United States Clean Coal Technologies Market Size, Share, Trends and Forecast by Technology, and Region, 2026-2034

United States Clean Coal Technologies Market Size and Share:

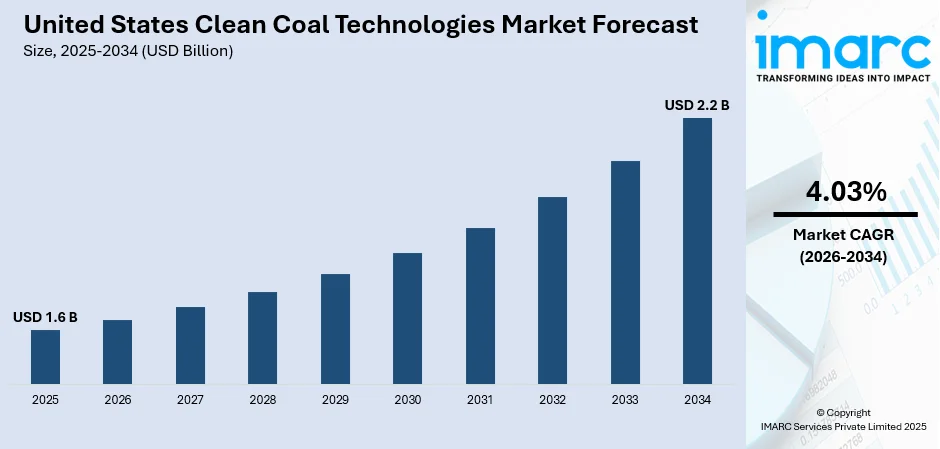

The United States clean coal technologies market size was valued at USD 1.6 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 2.2 Billion by 2034, exhibiting a CAGR of 4.03% from 2026-2034. The market is primarily driven by the increasing environmental regulations, demand for low-emission power generation, advancements in carbon capture and storage technologies, government incentives for clean energy, the need for energy security, and technological innovations in coal processing.

|

Report Attribute

|

Key Statistics |

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034 |

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1.6 Billion |

| Market Forecast in 2034 | USD 2.2 Billion |

| Market Growth Rate (2026-2034) | 4.03% |

Access the full market insights report Request Sample

The market in the United States is majorly influenced by the growing need to reduce carbon emissions and mitigate climate change. Additionally, increasing government regulations and environmental policies focusing on carbon capture and storage (CCS) technologies are key contributors to market expansion. Moreover, the rising awareness regarding the environmental impact of traditional coal-based power generation fuels demand for cleaner alternatives, which is providing an impetus to the market. Also, the shift toward energy security and the desire to reduce dependence on foreign energy sources further supports the adoption of clean coal technologies. Furthermore, continual advancements in carbon capture, utilization, and storage (CCUS) technologies have made clean coal options more economically viable, which provides a boost to market growth.

To get more information on this market Request Sample

In addition to this, there is a strong push for the modernization of aging coal plants to enhance their efficiency and reduce environmental damage. Besides this, the need to maintain a diverse energy mix and balance renewables with coal plays a significant role in driving the need for clean coal solutions. Apart from this, the rise of global demand for sustainable energy solutions results in countries seeking advanced technologies to reduce the environmental impact of coal-fired power plants; thereby, the export of clean coal technologies from the United States plays a crucial role in expanding the market growth. According to the U.S. Department of Commerce International Trade Administration report, the demand for U.S. clean coal technology (CCT) equipment from 2003 to 2030 is expected to reach USD 36 Billion. China, India, and South Korea represent the largest markets for U.S. CCT exports, with projected values of USD 26 Billion, USD 3.5 Billion, and USD 3.2 Billion, respectively. Additionally, countries such as Australia, Brazil, Mexico, New Zealand, South Africa, and the European Union are anticipated to contribute a further USD 2.9 Billion to the market growth.

United States Clean Coal Technologies Market Trends:

Development of High-Value Solid Products from Coal

The rising interest in the production of high-value solid products from coal, offering both economic and environmental advantages, is increasing the United States clean coal technologies market demand. Technologies converting coal into valuable byproducts such as carbon black, activated carbon, and synthetic materials have gained popularity since they allow the use of coal for purposes other than electricity generation. These byproducts are required in many different industries, such as manufacturing, water treatment, and production of specialty chemicals, among others. The development of these high-value solid products from coal helps diversify the coal market, thereby creating new revenue streams. According to a report by the U.S. Department of Energy, Battelle Memorial Institute of Columbus, Ohio, will develop a process that will convert high-volatile bituminous and sub-bituminous domestic coals into high-value polyurethane (PU) foam products, along with low-sulfur fuel oil byproduct. The project is to show the commercial feasibility of this coal-to-PU foam process. The total value of the project is USD 937,108, with USD 747,108 in DOE funding and USD 190,000 in non-DOE funding.

Regulatory Support and Government initiatives

Regulatory support and implementation of government initiatives are enhancing the United States clean coal technologies market outlook. This is driven through financial mechanisms such as grants, tax credits, and research funding for innovative solutions like carbon capture and energy-efficient systems. In response to rising regulatory pressure for lower emissions of greenhouse gases, clean coal technologies have emerged as an important field for utilities and industries seeking compliance. Therefore, government actions that help nurture such progress in the United States play a vital role in supporting market growth. Clean coal technologies often are capital-intensive and thus demand long-term investment. For instance, the Department of Energy, DOE, announced USD 56.5 Million in clean coal technology projects under the Maximizing the Coal Value Chain initiative. The projects target upgrading U.S. coal technologies, focusing on multiple areas. The funding supports technologies that aim to reduce emissions and enhance coal's commercial potential in various industries, including energy, materials, and manufacturing.

Advancements in Materials for High Efficiency

Advancements in materials for high-efficiency coal combustion systems are facilitating United States clean coal technologies market growth. High-performance materials, such as heat-resistant alloys, ceramic composites, and advanced metals, are of extreme importance in increasing efficiency at the coal power plant. Such materials enable plants to operate at greater temperatures and pressures, and the resultant beneficial effect on the whole energy conversion cycle is tremendous. With ongoing research into novel materials, the industry continues to progress toward higher efficiency and lower operational costs for coal plants. According to the U.S. Department of Energy report, Tennessee Technological University (Cookeville, TN) will be developing and testing corrosion- and erosion-resistant coatings for AUSC materials using electrolytic co-deposition. The project f

United States Clean Coal Technologies Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States clean coal technologies market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on technology.

Analysis by Technology:

To get detailed segment analysis of this market Request Sample

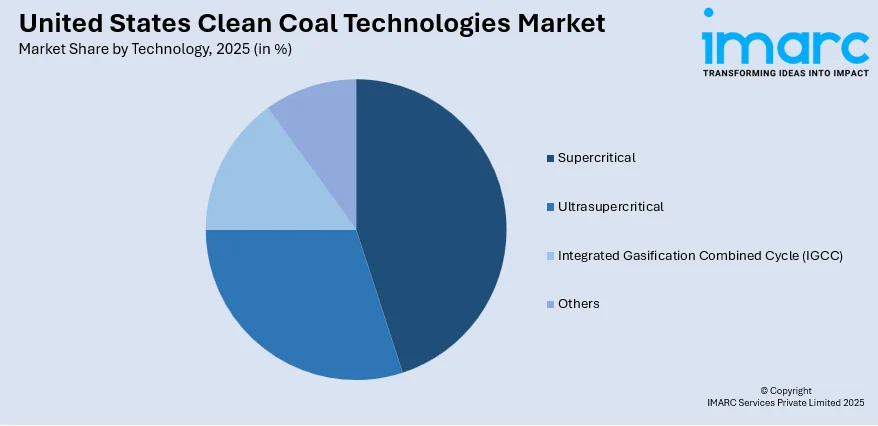

- Supercritical

- Ultrasupercritical

- Integrated Gasification Combined Cycle (IGCC)

- Others

Supercritical accounts for 48.7% of the market share due to its high efficiency and low environmental impact. The supercritical plant operates at temperatures and pressures above the subcritical system, therefore resulting in about 40% thermal efficiencies compared to the conventional older coal plant efficiency of around 33-35%. With this improved efficiency, less coal is burned with decreased carbon dioxide emissions per kilowatt-hour of electricity. Furthermore, supercritical technology is compatible with more stringent environmental standards, particularly in the context of greenhouse gas emissions and exploiting plentiful domestic coal supplies. The deployment of supercritical systems within the US energy system represents an affirmation to reconcile energy security with environmental care.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The Midwest represents the largest segment, accounting for over 42.0% of the market share due to its wide coal reserves, as well as its dependence on coal-fired plants. Illinois, Indiana, and Ohio are among the top coal-producing states in the country, so this region is of significant to the implementation of advanced technologies that can reduce emissions without sacrificing energy output. The Midwest's energy infrastructure supports industrial activities and powers Millions of homes. Clean coal solutions are integrated into the mix to meet environmental standards without compromising reliability. Supercritical and ultra-supercritical systems, carbon capture and storage (CCS), and other technologies are increasingly being adopted in the region to minimize the environmental footprint of coal-based power generation. These innovations allow the Midwest to find a balance of economic and energy security priorities within the context of national efforts at lowering greenhouse gas emissions and toward a more sustainable energy mix.

Competitive Landscape:

The market is highly competitive due to innovation-driven strategies, efforts at regulatory compliance, and investment in advanced technologies. Companies are focusing on the development and implementation of solutions, such as carbon capture and storage (CCS) and supercritical technologies, to make energy more efficient and reduce emissions. Strict environmental regulations and a decarbonization push have inspired market players to focus on research and development (R&D) activities, encouraging technological innovation and cost-effectiveness. Also, alliances between energy producers, research facilities, and the implementation of governmental policies are prevalent. For example, on August 27, 2024, the U.S. The Department of Energy's Office of Clean Energy Demonstrations has granted USD 5 Million to the "Carbon Capture Pilot at Dry Fork Power Station" project near Gillette, Wyoming. TDA Research will lead the project in partnership with Schlumberger Technology Corp., which is intended to deploy a system capable of capturing over 90% of carbon dioxide emissions from coal flue exhaust, equating to up to 158,000 metric tons of CO₂ annually. It is the first of four large-scale carbon capture pilots selected by the DOE for federal funding. There is also the market's competition with the renewable energy sectors that challenge it further to push more into sustainability and economic feasibility, thereby remaining a vital part of the national energy mix.

The report provides a comprehensive analysis of the competitive landscape in the United States clean coal technologies market with detailed profiles of all major companies.

Latest News and Developments:

- February 2024: The U.S. Department of Energy (DOE) announced up to $304 million in funding for four carbon capture pilot projects in Kentucky, Mississippi, Texas, and Wyoming. These initiatives aim to reduce carbon emissions from the power and industrial sectors, supporting the Biden-Harris Administration's goal of achieving net-zero emissions by 2050. Each project includes community engagement and workforce development plans, emphasizing public health benefits and economic revitalization while advancing innovative climate technologies through collaborative partnerships and strategic investments.

- December 20, 2024: North Dakota’s leadership in clean coal technologies was highlighted by Senator John Hoeven on the Senate floor. The state has a massive lignite coal reserve, enough to provide energy for more than 700 years. He stated that advanced coal-fired power plants in North Dakota ensure continuous access to affordable and reliable power and expressed his intent to collaborate with the Trump administration to achieve U.S. energy dominance.

- January 16, 2025: Governor Doug Burgum highlighted the integration of AI and clean coal technologies as pivotal to advancing sustainable energy in the United States. Speaking to policymakers, he emphasized the potential of these innovations to reduce emissions while ensuring energy reliability across the nation. Burgum also called for continued federal investment in research to maintain America’s leadership in the developing energy sector.

United States Clean Coal Technologies Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Supercritical, Ultrasupercritical, Integrated Gasification Combined Cycle (IGCC), Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States clean coal technologies market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the United States clean coal technologies market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States clean coal technologies industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The United States clean coal technologies market was valued at USD 1.6 Billion in 2025.

The key factors driving the United States clean coal technologies market include stringent environmental regulations aimed at reducing carbon emissions, advancements in technology enhancing efficiency and reducing costs, and the increasing demand for cleaner energy sources to meet rising power consumption.

IMARC estimates the United States clean coal technologies market to reach a value of USD 2.2 Billion by 2034.

Supercritical is the leading segment by application, accounting for 48.7% of the market share, driven by its higher efficiency and lower emissions compared to traditional coal-fired power plants, which makes it a preferred choice for new installations and upgrades.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)