U.S. Office Furniture Market Size, Share, Trends and Forecast by Product Type, Material Type, Distribution Channel, Price Range, and Region, 2026-2034

U.S. Office Furniture Market Size and Share:

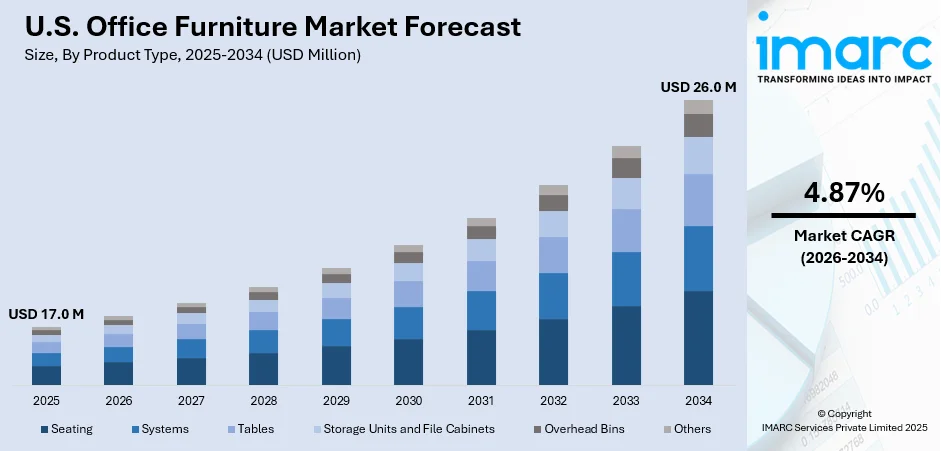

The U.S. office furniture market size was valued at USD 17.0 Million in 2025. Looking forward, IMARC Group estimates the market to reach USD 26.0 Million by 2034, exhibiting a CAGR of 4.87% from 2026-2034. The growing trend of remote or hybrid work models among employees, increasing construction activities to expand office spaces, and rising technological advancements in furniture manufacturing are some of the factors impelling the growth of the market in the United States.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 17.0 Million |

| Market Forecast in 2034 | USD 26.0 Million |

| Market Growth Rate (2026-2034) | 4.87% |

Access the full market insights report Request Sample

In the United States, the market is driven by a shift toward hybrid and flexible work environments. As remote work is becoming more frequent and hybrid office settings are gaining popularity, organizations are rethinking their work environments to boost employee efficiency and health. This is catalyzing the demand for adaptable furniture that can support both group and individual activity. Height-adjustable desks, modular workstations, and movable walls are becoming common as organizations are prioritizing versatility in office architecture. Ergonomics is an important trend, with a growing awareness about the importance of employee well-being and comfort. The emphasis on ergonomics goes beyond corporate workplaces. There is also an increased necessity for ergonomic home office furniture, as remote workers attempt to establish healthier and more productive work environments.

To get more information on this market Request Sample

Individuals and businesses are increasingly emphasizing on eco-friendly behaviors, making sustainability a crucial market driver. Manufacturers are increasingly using environment friendly materials, such as repurposed wood, bamboo, and biodegradable fabrics, while also ensuring that their manufacturing procedures reduce waste and carbon emissions. Certifications are becoming crucial indicators for purchasers looking for sustainable office furniture. This trend is bolstered by government rules that encourage green procurement and corporate activities aimed at meeting environmental, social, and governance (ESG) objectives. Technology integration is also influencing the sector, as smart furniture becomes more common. Products with built-in charging outlets, IoT connectivity, and customizable settings controlled by smartphone apps are increasing popularity, particularly among technology-driven organizations. These developments address the increased demand for seamless connection and user-centric.

U.S. Office Furniture Market Trends:

Rising Hybrid and Remote Work Trend

The rise of hybrid and remote work styles is impelling the growth of the market in the US. In accordance with Neat's The State of Remote Work: 2025 Statistics, 14% of the American workforce operates from their homes, while 58% of professional workers opt to work remotely for at least three days per week. With an increasing number of people working from their residents, either on a full-time or part-time basis, there is a rise in the need for home office furnishings. Individuals are purchasing ergonomic chairs, workstations, and other furniture in order to establish productive and pleasant workspaces within their homes. Furthermore, the focus on achieving a balance between work and personal life is strengthened by the rise of hybrid work, as numerous companies implement policies for increased flexibility. This is leading to growth opportunities for manufacturers who provide compact, affordable, and visually appealing home office furniture. Businesses and individuals are expected to continue emphasizing functionality, flexibility, and comfort in their work environments, making the hybrid work trend a key driver of the office furniture market.

Increasing Construction Activities

The rising construction activities are supporting the growth of the US market. According to the Associated Builders and Contractors’ analysis of U.S. Census Bureau data released in 2025, non-residential construction spending increased up to 0.1% in August to a seasonally adjusted annual rate of $1.22 trillion. Besides this, as new office buildings and commercial spaces are constructed, there is a direct need for office furniture. Companies moving into new premises or expanding their operations require a range of furnishings, from desks and chairs to conference tables and storage solutions. These factors are further supporting the U.S. office furniture market growth.

Technological Advancements

Technological advancements are driving the creation of smart office furniture that is more efficient. Height-adjustable desks, ergonomic chairs with technology features, and charging stations are gaining popularity. Additionally, a variety of office furniture suppliers in the United States are introducing new products to meet this growing demand. FURSYS, a manufacturer of office furniture, presented its creative designs at the Design Days event in Chicago on June 10-12, 2025. One of the main items offered is ABIERTO, a top-of-the-line adjustable desk designed for upscale executive offices, effortlessly blending practicality and style. These factors further contribute to the market share.

U.S. Office Furniture Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the U.S. office furniture market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on product type, material type, distribution channel, price range, and region.

Analysis by Product Type:

- Seating

- Systems

- Tables

- Storage Units and File Cabinets

- Overhead Bins

- Others

Seating is a key market category, owing to the importance of chairs and seating solutions in workplace ergonomics and productivity. This section offers a wide range of items, including task chairs, executive chairs, lounge seating, and conference room chairs. Ergonomic chairs are in high demand as employers and individuals prioritize employee health and comfort in order to prevent job weariness and musculoskeletal diseases. Lumbar support, adjustable armrests, and breathable materials have all gained popularity, as they have sustainable and environment friendly designs.

The systems furniture market, which comprises modular workstations and cubicle systems, has grown dramatically as office layouts become more open and hybrid. While classic cubicles are still utilized in some industries, current systems furniture focuses on flexibility and adaptation. Modular systems enable organizations to modify their layouts as needed, making them an attractive option for dynamic offices and coworking spaces.

The tables section comprises products such as conference tables, meeting tables, desks, and height-adjustable workstations, each of which addresses certain practical and aesthetic needs in the office. Height-adjustable desks, often known as sit-stand desks, are especially popular for their health benefits, as they allow users to alternate between sitting and standing during the day. This market is growing significantly in both commercial and residential offices, as wellness programs become a top priority.

Storage units and file cabinets remain an important part of the office furniture market. Their demand is influenced by the rising digitization of document management. Traditional file cabinets are being replaced or supplemented by multipurpose storage solutions that fit perfectly into current office layouts. Lockable cabinets, compact storage for personal possessions, and pieces that can serve as room separators or work surfaces are becoming more widespread.

Overhead bins, which are commonly utilized in modular workstations and open office layouts, are ideal for firms looking for effective storage options that do not take up valuable floor space. These containers allow easy access to regularly used products, resulting in superior organization and a clutter-free work environment. While their popularity is mostly driven by large and medium-sized offices, overhead bins are increasingly being incorporated into home office furniture to maximize storage in small spaces.

Analysis by Material Type:

- Wood

- Metal

- Plastic and Fiber

- Glass

- Others

Wood is a commonly used material in the office furniture industry, known for being durable, versatile, and having a classic charm. Wooden items like desks, cabinets, and tables are commonly used in traditional and high-ranking office settings because of their sophisticated look and their knack for projecting a professional image. Solid wood and engineered wood, like plywood and medium-density fiberboard (MDF), are frequently used depending on budget and design preferences. In response to growing consumer demand for eco-friendly products, manufacturers are using more sustainably produced or salvaged wood. In 2025, IKEA launched Mittzon, a new range of office furniture made with wood fiber. The concept around this system is to bring comfort along with natural elements and patterns into office spaces.

Metal is commonly used for office furniture, particularly for items that need to be durable and long-lasting, such as chair frames, filing cabinets, and modular systems. Steel and aluminum are frequently utilized metals known for their toughness, resistance to wear, and stylish appearance, making them ideal for contemporary and industrial office settings.

Plastic and fiber-based materials are known in the market for their affordability, versatility, and lightweight characteristics. Plastic chairs, desks, and storage units are in high demand in low-cost markets like small businesses, new companies, and household workspaces. Polypropylene and reinforced polymers, which are advanced types of plastics, offer both durability and adaptability. They come in a variety of colors and finishes.

Glass is being used more and more in office furniture to establish modern, trendy, and professional settings. Glass tops or panels are frequently utilized on conference tables, desks, and storage units to create a modern and simple look in office settings. Tempered glass is frequently used because of its durability and safety characteristics, being resistant to shattering and able to withstand heavy usage.

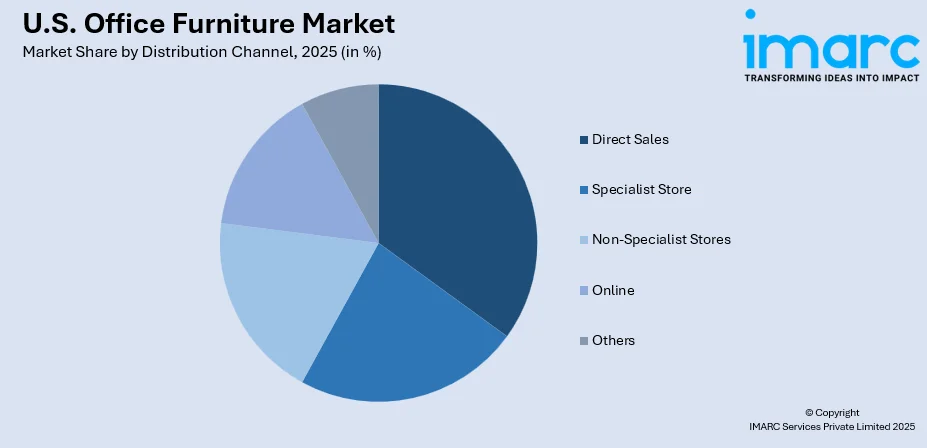

Analysis by Distribution Channel:

To get detailed segment analysis of this market Request Sample

- Direct Sales

- Specialist Store

- Non-Specialist Stores

- Online

- Others

The direct sales channel is important in the market, especially for big companies. Manufacturers and distributors frequently provide customized solutions and bulk buying opportunities directly to businesses. This channel stands out for its capacity to offer personalized goods and services, like furniture tailored to fit particular space restrictions or ergonomic preferences. Direct sales frequently include installation and post-sales assistance, making them a favored option for significant projects like setting up new offices or renovating existing ones.

Specialized stores that focus on selling office furniture serve a diverse customer base, including small and medium-sized companies as well as individual shoppers. These stores have wide product selections, including top-quality brands and specialty items like ergonomic furniture or luxurious executive office furniture. Many individuals choose specialized shops due to their knowledge, range of options, and assistance in choosing furniture that meets their unique needs.

General furniture outlets and large retail stores that are not specialized provide an affordable and convenient way to distribute office furniture. These stores serve individuals on a budget, small businesses, and home office buyers in search of simple yet practical furniture. Items available in general stores are typically manufactured in large quantities and made uniform, prioritizing cost-effectiveness and availability.

The online channel is rapidly emerging as one of the most significant distribution segments in the office furniture market, driven by the growing popularity of e-commerce and the convenience it offers. Online platforms provide a wide range of office furniture options, catering to various budgets and preferences. Online shopping is particularly popular among remote workers and small businesses due to its ease of comparison, access to reviews, and home delivery options.

Analysis by Price Range:

- Low

- Medium

- High

The low-price segment in the office furniture market caters primarily to budget-conscious buyers, including startups, small businesses, and individual home office users. Furniture in this category is often mass-produced and featured materials, such as engineered wood, plastic, or low-grade metal, which help keep costs affordable. Ready-to-assemble (RTA) furniture is a prominent offering in this segment due to its lower production and transportation costs. While functionality is the primary focus, aesthetics and durability may be less emphasized compared to higher-priced segments.

The medium-price range segment appeals to a broader customer base, including mid-sized businesses, professionals, and home office users seeking a balance between quality and affordability. Furniture in this category typically features better materials, such as high-quality engineered wood, stainless steel, and ergonomic-grade plastics. Many pieces in this segment emphasize functionality and design, offering features like adjustable components, improved durability, and a more polished aesthetic.

The high-price range segment targets premium customers, including large corporations, executive offices, and clients seeking bespoke furniture solutions. Products in this category emphasize superior craftsmanship, top-grade materials such as solid wood, leather, and tempered glass, and cutting-edge ergonomic features. Customization is a significant driver in this segment, with manufacturers offering tailored designs that align with specific office aesthetics and functional requirements. High-end furniture also incorporates advanced technology, such as integrated internet of things (IoT) systems, smart height-adjustable desks, and sustainable, eco-friendly materials certified by organizations.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The Northeast region of the United States, home to major urban hubs such as New York City, Boston, and Philadelphia, represents a key market for office furniture due to its concentration of corporate headquarters, financial institutions, and professional service firms. The demand in this region is driven by high-density office spaces, coworking facilities, and a preference for premium, design-forward furniture to reflect the professional image of businesses. Companies in this region often prioritize ergonomic and sustainable furniture to align with evolving workplace trends and corporate sustainability goals. Additionally, the growth of remote work is driving demand for home office furniture in suburban areas surrounding major cities.

The Midwest, often referred to as the industrial and manufacturing heartland of the United States, is characterized by a mix of corporate offices, small and medium-sized enterprises (SMEs), and public sector institutions. Cities like Chicago, Detroit, and Minneapolis drive regional demand for office furniture, particularly mid-priced and functional solutions that cater to the region's practical and cost-conscious business culture. The Midwest also has a significant presence of educational institutions and healthcare facilities, which contribute to demand for specialized furniture, such as ergonomic seating and modular workstations.

The South is one of the fastest-growing regions in the U.S. office furniture market, driven by rapid economic development, population growth, and the relocation of major companies to states like Texas, Florida, and Georgia. Cities such as Dallas, Atlanta, and Miami are experiencing a surge in demand for office furniture due to expansions in technology, healthcare, and corporate sectors. The region’s business-friendly policies and increasing number of startups and SMEs fuel demand for a wide range of furniture, from affordable solutions to premium executive designs.

The West, encompassing states such as California, Washington, and Colorado, represents a dynamic and innovative market for office furniture. Known for its strong technology sector and creative industries, the region’s demand is shaped by forward-thinking companies that prioritize design, ergonomics, and sustainability. Cities like San Francisco, Los Angeles, and Seattle are major hubs for coworking spaces and hybrid offices, driving demand for modular and multifunctional furniture. Sustainability is a particularly strong focus in the West, with businesses and individuals favoring eco-friendly furniture made from recycled or renewable materials.

Competitive Landscape:

Leading companies are leveraging a combination of innovative product development, sustainability initiatives, digital transformation, and customer-centric approaches to strengthen their market presence. As workplace dynamics evolve, driven by trends such as hybrid work models, health-focused designs, and environmental awareness, these companies are adapting their strategies to meet changing customer needs and stay competitive. One of the primary areas of focus for major office furniture manufacturers is innovation in product design and functionality. Companies are continually introducing new products that cater to the evolving needs of both corporate offices and home office users. Moreover, these companies are increasingly designing modular and multifunctional furniture to support flexible office layouts. In 2025, Haworth Inc., a Michigan based company, launched a new office chair, Breck, integrated with a Geostretch patented technology. The chair features a special flexible geometric-stretch back with optimal ratio of back suspension for ergonomic support.

The report provides a comprehensive analysis of the competitive landscape in the U.S. office furniture market with detailed profiles of all major companies, including:

- Ashley Furniture Industries Inc.

- Global Furniture Group

- Haworth Inc.

- Herman Miller Inc.

- HNI Corp.

- Kimball International Inc.

- Steelcase Inc.

- Virco Inc.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Latest News and Developments:

- August 2025: Humanscale launched its first branded online store for refurbished office furniture, aiming to reduce the 17 billion pounds of furniture that end up in landfills in the United States each year.

- June 2025: Kimball International Inc. the grand opening of new showroom in New York. Located at the entrance of the dynamic Flatiron District, the space is dedicated to showcasing Kimball International’s comprehensive array of workplace, education, and healthcare furniture solutions.

U.S. Office Furniture Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Seating, Systems, Tables, Storage Units and File Cabinets, Overhead Bins, Others |

| Material Types Covered | Wood, Metal, Plastic and Fiber, Glass, Others |

| Distribution Channels Covered | Direct Sales, Specialist Store, Non-Specialist Stores, Online, Others |

| Price Ranges Covered | Low, Medium, High |

| Regions Covered | Northeast, Midwest, South, West |

| Companies Covered | Ashley Furniture Industries Inc., Global Furniture Group, Haworth Inc., Herman Miller Inc., HNI Corp., Kimball International Inc., Steelcase Inc., Virco Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the U.S. office furniture market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the U.S. office furniture market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the U.S. office furniture industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Office furniture refers to furnishings designed specifically for workplace environments, including corporate offices, coworking spaces, and home offices. These products include desks, chairs, tables, storage units, and modular systems that improve functionality, organization, and employee productivity. Increasingly, ergonomic designs and smart technology features are integrated to enhance health, comfort, and connectivity.

The U.S. office furniture market was valued at USD 17.0 Million in 2025.

IMARC estimates the U.S. office furniture market to exhibit a CAGR of 4.87% during the forecast period of 2026-2034, reaching a market value of USD 26.0 Million by 2034.

The market is driven by the rise in hybrid and remote work trends, increasing construction activity for office expansions, and advancements in furniture technology, including smart furniture with IoT connectivity. Additionally, growing awareness of workplace ergonomics and sustainability initiatives are significant factors propelling market growth.

On a regional level, the market has been classified into the Northeast, Midwest, South, and West.

Some of the major players in the U.S. office furniture market include Ashley Furniture Industries Inc., Global Furniture Group, Haworth Inc., Herman Miller Inc., HNI Corp., Kimball International Inc., Steelcase Inc., and Virco Inc, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)