U.S. Logistics Automation Market Size, Share, Trends and Forecast by Component, Function, Enterprise Size, Industry Vertical, and Region, 2025-2033

U.S. Logistics Automation Market Size and Share:

The U.S. logistics automation market size is anticipated to reach USD 19.0 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 38.2 Billion by 2033, exhibiting a CAGR of 9.1% from 2025-2033. The market is witnessing significant growth due to the growing demand for e-commerce fulfillment and advancements in AI and IoT integration. Additionally, the adoption of robotics in warehousing, the growth of autonomous vehicles and drones, and the emphasis on data-driven supply chain optimizations are expanding the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2025 | USD 19.0 Billion |

| Market Forecast in 2033 | USD 38.2 Billion |

| Market Growth Rate (2025-2033) | 9.1% |

The rapid expansion of e-commerce is a primary driver for the U.S. logistics automation market. Consumers are increasingly seeking faster and more reliable delivery options, pushing businesses to adopt automation to meet these expectations. Automated systems, such as robotic sorting and pick-and-place solutions, streamline warehouse operations, improving order accuracy and reducing delivery times. For instance, in 2024, Amazon introduced Sequoia and Digit robots to improve workplace safety, speed up deliveries, and help meet holiday order fulfillment, with Sequoia now operational at a Houston, Texas, fulfillment center. Today, Amazon has more than 75000 robots working alongside its employees. The need to manage high order volumes during peak purchasing periods, such as promotional events and holidays, further underscores the importance of automation. As online retail continues to grow, logistics providers are prioritizing investments in automated technologies to enhance their operational efficiency and maintain a competitive edge in a demanding market.

.webp)

Technological advancements, primarily through artificial intelligence (AI) and the Internet of Things (IoT), have particularly played a significant role in reshaping the logistics automation market in the United States. AI systems assist with predictive analytics, making decisions in inventory management, and in optimizing routes to save more cost and enhance efficiency. IoT devices provide real-time information on shipments, conditions within warehouses, and how the fleet is performing. For example, in 2024, Honeywell launched Battery MXP, an AI-based platform that optimizes gigafactory operations by improving yields, reducing material scrap by 60%, accelerating ramp-ups, and enhancing quality control with actionable insights, meeting the growing demand for lithium-based batteries efficiently. These innovations enable logistics providers to address problems such as delays or equipment malfunctions ahead of time, thus minimizing disruptions. It is integrating AI and IoT to help develop autonomous vehicles and drones. The adoption of automation in the logistics sector is driven by these advancements.

U.S. Logistics Automation Market Trends:

Adoption of Robotics in Warehousing

The use of robotics in warehousing is one of the significant trends in the U.S. logistics automation market. Autonomous mobile robots (AMRs) and collaborative robots (cobots) are increasingly deployed to handle tasks such as picking, packing, and inventory management. By minimizing the need for manual labor, reducing errors, and 24/7 operations support, these systems boost operational efficiency. With the growing demand for quicker order fulfillment, robotics has become a cornerstone of modern logistics, providing scalability and cost-efficiency for businesses across industries. For instance, in 2024, Honeywell partnered with Hai Robotics to integrate flexible ACR solutions with Momentum software, enhancing efficiency in distribution centers. These robots, reaching 32 feet high, achieve 500 pieces/hour throughput versus 100-250 without robotics, optimizing storage.

Growth of Autonomous Vehicles and Drones

The development and deployment of autonomous vehicles and drones have revolutionized the last mile of delivery and long-haul transportation. Testing and implementation of autonomous trucks, which might save fuel consumption, resolve driver shortages, and cut costs of operations, are becoming common. Tesla introduced the Cybercab robotaxi, priced below $30,000, with a planned launch in 2026. Meanwhile, Full Self-Driving technology is set to be added to the Model 3 and Model Y in Texas and California the following year. Simultaneously, drones are becoming popular for the delivery of small packages, mainly in rural or urban areas where congested roads hinder delivery. Progress in regulatory and continuous development in technologies is likely to enhance the uptake of these solutions as the face of logistics shifts.

Emphasis on Data-Driven Supply Chain Optimization

Another important trend in the U.S. logistics automation market is increasing reliance on data analytics and artificial intelligence for optimizing supply chains. For instance, in 2024, Blue Yonder survey revealed over 50% of organizations utilize AI and ML in supply chain planning (56%), transportation management (53%), and order management (50%), enhancing efficiency and decision-making. Advanced algorithms and predictive analytics help businesses predict demand, optimize their levels of inventory, and make better route plans. Greater transparency and responsiveness in supply chains are achieved through real-time tracking by IoT devices. These devices integrate advanced AI capabilities, streamlining processes, and enabling real-time decision-making to support data-driven supply chain optimization and enhance customer experiences. As businesses prioritize customer satisfaction and cost efficiency, data-driven decision-making is becoming integral to logistics operations, fostering innovation and strategic growth in the sector.

U.S. Logistics Automation Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the U.S. logistics automation market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on component, function, enterprise size, and industry vertical.

Analysis by Component:

- Hardware

- Mobile Robots (AGV, AMR)

- Automated Storage and Retrieval Systems (AS/RS)

- Automated Sorting Systems

- De-palletizing/Palletizing Systems

- Conveyor Systems

- Automatic Identification and Data Collection (AIDC)

- Order Picking

- Software

- Warehouse Management Systems (WMS)

- Warehouse Execution Systems (WES)

- Services

- Value Added Services

- Maintenance

The hardware involved consists of mobile robots, including AGV, AMR, AS/RS, automated sorting systems, de-palletizing/palletizing systems, conveyor systems, AIDC, and order picking tools. All of these technologies increase the speed, accuracy, and efficiency of supply chain operations to help meet the rising demand of e-commerce and enhance inventory management and order fulfillment processes.

Warehouse management system (WMS) and warehouse execution systems (WES) are the key software products for United States logistics automation. The primary functions of such solutions include optimization in warehouse operations, where it offers streamlined inventory management, order processing, and resource allocation. Such software thus provides real-time data and predictive analytics, thus supporting efficient decisions, enhancing operational productivity, and supporting the rising demand for accurate and timely logistics services.

Value-added services and maintenance are among the important services in the U.S. logistics automation market. Value-added services, including customization, system integration, and process optimization, help in improving the efficiency of operations. Maintenance helps in making the automated systems last long and ensures reliability. It ensures continuous operation, and minimal downtime, and enables a company to cope with changing demands on its logistics efficiently.

Analysis by Function:

- Warehouse and Storage Management

- Transportation Management

Warehouse and storage management under the function segment is essentially about optimizing the organization of inventory, space utilization, and workflow efficiency in a warehouse. It caters to the United States market for logistics automation by reducing order fulfillment time, decreasing errors, and increasing operational productivity. Advanced technologies include automated storage and retrieval systems (AS/RS) and warehouse management software, allowing for increased scalability and streamlined processes in supply chains.

Transportation management in the function segment holds a significant share mainly focusing on optimizing the movement of goods through route planning, load optimization, and carrier selection. It serves the U.S. logistics automation market by enhancing efficiency, reducing costs, and ensuring timely deliveries. Leveraging advanced software and real-time tracking, it streamlines supply chains and supports growing demands for faster, reliable logistics operations.

Analysis by Enterprise Size:

- Small and Medium-sized Enterprises

- Large Enterprises

Small and medium-sized enterprises are small businesses with growth potential. They cater for the U.S. logistics automation market through affordable, scalable solutions like cloud-based management systems and mobile robotics. Thus, the SMEs can further push the market forward. It can be done through increases in demand for cost-effective automation, improved operational efficiencies, supply chain streamlining, and dynamic growth contribution.

Large enterprises represent large organizations that have very established operations and resources, where such companies have a high investment in sophisticated automation technologies. They serve the US market of logistics automation through the creation of innovation and acceptance of high-scale solutions like robotics, AI, and IoT. These organizations will help make supply chain activities more efficient, increase their scalability, and raise industry standards on automation-driven logistics operations.

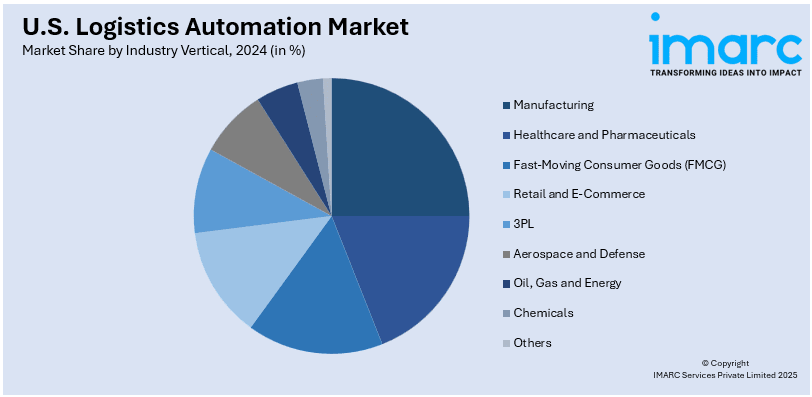

Analysis by Industry Vertical:

- Manufacturing

- Healthcare and Pharmaceuticals

- Fast-Moving Consumer Goods (FMCG)

- Retail and E-Commerce

- 3PL

- Aerospace and Defense

- Oil, Gas and Energy

- Chemicals

- Others

The manufacturing sector in the industry vertical segment holds a significant share mainly focusing on automating production and supply chain processes to enhance efficiency. It serves the U.S. logistics automation market by adopting technologies like automated storage systems, robotics, and real-time tracking. These innovations streamline inventory management, reduce operational costs, and improve delivery timelines, driving overall growth in logistics automation.

The healthcare and pharmaceuticals sector in the industry vertical segment accounts for a substantial share due to leveraging logistics automation to ensure efficient supply chain operations for critical products. It serves the U.S. logistics automation market by adopting solutions like temperature-controlled storage, automated tracking, and robotic handling systems, enhancing product safety, regulatory compliance, and timely delivery of medical supplies and pharmaceuticals.

The fast-moving consumer goods (FMCG) sector in the industry vertical segment holds a significant share by relying on logistics automation to streamline supply chain processes and meet high demand. It serves the U.S. logistics automation market by adopting solutions like automated sorting, inventory management, and real-time tracking, ensuring efficient distribution, reduced lead times, and enhanced customer satisfaction in a competitive market.

The retail and e-commerce sector in the industry vertical segment drives the U.S. logistics automation market by adopting advanced technologies such as automated sorting, order fulfillment systems, and real-time inventory tracking. These solutions enable faster deliveries, improved accuracy, and scalability, addressing rising consumer expectations and supporting the high demand for seamless and efficient supply chain operations.

The third-party logistics (3PL) sector in the industry vertical segment also holds a substantial share mainly focusing on outsourcing logistics services to optimize supply chain operations. It serves the U.S. logistics automation market by implementing advanced technologies like automated warehousing, route optimization, and real-time tracking. These innovations enhance efficiency, reduce costs, and enable businesses to meet growing demand for streamlined logistics solutions.

The aerospace and defense sector in the industry vertical segment accounts for a significant share due to leveraging logistics automation to streamline the transportation and storage of high-value, precision components. It serves the U.S. logistics automation market by adopting advanced systems like automated inventory management, secure tracking, and robotics, ensuring operational efficiency, regulatory compliance, and timely delivery in a highly specialized and critical industry.

The oil, gas, and energy sector in the industry vertical segment holds a substantial share as it utilizes logitics automation to optimize the transportation and storage of critical resources and equipment. It serves the U.S. logistics automation market by adopting advanced systems such as real-time tracking, automated inventory management, and robotics, enhancing supply chain efficiency, safety, and reliability in this resource-intensive industry.

The chemicals sector in the industry vertical segment holds a significant share of the market as it relies on logistics automation to manage the safe and efficient transportation of hazardous and non-hazardous materials. It serves the U.S. logistics automation market by adopting technologies such as automated tracking, inventory systems, and specialized storage solutions, ensuring compliance with safety regulations while enhancing operational efficiency and supply chain reliability.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The Northeast region supports the U.S. logistics automation market due to its high population centers, strong transportation infrastructure, and proximity to major ports. It pushes demand for automated solutions in warehousing, distribution, and last-mile delivery in order to satisfy the high e-commerce activity and industrial needs of the region, enhancing supply chain efficiency and scalability in a competitive market environment.

The Midwest will be a key support structure for the U.S. logistics automation market, given its strategic location as a transportation hub linking major industrial and agricultural regions. Its extensive network of railways, highways, and warehouses fosters demand for automated solutions in supply chain operations, thus making it possible to manage efficient inventory, streamlined distribution, and improved scalability for manufacturers and retailers across the region.

The U.S. logistics automation market is driven by the South with its ever-growing industrial base, the boom of e-commerce, and easy proximity to major ports. Strong transportation infrastructure in the region and the rising need for warehousing facilities drive the demand for advanced automation technologies for efficient supply chain operation, enhanced inventory management, and timely distribution to support a dynamic and rapidly growing economy.

The West supports the U.S. logistics automation market through its technological innovation hubs, thriving e-commerce sector, and strategic access to Pacific trade routes. The region's advanced infrastructure and high demand for efficient supply chain solutions drive the adoption of automation technologies, enabling streamlined warehousing, optimized transportation, and faster delivery operations in a competitive market landscape.

Competitive Landscape:

The U.S. logistics automation market is highly competitive, with key players, besides emerging innovators. Companies are making use of advanced technologies like robotics, artificial intelligence, and IoT to streamline supply chain operations. Strategic collaborations and investments in research and development are driving innovation in autonomous systems and sustainable solutions. With increasing demand in e-commerce and the necessity for efficiency in operations, competition is heating up, creating a dynamic atmosphere of technological progress and service differentiation. For example, in 2024, Honeywell invested in Near Earth Autonomy, where it collaborated on the USMC Aerial Logistics Connector program to demonstrate uncrewed rotorcraft logistics using Leonardo's AW139 helicopter in contested environments under a Naval Aviation Systems Consortium agreement.

The report provides a comprehensive analysis of the competitive landscape in the U.S. logistics automation market with detailed profiles of all major companies.

Latest News and Developments:

- In 2024, Zebra Technologies introduced enterprise mobile computing and intelligent automation solutions aimed at enhancing supply chain agility and workforce connectivity. These innovations highlight Zebra's commitment to driving supply chain resilience and digital transformation.

U.S. Logistics Automation Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Functions Covered | Warehouse and Storage Management, Transportation Management |

| Enterprise Sizes Covered | Small and Medium-sized Enterprises, Large Enterprises |

| Industry Verticals Covered | Manufacturing, Healthcare and Pharmaceuticals, Fast-Moving Consumer Goods (FMCG), Retail and E-Commerce, 3PL, Aerospace and Defense, Oil, Gas and Energy, Chemicals, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the U.S. logistics automation market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the U.S. logistics automation market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the U.S. logistics automation industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Logistics automation involves using advanced technologies, such as robotics, artificial intelligence, and software systems, to streamline supply chain operations. It enhances efficiency by automating processes like inventory management, order fulfillment, and transportation, reducing errors, improving speed, and optimizing resource use in warehouses, distribution centers, and delivery networks.

The U.S. logistics automation market size is anticipated to reach USD 19.0 Billion in 2025.

IMARC estimates the U.S. logistics automation market to exhibit a CAGR of 9.1% during 2025-2033.

The U.S. logistics automation market is driven by rising e-commerce demand, increasing consumer expectations for faster deliveries, and the need for efficient handling of high order volumes. Adoption of robotic technologies, artificial intelligence, and data-driven systems enhances operational efficiency, accuracy, and scalability, making automation essential for competitive supply chain management.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)