U.S. Logistics Market Size, Share, Trends and Forecast by Model Type, Transportation Mode, End Use, and Region, 2025-2033

U.S. Logistics Market Size and Share:

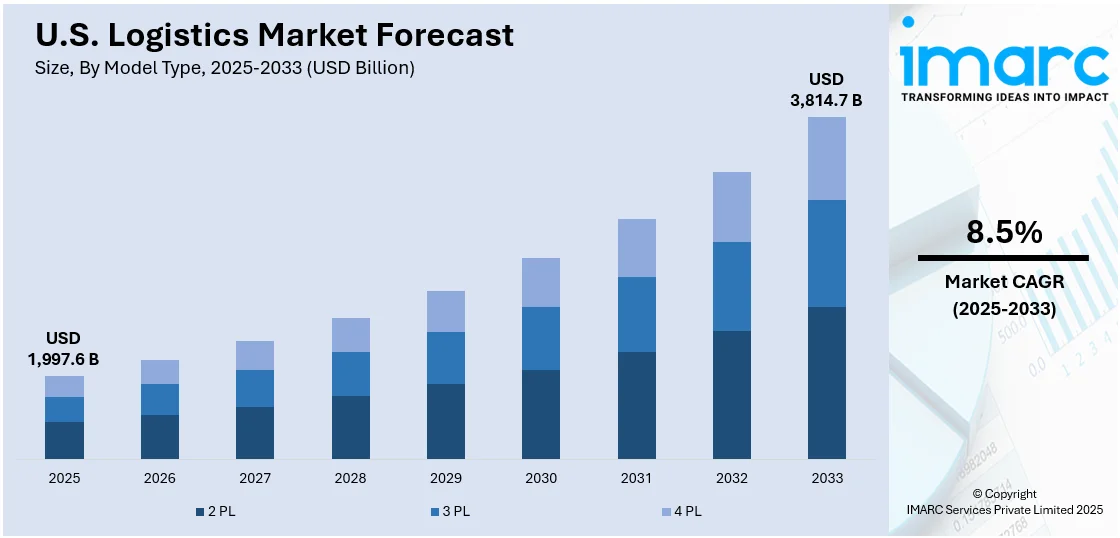

The U.S. logistics market size is anticipated to reach USD 1,997.6 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 3,814.7 Billion by 2033, exhibiting a CAGR of 8.5% from 2025-2033. The market is driven by e-commerce growth, advancements in automation and AI, the rising demand for fast delivery, global trade expansion, and infrastructure development. Increasing focus on supply chain optimization, real-time tracking, and sustainability significantly influence the growth of the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2025 | USD 1,997.6 Billion |

| Market Forecast in 2033 | USD 3,814.7 Billion |

| Market Growth Rate (2025-2033) | 8.5% |

The U.S. logistics market is growing substantially, and the growth is a result of various key factors that determine its development. One of the major factors driving this trend is the fast growth in e-commerce, which changed consumer buying habits and developed a need for faster delivery services. For example, in September 2024, Pitney Bowes launched a platform to aid e-commerce companies in developing their shipping capabilities. Lower rates can be sourced from the national and regional carriers through the U.S. Postal Service, UPS, FedEx through the ShipAccel platform. It also integrates with such e-commerce sites as eBay, Shopify, and Amazon. With companies now struggling to keep pace with high expectations of same-day or next-day delivery, advanced logistics technologies become an increasingly important investment to optimize all supply chain processes.

Furthermore, a good number of technological fronts move the market, some examples including automation, artificial intelligence and even IoT. An example where IoT led to revolution in the logistics. As of last August in the year 2024, Best Buy launched artificial intelligent delivery tracking system guaranteeing real time information after complaining of having customers super-irritated on being given very vague and even less orders visibility through its delivery. Predictive analytics, automated warehousing, and intelligent transportation systems increase productivity, reduce operating expenses, and also enhance order fulfillment accuracy. All these depend now on tracking and visibility in real-time to meet the needs of customers and keep the chain of supply transparent. Another significant driver that has evolved is sustainability. Companies increasingly are adopting greener approaches, such as using electric vehicles, optimizing delivery routes, and minimizing packaging waste, to achieve regulatory requirements and environmental considerations.

U.S. Logistics Market Trends:

E-commerce Growth

The quick rise in e-commerce is also an essential driver for the US logistics market. For instance, November 2024, the US Department of Commerce's Census Bureau indicated that it was estimated to be around $300.1 billion of retail e-commerce sales in the third quarter of 2024; however, after the application of seasonality variation but before considering any price adjustments, the sum had been 2.6 percent (±0.4) from that experienced during the second quarter of 2024. An estimated $1,849.9 billion was spent in retail during the third quarter of 2024, a 1.3% (±0.2) increase from the second quarter. E-commerce increased 7.4% (±1.2) in the third quarter of 2024 as compared to the same quarter in 2023, while total retail sales increased 2.1% (±0.5). E-commerce accounted for 16.2% of all sales in the third quarter of 2024. The increasing consumer demand for fast, reliable delivery has increased the need for efficient supply chain operations, including last-mile delivery solutions. Businesses are investing in advanced technologies and fulfillment networks to meet same-day and next-day delivery expectations. The shift toward online shopping, fueled by convenience and technological advancements, has significantly reshaped logistics strategies, making e-commerce a dominant force in the industry.

Significant Technological Advancements

Technological innovations such as automation, artificial intelligence (AI), and the Internet of Things (IoT) are changing logistics. For example, in March 2024, Walmart Commerce Technologies launched Route Optimization, an AI-based logistics product that helps businesses optimize the efficiency of their supply chains. Walmart had been using this new product internally but is now offering it to other companies as a Software as a Service (SaaS) solution. Automated warehousing, predictive analytics, and smart transportation systems enhance operational efficiency, accuracy, and cost-effectiveness. Real-time tracking and visibility solutions improve customer satisfaction by providing transparency throughout the supply chain. These advancements enable companies to adapt to dynamic market demands while optimizing performance, making technology a cornerstone of modern logistics operations in the U.S.

Rising Sustainability Initiatives

The U.S. logistics market is transformed by sustainability as companies employ environmentally friendly procedures to satisfy customer and regulatory requirements. Companies reduce carbon footprints by using electric vehicles and streamlining delivery routes, thus reducing packaging waste. Such initiatives solve environmental issues while improving operational efficiency. Along the lines of long-term environmental and financial goals, sustainability drives innovation and creates competitiveness in logistics by becoming a strategic focus. In line with this, the Universal Logistics Holdings, Inc., in August 2024, introduced its new 2025 Peterbilt 579EV in our fleet as part of our ongoing sustainability initiatives. With the assistance of these electric vehicles, Universal Intermodal Services, Inc., a subsidiary of Universal Logistics Holdings, Inc., is ready to reduce its carbon footprint in Southern California.

U.S. Logistics Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the U.S. logistics market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on model type, transportation mode, end use.

Analysis by Model Type:

- 2 PL

- 3 PL

- 4 PL

In the U.S. logistics market, the 2PL (Second-Party Logistics) model involves outsourcing specific logistics functions, primarily transportation and warehousing, to a service provider. 2PL providers handle the movement of goods via trucking, shipping, or rail and manage storage in warehouses. This model is commonly used by businesses seeking cost-effective and reliable solutions for managing freight without full supply chain integration. Companies retain control over strategic decisions while benefiting from specialized expertise and operational efficiency offered by 2PL providers.

3PL providers are projected to dominate the U.S. logistics market due to their comprehensive services, including transportation, warehousing, inventory management, and distribution. Companies increasingly rely on 3PLs for their expertise in optimizing supply chains, reducing costs, and improving efficiency. With the growth of e-commerce and complex supply chains, 3PL providers offer scalability, advanced technology integration, and flexible solutions, making them an essential partner for businesses seeking to focus on core activities while outsourcing logistics operations to experts.

The fourth-party logistics (4PL) solutions provide a complete package of supply chain management and control, combining and integrating the existing multi-3PL services under one umbrella. Seeking more control and less complexity in logistics operations, 4PLs are the few that offer solutions that cover optimization strategic planning, and technology-driven insights. Their ability to manage all aspects of the supply chain, including procurement and logistics technology, makes them a valuable partner for organizations aiming to improve overall supply chain performance.

Analysis by Transportation Mode:

- Roadways

- Seaways

- Railways

- Airways

Roadways offer flexibility and accessibility for last-mile deliveries and regional transportation. The vast network of highways and interstates enables efficient movement of goods across cities and states. Trucking is particularly vital for transporting consumer goods, agricultural products, and industrial materials. The increasing demand for e-commerce and the expansion of regional distribution centers further fuel the need for reliable and cost-effective road transportation, solidifying its dominance in logistics.

Seaways, which facilitate international trade through important ports like Los Angeles, Long Beach, and Houston, are vital to the U.S. logistics market. Large quantities of items can be transported internationally at a reasonable cost by shipping, particularly industrial and bulk commodities. Seaways are essential for economic growth because the United States depends on them for imports and exports. It is anticipated that the use of larger boats and the ongoing development of port infrastructure would improve maritime logistics' efficiency and guarantee its dominance.

Railways play a key role in the U.S. logistics market, particularly for transporting bulk goods, industrial products, and long-haul shipments. Rail offers cost-efficiency, energy savings, and high capacity, making it ideal for heavy or large-volume freight. Extensive rail networks connect key manufacturing and distribution hubs, supporting intermodal transportation. Rail’s environmental benefits and advancements in technology, such as automated tracking and fuel-efficient locomotives, position it as a dominant and sustainable solution for freight movement in the logistics industry.

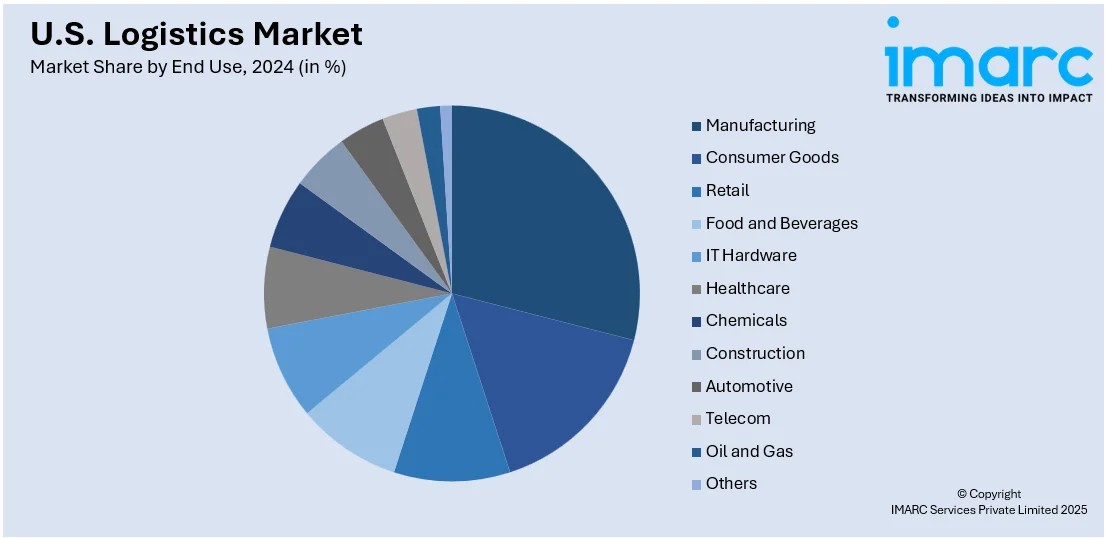

Analysis by End Use :

- Manufacturing

- Consumer Goods

- Retail

- Food and Beverages

- IT Hardware

- Healthcare

- Chemicals

- Construction

- Automotive

- Telecom

- Oil and Gas

- Others

Manufacturing drives the U.S. logistics market as it requires efficient supply chains to transport raw materials and finished goods. The sector relies on robust networks for inbound and outbound logistics, especially in industrial hubs like the Midwest. Advancements in automation and just-in-time production further demand precise logistics solutions. Global trade growth and domestic production increases amplify the need for seamless freight, warehousing, and distribution systems, positioning manufacturing as a dominant contributor to logistics market growth.

Consumer goods dominate the U.S. logistics market due to consistent demand for fast and reliable delivery. The necessity for effective inventory control, real-time tracking, and last-mile delivery has increased due to the growth of e-commerce. Distribution and warehousing facilities are essential to guaranteeing the availability of commonplace items. Investments in cutting-edge logistics technologies are fueled by consumer expectations for speed and convenience as well as seasonal variations in demand, making consumer goods a major factor in market expansion.

Retail significantly influences the U.S. logistics market, driven by the e-commerce boom and omnichannel strategies. Retailers depend on efficient supply chain operations for timely deliveries, inventory optimization, and seamless returns. The shift toward same-day and next-day delivery fuels demand for advanced fulfillment networks. Real-time visibility and sustainability initiatives further shape retail logistics. The sector’s dynamic nature, characterized by high consumer expectations and intense competition, ensures its dominance in driving innovation and growth in logistics operations.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The Northeast's logistics market is driven by dense urban populations and proximity to major ports like New York and Boston, facilitating international trade. High e-commerce demand requires efficient last-mile delivery solutions. Cold chain logistics are crucial due to the region’s strong pharmaceutical and food industries. Advanced infrastructure, such as rail and road networks, supports the seamless movement of goods across densely populated areas, while innovation in warehouse automation caters to the high-volume supply chain demands.

In the Midwest, logistics is fueled by its status as a manufacturing and agricultural hub. The region's central location makes it a strategic distribution point, enabling efficient connectivity to other parts of the country. Key transportation modes include rail and trucking, supported by extensive infrastructure. Warehousing and intermodal logistics thrive due to large industrial zones. Additionally, growing e-commerce demand has led to investments in fulfillment centers and last-mile delivery networks to cater to rising consumer expectations.

The South benefits from its access to major ports like Houston, Miami, and New Orleans, driving global trade and logistics growth. Its growing energy and manufacturing industries require strong supply chain solutions. Urbanization and population expansion raise demand for regional distribution hubs and e-commerce logistics. The region's vast highway networks and developing infrastructure facilitate effective freight transit, while innovations in technology, including automated warehousing, further increase the scalability and efficiency of the logistics industry.

The West's logistics market thrives on the region's role as a gateway for international trade through ports like Los Angeles and Long Beach. Advanced last-mile delivery systems are in high demand due to the widespread use of e-commerce. Automation and artificial intelligence are two innovations in logistics that are fueled by the technology sector. Green logistics strategies, including using electric vehicles, are encouraged by sustainability objectives and environmental legislation. A dynamic logistics ecosystem centered on efficiency and innovation is produced by the region's large terrain and varied industries.

Competitive Landscape:

The U.S. logistics market is highly competitive, with key players including FedEx, UPS, DHL, and XPO Logistics dominating the industry. These companies focus on technology integration, extensive networks, and service diversification to maintain market leadership. Emerging players and specialized firms compete by offering niche services like last-mile delivery or sustainable solutions. E-commerce giants like Amazon further intensify competition with in-house logistics capabilities. The market's competitive landscape is shaped by innovation, operational efficiency, and evolving customer demands. For instance, in August 2024, The Federal Express Corporation introduced a monitoring and intervention solution. FedEx Surround is a product that uses artificial intelligence (AI) and machine learning (ML) to improve customer visibility and control over shipments, hence enhancing supply chain management and logistics.

Latest News and Developments:

- In June 20204, Eco-Energy, LLC and Commtrex announced a collaboration to provide fleet management and outsourced logistics services across North America. Through the combination of two industry leaders' strengths, this partnership will revolutionize train logistics management by utilizing state-of-the-art technology, first-rate customer service, and highly skilled physical logistics skills.

- In June 20204, Allcargo Logistics' fully-owned international subsidiary ECU Worldwide announced its partnership with ShipBob to provide its air and ocean freight services to the latter's fulfillment centers and receiving hubs in the US, Europe, Canada, and Australia. Through its network in more than 180 countries, more than 2,400 direct trade lanes, and door-to-door deliveries, ECU Worldwide will be a key component of FreightBob, ShipBob's end-to-end managed freight and inventory distribution program.

U.S. Logistics Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Model Types Covered | 2 PL, 3 PL, 4 PL |

| Transportation Modes Covered | Roadways, Seaways, Railways, Airways |

| End Uses Covered | Manufacturing, Consumer Goods, Retail, Food and Beverages, IT Hardware, Healthcare, Chemicals, Construction, Automotive, Telecom, Oil and Gas, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the U.S. logistics market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the U.S. logistics market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the U.S. logistics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Logistics is the process of planning, implementing, and managing the efficient flow of goods, services, and information from origin to destination. It involves transportation, warehousing, inventory management, and supply chain coordination to ensure timely delivery, cost-effectiveness, and customer satisfaction. Logistics is crucial for businesses to optimize operations and meet demand.

The U.S. logistics market size is anticipated to reach USD 1,997.6 Billion in 2025.

IMARC estimates the U.S. logistics market to exhibit a CAGR of 8.5% during 2025-2033.

The key factors driving the U.S. logistics market include e-commerce growth, technological advancements like automation and AI, increasing demand for faster delivery, and the expansion of global trade. Additionally, infrastructure development, supply chain optimization, and rising consumer expectations for real-time tracking and sustainability significantly influence the logistics market's growth and evolution.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)