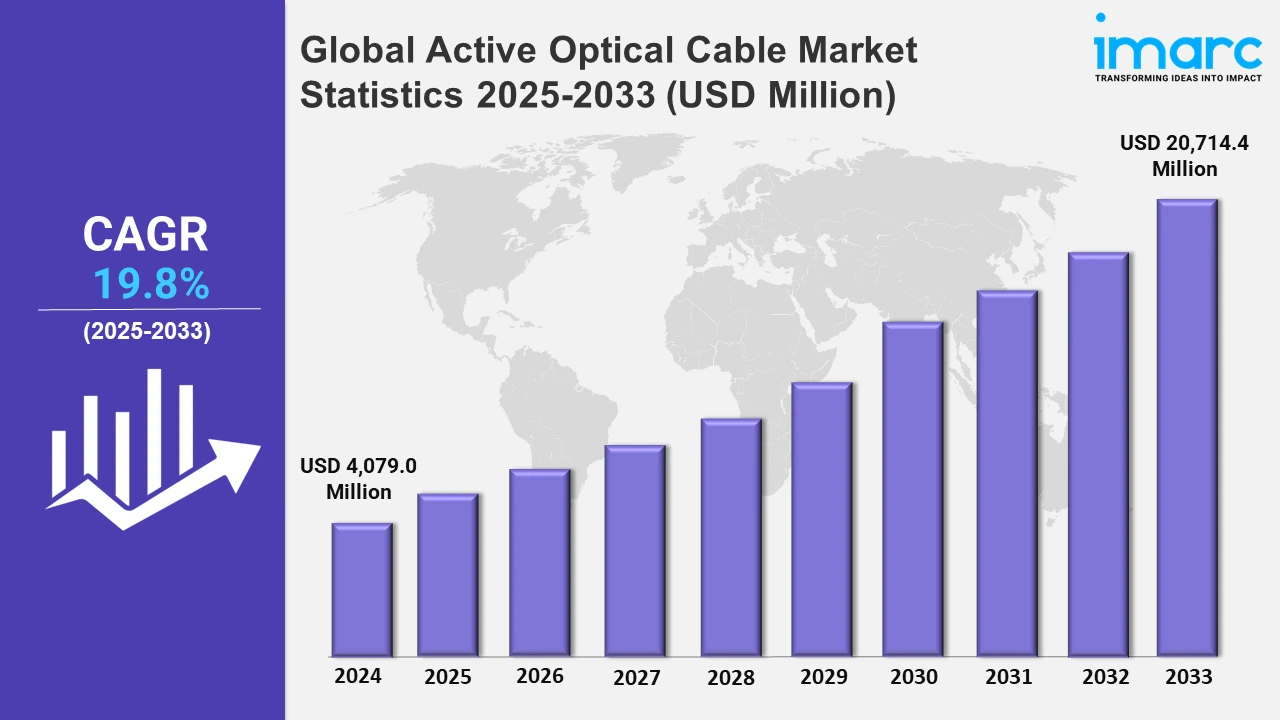

Global Active Optical Cable Market Expected to Reach USD 20,714.4 Million by 2033 - IMARC Group

Global Active Optical Cable Market Statistics, Outlook and Regional Analysis 2025-2033

The global active optical cable market size was valued at USD 4,079.0 Million in 2024, and it is expected to reach USD 20,714.4 Million by 2033, exhibiting a growth rate (CAGR) of 19.8% from 2025 to 2033.

To get more information on this market, Request Sample

The increasing adoption of 5G networks is a major driver of growth in the active optical cable market. For instance, according to Statista, in 2022, around one-tenth of all global connections used 5G technology, with this figure expected to exceed one-half by the coming years. 5G networks demand ultra-high-speed data transmission and low latency to support applications, such as real-time communications, autonomous vehicles, industrial IoT, and immersive media, such as AR/VR. AOCs, with their high bandwidth (up to 400Gbps and beyond) and low signal loss over long distances, are ideal for meeting these requirements, making them highly suitable for the infrastructure needed for 5G networks.

Moreover, the rising production of automotive vehicles is one of the significant factors driving the growth of the active optical cable market. For instance, according to the India Brand Equity Foundation, India's annual automobile production in FY23 was 25.9 million units. India is a strong market in terms of both domestic demand and exports. In April 2024, the total production of passenger vehicles, three-wheelers, two-wheelers, and quadricycles was approximately 23,58,041. As automotive manufacturers push towards incorporating ADAS and autonomous driving technologies, there is an inflating need for high-speed data transmission between various vehicle components, including sensors, cameras, radar, LiDAR, etc. AOCs are ideal for these applications because they offer faster data transfer rates, lower latency, and high bandwidth compared to traditional copper cables. They are crucial for the real-time processing required in these advanced systems. Besides this, the introduction of advanced AOCs that are equipped with improved optical components, advanced modulation techniques, and optimized signal processing to facilitate long-distance connectivity, low signal loss, and lower energy consumption is positively influencing the market growth. For instance, in September 2019, Eurotech Technologies, a technological solutions provider, launched BestNet HDMI active optical cables, which enable the transmission of ultra-high-bandwidth video and audio. BestNet AOC HDMI 2.0 cables with Ethernet are engineered with the utmost innovation to provide an ultra-high definition bandwidth of 18 Gbps. The plug-and-play, active optical cable provides excellent video quality and is available in lengths of 50, 100, and 150 meters.

Global Active Optical Cable Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America represented the largest market segment, owing to the implementation of favorable policies and the introduction of high-performance computing.

North America Active Optical Cable Market Trends:

North America dominates the active optical cable market due to a robust ecosystem of R&D activities, technology businesses, and startups focused on data analytics, cloud computing, artificial intelligence (AI), and high-performance computing. Furthermore, the region's increasing demand for data centers as a result of rapid digital transformation and significant development in data-intensive applications is driving market expansion. Recent data from Cloudscene, as of March 2024, highlights the United States as the global leader, housing 5,381 reported data centers. Furthermore, the implementation of favorable policies by regional governments to foster competition and technical innovation promotes market expansion.

Europe Active Optical Cable Market Trends:

The growth of data centers, cloud computing, and high-performance computing (HPC) is pushing the demand for faster, more reliable, and more energy-efficient data transmission solutions. AOCs provide high bandwidth and low latency, making them ideal for interconnecting servers, switches, and storage devices in data centers. For instance, in Germany, major data centers are adopting active optical cable for their high-speed, high-volume data communication needs, replacing traditional copper cables for improved performance and lower energy consumption.

Asia-Pacific Active Optical Cable Market Trends:

In Asia-Pacific, the 5G network rollout is driving AOC adoption. Countries like China, South Korea, and India are heavily investing in 5G infrastructure, where AOCs are used for high-speed, low-latency interconnects between base stations and central hubs. Active optical cables help meet the high bandwidth demands for 5G applications such as IoT and augmented reality, making them crucial in this region's telecom evolution.

Latin America Active Optical Cable Market Trends:

In Latin America, the ongoing cloud adoption and digital transformation are accelerating the demand for the product. Countries like Brazil and Mexico are rapidly expanding cloud services to support e-commerce and tech startups. Active optical cable is being deployed in newly built data centers to optimize data transfer speeds, providing reliable, energy-efficient solutions for cloud-based services and virtualized environments, aligning with the region's technological growth.

Middle East and Africa Active Optical Cable Market Trends:

The increasing demand for cloud services, big data analytics, and digital transformation has led to the rapid development of data centers across the MEA region. For instance, in the United Arab Emirates, particularly Dubai, the government and private companies are building large-scale data centers to cater to regional and international businesses. The Dubai Silicon Oasis Authority, for instance, is home to numerous data center projects, with a growing need for high-performance interconnects like AOCs for data transmission.

Top Companies Leading in the Active Optical Cable Industry

Some of the leading active optical cable market companies include Amphenol Communications Solutions, Broadcom Inc., Corning Incorporated, Dell Inc., Eaton, Gigalight, IOI Technology Corporation, JPC Connectivity, Linkreal Co., Ltd., Molex, LLC (Koch IP Holdings, LLC), Siemon, and TE Connectivity, among many others. For instance, in April 2020, Sumitomo Electric Industries Ltd. received Thunderbolt 3 certification from Intel Corporation for its new active optical cables (AOCs). Also, in March 2022, Lumentum Operations LLC unveiled its cutting-edge optical and photonic products at the Optical Fiber Communication Conference and Exhibition (OFC) 2022. One of its offerings was vertical-cavity surface-emitting lasers (VCSELs), which can be employed in low-cost, high-performance active optical cable applications.

Global Active Optical Cable Market Segmentation Coverage

- On the basis of the connector type, the market has been bifurcated into QSFP, CXP, CDFP, CFP, SFP, and others, wherein QSFP represented the largest market segment, owing to its high-speed data transmission. Additionally, it has a small form factor compared to its alternatives, which is augmenting the growth of the segment.

- Based on the technology, the market is categorized into infiniband, ethernet, HDMI, displayport, USB, and others, amongst which infiniband represented the largest market segment due to its large bandwidth, low latency, and high-speed data transfer capabilities, thereby making it ideal for applications in financial trading, scientific simulations, data analytics, and high-performance computing.

- On the basis of the application, the market has been divided into data center, high-performance computing, personal computing, digital signage, consumer electronics, and others. Among these, data center represented the largest market segment. AOC is widely used in data centers to provide high-speed, high-bandwidth connectivity between servers, storage systems, and networking equipment.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 4,079.0 Million |

| Market Forecast in 2033 | USD 20,714.4 Million |

| Market Growth Rate 2025-2033 | 19.8% |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Connector Types Covered | QSFP, CXP, CDFP, CFP, SFP, Others |

| Technologies Covered | InfiniBand, Ethernet, HDMI, DisplayPort, USB, Others |

| Applications Covered | Data Center, High-Performance Computing, Personal Computing, Digital Signage, Consumer Electronics, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Amphenol Communications Solutions, Broadcom Inc., Corning Incorporated, Dell Inc., Eaton, Gigalight, IOI Technology Corporation, JPC Connectivity, Linkreal Co., Ltd., Molex, LLC (Koch IP Holdings, LLC), Siemon, TE Connectivity, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)