Aerospace Foam Market Size, Share, Trends and Forecast by Type, Application, End User, and Region, 2025-2033

Aerospace Foam Market Size and Share:

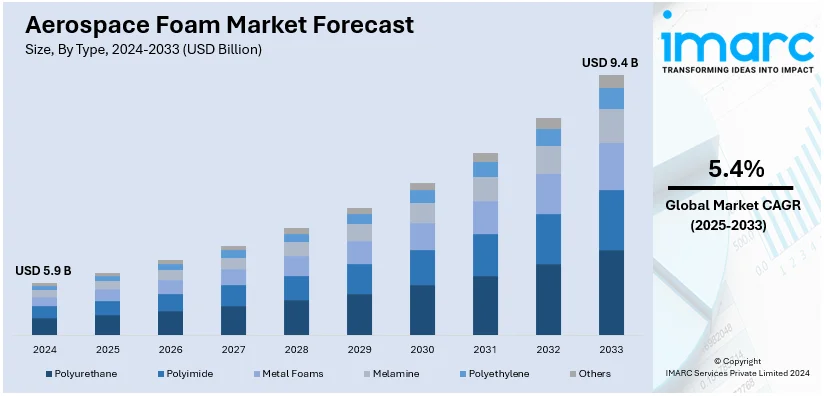

The global aerospace foam market size was valued at USD 5.9 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 9.4 Billion by 2033, exhibiting a CAGR of 5.4% from 2025-2033. North America currently dominates the market, holding a market share of over 37.8% in 2024. The growing defense investments, expanding commercial aviation, technological advancements, and the increasing use of lightweight materials to enhance fuel efficiency and performance are driving the market expansion in this region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 5.9 Billion |

|

Market Forecast in 2033

|

USD 9.4 Billion |

| Market Growth Rate (2025-2033) | 5.4% |

The increasing demand for lighter-weight materials used in aircraft manufacturing to improve fuel efficiency and performance is one of the main factors strengthening the market growth. The surge in commercial aviation, driven by rising passenger traffic and tourism, is boosting the demand for advanced insulation and cushioning solutions. With their superior durability, thermal resistance, and noise absorption qualities, polyurethane, polyethylene, and metal foams are being used for various applications in the aerospace sector. In line with this, the defense sector has also been focusing on the modernization of fleets with advanced materials. This, combined with advancements in the production of foams, providing enhanced properties, along with stringent safety and regulatory requirements, are impelling aerospace foams adoption.

To get more information on this market, Request Sample

The United States stands out as a key market disruptor, holding 88.10% of the total share. This is primarily on account of the increase in the adoption of lightweight materials to raise fuel efficiency in aircraft, coupled with the growing number of aircraft components using aerospace foams in the aviation sector. Additionally, modernization efforts in the defense sector, such as significant investments in advanced aircraft by the U.S. Department of Defense, have increased demand for high-performance materials, including specialized foams. Apart from this, ongoing technological advancement has also led to improvements in thermal resistance and durability, allowing foams to be applied more widely in both commercial and military aviation.

Aerospace Foam Market Trends:

Increased Defence Investments and Modernization Programs

Several countries across the globe have begun implementing modernization programs related to defense, which, therefore demands more advanced materials to produce its aircraft. In 2021, the Ministry of Defence, India agreed upon a USD 2.5 billion deal to receive 56 cargo and troop-carrying C-295 aircraft by Airbus Defence and Space. All such deals have increased the priority upon the upgradation of their fleets and performance capabilities which again raises the demand for such lightweight yet strong polyurethane and metal foams, thus creating a positive outlook for market expansion.

Increasing Investments in Manufacturing and Chain Supply Upgrades

Major aerospace companies are channeling significant resources into manufacturing and supply chain upgrades to meet growing demand. In 2024, GE Aerospace announced plans to invest over USD 650 million in its manufacturing facilities and supply chain, with nearly USD 550 million allocated to U.S. facilities and supplier partners. These investments aim to boost production capacity, improve material quality, and support commercial and defense projects, further driving the adoption of aerospace foam in critical applications.

Technological Advances in Foam Production and Applications

Advances in aerospace foam technology improve the performance characteristics of thermal resistance, durability, and noise absorption. These developments allow using the material in various applications- insulation, seating, and structure. Lightweight aerospace foams are increasingly becoming crucial as the markets move towards fuel-efficient technologies in both commercial and defense realms. The growth of this market will be driven as more research and development (R&D) in bio-based and sustainable foam materials will start to meet environmental and other regulatory requirements.

Aerospace Foam Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global aerospace foam market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, application, and end user.

Analysis by Type:

- Polyurethane

- Polyimide

- Metal Foams

- Melamine

- Polyethylene

- Others

Polyurethane is the largest product segment in the aerospace foam market in 2024, holding around 33.8% of the total market share. This is due to its versatile properties, which include excellent durability, lightweight structure, and superior thermal insulation, making it suitable for most aerospace applications. Polyurethane foams are widely used in seating, cabin interiors, and insulation, where comfort, safety, and performance are critical. The adaptability of the material to stringent aerospace standards and its ability to meet fire resistance regulations further consolidate its position in the market. With growing investments in lightweight materials and advancements in foam manufacturing, polyurethane continues to play a pivotal role in enhancing aircraft efficiency and passenger experience.

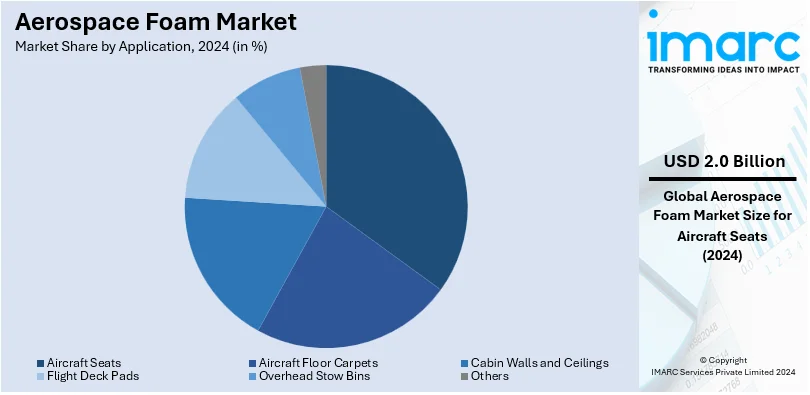

Analysis by Application:

- Aircraft Seats

- Aircraft Floor Carpets

- Cabin Walls and Ceilings

- Flight Deck Pads

- Overhead Stow Bins

- Others

Aircraft seats have accounted for the largest application area of aerospace foam market and accounted for approximately 33.4% in 2024. This growth is driven due to the rising demand for lightweight and comfortable seating solutions for improving fuel efficiency and enhancing passenger experience. Advanced aerospace foams, especially polyurethane and memory foams, are very widely used in seat cushioning, mainly because they provide exceptional impact absorption and flexibility, in addition to a good durability property. The growth in air travel and improvement in aircraft interiors of commercial and business aviation has increased the demand for high-performance seating materials. In addition, compliance with strict safety and fire resistance standards ensures the continued use of aerospace foams in this critical application area, ensuring market leadership.

Analysis by End User:

- General Aviation

- Military Aircraft

- Commercial Aviation

Commercial aviation will dominate the aerospace foam market in 2024, holding approximately 85.0% of the market share. This significant share is fueled by the rising global demand for air travel, driven by increasing passenger traffic and tourism. Airlines are prioritizing lightweight materials like aerospace foams to improve fuel efficiency and reduce operating costs. The widespread use of foam in seating, cabin interiors, and thermal insulation contributes to its strong presence in the commercial aviation sector. Additionally, ongoing fleet expansions and upgrades by major carriers, coupled with the surge in low-cost airlines, further boost the demand for advanced foam solutions. The emphasis on passenger comfort and safety also drives innovation in aerospace foam applications within commercial aviation.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America holds the largest share of the aerospace foam market, accounting for over 37.8% of the global revenue. This dominance is attributed to the region’s well-established aerospace industry, high investment in defense and commercial aviation, and the presence of leading manufacturers. The U.S., as a major hub for aircraft production, drives significant demand for advanced aerospace foams used in cabin interiors, seating, and insulation. Ongoing modernization of military fleets and robust air travel demand further bolster market growth. Additionally, stringent safety and environmental regulations encourage the adoption of lightweight, durable, and fire-resistant materials. Strong research and development efforts, coupled with substantial funding for innovative foam solutions, solidify North America's leadership in the global market.

Key Regional Takeaways:

United States Aerospace Foam Market Analysis

The aerospace foam market in the United States is significantly driven by the robust and expansive aviation industry. This sector contributes 5% of the U.S. GDP, equating to USD 1.37 Trillion in 2023. With more than 26,000 flights operating daily, carrying 2.6 Million passengers and 61,000 Tons of cargo to and from nearly 80 countries, the demand for lightweight and efficient materials, including aerospace foams, continues to rise. These foams are vital to aircraft weight reduction, which would facilitate higher fuel efficiency and strong performance, consistent with a more sustainable and cost-sensitive trend in the industry. With regulations on noise reduction and environmental standards tightening, sound-absorbing and ecologically friendly foam solutions now need to be included in aerospace designs. Advances in the production of foam are further driving market growth, especially through recent innovations in fire-retardant materials and high-performance materials. With industry giants such as Boeing and Lockheed Martin in the U.S. and a long-established aerospace manufacturing infrastructure, the demand for innovative foam solutions will be constant and consistent with the evolving needs of both commercial and military aviation.

Europe Aerospace Foam Market Analysis

The aerospace foam market in Europe is growing steadily. This is due to the strong aerospace manufacturing base of the region and increasing environmental concerns. Europe is home to some of the key aerospace players, such as Airbus and Rolls-Royce, which are now integrating lightweight foam solutions to meet regulatory standards and improve aircraft performance. The EU is committed to decreasing greenhouse gas emissions and is reported to have already managed an 8% reduction in 2023, based on data from the European Commission. The region is keen on having eco-friendly technologies in all industries, and aerospace foams are not an exception as they offer solutions that reduce weight while also enhancing fuel efficiency and reducing carbon emissions. The increasing requirements of aircraft design for sound dampening and safety enhance demand for sound-absorbing and fire-retardant foams. As sustainability in the region is being worked towards by the European Green Deal regulations, the aerospace foam market shall increase its pace, with continuous investments into research and development to create innovative, high-performance materials, aligned with the EU environmental targets.

Asia Pacific Aerospace Foam Market Analysis

The APAC region market of aerospace foam is growing hugely as a result of the expansion in the aviation industry and high investment in aerospace manufacturing. Air travel demand is rising with respect to these countries-China, Japan, and India-in addition to production capability. For instance, in April 2024, GE Aerospace reported an investment of over INR 240 Crore (amounting to USD 30 Million) into the expansion of its Pune, India manufacturing facility. The investment in new machines, equipment, and specialized tools is expected to boost the capacity of the company along with expanding other product lines under the same entity. It explains the trend growing in the regions to upgrade with advanced manufacturing procedures and innovative technology. Furthermore, the demand for lightweight, high-performance foams that enhance fuel efficiency and comply with environmental regulations is increasing. With the growing momentum of military aircraft modernization and sustainability initiatives, aerospace foam products are becoming an integral part of both commercial and defense aviation developments in APAC, which is further driving the growth of the market.

Latin America Aerospace Foam Market Analysis

In Latin America, the aerospace foam market is benefiting from the region’s expanding aviation sector, particularly in Brazil. In 2024, Brazil’s domestic flight demand outpaced the global average, growing by 6.6% compared to the worldwide growth of 5.6%, according to the Government of Brazil. According to IATA, by July 2023, 44 Million passengers had been transported domestically. This increase in air traffic is driving demand for lightweight and efficient aerospace materials, including foams, which contribute to fuel savings and enhanced aircraft performance. Additionally, Brazil's focus on sustainability and cost-effective solutions further boosts the adoption of eco-friendly and noise-reducing foams, supporting the growth of the aerospace foam market across the region.

Middle East and Africa Aerospace Foam Market Analysis

The aerospace foam market in the Middle East is experiencing growth, driven by the region’s expanding aviation sector. Dubai, for instance, saw its aviation sector, including Emirates Group, Dubai Airports, and other related entities, contribute AED 137 Billion (USD 37.3 Billion) in gross value added (GVA) in 2023, which accounted for 27% of Dubai’s GDP. This robust sector growth is fueling demand for lightweight and high-performance materials, such as aerospace foams, which are essential for improving fuel efficiency and aircraft performance. Additionally, with the region’s emphasis on sustainability and noise reduction, there is a rising demand for eco-friendly and sound-absorbing foam solutions, further supporting the expansion of the aerospace foam market.

Competitive Landscape:

The global aerospace foam market is highly competitive, characterized by the presence of established players and innovative newcomers vying for market share. Major companies dominate through extensive product portfolios, strong research and development capabilities, and global distribution networks. These leaders focus on developing advanced lightweight, durable, and fire-resistant foam solutions tailored for aerospace applications. Additionally, strategic partnerships, acquisitions, and collaborations are common strategies to enhance market presence and meet evolving industry demands. Smaller players and regional manufacturers compete by offering cost-effective and niche products, leveraging localized supply chains. The market also sees an increasing emphasis on sustainability, prompting companies to invest in bio-based and recyclable foam materials, adding another layer of competition. As airlines and defense sectors prioritize innovation, the competitive landscape continues to evolve with a focus on quality, regulatory compliance, and customization to meet client-specific needs.

The report provides a comprehensive analysis of the competitive landscape in the aerospace foam market with detailed profiles of all major companies, including:

- Aerofoam Industries, LLC

- Armacell

- BASF SE

- Boyd

- DuPont de Nemours, Inc.

- Evonik Industries AG

- General Plastics Manufacturing Company

- Greiner AG

- Huntsman International LLC

- NCFI Polyurethanes

- Rogers Corporation

- SABIC

- Zotefoams plc

Latest News and Developments:

- September 2024: L&L Products has introduced its proprietary InsituCore™ foaming materials for lightweight composite manufacturing. Designed for aerospace applications, these one-component, heat-activated materials simplify production by creating lightweight, strong, net-shape 3D parts with targeted density and strength. The InsituCore™ technology generates internal pressure to form these parts in a cost-effective, clean, and efficient process, making it a valuable solution for aerospace foam applications.

- March 2024: Boeing has announced strategic investments in several Québec-based companies to advance aerospace innovation, including a USD 110 Million investment in an Aerospace Development Centre in the Espace Aéro Innovation Zone. Additionally, Boeing will invest USD 95 Million in Wisk Aero's development of an autonomous, electric eVTOL aircraft, with a focus on lightweight materials such as aerospace foam. A further USD 35 Million will be directed toward research in advanced landing gear technology with Héroux-Devtek. These investments highlight Boeing's commitment to advancing aerospace materials and technologies, including aerospace foam, to enhance performance and efficiency in the sector.

- March 2024: 3DEO has partnered with IHI Aerospace Co., Ltd. to advance the use of additive manufacturing (AM) technologies in aerospace. The collaboration leverage 3DEO’s expertise in Design for Additive Manufacturing (DfAM) to enhance IA’s capabilities.

Aerospace Foam Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Polyurethane, Polyimide, Metal Foams, Melamine, Polyethylene, Others |

| Applications Covered | Aircraft Seats, Aircraft Floor Carpets, Cabin Walls and Ceilings, Flight Deck Pads, Overhead Stow Bins, Others |

| End Users Covered | General Aviation, Military Aircraft, Commercial Aviation |

| Region Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Aerofoam Industries, LLC, Armacell, BASF SE, Boyd, DuPont de Nemours, Inc., Evonik Industries AG, General Plastics Manufacturing Company, Greiner AG, Huntsman International LLC, NCFI Polyurethanes, Rogers Corporation, SABIC, Zotefoams plc, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the aerospace foam market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global aerospace foam market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the aerospace foam industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Aerospace foam is a lightweight, durable material used in aircraft manufacturing for applications such as seating, insulation, and structural components, offering superior thermal resistance, noise absorption, and fire safety.

The aerospace foam market was valued at USD 5.9 Billion in 2024.

IMARC estimates the global aerospace foam market to exhibit a CAGR of 5.4% during 2025-2033.

Increasing demand for lightweight materials, expanding commercial aviation, defense modernization programs, and technological advancements in foam production are key drivers for market growth.

In 2024, polyurethane represented the largest segment by type, driven by its durability and versatility.

Aircraft seats lead the market by application owing to the demand for lightweight, ergonomic seating solutions.

Commercial aviation is the leading segment by end-user, driven by rising passenger traffic and airline fleet expansions.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global aerospace foam market include Aerofoam Industries, LLC, Armacell, BASF SE, Boyd, DuPont de Nemours, Inc., Evonik Industries AG, General Plastics Manufacturing Company, Greiner AG, Huntsman International LLC, NCFI Polyurethanes, Rogers Corporation, SABIC, Zotefoams plc, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)