Global Advanced Packaging Market Expected to Reach USD 113.33 Billion by 2033 - IMARC Group

Global Advanced Packaging Market Statistics, Outlook and Regional Analysis 2025-2033

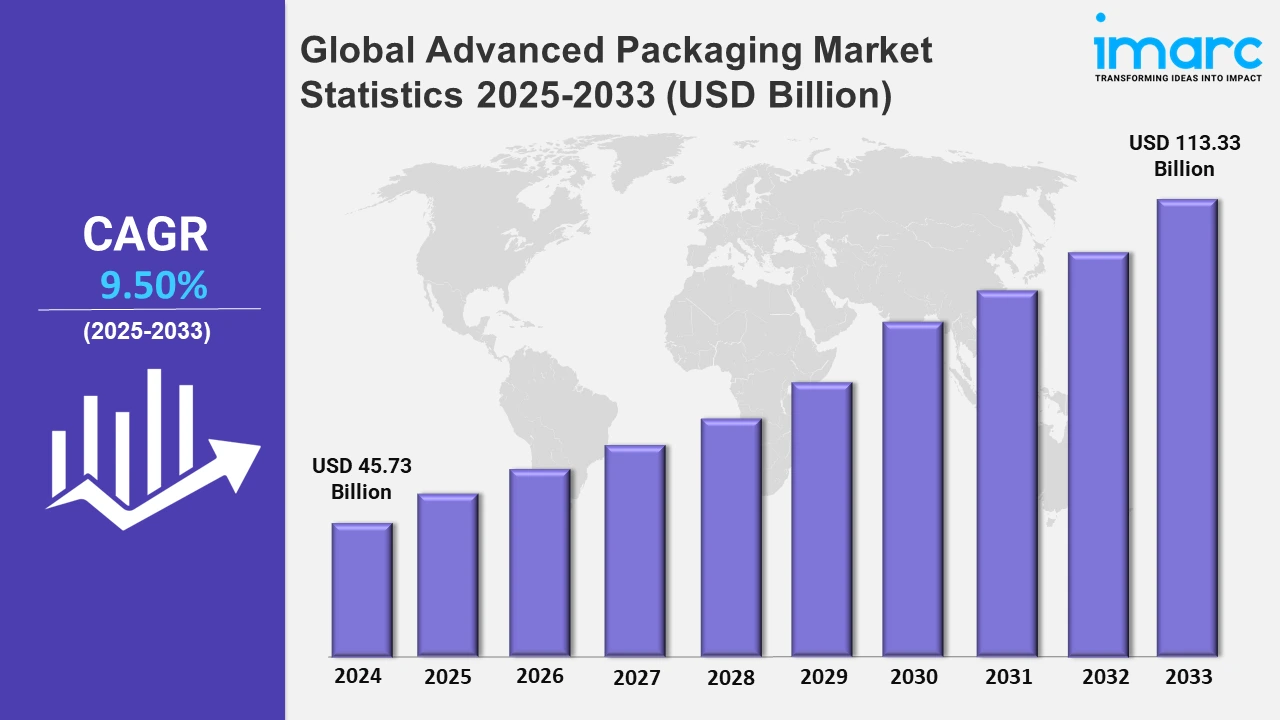

The global advanced packaging market size was valued at USD 45.73 Billion in 2024, and it is expected to reach USD 113.33 Billion by 2033, exhibiting a growth rate (CAGR) of 9.50% from 2025 to 2033.

To get more information on this market, Request Sample

The global advanced packaging market is witnessing massive growth due to the high demand for miniaturized electronic devices that require innovative packaging solutions for efficiency and performance. For instance, in 2024, innovations in advanced packaging like 2.5D/3D technologies revolutionize semiconductor manufacturing, and investment from Amkor and Silicon Box and Siemens EDA enhances 3D-IC packaging tools for chiplets integration. Moreover, the consumer preferences shift toward compact, high-performance devices, such as smartphones, wearable technology, and Internet of Things (IoT) devices making manufacturers turn toward advanced packaging to achieve the miniaturization required without loss of functionality. Technologies like fan-out wafer-level packaging (FOWLP) and system-in-package (SiP) are now very important because they enable a single package to integrate multiple functions, thus minimizing size while increasing speed and energy efficiency. Further driving the demand for advanced semiconductor solutions that are capable of supporting higher frequencies and high-speed data transfer is the rollout of 5G technologies and data centers. These are problems being solved by newer packaging technologies such as flip-chip and through-silicon via (TSV) technology, improving thermal and electrical performance. The raised advancement of semiconductor designs to answer the needs of changing consumers and industries speed up the adoption of such solutions are bolstering the market growth.

The growing concern over energy-efficient and green electronics, compounded by regulatory pressure and heightened consumer consciousness is another key driver. Industry is shifting the focus on packaging solutions which have less power consumption and maximised performance, especially for automotive electronics and renewable energy applications. For instance, in November 2024, Applied Materials announced its EPIC Advanced Packaging platform to drive global collaboration in the development of energy-efficient AI chip packaging technologies to meet rising energy demands and enable next-generation semiconductor innovations. In addition to this, the sudden shift to electric vehicles (EVs) requires the development of power electronics where innovative packaging techniques ensure high-power performance with minimum heat dissipation. It is also driven by the rise in demand for artificial intelligence (AI) and machine learning (ML) applications, heavily reliant on advanced semiconductor technologies. These applications require higher computational capabilities and efficient energy management, which advanced packaging technologies support. Additionally, government incentives and investments in semiconductor manufacturing are supporting the infrastructure needed in regions such as Asia-Pacific and North America. Efforts at securing supply chains and minimizing reliance on imports are furthering local production, spurring innovation in packaging technologies. The intersection of technological development, regulatory pressures, and economic investment is a guarantor of continued growth in the advanced packaging market globally.

Global Advanced Packaging Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific accounted for the largest market share on account high semiconductor manufacturing and robust consumer electronics demand.

North America Advanced Packaging Market Trends:

Strong investments in semiconductor innovation in North America, supported by accelerating demand from industries like telecommunications, automotive, and healthcare, are driving the advanced packaging market. Focus on 5G deployment, IoT integration, and artificial intelligence are driving the adoption of cutting-edge packaging technologies in the region. The growth of renewable energy and electric vehicles is also creating a conducive environment for domestic semiconductor manufacturing, further solidifying North America's position as a leader in the advanced packaging sector.

Asia-Pacific Advanced Packaging Market Trends:

Robust semiconductor manufacturing capabilities prevail in the Asia-Pacific region, as countries like China, South Korea, Taiwan, and Japan maintain the dominance of global semiconductor production and continue investing in research and development to advance packaging technologies. Sources report that in November 2024, TriMas expanded into the region by opening a 225,000-square-foot advanced packaging facility in Haining, China, integrating automation and sustainability, producing pumps, caps, and closures for beauty, personal care, and e-commerce markets. Moreover, amplifying demand for smartphones, tablets, and wearables has made the region a thriving hotbed for the consumer electronics market, further pushing adoption in the region. Furthermore, the acceleration of 5G network rollouts and the massive increase in IoT devices lead to a growing demand for compact, efficient packaging solutions. The government support to local semiconductor industries, increased investment in electric vehicles, and renewable energy also contribute. The region of Asia-Pacific has an advantage in manufacturing cost and availability of talent to establish dominance in advanced packaging innovations.

Europe Advanced Packaging Market Trends:

Europe is more focused on high-performance semiconductors in automobiles and industries. The heightened dominance of the electric vehicle and renewable energy sectors will increase the demand for more advanced power electronics in Europe. Strict environmental laws make use of eco-friendly and greener packaging solutions. The Germans and French are investing a lot in R&D of manufacturing chips to improve its yield factor, which will positively help the advanced packaging technology sector.

Latin America Advanced Packaging Market Trends:

Advanced packaging is one of the significant growth drivers for Latin America, especially in Brazil and Mexico, due to the region's strong electronics manufacturing sector. As penetration with smartphones, IoT devices, and consumer electronics amplifies in Latin America as the demand for innovation in packaging solutions is at a rising level. High investment in local semiconductor manufacturing and an amplifying automotive market offers more opportunities for using advanced packaging technologies, including energy efficiency and compact forms.

Middle East and Africa Advanced Packaging Market Trends:

The Middle East and Africa are experiencing rising demand in advanced packaging due to escalating consumer electronics adoption and new investments in semiconductor manufacturing. The government initiatives for local manufacturing and sustainable packaging further influence the market. The acceleration of e-commerce in the area also requires reliable and effective packaging solutions, thus facilitating the adoption of advanced logistics and supply chain applications based on advanced technologies.

Top Companies Leading in the Advanced Packaging Industry

Some of the leading advanced packaging market companies include Advanced Semiconductor Engineering, Inc., Amkor Technology, Brewer Science, Inc., ChipMOS Technologies Inc., Microchip Technology Inc., Powertech Technology Inc., Prodrive Technologies, Samsung Electronics Co. Ltd, SUSS MicroTec SE, Taiwan Semiconductor Manufacturing Company Limited, Texas Instruments Incorporated, Universal Instruments Corporation, Yole Group, among many others.

- On October 31, 2024, Advanced Semiconductor Engineering, Inc. (ASE) announced plans to collaborate with Taiwan Semiconductor Manufacturing Company (TSMC) to expand advanced packaging capacity. The company projects over $500 million in advanced packaging and testing revenue for 2025, driven by AI and HPC demand, with anticipated growth exceeding 10%, despite challenges in gross margin trends.

Global Advanced Packaging Market Segmentation Coverage

- On the basis of the type, the market has been categorized into flip-chip ball grid array, flip chip CSP, wafer level CSP, 5D/3D, fan out WLP, and others, wherein flip-chip ball grid array represent the leading segment. It dominates the advanced packaging market due to adoption in high-performance computing, gaming consoles, and data centers. This segment offers superior thermal and electrical performance, making it ideal for complex semiconductor applications. The growing demand for smaller, energy-efficient devices further propels the adoption of FCBGA, cementing its position as a preferred packaging solution in the global semiconductor industry.

- Based on the end use, the market is classified into consumer electronics, automotive, industrial, healthcare, aerospace and defense, and others, amongst which consumer electronics dominates the market. It is dominating the advanced packaging market, driven by the rapid adoption of smartphones, tablets, and wearable devices. The heightening demand for compact, high-performing devices with enhanced functionality propels the use of advanced packaging technologies. Continuous innovation in 5G-enabled gadgets and IoT devices further amplifies growth in this segment, as manufacturers prioritize efficiency, miniaturization, and performance optimization to cater to evolving consumer preferences.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 45.73 Billion |

| Market Forecast in 2033 | USD 113.33 Billion |

| Market Growth Rate 2025-2033 | 9.50% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Flip-Chip Ball Grid Array, Flip Chip CSP, Wafer Level CSP, 5D/3D, Fan Out WLP, Others |

| End Uses Covered | Consumer Electronics, Automotive, Industrial, Healthcare, Aerospace and Defense, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Advanced Semiconductor Engineering, Inc., Amkor Technology, Brewer Science, Inc., ChipMOS Technologies Inc., Microchip Technology Inc., Powertech Technology Inc., Prodrive Technologies, Samsung Electronics Co. Ltd, SUSS MicroTec SE, Taiwan Semiconductor Manufacturing Company Limited, Texas Instruments Incorporated, Universal Instruments Corporation, Yole Group, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)