United States Identity Verification Market Size, Share, Trends and Forecast by Type, Component, Deployment Mode, Organization Size, Vertical, and Region, 2025-2033

United States Identity Verification Market Size and Share:

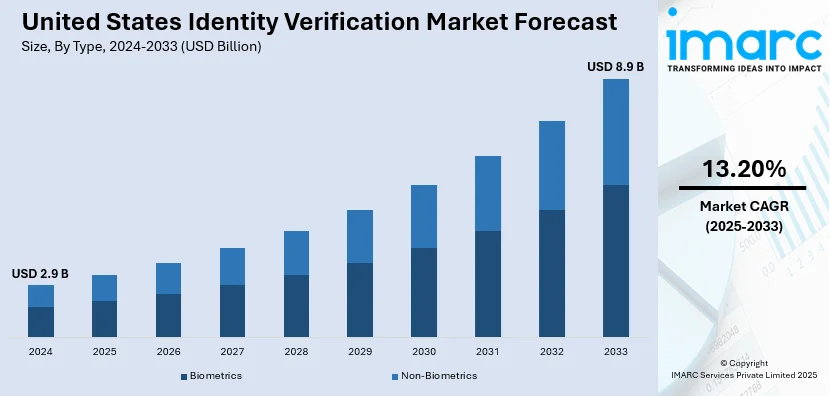

The United States identity verification market size was valued at USD 2.9 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 8.9 Billion by 2033, exhibiting a CAGR of 13.20% from 2025-2033. Factors such as the growing adoption of advanced technologies, increasing demand for secure digital transactions, rising regulatory compliances, and surging identity theft concerns are impelling the market growth in this region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.9 Billion |

| Market Forecast in 2033 | USD 8.9 Billion |

| Market Growth Rate (2025-2033) | 13.20% |

The United States identity verification (IDV) market is witnessing robust growth driven by the rising need for highly protected online transactions. In line with this, emerging trends such as the increased incidence of online fraud and identity theft are compelling businesses to adopt more secure technologies. Moreover, regulations such as Know Your Customer (KYC) and Anti-Money Laundering (AML) are impacting financial institutions to keep stringent verification processes, driving the market demand for IDV. For instance, for every $1 loss in online fraud, the firms in the financial services sector of the U.S. lose $4 as a penalty. This is urging the financial organizations, and the government banking companies to integrate authentic verification processes across the region, fueling the market demand. Apart from this, the growing e-commerce and digital banking sector is implementing the use of real-time IDV solutions, guaranteeing positive user experiences, thus supporting the market growth.

Concurrent with this, ongoing technological advancements such as artificial intelligence (AI), machine learning (ML), and biometrics have emerged as solutions, serving IDV processes, with enhanced methods than the previous ones. For example, the automation check rate is 98% and this takes the customers to the desired section in 6 seconds. The implementation of these innovations is improving the customer authentication processes, offering superior accuracy and better user experience, contributing to the market expansion. In addition, improved decentralization of remote work has increased the need for strong identification methods to safeguard access to corporate networks and resources, boosting the market demand. Besides this, the increasing importance of personal data protection is allowing businesses to switch to more efficient verifying processes, thereby aiding the market growth.

United States Identity Verification Market Trends:

The growing use of biometric verification:

The growing use of biometric verifications, such as fingerprints, facial recognition, and voice identification are acting as significant growth-inducing factors. For instance, 75% of the total travelers preferred biometrics over traditional passports and boarding passes in 2023. These methods offer greater security and a seamless user experience for the user by utilizing distinctive physiological properties, thus aiding the market growth. Additionally, several industries like finance, healthcare, and retail businesses are employing the use of biometric systems to minimize fraud and simplify the client identification process, driving the market forward.

Integration of AI and ML:

AI and ML offer accurate results, making IDV more effective as it permits the recognition of frauds instantly. In addition to this, ML technologies work with large amounts of data to search for discrepancies, validate the consumers’ identities, and estimate risks effectively as compared to conventional approaches. For example, in 2024, the U.S. Department of Treasury Office of Payment Integrity used AI and ML to shield more than USD 4 Billion of fraudulent and improper payments. Moreover, the integration of these innovations in cases such as synthetic ID fraud and improving industry changes to meet varying regulatory requirements is fueling the market growth. This shift towards the implementation of AI and ML is establishing a new baseline for scalability and dependability throughout the region, bolstering the market growth.

Increasing adoption of remote work and digital services

The rising adoption of work from home (WFH) and digital service delivery is driving the market demand for IDV services in the U.S. In confluence with this, corporations are focusing on strong access control for employees who are working from home, and service providers in sectors such as telemedicine and distance learning, boosting the market expansion. According to the U.S. Bureau of Labor Statistics report, approximately 35 percent of employed individuals worked at home most of the time as compared to when they worked in 2023. Besides this, innovations like document verification and multi-factor authentication solutions are providing an impetus to the market as they address the security issues in the decentralized platforms.

United States Identity Verification Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States identity verification market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on type, component, deployment mode, organization size, and vertical.

Analysis by Type:

- Biometrics

- Non-Biometrics

Biometric solutions are driving market demand due to their accuracy and high-level security, making them essential in areas such as banking and law enforcement. Moreover, technologies like facial recognition, fingerprint scanning, and iris detection help reduce fraud by ensuring secure and specific access to information, boosting the market growth. Additionally, their growing use in financial sectors, healthcare, and government institutions for reliable identification is significantly contributing to the market expansion.

Furthermore, non-biometric solutions are widely adopted in sectors like retail and e-commerce due to their lower implementation costs, reliance on knowledge-based authentication, and document verification. These solutions are ideal for low-risk environments and regions where advanced technologies are not feasible. Besides this, the growing adoption of digital onboarding processes is promoting their expansion, playing a vital role and propelling the market forward.

Analysis by Component:

- Solutions

- Services

IDV solutions are necessary for streamlining compliances and increasing the productivity of the information technology (IT) industry. Besides this, document authentication, database search, and digital ID solutions are surging driven by the increasing prevalence of ID and financial fraud, and emerging regulatory requirements. Apart from this, organizations utilize these solutions for enriching user confidence, improving on-ramp experience, and meeting the KYC and AML requirements for continued growth, which is driving the market forward.

Concurrently, verification services are being adopted through consulting and support services, as the existing tools are increasingly utilized across various industries that are embracing automation for multiple business aspects. These services allow organizations to implement processes in case of operational issues, aiding the market growth. Moreover, the rise in demand for managed services that address the surging need for identification, and authentication are supporting the market expansion.

Analysis by Deployment Mode:

- On-premises

- Cloud-based

On-premises deployment model is preferred by companies to have specific control over data and infrastructure, thus fueling the market demand. Furthermore, industries such as financial, healthcare, and government departments, that work with highly sensitive information, are implementing these advanced services. They are essential for compliance with strict regulative requirements, and secure data protection, which is propelling the market forward.

Cloud-based deployment is boosting market demand due to its ability to operate seamlessly on large-scale platforms and reduce service costs. It also supports remote work, offering quick, secure implementation and updates, making it highly beneficial for businesses undergoing digital transformation. Moreover, the growing reliance on cloud-based operations in e-commerce and WFH environments is further driving the market growth.

Analysis by Organization Size:

- Small and Medium-sized Enterprises

- Large Enterprises

Several small and medium enterprises (SMEs) are integrating these flexible approaches to IDV of onboarding clients and mitigate risk, to build the customers’ trust. Apart from this, with the utilization of affordable cloud-based solutions that are scalable to their needs, these businesses are engaging in effective processes of fully digitizing onboarding and aligning with the necessary compliance to relevant industries, thereby supporting the market growth.

Meanwhile, large enterprises require reliable solutions that can handle a large number of transactions, adhering to several formal rules. In conjunction with this, these organizations are utilizing technologies such as AI to meet their requirements for enhanced security, and efficiency by regulating the emerging standards and legal requirements of the jurisdictions, which is providing an impetus to the market.

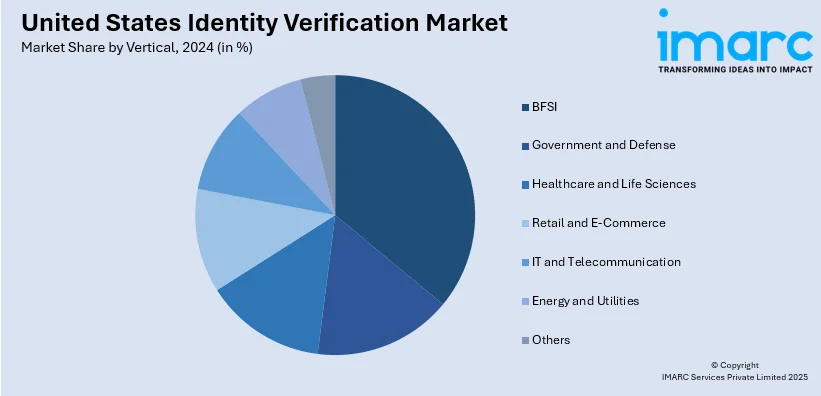

Analysis by Vertical:

- BFSI

- Government and Defense

- Healthcare and Life Sciences

- Retail and E-Commerce

- IT and Telecommunication

- Energy and Utilities

- Others

Banking, financial services, and Insurance (BFSI) institutions often have to verify identities to make certain that ongoing transactions are safe and legal. This is increasing emphasis on incidents of fraud, compliance, and secure digital operations, fueling the market demand. Furthermore, an increase in demand for safe IDV is creating high-growth biometric and non-biometric solutions, thus aiding in the market expansion.

Additionally, accurate identification in the government and defense sectors is critical for applications such as delivering secure citizen services and safeguarding national security. Furthermore, ID assurance in these areas prevents unauthorized access to facilities, systems, and sensitive information, reducing the risk of data breaches and impelling the market demand.

Concurrent with this, the healthcare and life sciences sector use IDV to protect the data of the patient and prevent fraud in telehealth services. Besides this, the rising adoption enhances technologies to increase digital health services and manage patients remotely, is fueling the market demand.

IDV in the e-commerce and retail businesses is integrated to combat fraud. Besides this, they establish the security and secrecy of payments and increase the trust of the customer at the time of sign-up, and when checking out on web-based stores, which is boosting their market demand.

Furthermore, the demand for IDV in the IT and telecommunication industry is rising as it is vital for the protection of networks with access to critical information, along with establishing legitimate interaction in cyberspace. This makes it easy for newly hired workers and employees to gain access to their organization by working remotely and through digital communication applications, supporting the market growth.

Besides this, the energy and utilities sector is utilizing IDV process to ensure zero fraudulent activities in billing, providing security to access infrastructures. This sector further enforces IDV to protect assets, and users, and to address regulatory standards on the provision of utility services and energy networks, which is impelling the market forward.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The Northeast region has several financial institutions and numerous regulatory centers, which drive the demand for advanced IDV solutions. Moreover, the specific standards in compliance for banking, insurance, and fintech, along with the region’s concern with the security of digitalization, advanced technologies for the prevention of risk, and improvement of the customer identification process, are aiding in the market expansion.

Additionally, manufacturing and logistic industries in the Midwest are fueling the demand for IDV services to protect the supply chain and operations. Furthermore, the need for reliable verification systems suitable for industries and the region is growing due to rising investments in smart technologies and automation in the automotive industry and agriculture, which is supporting the market growth.

The rapidly expanding e-commerce industry and tech startups in the South are driving the need for efficient and cost-effective ID verification solutions. Furthermore, rising concerns over customer data security and fraud prevention are encouraging the adoption of technologies like multi-factor authentication and real-time document verification in digital retail and payment systems, further fueling market demand.

The ongoing technological advancement in the West is also bolstering the demand for advanced IDV platforms. Apart from this, the region is fortifying the use of blockchain and AI in security, fueling a solid growth in the demand for IDV solutions in different industries.

Competitive Landscape:

The competitive landscape in the United States IDV market is shaped by established providers and innovative startups. Industry leaders are focusing on advanced technologies like AI, ML, and biometrics to enhance their offerings, driving the market growth. Meanwhile, startups are introducing flexible, cloud-ready solutions optimized for specialized applications, including gig economy platforms and telehealth, aiding in the market expansion. Furthermore, collaborations with government agencies to enhance compliance with AML and KYC regulations are boosting the competitiveness of ID management programs. Additionally, the competition is intensifying as providers are prioritizing personalized solutions, technology breakthroughs, and measures to address emerging ID fraud risks, propelling the market growth.

The report provides a comprehensive analysis of the competitive landscape in the United States identity verification market with detailed profiles of all major companies.

Latest News and Developments:

- In December 2024, AuthenticID announced its partnership with Credivera to blend its identity verification and biometric authentication system into Credivera’s app for fast and secure workforce verifications.

United States Identity Verification Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Biometrics, Non-Biometrics |

| Components Covered | Solutions, Services |

| Deployment Modes Covered | On-premises, Cloud-based |

| Organization Sizes Covered | Small and Medium-sized Enterprises, Large Enterprises |

| Verticals Covered | BFSI, Government and Defense, Healthcare and Life Sciences, Retail and E-Commerce, IT and Telecommunication, Energy and Utilities, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States identity verification market from 2019-2033

- The research study provides the latest information on the market drivers, challenges, and opportunities in the United States identity verification market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States identity verification industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Identity verification (IDV) refers to the validation of an individual’s identity with the help of biometrics, documents, or database search. It helps to achieve secure access to systems, helps to follow the regulations, and identifies frauds.

The United States identity verification market was valued at USD 2.9 Billion in 2024.

IMARC estimates the United States identity verification market to exhibit a CAGR of 13.20% during 2025-2033.

The factors impacting the United States identity verification market include the rising digital fraud, implementing requirements for compliance, the development of biometric and AI technologies, and the development of working remotely.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)