage

- On the basis of the type, the market has been bifurcated into activator adjuvant and utility adjuvant, wherein activator adjuvant represents the largest segment. These adjuvants contribute to better overall crop management, including improved coverage on plant surfaces, enhanced absorption of active ingredients, and increased target specificity, further propelling the segment's growth.

- Based on the crop type, the market is categorized into cereals & oilseeds, fruits & vegetables, and others, amongst which cereals & oilseeds currently hold the largest market share. Adjuvants tailored for cereals and oilseeds help optimize pesticide applications, improve coverage, and enhance absorption, thereby driving market growth in this segment.

- On the basis of the application, the market has been divided into herbicides, fungicides, insecticides, and others. Among these, herbicides accounted for the largest market share. With increasing concerns about weed management and the need for effective solutions, the demand for adjuvants in the herbicides segment continues to grow.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 4.0 Billion |

| Market Forecast in 2033 | USD 6.6 Billion |

| Market Growth Rate (2025-2033) | 5.14% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Activator adjuvant, Utility adjuvant |

| Crop Types Covered | Cereals & Oilseeds, Fruits & Vegetables, Others |

| Applications Covered | Herbicides, Fungicides, Insecticides, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Akzo Nobel N.V., Croda International PLC, Corteva Agriscience, Evonik Industries Ag, Solvay SA, Huntsman International LLC, Nufarm Limited, Helena Agri-Enterprises, LLC, Wilbur-Ellis Holdings, Inc., and Brandt Consolidated, Inc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Agricultural Adjuvant Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

.webp)

.webp)