U.S. LED Lighting Market Size, Share, Trends and Forecast by Application, and Region, 2026-2034

U.S. LED Lighting Market Size and Share:

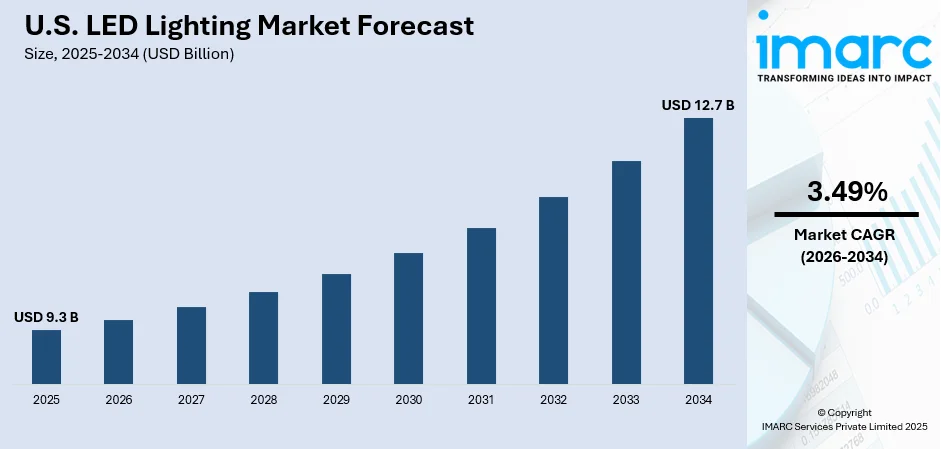

The U.S. LED lighting market size was valued at USD 9.3 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 12.7 Billion by 2034, exhibiting a CAGR of 3.49% from 2026-2034. The market is growing due to energy efficiency, government incentives and advancements in technology. The widespread product adoption in residential, commercial, and industrial sectors, along with declining prices and longer lifespan of LEDs further boost the demand. Rising environmental awareness and the shift toward sustainable lighting solutions also contribute to market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 9.3 Billion |

| Market Forecast in 2034 | USD 12.7 Billion |

| Market Growth Rate (2026-2034) | 3.49% |

Access the full market insights report Request Sample

The U.S. LED lighting market is primarily driven by the significant energy efficiency that LEDs offer as compared to traditional lighting solutions. Businesses and homeowners are increasingly adopting LED technology to reduce energy consumption and lower utility bills. According to an article published by the United States Department of Energy, switching to energy-efficient LED lighting can reduce electricity use in homes by 15% saving the average household about $225 annually. LEDs consume up to 90% less energy and last 25 times longer than incandescent bulbs. Additionally, government incentives and rebates aimed at promoting energy-efficient products have accelerated the adoption across residential, commercial, and industrial sectors. The decreasing cost of LED products combined with their longer lifespan makes them an economically attractive option for a wide range of applications.

To get more information on this market Request Sample

Technological advancements also play a crucial role in driving the LED lighting market forward. Innovations in LED design and manufacturing have led to improved brightness, color quality and versatility making LEDs suitable for various environments and purposes. For instance, in November 2024, Lightpanel launched a new LED strip for light guide panels achieving a remarkable 215 lumens per watt surpassing the industry standard by 30%. This innovation enhances brightness and energy efficiency making it ideal for various applications while promoting sustainability and reducing operational costs. Furthermore, growing environmental awareness and the global push toward sustainability have heightened the demand for eco-friendly lighting solutions. The shift toward smart lighting systems, which integrate with IoT devices for enhanced control and automation also contributes to the expanding LED market in the United States.

U.S. LED Lighting Market Trends:

Increasing Energy Efficiency

Increasing energy efficiency and cost savings are major drivers in the adoption of LED lighting across the United States. As businesses, governments and consumers become more conscious of their energy consumption LEDs offer a compelling alternative to traditional lighting due to their significantly lower energy usage. For instance, in December 2023, a University of Michigan study reveals that switching from fluorescent lamps to LED lighting can improve energy efficiency by 18%-44%. LEDs offer cost savings, longer lifespan, and better dimming performance. This efficiency translates to reduced electricity bills and operational costs over time. Additionally, LEDs have a longer lifespan, minimizing maintenance and replacement expenses. The cumulative financial benefits make LEDs an attractive investment for sectors, such as commercial, industrial, and residential. Enhanced energy efficiency not only supports sustainability goals but also provides economic incentives accelerating the widespread adoption of LED technology.

Government Regulations and Incentives

Government regulations and incentives play a pivotal role in promoting LED lighting adoption in the United States. Federal initiatives such as energy efficiency standards set by the Department of Energy (DoE) mandate the phase-out of less efficient lighting technologies encouraging businesses and consumers to switch to LEDs. For instance, in April 2024, the United States Department of Energy finalized new energy efficiency standards for general service lamps set to take effect in July 2028. The updated rules aim to save American households $1.6 billion annually promote LED adoption and substantially reduce greenhouse gas (GHG) emissions supporting the Biden-Harris administration's energy efficiency initiatives. Additionally, federal tax credits and rebates help reduce the initial cost of LED installations making them more financially attractive. At the state level numerous programs offer further incentives including grants, rebates, and property tax exemptions for energy efficient upgrades. These combined efforts not only lower the barriers to LED adoption but also support national sustainability and energy conservation goals driving widespread market growth.

Expansion in Automotive and Outdoor Lighting

The expansion of LED lighting into automotive and outdoor sectors significantly broadens the United States LED market. In the automotive industry LEDs are increasingly used for headlights, taillights, and interior lighting due to their superior brightness, energy efficiency and longer lifespan compared to traditional bulbs. This enhances vehicle safety, aesthetics and reduces energy consumption. For outdoor applications LEDs are favored for street lighting, signage, and architectural lighting because of their durability, weather resistance and lower maintenance costs. In line with this, in September 2024, ORACLE Lighting acquired Trigger Control System, enhancing its LED solutions portfolio. This strategic move aims to accelerate growth and diversify offerings. Trigger specializes in wireless control systems for vehicle lighting known for its reliability and innovation. The partnership strengthens ORACLE's commitment to quality and advanced automotive lighting solutions. Additionally, the adoption of smart LED systems for adaptive and connected outdoor lighting solutions supports urban development and infrastructure modernization. This growth in automotive and outdoor uses drives the overall market expansion and innovation in LED technologies.

U.S. LED Lighting Industry Segmentation:

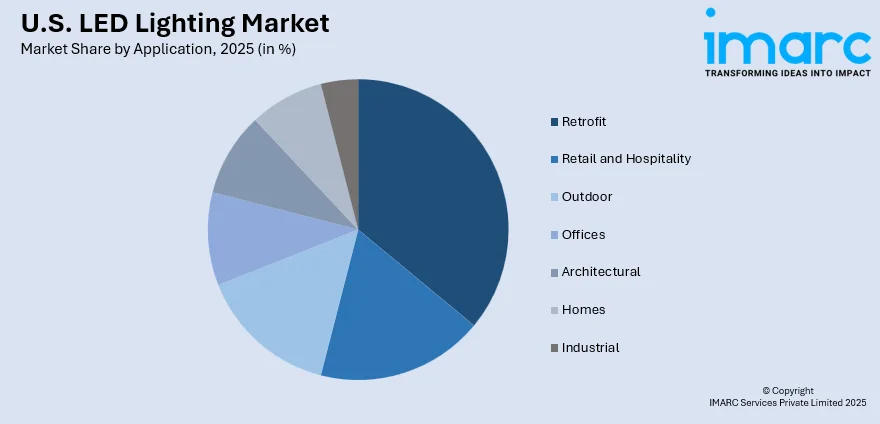

IMARC Group provides an analysis of the key trends in each segment of the U.S. LED lighting market, along with forecasts at the regional and country levels from 2026-2034. The market has been categorized based on application.

Analysis by Application:

To get detailed segment analysis of this market Request Sample

- Retrofit

- Retail and Hospitality

- Outdoor

- Offices

- Architectural

- Homes

- Industrial

The retrofit segment involves upgrading existing lighting systems to LED technology offering significant energy savings and improved performance. Businesses and homeowners opt for LED retrofits to reduce energy consumption, lower maintenance costs and enhance lighting quality. Government incentives and rebates further drive adoption by offsetting initial investment costs. Retrofit projects are prevalent in commercial buildings, warehouses and public infrastructure facilitating a seamless transition from traditional lighting to more efficient LED solutions while supporting sustainability goals.

In the retail and hospitality sectors LED lighting enhances the customer experience through vibrant and customizable lighting solutions. Retailers use LEDs to highlight products to create appealing store atmospheres and improve energy efficiency. Hotels, restaurants and resorts implement LED lighting to achieve aesthetic appeal, reduce operational costs and ensure consistent lighting quality. Smart LED systems enable dynamic lighting control allowing for mood adjustments and energy management. The combination of functionality and design flexibility makes LEDs a preferred choice for enhancing visual appeal and operational efficiency in these industries.

LED lighting in outdoor applications includes street lighting, signage, landscape lighting and sports facilities. LEDs offer superior brightness, energy efficiency and longevity making them ideal for public infrastructure and safety lighting. Enhanced durability and weather resistance ensure reliable performance in various environmental conditions. Smart LED systems enable adaptive lighting control, improving energy management and reducing light pollution. The adoption of LED outdoor lighting supports urban modernization enhances public safety and contributes to sustainable energy practices driving significant growth in this segment.

In office environments LED lighting provides optimal illumination for productivity and comfort. LEDs offer customizable lighting solutions that reduce eye strain and improve overall workplace ambiance. Energy-efficient LEDs lower operational costs and support corporate sustainability initiatives. Advanced features like dimming, color temperature control and smart lighting systems enable personalized lighting settings enhancing employee well-being and efficiency. The shift towards LED lighting in offices aligns with modern workplace trends promoting a healthier and more productive work environment while reducing energy consumption.

Architectural LED lighting highlights building features, enhances aesthetics and improves energy efficiency in both interior and exterior applications. Architects and designers use LEDs to create dynamic lighting effects, emphasize structural elements and achieve creative lighting designs. LEDs offer flexibility in color and intensity allowing for innovative and sustainable architectural lighting solutions. The long lifespan and low maintenance requirements of LEDs make them ideal for large-scale projects including commercial buildings, landmarks and residential complexes. This segment benefits from the blend of functionality and artistic expression that LED technology provides.

In residential settings LED lighting offers energy-efficient, versatile and cost-effective solutions for various household needs. Homeowners adopt LEDs for general lighting, accent lighting and smart home integration enhancing both functionality and ambiance. LEDs provide a wide range of color temperatures and brightness levels, allowing for personalized lighting designs. The long lifespan and low energy consumption of LEDs reduce replacement and electricity costs. Additionally, smart LED systems enable remote control and automation contributing to convenience and energy management in modern homes driving widespread residential adoption.

The industrial segment utilizes LED lighting for warehouses, manufacturing facilities and distribution centers due to its high efficiency and durability. LEDs provide superior illumination enhancing visibility and safety in large industrial spaces. Energy savings from LED adoption significantly reduce operational costs while the long lifespan minimizes maintenance efforts and downtime. LEDs’ robust performance in harsh environment including resistance to vibrations and extreme temperatures makes them ideal for industrial applications. Advanced lighting controls and smart LED systems further optimize energy usage and operational efficiency supporting the growth of the industrial LED market.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The Northeast region encompassing states like New York, Massachusetts and Pennsylvania leads in LED adoption driven by stringent energy regulations and progressive sustainability initiatives. High urbanization and significant commercial and industrial activities boost demand for energy-efficient lighting solutions. Government incentives and rebates further encourage businesses and homeowners to transition to LEDs. Additionally, the presence of advanced infrastructure and smart city projects in cities like Boston and New York enhances the integration of smart LED technologies fostering market growth in this region.

The Midwest including states such as Illinois, Ohio and Michigan experiences steady growth in the LED lighting market fueled by industrial expansion and infrastructure modernization. The region’s strong manufacturing base adopts LEDs for energy efficiency and operational cost reduction. Government programs promoting energy conservation and sustainability initiatives support LED adoption in residential and commercial sectors. Additionally, increasing investments in smart lighting and outdoor applications such as street lighting and signage contribute to the Midwest’s expanding LED market landscape.

The South region covering states like Texas, Florida and Georgia showcases rapid growth in the LED lighting market driven by extensive construction and urban development. The warm climate and large geographical area increase demand for outdoor and industrial LED applications including street lighting, signage and manufacturing facilities. Favorable government policies, incentives and a focus on energy efficiency bolster LED adoption among businesses and homeowners. Additionally, the region’s burgeoning hospitality and retail sectors leverage LEDs to enhance aesthetics and reduce energy costs further propelling market expansion.

The West including states such as California, Washington and Arizona is a key driver in the LED lighting market due to its emphasis on innovation and sustainability. California’s strict energy codes and environmental regulations promote widespread LED adoption across residential, commercial and industrial sectors. The presence of leading technology companies fosters advancements in smart and connected LED solutions. Additionally, the region’s focus on green building practices and renewable energy integration supports the growth of energy-efficient LED lighting. High consumer awareness and progressive policies make the West a dynamic and expanding market for LED technologies.

Competitive Landscape:

The U.S. LED lighting market is characterized by intense competition among numerous manufacturers and suppliers striving to capture market share. Companies differentiate themselves through continuous innovation offering advanced features such as smart connectivity and energy-efficient technologies. Competitive pricing strategies are employed to attract a diverse range of customers from residential to industrial sectors. Strong distribution networks and strategic partnerships and acquisitions enhance market reach and accessibility. For instance, in June 2024, Schréder announced the acquisition of Ligman Lighting USA, a prominent urban lighting solutions provider in North America. This strategic move enhances Schréder's portfolio and accelerates growth in the region. Additionally, firms focus on sustainable and eco-friendly product offerings to meet growing environmental demands. This highly competitive landscape drives rapid technological advancements and a wide variety of product options fostering a dynamic and evolving market environment.

The report provides a comprehensive analysis of the competitive landscape in the U.S. LED lighting market with detailed profiles of all major companies.

Latest News and Developments:

- In May 2024, Lumileds announced its agreement to sell its Lamps and Accessories business to First Brands Group for $238 million allowing it to focus on LED and MicroLED innovations.

- In May 2024, CLEANLIFE® acquired ATX LED Consultants enhancing its LED technology portfolio. ATX LED specializes in low voltage lighting solutions. The partnership aims to innovate energy-efficient and eco-friendly lighting transforming the residential market and aligning with CLEANLIFE®'s mission of "Finding a Better Way®."

U.S. LED Lighting Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Retrofit, Retail and Hospitality, Outdoor, Offices, Architectural, Homes, Industrial |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the U.S. LED lighting market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the U.S. LED lighting market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the U.S. LED lighting industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

LED lighting refers to Light Emitting Diode technology that provides energy-efficient illumination for various applications, including residential, commercial, industrial, automotive, and outdoor settings. LEDs offer long lifespans, low energy consumption, and versatile design options, making them a preferred choice for sustainable lighting solutions.

The U.S. LED lighting market was valued at USD 9.3 Billion in 2025.

IMARC estimates the U.S. LED lighting market to exhibit a CAGR of 3.49% during 2026-2034.

Key factors driving the U.S. LED lighting market include enhanced energy efficiency and cost savings, government regulations and incentives, technological advancements in smart and connected lighting, increasing adoption across residential, commercial, and industrial sectors, declining LED prices, longer product lifespans, and rising environmental awareness promoting sustainable lighting solutions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)