United States E-Bike Market Size, Share, Trends and Forecast by Mode, Motor Type, Battery Type, Class, Design, Application, and Region, 2026-2034

United States E-Bike Market Size, Share & Analysis:

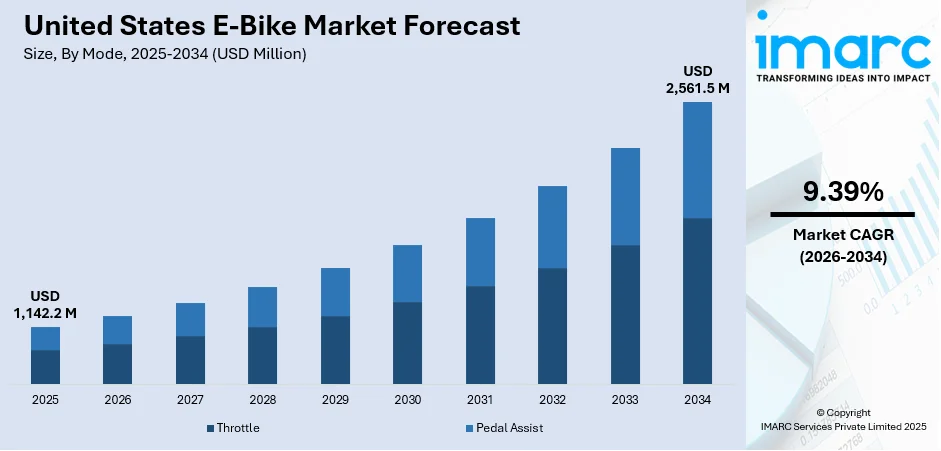

The United States e-bike market size was valued at USD 1,142.2 Million in 2025. Looking forward, IMARC Group estimates the market to reach USD 2,561.5 Million by 2034, exhibiting a CAGR of 9.39% from 2026-2034. Shifting user preferences from gasoline-powered cars to zero-emission vehicles are fueling the market growth. Besides this, the increasing government support to promote e-bike adoption, coupled with the rising cost of fuel incentives with lower operating costs, are contributing to the expansion of the United States e-bike market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034 |

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 1,142.2 Million |

|

Market Forecast in 2034

|

USD 2,561.5 Million |

| Market Growth Rate 2026-2034 | 9.39% |

Access the full market insights report Request Sample

United States E-Bike Market Analysis:

- Growth Drivers: Eco-conscious lifestyles, traffic congestion solutions, rising gas prices, government support, and technological innovations in motors and batteries are driving interest and adoption of e-bikes across urban and suburban communities.

- Market Key Trends: Consumers prefer versatile models like folding and cargo e-bikes. Smart features, improved battery designs, and sleek aesthetics are trending. Demand is rising in both commuting and recreational segments nationwide.

- Market Opportunities: Expanding urban mobility solutions, bike-sharing systems, last-mile delivery services, and partnerships with tourism or fitness sectors open doors for new business models, retail innovation, and customer engagement platforms.

- Market Challenges: Limited cycling infrastructure, inconsistent regulations, safety concerns, and high initial costs remain hurdles. Consumer education, battery safety, and supply chain issues also challenge consistent United States e-bike market demands.

To get more information on this market Request Sample

At present, rising concerns about the environment and the need to reduce carbon emissions are encouraging people in the United States to adopt greener transportation options like e-bikes. High fuel prices are making electric bikes a more affordable and practical choice for daily commuting. High urbanization and increasing traffic congestion are leading city dwellers to seek faster and more efficient ways to move around, and e-bikes offer a perfect solution. Additionally, supportive policies are promoting the use of electric vehicles (EVs), which is propelling the United States e-bike market growth. Innovations in battery technology and motor efficiency are improving e-bike performance, range, and charging times, attracting more users.

Apart from this, the growing popularity of last-mile logistics services is driving the demand for low-cost delivery methods like e-bikes. Younger generations prefer sustainable and tech-friendly transportation, while older populations enjoy the ease and comfort that e-bikes provide. Expanding cycling infrastructure, such as bike lanes and parking spaces, is also making e-bike traveling safer and more appealing. Increasing influencer marketing efforts and the availability of diverse models for different lifestyles, ranging from mountain biking to city commuting, are impelling the market growth. The broadening of e-commerce portals in the country is making purchase of e-bikes more convenient, thereby reaching a wider audience. As per the IMARC Group, the United States e-commerce market size is anticipated to show a growth rate (CAGR) of 6.46% during 2025-2033.

United States E-Bike Market Trends:

Rising Environmental Consciousness

The growing environmental consciousness among people in the United States is positively influencing the market. As individuals are becoming more aware about the detrimental effects of traditional fuel-based vehicles on the environment, there is a rising demand for sustainable transportation alternatives. As per industry reports, in 2022, passenger vehicles in the United States generated the equivalent of 370 Million Metric Tons of carbon dioxide. This indicated a rise of 1.3% compared to 2021 and a 43% increase relative to 1990 levels. An average passenger car released approximately 4.6 Metric Tons of carbon dioxide annually. Furthermore, the government authorities of the US are also taking initiatives to promote the adoption of e-bikes, which is propelling the market growth. For instance, in September 2023, Joe Biden’s legislation provided a USD 4.1 Billion investment in the development of e-bikes, offering a reimbursement of 30% of the price, up to a maximum of USD 900. In addition to this, local initiatives, such as New York’s low-cost E-bike Loan NYC initiative, are encouraging the employment of e-bikes.

Advancements in E-Bike Technology

Advancements in technology are offering a favorable United States e-bike market outlook. These innovations have improved the performance, efficiency, and overall user experience of e-bikes, making them more appealing to a wider user base. Besides this, the integration of smart features and connectivity options is a notable advancement. E-bikes come equipped with features, such as integrated displays, global positioning system (GPS) navigation, smartphone connectivity, and app-controlled settings. Additionally, various key market players are investing in launching enhanced e-bikes. For instance, in October 2023, Kawasaki, the prominent Japanese motorcycle manufacturer, unveiled the Kawasaki Ninja e-1 and Z e-1 electric bikes in the US. The models had earlier appeared in certification documents, revealing some details. Both models were equivalent to 150cc gasoline-oriented motorbikes, having similar designs to the Ninja 400 and Z400 ICE motorbikes.

Increasing Fuel Costs

High levels of urbanization are stimulating the United States e-bike market growth. As per the estimates by Worldometers, in 2025, 82.76% of the population of the United States is anticipated to live in urban areas, equating to 287,421,363 individuals. Countries with high population densities, such as the US, need an effective transportation system. E-bikes enable riders to maneuver through traffic effortlessly, frequently using shortcuts that cars cannot access and removing the necessity for lengthy parking searches. In addition, rising gasoline prices, traffic jams during peak hours, and the health benefits of exercise are promoting the utilization of e-bikes across the United States. Gas prices in the US keep increasing, a trend that is expected to persist through the summer. As of March 2024, the national average gas price reached USD 3.53 per gallon, USD 0.26 higher than February 2024, according to AAA data. The surging prices of fuel are impelling the United States e-bike market growth.

United States E-Bike Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States e-bike market, along with forecast at country and regional levels from 2026-2034. The market has been categorized based on mode, motor type, battery type, class, design, and application.

Analysis by Mode:

- Throttle

- Pedal Assist

Throttle offers easy and effortless riding, making it highly attractive to a wide range of users. With throttle e-bikes, riders can control the bike’s speed by simply twisting or pressing a throttle without the need to pedal, providing convenience, especially for beginners, older adults, and those with physical limitations. This mode allows users to travel longer distances without getting tired, making it ideal for commuting, errands, and leisurely rides. In busy cities, throttle e-bikes help riders navigate traffic smoothly without excessive effort. Many people prefer the instant power and speed control that throttle e-bikes offer, especially when starting from a full stop or climbing hills. The simple operation of throttle models also appeals to delivery workers and recreational riders who need quick and reliable transportation. As comfort, convenience, and accessibility are becoming important, the demand for throttle e-bikes continues to grow and strengthen their market leadership.

Analysis by Motor Type:

- Hub Motor

- Mid Drive

- Others

Hub motors offer a simple, cost-effective, and reliable solution for riders. They are placed directly in the wheel hub, making them easy to install and maintain. Many people prefer hub motor e-bikes because they provide smooth and consistent power without affecting the bike’s gears or pedaling system. Hub motors also tend to be more affordable than mid-drive motors, making e-bikes accessible to a larger group of people. Their design reduces wear and tear on the bike’s chain and drivetrain, lowering maintenance needs and costs. Riders enjoy the quiet operation and steady performance that hub motors deliver, whether for commuting, recreation, or deliveries. In urban areas, hub motor e-bikes assist riders in traveling comfortably across flat roads and moderate slopes. As individuals are looking for low-maintenance e-bikes at reasonable prices, the popularity of hub motor models continues to rise and dominate the U.S. e-bike market.

Analysis by Battery Type:

- Lead Acid

- Lithium Ion

- Nickel-Metal Hydride (NiMH)

- Others

Lithium ion batteries provide a significant energy density, long lifespan, and lightweight performance. Riders prefer lithium-ion batteries because they allow e-bikes to travel longer distances on a single charge without adding much weight. They charge faster than older technologies like lead-acid batteries, making them more convenient for daily use. Lithium-ion batteries also support a greater number of charge cycles, which means users can enjoy reliable performance for several years. Their compact size helps manufacturers design sleek and modern e-bikes that appeal to both commuters and recreational users. Safety features built into lithium-ion batteries, such as protection against overheating and overcharging, further boost user confidence. As technology is advancing, the cost of lithium-ion batteries continues to drop, making high-quality e-bikes more affordable. Lithium-ion batteries, with their strong combination of efficiency, durability, and convenience, remain the preferred choice, driving their dominance in the market. The lithium-ion battery market revenue in the United States was valued at USD 11.2 Billion in 2023. It is set to attain USD 35 Billion by 2028 according to the United States e-bike market forecast.

Analysis by Class:

- Class I

- Class II

- Class III

Based on the United States e-bike market analysis, the class I e-bikes offer a perfect balance of ease, safety, and accessibility. They provide pedal-assist support up to 20 Miles per hour without a throttle, making them simple to operate for a wide range of riders. Class I e-bikes are allowed on most bike paths, trails, and city lanes, which increases their appeal to commuters, fitness enthusiasts, and casual riders. Since they do not rely on a throttle, they encourage light pedaling, supporting users who want some physical activity while still enjoying motor assistance. Many cities and states create favorable regulations for Class I e-bikes, promoting their use in both urban and recreational spaces. Manufacturers are focusing heavily on this category, offering a wide range of models with varying features and designs. The combination of legal flexibility, user-friendly operation, and health benefits helps Class I e-bikes maintain their leading position in the market.

Analysis by Design:

- Foldable

- Non-Foldable

Foldable e-bikes are gaining popularity in the United States because they offer high convenience and portability. Riders easily fold and carry these bikes onto public transportation, into offices, or store them in small apartments. Urban commuters especially prefer foldable models because they save space and simplify daily travel. Foldable e-bikes often come with lightweight frames and quick-fold mechanisms, making them ideal for people who need flexible travel options. As cities are becoming more crowded, the demand for foldable e-bikes continues to grow. Their practical design supports easy and efficient commuting across short and medium distances.

Non-foldable e-bikes hold significance since they offer stronger frames, better stability, and a smoother riding experience. They are popular among riders who prioritize comfort, long-distance travel, and better motor performance. Non-foldable e-bikes often support larger batteries, allowing extended range and more powerful rides. Many recreational riders, delivery workers, and long-distance commuters prefer non-foldable designs for their reliability and durability. Their sturdy build makes them ideal for diverse terrains, including hills and rough roads.

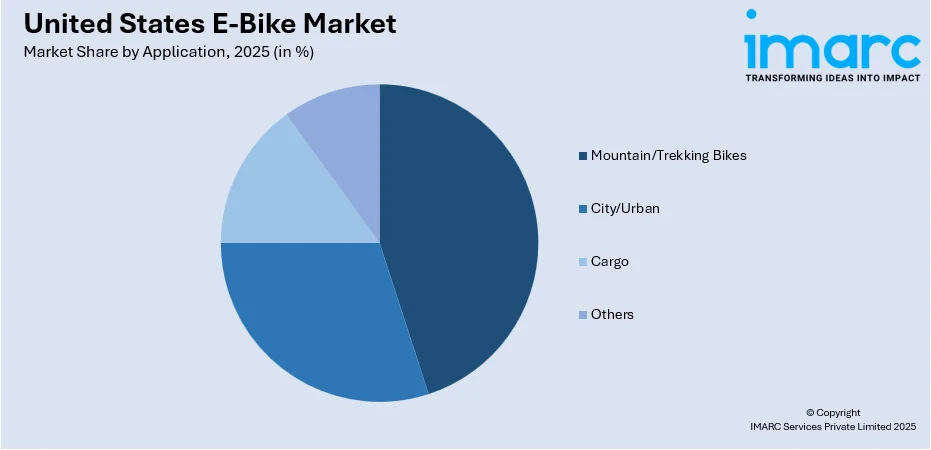

Analysis by Application:

To get detailed regional analysis of this market Request Sample

- Mountain/Trekking Bikes

- City/Urban

- Cargo

- Others

City/urban areas hold dominance due to their high population density, traffic congestion, and demand for efficient transportation. For instance, in 2020, about 82.66% of the total population in the United States lived in cities and urban areas. E-bikes provide an efficient option for short-range travel, enabling cyclists to bypass traffic and reach destinations faster. Urban areas also have better infrastructure, such as bike lanes and dedicated parking spaces, making e-bike use safer and more appealing. With rising fuel costs and the encouragement for eco-friendly alternatives, many city dwellers prefer e-bikes over traditional vehicles for daily commutes. Additionally, e-bikes are ideal for tackling the short and medium-range trips common in cities, as they reduce reliance on public transportation and private cars. The growing awareness about environmental issues and the desire for healthier lifestyles is also contributing to their popularity in urban settings. As cities are adopting policies that support green mobility, the demand for e-bikes in urban areas continues to rise, further solidifying their dominance in the market.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The Northeast region is gaining prominence due to its dense urban areas and heavy traffic congestion. Cities like New York and Boston are encouraging e-bike usage through improved bike lanes and supportive policies. Many commuters in the area prefer e-bikes to avoid long car rides and expensive parking. The region’s focus on reducing emissions and promoting green transportation is also driving the demand for e-bikes. Foldable and compact e-bikes are especially popular in the Northeast, where space is limited.

In the Midwest region, people in suburban and smaller urban areas are adopting eco-friendly transportation. Cities like Chicago and Minneapolis are developing bike-friendly infrastructure, making e-bike commuting more appealing. The Midwest’s wide-open spaces and long-distance routes are encouraging the use of durable and high-range e-bikes. Recreational riding is also popular, with many people employing e-bikes for fitness and leisure.

The South is experiencing rising demand, as urban areas are growing and people are seeking affordable transportation options. Cities like Austin, Atlanta, and Miami are promoting bike-friendly initiatives, supporting greater e-bike adoption. The warmer climate allows year-round riding, making e-bikes attractive for commuting and recreation. Many residents choose e-bikes to reduce commuting costs and avoid heavy traffic. Recreational use, especially along coastal areas and parks, is further catalyzing the demand for e-bikes.

The West is witnessing market expansion, fueled by strong environmental values and the presence of tech-savvy users. People in the West are adopting e-bikes quickly for commuting, recreation, and fitness, supported by a culture of sustainability and innovations. Extensive bike lanes, scenic routes, and government policies are making riding easier and safer. The region’s hilly terrains also aid in increasing the demand for powerful and efficient e-bikes.

Competitive Landscape:

Key players are working on developing new products with advanced designs to meet the high demand. They are investing in innovations, expanding product lines, and improving distribution networks. They focus on manufacturing lightweight, durable, and high-performance e-bikes that meet different user needs, ranging from city commuting to mountain adventures. Leading companies are introducing smart features like GPS tracking, app connectivity, and better battery systems to attract tech-savvy users. They are also forming partnerships with retail stores and online platforms to increase product availability across the country. Key players are promoting e-bikes through strong marketing campaigns, sponsorships, and demo events to boost public awareness and interest. Many companies are offering flexible financing options and warranty programs, making e-bikes more affordable and appealing. For instance, in January 2024, VinFast introduced its DrgnFly electric bicycle in the United States. It included a 750W rear hub motor and provided a distance of up to 63 Miles. The bicycle featured a removable lithium-ion battery, built-in 4G connectivity, and a companion app that offered multiple functionalities, including GPS tracking and remote diagnostics.

The report provides a comprehensive analysis of the competitive landscape in the United States e-bike market with detailed profiles of all major companies.

Latest News and Developments:

- April 2025: Washington State's WE-Bike initiative took place from April 9 to April 23 and provided immediate rebates to encourage e-bike usage. Qualified residents received USD 1,200 if their household income was at or below 80% of the county median, or USD 300 in other cases. The discounts were applicable to authorized e-bikes, accessories, and maintenance plans, available for redemption at participating bike shops.

- December 2024: Segway, a firm in the micro-mobility transport and robotic services industries, established a dedicated e-bike division in the US for the launch of its inaugural two e-bikes, the Xyber and the Xafari, along with other cycling products.

- October 2024: Urban Arrow unveiled a refreshed Family Line of electric cargo bicycles in the US, incorporating Bosch's Smart System for improved performance and safety. The two models, ‘the Performance Line and Cargo Line’, featured 75Nm and 85Nm motors, respectively, along with 545Wh batteries. The Bosch Connect Module incorporated GPS tracking, motion detectors, and remote motor locking.

- March 2024: Gazelle launched the Eclipse, its inaugural US Class 3 e-bike equipped with Bosch's Smart System and Performance Line Speed motor, providing up to 85 Nm of torque and reaching a maximum speed of 28 mph. Fitted with a 750 Wh UL-certified battery, it featured the Bosch Kiox 300 display, automatic mode assistance, and MIK-compatible racks.

United States E-Bike Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Modes Covered | Throttle, Pedal Assist |

| Motor Types Covered | Hub Motor, Mid Drive, Others |

| Battery Types Covered | Lead Acid, Lithium Ion, Nickel-Metal Hydride (Nimh), Others |

| Classes Covered | Class I, Class II, Class III |

| Designs Covered | Foldable, Non-Foldable |

| Applications Covered | Mountain/Trekking Bikes, City/Urban, Cargo, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States e-bike market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the United States e-bike market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States e-bike industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The United States e-bike market was valued at USD 1,142.2 Million in 2025.

Government incentives, such as tax credits and rebates, are encouraging adoption by making e-bikes more affordable for a broader audience. Besides this, technological improvements, including enhanced battery life, motor efficiency, and smart features like GPS tracking, are making e-bikes more appealing to both commuters and recreational users. Apart from this, the rise of e-commerce portals is facilitating easier access to a variety of e-bike models, catering to diverse user needs.

The United States e-bike market is projected to exhibit a CAGR of 9.39% during 2026-2034, reaching a value of USD 2,561.5 Million by 2034.

Lithium ion batteries hold the biggest battery type market share since they support a greater number of charge cycles and protection against overheating and overcharging.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)