Global Aerosol Refrigerants Market Expected to Reach USD 1.7 Billion by 2033 - IMARC Group

Global Aerosol Refrigerants Market Statistics, Outlook and Regional Analysis 2025-2033

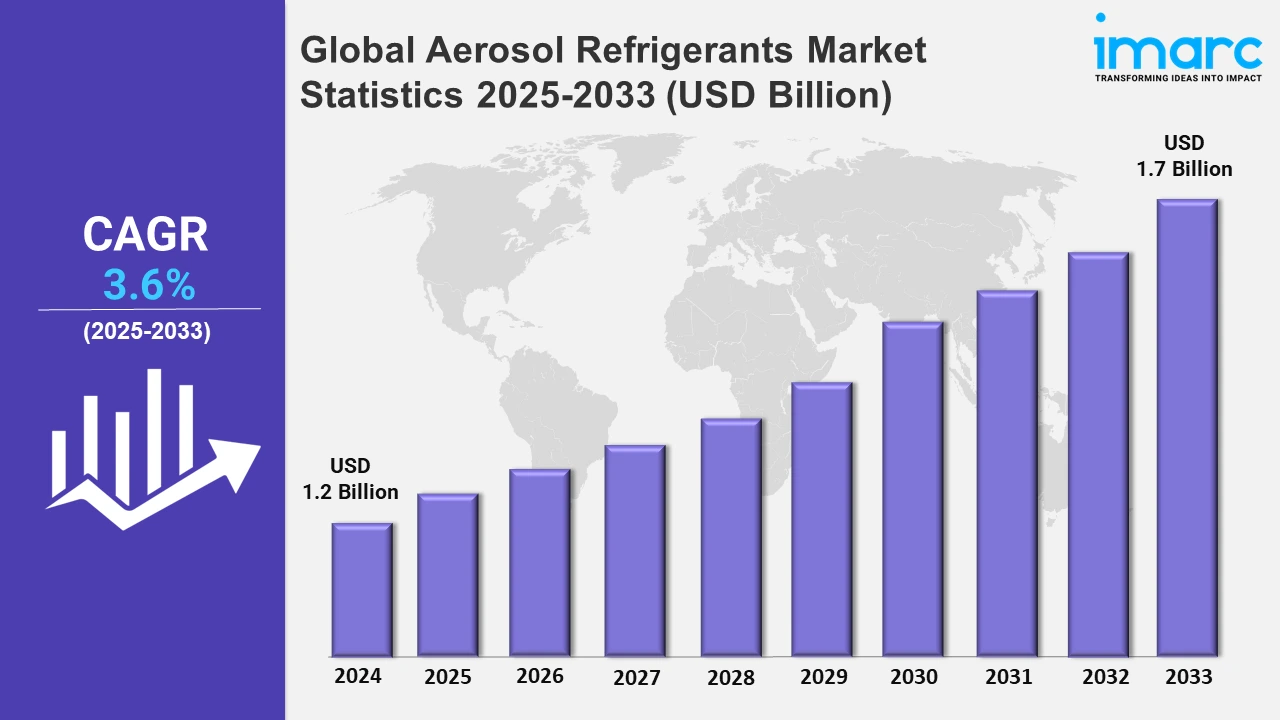

The global aerosol refrigerants market size was valued at USD 1.2 Billion in 2024, and it is expected to reach USD 1.7 Billion by 2033, exhibiting a growth rate (CAGR) of 3.6% from 2025 to 2033.

To get more information on this market, Request Sample

LNG technological advancements are transforming the energy business, with strategic acquisitions increasing process efficiency and capacities. These advancements are intended to fulfill the rising worldwide need for greener energy options and innovative gas processing technologies. For example, in July 2024, Honeywell acquired the LNG process technology and equipment business from industrial gas supplier Air Products for approximately USD 1.81 Billion.

Moreover, innovative HVAC systems with reduced global warming potential are emerging to fulfill severe environmental requirements. These solutions aim to reduce environmental effects while preserving energy efficiency, which aligns with worldwide initiatives to promote sustainable and climate-friendly cooling technology. For instance, in May 2024, Lennox, a developer of creative climate solutions, launched a low global warming potential (GWP) light commercial and ducted residential HVAC equipment to comply with the 2025 low GWP refrigerant rules. Furthermore, aerosol refrigerant producers are concentrating on producing eco-friendly and energy-efficient solutions to comply with worldwide environmental regulations. This involves replacing hydrofluorocarbons with low-GWP alternatives and maintaining compliance with laws, such as the Kigali Amendment. Additionally, the aftermarket sector has significant prospects as customers increasingly seek refrigerants that are compatible with current systems. High-performance aerosol refrigerants are gaining popularity since they are more efficient and have a lower environmental effect than conventional alternatives. For example, in North America, the automotive sector is moving toward HFO-based refrigerants notably R-1234yf, which meet with U.S. requirements such as the AIM Act. Automotive companies such as Ford and General Motors have incorporated these refrigerants into their air conditioning systems to provide sustainable cooling, increase vehicle efficiency, and fulfill the rising demand for ecologically responsible automotive solutions.

Global Aerosol Refrigerants Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific accounted for the largest aerosol refrigerants market share on account of rapid urbanization and industrialization, driving the demand for cooling solutions across the manufacturing, construction, and consumer sectors.

North America Aerosol Refrigerants Market Trends:

North America emphasizes low-GWP refrigerants to comply with environmental regulations like the AIM Act. For instance, the U.S. refrigeration sector is increasingly using HFOs such as R-1234yf to replace hydrofluorocarbons in automotive air conditioning systems.

Europe Aerosol Refrigerants Market Trends:

The F-Gas Regulation has pushed Europe to be the leader in the phase-out of high-GWP refrigerants. Countries such as Germany and France frequently employ CO2-based aerosol refrigerants for commercial refrigeration, which aligns with aims to reduce greenhouse gas emissions.

Asia Pacific Aerosol Refrigerants Market Trends:

The transition to energy-efficient and low-GWP refrigerants promotes sustainable cooling solutions, minimizing environmental impact while satisfying regulatory requirements for climate-friendly technology. This is exhibiting the largest regional market. In July 2024, Actrol announced that it would utilize Honeywell's energy-efficient and low global warming potential (GWP) refrigerant Solstice L40X (R-455A) for its condensing units.

Latin America Aerosol Refrigerants Market Trends:

Latin America focuses on low-cost aerosol refrigerants for home appliances. For example, Brazil is experiencing an increase in the use of hydrocarbon-based refrigerants in refrigerators, driven by energy-saving initiatives and increased customer demand for eco-friendly solutions.

Middle East and Africa Aerosol Refrigerants Market Trends:

To cope with severe temperatures, the Middle East and Africa region invests in industrial cooling systems that use proficient aerosol refrigerants. In Saudi Arabia, ammonia-based refrigerants are gaining popularity for large-scale warehouse refrigeration, guaranteeing both economic effectiveness and environmental safety.

Top Companies Leading in the Aerosol Refrigerants Industry

Some of the leading aerosol refrigerants market companies include A-Gas, Arkema S.A., Baltic Refrigeration Group, Daikin Industries Ltd., Dongyue Group, Fastenal Company, Groupe Gazechim, Honeywell International Inc., Navin Fluorine International Limited, Sinochem Corporation, SRF Limited (Kama Holdings Ltd.), Technical Chemical Company, and The Chemours Company, among many others. For example, in April 2024, Daikin Europe, a part of Japanese manufacturer Daikin Industries Ltd., unveiled the Altherma 4 HS-S+ series, its first propane (R290) air-to-water residential heat pump.

Global Aerosol Refrigerants Market Segmentation Coverage

- On the basis of the product, the market has been bifurcated into HFC-143a, HFC-32, HFC-125, SF6, and others, wherein HFC-143a represents the most preferred segment. Several significant reasons contribute to the HFC-143a segment's growth, including its comparatively low ozone depletion potential (ODP) and moderate global warming potential (GWP) when compared to other refrigerants.

- Based on the container type, the market is categorized into steel and aluminum, amongst which aluminum dominates the market. Aluminum's lightweight but durable characteristics make it an excellent choice for a variety of structural components.

- On the basis of the end use sector, the market has been divided into residential, commercial, and industrial. Among these, residential exhibits a clear dominance in the market. Residential sector development is being driven by rising worldwide urbanization rates, which has resulted in higher demand for residential spaces as well as the need for effective and environmentally friendly cooling solutions.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 1.7 Billion |

| Market Growth Rate 2025-2033 | 3.6% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Products Covered | HFC-143a, HFC-32, HFC-125, SF6, Others |

| Container Types Covered | Steel, Aluminum |

| End Use Sectors Covered | Residential, Commercial, Industrial |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | A-Gas, Arkema S.A., Baltic Refrigeration Group, Daikin Industries Ltd., Dongyue Group, Fastenal Company, Groupe Gazechim, Honeywell International Inc., Navin Fluorine International Limited, Sinochem Corporation, SRF Limited (Kama Holdings Ltd.), Technical Chemical Company, The Chemours Company, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)