United States Industrial Lubricants Market Size, Share, Trends and Forecast by Product Type, Base Oil, End Use Industry, and Region, 2025-2033

United States Industrial Lubricants Market Size and Share:

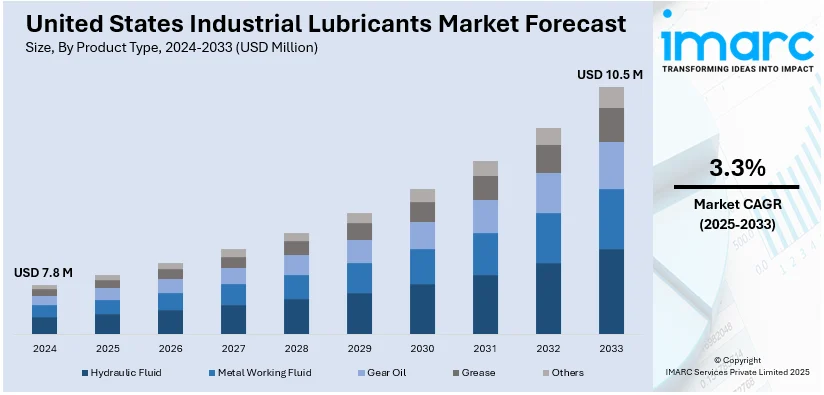

The United States industrial lubricants market size was valued at USD 7.8 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 10.5 Million by 2033, exhibiting a CAGR of 3.3% from 2025-2033. The market in the United States is primarily driven by technological advancements in the management of lubricants, concern for environmental-friendly alternatives, increasing application of specialty formulations, strategic partnerships within the industry, significant investments in infrastructure, improvements in manufacturing processes, efforts toward the optimization of machinery, and the widespread adoption of data-driven maintenance solutions across sectors.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 7.8 Million |

| Market Forecast in 2033 | USD 10.5 Million |

| Market Growth Rate (2025-2033) | 3.3% |

The market in the United States is majorly driven by the rapid manufacturing sector expansions, as industries need to use more high-performance lubricants that improve equipment efficiency and shorten operation downtime. Increasingly growing automotive and aerospace industries further require precise, high-quality lubrication that further promotes growth within this market. For instance, on November 25, 2024, S&P Global Mobility reported a 6% year-over-year increase in U.S. light vehicle sales for November at around 1.31 million units. The increasing sales in the automotive industry mirrors the increased demand for highly specialized lubricants that can pass stringent performance criteria.

The increasing investments in infrastructure development and construction projects are significantly driving the demand for lubricants in heavy machinery and equipment. For example, the U.S. Department of Transportation announced more than USD 4.2 Billion in funding through the Bipartisan Infrastructure Law on October 21, 2024. These funds will support 44 nationwide projects that include bridge constructions, port expansions, and interchange redesigns to enhance safety, mobility, and economic growth. Furthermore, the proliferation of industrial maintenance programs aiming at prolonging machinery life and minimizing costs also fuels the market. Additionally, the development of innovative distribution channels, such as online platforms, ensures broader accessibility and convenience, supporting market expansion.

United States Industrial Lubricants Market Trends:

Rising Demand for Specialty Lubricants

The market in the United States is experiencing a growing preference for specialty lubricants tailored for specific applications, with strong demand from industries such as pharmaceuticals, food processing, and electronics. These sectors need lubricants that adhere to strict safety, performance, and regulatory standards, ensuring excellent resistance to extreme temperatures, heavy loads, and chemical exposure. This trend is further propelled by strategic collaborations, such as Kano Laboratories, located in Nashville, Tennessee, acquiring Synco Chemical Corporation, also based in the U.S., on January 22, 2024. The acquisition includes Synco's Super Lube line of high-quality synthetic, food-grade lubricants, which aims to enhance product offerings, especially in industrial and food-grade lubrication solutions. The partnerships are offering comprehensive, customized solutions to meet changing customer demands. As manufacturing processes evolve, the need for these specialized lubricants is growing, driven by their capacity to improve productivity, minimize equipment wear, and comply with industry-specific regulations.

Adoption of Bio-based Lubricants

The growing use of bio-based lubricants in the United States is enhancing demand in the market, mainly due to increasing environmental consciousness and favourable policies. These bio-based lubricants are prepared from renewable resources and, therefore, reduce dependence on fossil fuels while offering lesser toxicity and greater biodegradability. Many industries are shifting towards these eco-friendly options as a part of their commitment to corporate social responsibility as well as to comply with stricter regulations. For instance, on September 10, 2024, Chevron launched Clarity Bio EliteSyn AW, a high-performance hydraulic fluid that meets the most stringent environmental requirements while offering superior performance. This biodegradable fluid has more than 90% renewable carbon and possesses a TOST life of more than 10,000 hours, which means it is very long-lasting and offers efficiency in operation. Additionally, it provides excellent seal compatibility, making it easy to integrate into existing systems. Moreover, favourable government incentives and advancements in cost-effective production are further propelling the growth of the bio-based lubricants market across various industries.

Continual Technological Advancements in Lubricant Management

Internet of things (IoT) and predictive analytics are transforming the market in the United States by enabling data-driven maintenance practices. Sensors and connected devices are continuously monitoring the performance of lubricants in real-time, providing information on viscosity, contamination levels, and operating conditions. These predictively analyse maintenance requirements, optimal usage of lubricants, and avert equipment failures in an attempt to minimize downtime and decrease operational costs. In the case of high-value machinery, this advancement contributes significantly to innovation and to transforming lubricant management strategies. Continual advancements in lubricant management, driven by IoT and predictive analytics, also facilitate proactive decision-making by offering deep insights into the health of machinery. These technologies allow for the automation of lubrication processes, ensuring that the right type and amount of lubricant is applied at optimal intervals, reducing waste and environmental impact.

United States Industrial Lubricants Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States industrial lubricants market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on product type, base oil, and end use industry.

Analysis by Product Type:

- Hydraulic Fluid

- Metal Working Fluid

- Gear Oil

- Grease

- Others

Hydraulic fluids have one of the largest applications in the United States industrial lubricants market. This is because of high machinery demand that requires absolute control and efficient power delivery. The manufacturing, construction, and agriculture industries rely on hydraulics for their function and longevity. These enhance the performance of machines since they reduce wear and keep the machine running under varied temperatures and pressures, thus making them pivotal for industrial processes.

Metalworking fluids are applied to shape, cut, and finish metal parts that must be precise and accurate for applications in the automotive, aerospace, and heavy machinery industries. These fluids provide cooling and lubrication during the machining process, which reduces friction and heat. This reduces tool wear, increasing tool life and subsequently productivity. In the U.S. industrial lubricants market, these fluids are valued for their role in enhancing operational efficiency and cutting costs in demanding manufacturing environments.

Gear oil is used in industrial equipment, specifically in gear systems. Its primary function is to perform under high pressure with minimum friction, thus adding up to the lifetime of the heavy-duty machines. Therefore, the gear oil in the industrial lubricants market in the United States has emerged as an essential component due to its need for uninterrupted working, especially in mines, manufacturing plants, and energy companies.

Analysis by Base Oil:

- Mineral Oil

- Synthetic Oil

- Bio-based Oil

Mineral oil is the primary choice in the United States industrial lubricants market due to its low cost and easy availability. It is sourced from crude oil and commonly utilized in various applications that require basic lubrication, such as hydraulic systems, gearboxes, and general machinery. Its adaptability and affordability make it a favored option for industries looking for dependable performance under typical operating conditions, ensuring its continued significance in the market.

Synthetic oil plays a key role in the U.S. industrial lubricants market, providing exceptional performance in challenging conditions. Its specially engineered formulation offers outstanding thermal stability, resistance to oxidation, and a longer service life. Sectors such as aerospace, automotive, and manufacturing prefer synthetic oils for critical applications that demand higher efficiency and reliability. The benefits of reduced maintenance and enhanced equipment performance validate their essential role in industrial operations.

Bio-based oils are increasingly popular in the U.S. industrial lubricants market due to the rising environmental awareness and regulatory demands. They are made from renewable resources and provide eco-friendly lubrication options while helping to lower carbon emissions. Their biodegradability and lower toxicity make them suitable for applications in environmentally sensitive areas. Industries seeking to meet sustainability objectives are progressively adopting bio-based oils, underscoring their growing significance in the future of industrial lubrication.

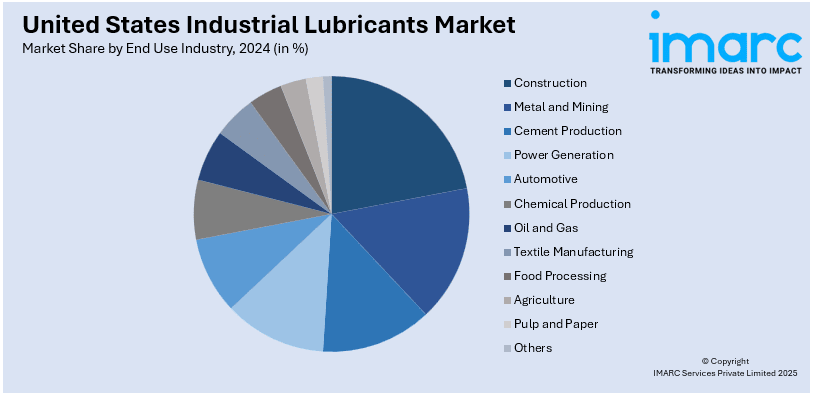

Analysis by End Use Industry:

- Construction

- Metal and Mining

- Cement Production

- Power Generation

- Automotive

- Chemical Production

- Oil and Gas

- Textile Manufacturing

- Food Processing

- Agriculture

- Pulp and Paper

- Others

The construction industry is one of the major areas in the U.S. industrial lubricants market mainly because of the dependency of the industry on machinery, including excavators, loaders, and cranes. Lubricants are of great importance in ensuring efficient running of the equipment, especially in harsh weather conditions; they reduce friction and increase the period between failures. The need for dependable lubrication solutions is increasing, hence highlighting the industry's vital role in the expansion of the industrial lubricant market.

The metal and mining industry, having a tough operational environment, contributes much to the U.S. industrial lubricants market. High pressure and extreme conditions have to be encountered in extraction and processing by the heavy-duty machinery used. Industrial lubricants improve the efficiency of equipment, an aspect vital for keeping productivity high. Increasing demand for strong lubrication solutions underlines the central position that the sector occupies in terms of driving innovation and sales within the lubricant industry.

Cement production is an essential part of the U.S. industrial lubricants market, as it heavily relies on lubrication for smooth and efficient operations. Equipment like kilns, crushers, and conveyors require high-performance lubricants to withstand heat, dust, and extended use. By ensuring the reliability of machinery and lowering maintenance costs, industrial lubricants are vital for supporting cement manufacturers, making this sector a major contributor to the demand for lubricants.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The Northeast region is vital to the United States industrial lubricants market due to its dense concentration of manufacturing industries and urban infrastructure projects. Heavy machinery in sectors like construction and transportation depends on advanced lubricants for optimal performance. The area's industrial growth and the push for sustainable solutions ensure a steady demand for lubricants, making it a key player in the market.

The Midwest serves as an essential hub for the United States industrial lubricants market, bolstered by its strong agricultural, automotive manufacturing, and heavy machinery sectors. Industrial lubricants are crucial for maintaining efficient equipment operation in challenging weather and demanding conditions. The commitment to industrial innovation and energy-efficient machinery is leading to consistent demand, enhancing the region's role in the lubricant market.

The South stands out as a major force in the United States industrial lubricants market, driven by its flourishing oil and gas, manufacturing, and transportation industries. The region's solid industrial foundation and expanding infrastructure projects create a strong need for high-performance lubricants. Furthermore, the South's favorable business environment and investments in industrial growth contribute to a steady demand for lubrication solutions, ensuring its significant presence in the market.

The West region plays a key role in the United States industrial lubricants market, fueled by its technology-focused industries, renewable energy initiatives, and construction activities. The diverse industrial requirements, including high-tech manufacturing and heavy-duty machinery, generate a dynamic demand for advanced lubricants. The region is at the forefront of adopting eco-friendly lubrication solutions as sustainability becomes increasingly important, highlighting its significance in shaping future market trends.

Competitive Landscape:

The competitive landscape of the United States industrial lubricants market is characterized by intense competition among established manufacturers and emerging players. Companies focus on innovation to develop high-performance and eco-friendly lubricants tailored to diverse industries, including manufacturing, construction, and mining. The competitive landscape is further driven by continual technological advancements, regional expansion, and partnerships to strengthen distribution networks. For instance, On January 25, 2024, BASF Corporation, headquartered in New Jersey, and The Lubrizol Corporation, based in Wickliffe, Ohio, entered a licensing agreement, enabling Lubrizol to produce and distribute specific industrial lubricant products. Strategic collaborations like this aim to meet specific customer requirements, which is influencing the market landscape positively.

The report provides a comprehensive analysis of the competitive landscape in the United States industrial lubricants market with detailed profiles of all major companies.

Latest News and Developments:

- October 1, 2024: U.S. Lubricants, part of U.S. Venture, Inc., purchased a warehouse facility operated by Jones Oil in Virginia. This strategic move further solidifies United States industrial lubricants distribution capabilities in the Mid-Atlantic region, as it supplements its existing blending facility in Baltimore, Maryland, which was acquired from BP in 2020. The Richmond facility provides over 200,000 gallons of bulk capacity underlining the company's high commitment to quality products and services delivery to its customers and partners.

- April 11, 2024; Castrol launched the 'Castrol MoreCircular,' a new program it has collaborated with Safety-Kleen, the environmental services subsidiary of Clean Harbors Inc. The initiative is a collaborative effort to reduce the carbon footprint of industrial lubricants in the United States. This is achieved by collecting used oil from customers, re-refining it, and integrating the re-refined base oil into premium industrial lubricants. The program was formally launched on May 20, 2024, at the Advanced Clean Transportation Expo in Las Vegas, Nevada.

United States Industrial Lubricants Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Hydraulic Fluid, Metal Working Fluid, Gear Oil, Grease, Others |

| Base Oils Covered | Mineral Oil, Synthetic Oil, Bio-based Oil |

| End Use Industries Covered | Construction, Metal and Mining, Cement Production, Power Generation, Automotive, Chemical Production, Oil and Gas, Textile Manufacturing, Food Processing, Agriculture, Pulp and Paper, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States industrial lubricants market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the United States industrial lubricants market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States industrial lubricants industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Industrial lubricants in the United States are specialized oils, greases, and fluids designed to reduce friction, wear, and heat in machinery across sectors like manufacturing, construction, and mining. They enhance equipment efficiency and longevity, supporting applications in hydraulics, gear systems, and compressors.

The United States industrial lubricants market was valued at USD 7.8 Million in 2024.

IMARC estimates the United States industrial lubricants market to exhibit a CAGR of 3.3% during 2025-2033.

The key factors driving the United States industrial lubricants market include continual technological advancements, increasing demand for eco-friendly lubricants, regional expansions, and strategic partnerships, such as licensing agreements, to enhance product distribution and meet regulatory sustainability requirements.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)