US Coffee Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2026-2034

US Coffee Market Size, Share & Analysis:

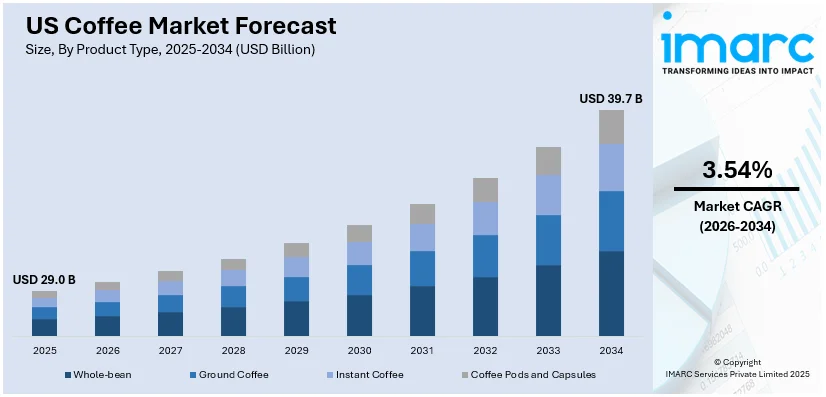

The US coffee market size was valued at USD 29.0 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 39.7 Billion by 2034, exhibiting a CAGR of 3.54% from 2026-2034. The market is driven by the increasing demand for specialty coffee, with consumers seeking premium, ethically sourced products. Health consciousness is promoting healthier coffee options like plant-based milk and low-sugar beverages. Besides this, the U.S. coffee market share is influenced by technological innovations, such as smart brewing machines and coffee subscriptions, which offer convenience and customization.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 29.0 Billion |

|

Market Forecast in 2034

|

USD 39.7 Billion |

| Market Growth Rate (2026-2034) | 3.54% |

Access the full market insights report Request Sample

US Coffee Market Analysis:

- Growth Drivers: Increased demand from consumers for high-end coffee, growing consumption of coffee among millennials, growth of specialty coffee shops, and convenience products such as ready-to-drink coffee propel US coffee market growth.

- Key Market Trends: Plant-based creamers, sustainable packaging, cold brew, and nitro coffee lead trends. Tech-enabled ordering and customization, and emphasis on fair trade sourcing and roasting locally are also influencing preferences.

- Market Opportunities: Expanding demand for organic and fair-trade coffee, ecommerce growth, subscription models, and flavor and brewing innovation provide ample growth opportunities in both retail and foodservice channels.

- Market Challenges: Volatile prices for coffee beans, supply chain interruptions, increased competition, climate change affecting production, and shifting consumer behavior post-COVID-19 create challenges to sustained market stability and profitability in the US coffee market forecast.

To get more information on this market Request Sample

Technological innovation in coffee is significantly influencing coffee market in the United States by enhancing consumer experiences. Advances in coffee brewing technology, such as smart coffee machines and app-controlled brewing methods, offer convenience. These devices allow consumers to control factors like temperature, brewing time, and strength, creating a personalized coffee experience. With the increasing demand for customized coffee, such technologies provide a way for coffee enthusiasts to replicate café-quality brews at home. The rise of single-serve coffee systems is transforming home brewing. These machines offer speed, consistency, and convenience, attracting busy consumers who want quality coffee without effort. The development of coffee grinders with precision settings ensures a better extraction process, enhancing flavor and quality, which is strengthening the market growth.

US Coffee Market Trends:

Increasing demand for specialty coffee

Consumers are seeking high-quality, ethically sourced coffee with specific flavors and methods of brewing. Specialty coffee provides premium tastes that attract customers who are willing to pay extra for better quality. This increases the US coffee market demand and gives rise to independent roasters and third-wave coffee shops. These businesses aim at transparency, sustainability, and direct trade; hence, this appeal to ethically conscious consumers. This trend is driven by younger generations, particularly millennials and Gen Z who prefer artisanal and craft coffee options. The preference for unique flavors, organic beans, and sustainable packaging supports the market growth. To meet this demand, in January 2025, Reborn Coffee announced its plan to expand across the US with more than 100 franchise locations by 2028. It currently operates 11 stores in California and has franchise approval in 40 states, with applications pending in 12. The growth of home brewing is also fueling specialty coffee's popularity among quality-conscious consumers. This enables better preparation of specialty coffee at home with the help of pour-over kits and espresso machines. Online platforms make available diverse specialty coffee brands and increase consumer reach and engagement. Coffee chains and supermarkets are expanding their specialty coffee offerings to match the changing tastes of consumers.

Rising health consciousness among consumers

Many people in the US prefer coffee with functional benefits, such as added probiotics, adaptogens, or immune-boosting ingredients. The demand for plant-based milk alternatives, like almond or oat milk, thereby reshaping US coffee market trends. To deliver this demand, in January 2025, Minus Coffee launched a bean less instant vanilla oat milk latte, made from upcycled date and grape seeds. This vegan, dairy-free drink contains 50mg caffeine, 6g plant protein, and L-Theanine for steady energy. Health-conscious individuals are reducing sugar intake, choosing unsweetened or naturally flavored coffee beverages. Cold brew and nitro coffee are gaining popularity due to their smoother taste and lower acidity. Consumers seeking weight management benefits often opt for black coffee or bulletproof coffee with healthy fats. The rising preference for clean-label products encourages brands to focus on natural and minimally processed ingredients. Functional coffee infused with vitamins, collagen, or superfoods is also becoming a growing trend. Many coffee brands now highlight organic certifications and ethical sourcing to attract health-conscious buyers. The shift towards wellness-focused beverages is driving innovation in both retail and café offerings. As consumers prioritize healthier lifestyles, coffee companies are adapting by introducing more nutritious and transparent product options.

Expanding on-the-go (OTG) culture

As the hectic pace of life persists, consumers in the US demand ready-to-drink (RTD), on-the-go (OTG), and easy coffee products that align with their active lifestyles. Pre-packaged products like bottled iced coffee are convenient and readily available through popular coffee chains and brands. Moreover, the need for single-serve coffee pods and capsules grows, making it easy and fast to brew the perfect cup of coffee. For instance, Diamond Brew launched its innovative "brewless" coffee in the US in August 2024. This product delivers barista-quality taste without brewing, using freeze-dried coffee that dissolve in warm or cold water and deliver 160mg of caffeine per serving. The brand is also sustainable in its packaging and uses upcycled coffee grounds in furniture production. In addition, coffee shops are innovating by introducing grab-and-go options for the commuters and working professionals in cities. Consumers can now buy coffee from vending machines, convenience stores, and mobile apps. The RTD coffee segment is gaining popularity as consumers increasingly opt for traditional and cold brew. Newer methods of adding caffeine to energy drinks are also being explored by coffee brands in a bid to appeal to the consumer who needs a boost. Drive-thru coffee shops and mobile ordering services are meeting the demand for speed and convenience thus influencing the US coffee market analysis.

US Coffee Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the US coffee market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on product type and distribution channel.

Analysis by Product Type:

- Whole-bean

- Ground Coffee

- Instant Coffee

- Coffee Pods and Capsules

Whole-bean coffee is preferred by consumers who value freshness and enjoy grinding their beans. This segment appeals to coffee enthusiasts who believe grinding coffee just before brewing preserves its flavor and aroma. Whole-bean coffee also allows for a customized brewing experience, as consumers can adjust the grind size according to their brewing method. Moreover, the premium nature of whole-bean coffee aligns with the increasing demand for specialty and artisanal products, further influencing its popularity.

Ground coffee is popular among consumers who seek convenience without compromising quality. This product type eliminates the need for grinding, making it an easy option for busy individuals. Ground coffee is available in various blends and roast levels, catering to a broad range of tastes. With its long shelf life, it is often preferred by those looking for a stable, ready-to-brew (RTB) option.

Instant coffee appeals to consumers seeking convenience and affordability. It requires minimal preparation, making it ideal for those with limited time or resources. As lifestyles become busier, instant coffee’s ease of use has made it a popular choice, especially in offices and for on-the-go (OTG) consumption. The rise of premium instant coffee options, often crafted with higher-quality beans, has helped shift the perception of instant coffee as a low-quality product.

Coffee pods and capsules are revolutionizing the coffee market by providing quick, consistent, and high-quality coffee with minimal effort. These products are designed for consumers who value convenience, offering single-serving solutions that eliminate the need for grinding, measuring, or cleaning. The popularity of pod-based machines is surging, attracting a wide range of consumers. The market for coffee pods is expanding as more brands introduce innovative flavors and sustainable, eco-friendly pod options.

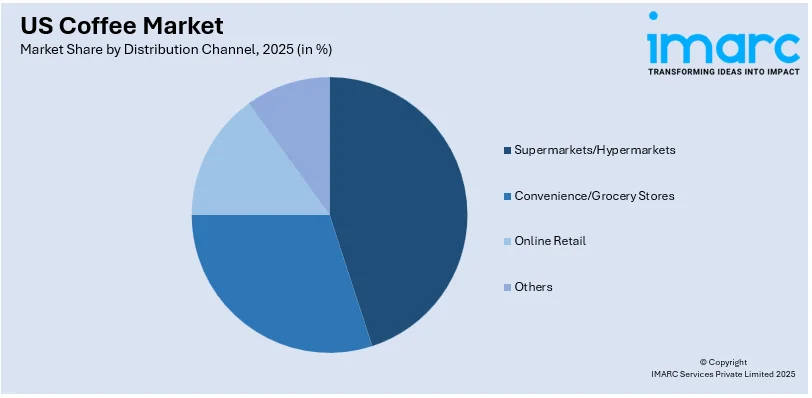

Analysis by Distribution Channel:

To get detailed segment analysis of this market Request Sample

- Supermarkets/Hypermarkets

- Convenience/Grocery Stores

- Online Retail

- Others

Supermarkets and hypermarkets are key distribution channels for coffee due to their wide reach and convenience. These retail formats cater to a broad customer base, offering a diverse range of coffee products. Consumers visit supermarkets regularly for their grocery needs, which increases coffee sales through impulse buys and the availability of multiple brands. They often feature promotional offers, discounts, and loyalty programs, further attracting customers. The physical store experience allows consumers to browse various coffee types and make informed purchasing decisions.

Convenience stores and smaller grocery outlets provide easy access to coffee, especially for consumers seeking a quick purchase. These stores are located in high-traffic areas, such as residential neighborhoods or near transportation hubs, making them convenient for last-minute coffee buys. They generally offer a limited but essential selection of popular coffee brands and products, catering to individuals seeking fast, hassle-free shopping.

Online retail is emerging as a dominant distribution channel, offering consumers convenience, variety, and easy price comparison. E-commerce platforms allow customers to access a broader range of coffee brands, blends, and types that may not be available in physical stores. Online shopping also enables consumers to purchase specialty and premium coffee products, often with the added benefit of subscription services. The growth of online coffee sales has been fueled by the increasing popularity of home brewing and the desire for customized coffee experiences.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The Northeast region is one of the largest coffee-consuming areas in the US due to its dense urban population and high-income levels. Coffee culture is deeply ingrained in cities like New York and Boston, where consumers frequently visit coffee shops and cafes. The region's demand is driven by the popularity of premium and specialty coffee, aligning with the growing trend for high-quality, artisanal products. Additionally, the Northeast's colder climate increases the consumption of hot beverages like coffee.

The Midwest is experiencing steady growth in coffee consumption, driven by a growing interest in local roasters and craft coffee. While traditionally less focused on specialty coffee, the region is recently witnessing an uptick in consumer interest in high-quality blends. The Midwest’s strong agricultural sector also contributes to the coffee market, with some areas fostering strong ties to sustainable farming practices and fair-trade coffee. Coffee chains and local cafes are expanding, responding to the growing urbanization and the shift toward more personalized coffee experiences.

The South is characterized by a more diverse coffee-drinking culture, with a preference for both traditional coffee styles and flavored options. The warmer climate in many Southern states can influence higher demand for iced coffee and ready-to-drink (RTD) beverages. The region is also seeing increased interest in specialty coffee as younger consumers look for higher-quality, ethically sourced products. Major coffee chains have a strong presence in the South, helping to influence overall consumption.

The West region, particularly cities like Los Angeles and Seattle, has long been a hub for coffee innovation and culture. This region is home to many coffee roasters, cafes, and tech-driven coffee companies, promoting the rapid growth of the specialty coffee market. Consumers in the West tend to favor high-quality, ethically sourced coffee and have a strong affinity for unique brewing methods, such as pour-over or cold brew. The West's trendy coffee culture attracts millennials and Gen Z, further catalyzing coffee consumption.

Competitive Landscape:

Key players drive the coffee culture in the US by offering various menus. In this respect, companies drive innovation by introducing constantly new blends, flavors, and seasonal offerings for consumers. Leaders in the market often take up sustainability initiatives where they source their beans from farms that are either certified as fair-trade or environment friendly. Consumers who prefer sourcing practices with such ethics develop more loyalty to these brands. The market is also influenced by smaller, specialty roasters who are creating unique, high-quality blends to go along with the niche tastes. Premium coffee is something that attracts consumers looking for distinctive, artisanal products. Key players in the industry lead technological advancements, popularizing single-serve coffee pods and ready-to-drink (RTD) coffee. These innovations place the beverage within reach and make it convenient for busy lives. For example, Nestle’s Nespresso's first RTD coffee introduced in the United States with Master Origins Colombia back in September 2024 and it is crafted using honey from Colombian beans.

The report provides a comprehensive analysis of the competitive landscape in the US coffee market with detailed profiles of all major companies, including:

- Danone North America Public Benefit Corporation

- Califia Farms LLC

- Fresh Roasted Coffee LLC

- Keurig Green Mountain Inc.

- Napco Inc.

- Nestle

- Starbucks

- The Eight O'Clock Coffee Company

- The J.M. Smucker Company

- The Kraft Heinz Company

Latest News and Developments:

- November 2024: Victor Allen's Coffee launched a 60-count variety pack of premium coffee pods, including Colombia, Espresso, Mexico, and Brazil blends in the US. Made from 100% Arabica beans, these medium and dark roasts are crafted in Little Chute, Wisconsin.

- April 2024: NESCAFÉ launched two new instant coffee products in the US: Gold Espresso and Ice Roast. Gold Espresso offers a café-style experience with Blonde and Intense Roasts, while Ice Roast dissolves in cold water or milk for a smooth, cocoa-flavored beverage.

US Coffee Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Whole-bean, Ground Coffee, Instant Coffee, Coffee Pods and Capsules |

| Distribution Channels Covered | Supermarkets/Hypermarkets, Convenience/Grocery Stores, Online Retail, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Companies Covered | Danone North America Public Benefit Corporation, Califia Farms LLC, Fresh Roasted Coffee LLC, Keurig Green Mountain Inc., Napco Inc., Nestle, Starbucks, The Eight O'Clock Coffee Company, The J.M. Smucker Company, The Kraft Heinz Company, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, US coffee market outlook, and dynamics of the market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the US coffee market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the US coffee industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The coffee market in the US was valued at USD 29.0 Billion in 2025.

The US coffee market growth is driven by increasing demand for specialty coffee, with consumers seeking premium, high-quality options. Health consciousness is fueling the shift towards low-sugar, plant-based, and functional beverages. The expanding on-the-go (OTG) culture is driving demand for ready-to-drink (RTD) coffee and convenient brewing methods.

The US coffee market is projected to exhibit a CAGR of 3.54% during 2026-2034, reaching a value of USD 39.7 Billion by 2034.

Some of the major players in the US coffee market include Danone North America Public Benefit Corporation, Califia Farms LLC, Fresh Roasted Coffee LLC, Keurig Green Mountain Inc., Napco Inc., Nestle, Starbucks, The Eight O'Clock Coffee Company, The J.M. Smucker Company, The Kraft Heinz Company, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)