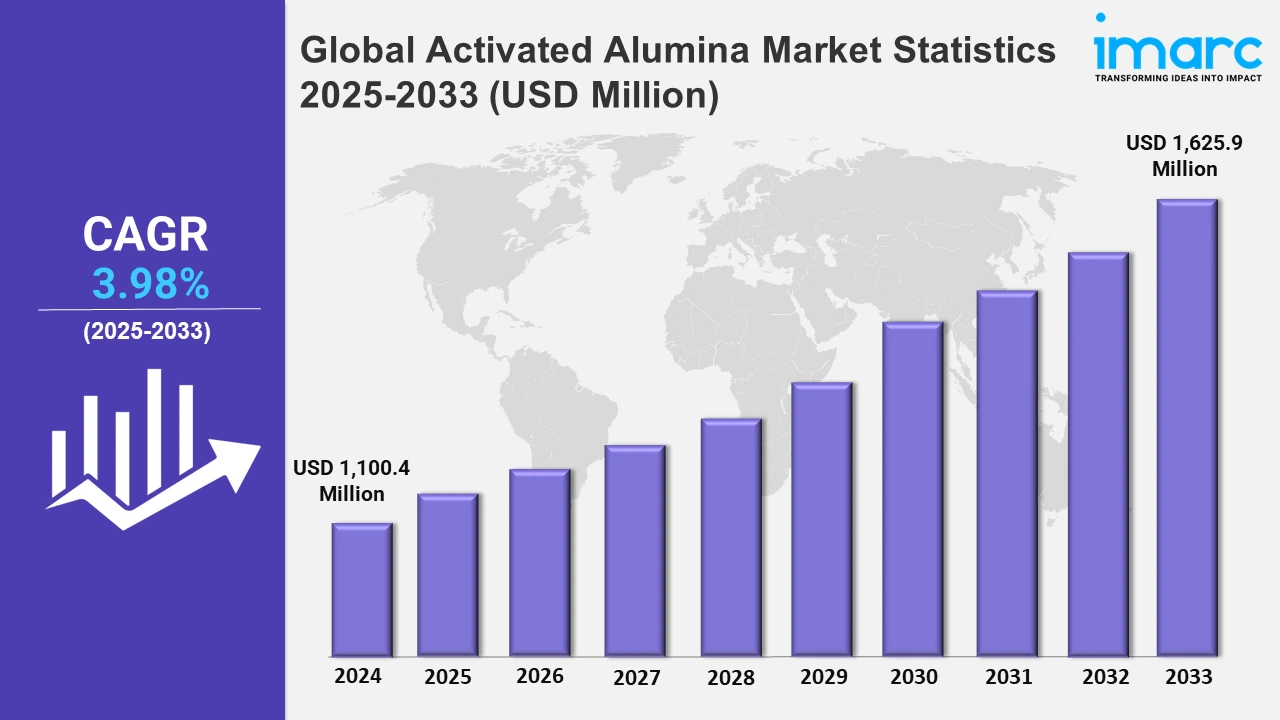

Global Activated Alumina Market Projected to Reach USD 1,625.9 Million by 2033, Exhibiting a CAGR of 3.98% from 2025 to 2033

Global Activated Alumina Market Statistics, Outlook and Regional Analysis 2025-2033

The global activated alumina market size was valued at USD 1,100.4 Million in 2024, and it is expected to reach USD 1,625.9 Million by 2033, exhibiting a growth rate (CAGR) of 3.98% from 2025 to 2033.

To get more information on the this market, Request Sample

Companies are seeking ways to broaden their product offerings and geographic reach by purchasing existing facilities. Such acquisitions enable businesses to expand their market presence, optimize production, and meet rising demand for activated alumina in industrial applications. For example, in October 2023, Axens announced an Asset Sale Agreement (ASA) with Rio Tinto Alcan of Canada, acquiring their activated alumina business in Brockville, Ontario. Similarly, mergers, acquisitions, joint ventures, and partnerships are significant strategies adopted by activated alumina producers to grow their geographical footprint and lessen competition.

The demand for more sustainable fuel generation and efficient petrochemical processes is driving the development of high-performance hydrogenation catalysts with improved impurity resistance. This strategy favors catalysts that retain stability and activity under difficult settings, hence promoting sustainability and operating efficiency in industries with strict purity and environmental regulations. For instance, in September 2020, BASF SE introduced a range of novel selective hydrogenation catalysts, including palladium alumina catalysts designed to exhibit strong resistance against sulfur impurities. Furthermore, China is a major contributor, with huge expenditures in wastewater treatment facilities and chemical processing companies. In this regard, the Chinese government intends to increase wastewater treatment capacity by 20 million cubic meters per day over the next five years. This development is projected to drive up demand for activated alumina in Asia Pacific. For example, key companies in the region, including CHALCO Shandong Co., Ltd., Honeywell International Inc., Jiangsu Jingjing New Material Co. Ltd., Axens, and BASF SE, are developing new activated alumina products to strengthen their market positions. This expansion is fueled by rising demand from industries such as water treatment and oil and gas.

Global Activated Alumina Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific accounted for the largest market share due to rapid development and urbanization, which are driving demand for clean water and purified gasses, resulting in a growing need for effective water treatment and gas drying solutions.

North America Activated Alumina Market Trends:

Due to severe arsenic removal standards in North America, there is an increase in demand for activated alumina in water treatment. For example, the United States Environmental Protection Agency requires arsenic levels of less than 10 ppb, which encourages the use of activated alumina in filtration systems.

Asia Pacific Activated Alumina Market Trends:

Asia Pacific region’s booming industrial sector, notably in electronics and petrochemicals, demands high-purity gases for production processes, thus catalyzing the requirement for activated alumina’s adsorption capabilities. For example, in March 2024, Australia's Alumina Limited signed a binding agreement to be acquired by joint-venture partner Alcoa, in a deal valued at approximately US$2.2 Billion. This acquisition was intended to strengthen Alcoa's position as a leading producer of bauxite and alumina.

Europe Activated Alumina Market Trends:

In Europe, activated alumina is rapidly being utilized in air-drying applications, notably in the chemical and pharmaceutical industries. For example, Germany's industrial focus on high-quality compressed air systems drives up demand for moisture management using activated alumina desiccants.

Latin America Activated Alumina Market Trends:

Due to increased extraction operations, notably in Brazil, Latin America is seeing an increase in the use of activated alumina in oil and gas refineries. Its function in sulfur removal procedures is consistent with regional requirements for cleaner fuel production standards.

Middle East and Africa Activated Alumina Market Trends:

In the Middle East and Africa, the requirement for activated alumina is increasing for gas purification, which is required in large-scale petrochemical operations. Saudi Arabia's focus on efficient gas drying technology emphasizes the necessity of activated alumina in natural gas processing and refining.

Top Companies Leading in the Activated Alumina Industry

Some of the leading activated alumina market companies include AGC Chemicals Pvt. Ltd., Axens, BASF SE, Dynamic Adsorbents Inc., Honeywell International Inc., Huber Engineered Materials, Jiangxi Sanxin Hi-Tech Ceramics Co. Ltd., Porocel Industries, Shandong Zhongxin New Material Technology Co. Ltd., Sialca Industries, Sorbead India, and Sumitomo Chemical Co. Ltd., among many others. For example, in October 2020, BASF SE introduced a new series of alumina catalysts designed for selective hydrogenation applications, such as first-stage pyrolysis gasoline (PYGAS) and selective hydrogenation of dienes in C4 olefin streams. These catalysts offer improved activity and sulfur tolerance due to higher palladium dispersion.

Global Activated Alumina Market Segmentation Coverage

- On the basis of the application, the market has been bifurcated into catalysts, desiccant, absorbent, and others, wherein absorbent represents the most preferred segment. The growing usage of activated alumina as an absorbent due to its compatibility with a wide range of chemicals and accurate adsorption via specific surface changes is propelling the market.

- Based on the end-use industry, the market is categorized into water treatment, pharmaceutical, textile, oil & gas, chemical, and others, amongst which oil & gas dominates the market. The widespread necessity of activated alumina in the broadening oil & gas sector, particularly due to its critical role in improving the efficiency of natural gas processing, is driving market expansion.

- On the basis of the form, the market has been divided into powder and beads. Among these, beads exhibit a clear dominance in the market on account of the rising demand for activated alumina beads owing to their applicability for specific applications such as chromatography.

- Based on the mesh size, the market is bifurcated into 80-150 mesh, 150-300 mesh, and above 300 mesh. The 80-150 mesh is suitable for water treatment and fluoride removal, while the 150-300 mesh acts as an adsorbent in air and gas drying. Above 300 mesh is appropriate for specialized filtering in applications needing finer particle collection and adsorption.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 1,100.4 Million |

| Market Forecast in 2033 | USD 1,625.9 Million |

| Market Growth Rate 2025-2033 | 3.98% |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Applications Covered | Catalysts, Desiccant, Absorbent, Others |

| End-Use Industries Covered | Water Treatment, Pharmaceutical, Textile, Oil & Gas, Chemical, Others |

| Forms Covered | Powder, Beads |

| Mesh Sizes Covered | 80-150 Mesh, 150-300 Mesh, Above 300 Mesh |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | AGC Chemicals Pvt. Ltd., Axens, BASF SE, Dynamic Adsorbents Inc., Honeywell International Inc., Huber Engineered Materials, Jiangxi Sanxin Hi-Tech Ceramics Co. Ltd., Porocel Industries, Shandong Zhongxin New Material Technology Co. Ltd., Sialca Industries, Sorbead India, Sumitomo Chemical Co. Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

.webp)

.webp)