United States Location Analytics Market Size, Share, Trends and Forecast by Component, Deployment Mode, Location Type, Application, End Use Industry, and Region, 2025-2033

United States Location Analytics Market Size and Share:

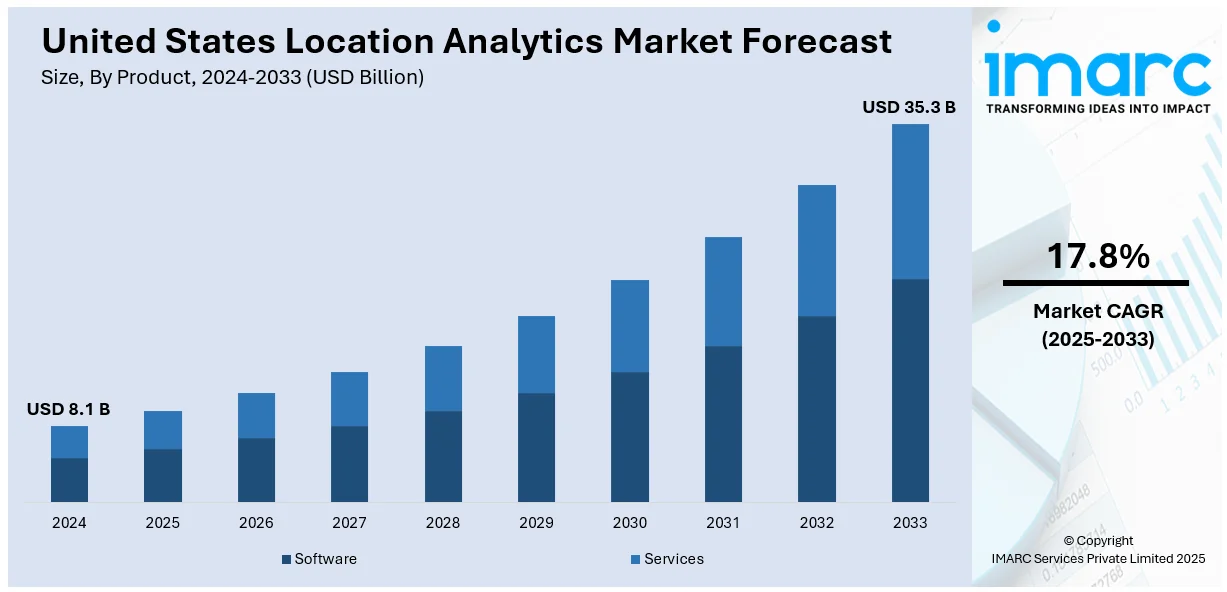

The United States location analytics market size was valued at USD 8.1 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 35.3 Billion by 2033, exhibiting a CAGR of 17.8% from 2025-2033. The increasing adoption of advanced technologies, such as AI, big data, and cloud computing, that enhance the accuracy and efficiency of location-based analysis is significantly driving the growth of the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 8.1 Billion |

| Market Forecast in 2033 | USD 35.3 Billion |

| Market Growth Rate (2025-2033) | 17.8% |

A high demand for real-time data-driven insights continues across a wide range of industry sectors, including retail, transportation, healthcare, and urban planning, driving ongoing expansion in the market. In addition, growing trends in optimizing supply chains and improving customer experience along with supporting smart city initiatives push the adoption of location analytics. The need for efficient decision-making, improving service operations, and offering a personalized experience remains one of the key drivers of adopting location-based solutions.

The increasing integration of Internet of Things (IoT) devices in various industries is providing an impetus to the location analytics market growth. Moreover, the need for businesses to obtain a competitive edge through consumer behavior analytics significantly drives market growth. Apart from this, an increase in remote working conditions necessitates better location tracking systems, advancing the market growth further. Some of the other factors contributing to the market growth include the emergence of smart cities, the need for enhanced public safety measures, increasing utilization in the retail industry for personalized customer experiences, and robust investment in research and development yielding more efficient analytics solutions.

United States Location Analytics Market Trends:

Growing Adoption of AI and Machine Learning in Location Analytics

Integration of AI and ML in location analytics is changing the market dynamics. AI algorithms are used for processing large datasets, predicting customer behavior, optimizing supply chains, and improving decisions in retail, logistics, and healthcare industries. Companies such as Walmart and Amazon use AI-based location analytics to optimize inventory management, customer targeting, and store placement, enhancing operational efficiency and customer experience.

Increasing Use of Location-Based Services in Retail and Marketing

Many retailers and marketers use location analytics to understand consumer behavior, build personalized experiences, and fine-tune their targeted marketing approach. Companies analyze data from mobile devices, GPS, and IoT sensors to customize promotions, track foot traffic, and optimize store layouts. For example, Starbucks and Target send personalized offers based on distance to stores in order to improve sales conversion rates and customer engagement.

Expansion of Location Analytics in Smart Cities and Urban Planning

With the growing smart cities and emphasis on urban planning and development, location analytics is being applied to improve infrastructure, public services, and sustainability. Governments and urban planners monitor traffic, manage utilities, and optimize public transportation systems using location-based data. Cities such as San Francisco and New York are leveraging location analytics to address their urban mobility challenges, eliminate congestion, and reduce the time taken to respond to emergencies, making cities better to live.

United States Location Analytics Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States location analytics market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on component, deployment mode, location type, application, and end use industry.

Analysis by Product:

- Software

- Services

Growth is seen in the software segment as there is a surging demand for data visualization and real-time analytics. The use of location-based data for making informed decisions among companies has increased the demand for specialist software solutions. Additionally, it makes complex data sets understandable and accessible to businesses of every scale. The increasing relevance of geospatial data in sectors such as retail, healthcare, and logistics also fuels the growth of this segment.

The growing need for analytics skills and the increased usage of cloud-based solutions drive the services segment. Companies are outsourcing tasks such as data analysis, maintenance, and training. This is very important to small and medium enterprises because they do not have in-house capabilities for the execution of complex analytics. This also means that businesses will require specialized services as analytics technology continues to evolve to meet industry standards.

Analysis by Deployment Mode:

- On-premises

- Cloud-based

Businesses are leveraging cloud-based location analytics to facilitate remote working conditions and to better align with digital transformation strategies. The ability to integrate with other cloud services and platforms is driving the segment growth.

Data security, regulatory compliance, and need for customized solutions are driving the on-premises segment growth. Companies that deal with sensitive information or fall under the category of highly regulated industries prefer on-premises solutions. This offers them control over their data and, accordingly, provides them with customized options. In-house analytics solutions come across as more secure as well as compliant with extremely stringent regulations..

Analysis by Location Type:

- Indoor

- Outdoor

This outdoor segment is driven by increasing mobile devices and IoT use. With this, businesses capture tons of data that can range from traffic patterns to the behavior of consumers in an outdoor environment. Location analytics is increasingly becoming a requirement in urban planning and public safety service optimization. Tourism and hospitality industries also play a huge role by using outdoor analytics to enrich visitor experiences. The growth of this segment is further enhanced by commercial applications, such as targeted advertisements based on location.

The indoor segment is driven by the expansion of indoor location-based services like in-store navigation, asset tracking, and proximity marketing. The growth is also influenced by the adoption of technologies like Bluetooth, Wi-Fi, and RFID for precise indoor positioning. The retail, healthcare, and logistics sectors find such services indispensable in enhancing the overall user experience and improving business efficiency. Indoor malls, airports, and other giant public facilities are increasingly applying these technologies to streamline operations while creating a better experience for customers.

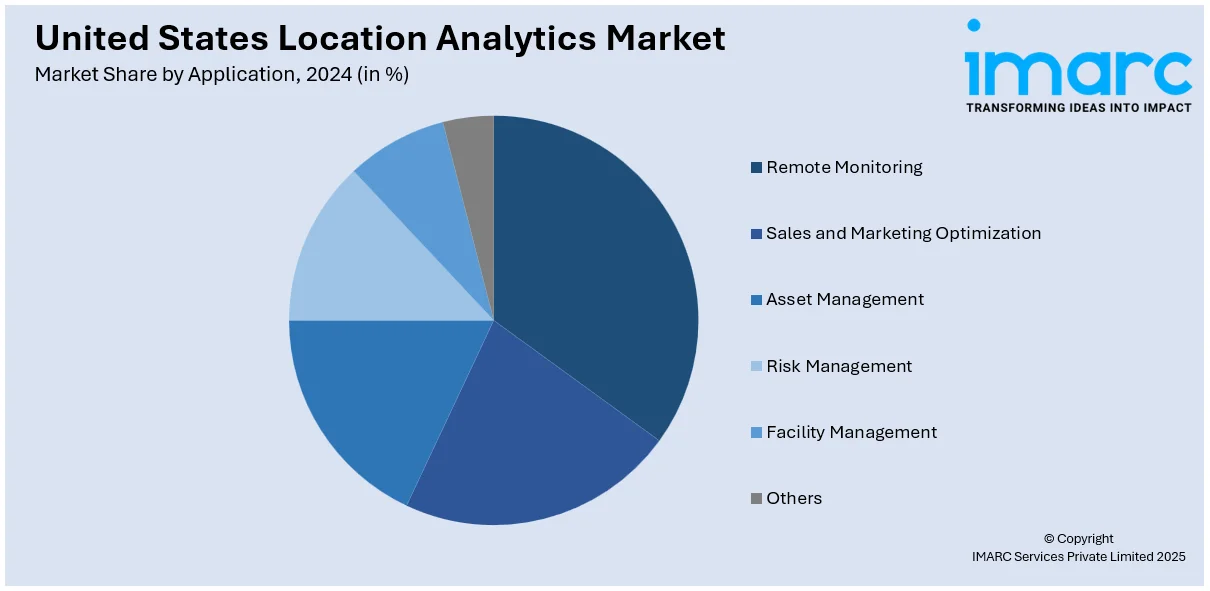

Analysis by Application:

- Remote Monitoring

- Sales and Marketing Optimization

- Asset Management

- Risk Management

- Facility Management

- Others

The increase in demand for real-time data analytics, the growth of connected devices, and the advancements in IoT technologies are some of the factors driving the growth of the remote monitoring segment. The need for enhanced operational efficiency and preventive maintenance has led businesses to opt for remote monitoring solutions. Heightened security concerns also contribute to this trend, as businesses seek to monitor assets and operations 24/7. The rise in smart cities and smart infrastructure further fuels the adoption of remote monitoring.

On the other hand, the demand for insights into consumer behavior, real-time analytics, and competitive intelligence is driving the sales and marketing optimization segment. The usage of location analytics in this area assists organizations in customer segmentation, targeted advertising, and location-based promotions.

Analysis by End Use Industry:

- BFSI

- Healthcare

- Hospitality

- Government

- Transportation and Logistics

- IT and Telecom

- Retail and Consumer Goods

- Media and Entertainment

- Others

In the retail and consumer goods sector, location analytics help the understanding of the behavior and preferences of consumers, which subsequently leads to retailers optimizing the layouts of stores, managing inventory levels, and making improvements to supply chains. Geo-fencing and proximity marketing make use of location analytics for targeting customers through promotions. These technologies help customers engage and have resulted in higher volumes of sales. The integration of online and offline data is another driver that provides a more holistic view of the consumer journey.

The market is witnessing significant growth in various segments such as BFSI, healthcare, hospitality, government, transport and logistics, IT and telecom, and media and entertainment. One of the major drivers for this growth is the increasing need for real-time data analytics to improve efficiency in operations and customer experience. For example, in BFSI, location analytics is used to detect fraud by analyzing the locations of transactions while in healthcare, it is used for resource allocation and patient care. The advent of cutting-edge technologies like the Internet of Things, Big Data, and artificial intelligence has bolstered the demand enabling businesses to use spatial as well as geographic data on a variety of applications.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The Northeast location analytics market growth is supported by technological advancements in the fields of data analytics, artificial intelligence, and machine learning. The region is experiencing high concentrations of tech companies, academic institutions, and healthcare facilities, hence capitalizing on the availability of location data to maximize urban planning, transportation systems, and customer experiences. Key sectors like finance, healthcare, and retail are increasingly adopting location analytics to enhance operational efficiency, improve decision-making, and gain insights into consumer behavior.

The market in the Midwest is growing steadily, with the region's manufacturing, agriculture, and logistics sectors driving the growth. Companies in states like Illinois, Michigan, and Ohio are using location-based data to optimize supply chains, improve fleet management, and enhance logistics efficiency. Cost-effective and practical applications of location analytics contribute to the increasing adoption of this technology in the Midwest, especially in industries that rely on spatial data for decision-making. In addition, the smart city initiatives and integration of location analytics into infrastructure planning are shaping the future market trends in this region.

The South region is experiencing rapid demand for location analytics solutions. Cities such as Atlanta, Miami, and Houston are leading the way in applying location-based insights across various industries. The region is experiencing a high demand for location analytics in real estate, healthcare, retail, and transportation sectors, where businesses are leveraging spatial data to enhance customer targeting, optimize routes, and improve site selection. The South's burgeoning tech ecosystem, favorable business conditions, and strong focus on smart city development are driving the adoption of location analytics tools.

The West, specifically California, is at the forefront of technological innovation. The region leads in integrating leading-edge technologies, including artificial intelligence, big data, and cloud computing. Location analytics is increasingly being applied in industries such as e-commerce, entertainment, transportation, and real estate in cities like San Francisco, Los Angeles, and Seattle to enhance operational efficiency and customer engagement. The region's tech-driven environment fosters innovation, and the demand for real-time location data is growing, especially with the rise of autonomous vehicles, IoT, and smart city initiatives.

Competitive Landscape:

Key players in the market are significantly investing in research and development in order to develop cutting-edge solutions. The market leaders are also forming strategic alliances and partnerships in order to expand their product offerings as well as their geographical reach. Mergers and acquisitions are adopted in order to consolidate market positions and acquire new technologies. In order to ensure scalability and performance, companies are embracing cloud-based solutions and integrating them with existing enterprise systems. Further, they are working on enhancing data security measures to comply with regulatory standards. To build a sustainable market presence, the key players are actively engaging with customers through robust after-sales support and training programs. Businesses are also providing free trials and proofs of concept to potential clients, thereby reducing the adoption barriers.

The report provides a comprehensive analysis of the competitive landscape in the United States location analytics market with detailed profiles of all major companies.

Latest News and Developments:

- March 2024: dunnhumby announced a strategic partnership with Placer.ai, enabling retailers to unlock online-offline customer insights and create unique customer propositions. Drawing together location data, the science of behavior, and dunnhumby know-how in retail consulting will ensure this strategic collaboration provides retailers and consumer packaged goods companies with market superiority and agility in competitive environments. The partnership will introduce a new range of connected insights from dunnhumby, powered by Placer.ai’s suite of location data.

United States Location Analytics Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Software, Services |

| Deployment Modes Covered | On-premises, Cloud-based |

| Location Types Covered | Indoor, Outdoor |

| Applications Covered | Remote Monitoring, Sales and Marketing Optimization, Asset Management, Risk Management, Facility Management, Others |

| End Use Industries Covered | BFSI, Healthcare, Hospitality, Government, Transport and Logistic, IT and Telecom, Retail and Consumer Goods, Media and Entertainment, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States location analytics market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the United States location analytics market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States location analytics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Location analytics is the process of using geographic data and spatial analysis to gain insights and make data-driven decisions. It involves collecting, analyzing, and visualizing data related to the physical location of people, assets, or events. By leveraging tools like geographic information systems (GIS), GPS, and mapping software, location analytics helps businesses optimize operations, improve customer experiences, and make more informed decisions.

The United States location analytics market was valued at USD 8.1 Billion in 2024.

IMARC estimates the United States location analytics market to exhibit a CAGR of 17.8% from 2025-2033.

The key factors driving the United States location analytics market include the growing adoption of advanced technologies like artificial intelligence, big data, and cloud computing, which enhance the accuracy and efficiency of spatial analysis. Additionally, increasing demand for location-based insights across industries such as retail, healthcare, logistics, and urban planning is fueling market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)