UK Waste Management Market Size, Share, Trends and Forecast by Waste Type, Disposal Methods, and Region, 2025-2033

UK Waste Management Market Overview:

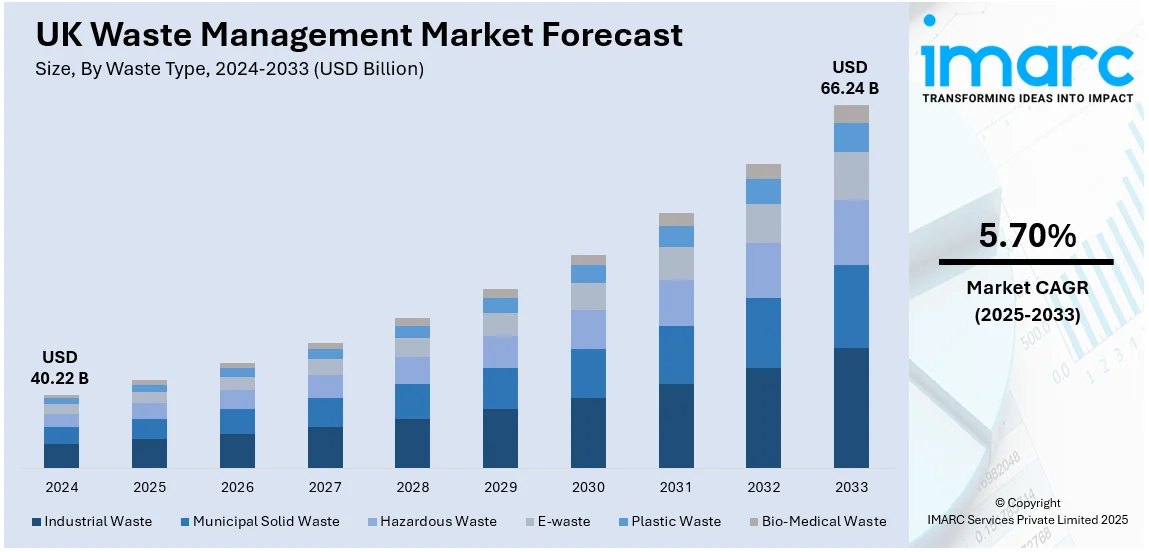

The UK waste management market size reached USD 40.22 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 66.24 Billion by 2033, exhibiting a growth rate (CAGR) of 5.70% during 2025-2033. The UK waste management market share is driven by heightening government regulations on recycling and waste reduction, coupled with the increasing awareness regarding sustainability. In addition, technological advancements in waste treatment techniques and the shift towards circular economy further propels the market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 40.22 Billion |

| Market Forecast in 2033 | USD 66.24 Billion |

| Market Growth Rate (2025-2033) | 5.70% |

UK Waste Management Market Trends:

Heightened Emphasis on Recycling and Circular Economy

The growing emphasis on recycling and the implementation of circular economy principles is influencing the UK waste management market outlook. Regulatory policies and incentive schemes are motivating manufacturers to be responsible for their products' life cycle to enhance waste reduction and recycling. This, in turn, is influencing significant investment in recycling facilities, particularly for plastic, electronic, and construction waste. Companies as well as individuals are becoming more environmentally conscious about their footprint, which is further fueling demand for sustainable waste management solutions. Apart from this, the trend towards a circular economy is also expected to prevail as the UK government enforces more stringent recycling rates and waste minimization targets as part of its long-term sustainability goals. According to industry reports, of the 26 million tons of UK waste, 12 million tons are recycled, and 14 million tons go to landfill sites, giving an average recycling percentage of 45%.

Advancements in Waste Treatment Technologies

Technological developments are playing an important role in propelling the UK waste management market growth through improvements in waste treatment, sorting, and disposal technologies. Implementing artificial intelligence (AI)-based systems and automation at waste sorting plants increases the efficiency and precision of separating materials, minimizes levels of contamination, and maximizes recycling rates. Besides, waste-to-energy technologies such as incineration and anaerobic digestion are also gaining prominence as a method of converting waste into renewable energy. Moreover, these technologies aid in diverting waste from landfills, lower environmental impact, and contribute to the country's renewable energy target. Moreover, ongoing heavy expenditure on research and development (R&D) is also likely to further improve the functionality of waste management technologies in the UK. For instance, in August 2024, FCC Environment, a UK waste company, and CARBIOS partnered in a joint venture to develop a PET bio recycling facility in the UK through CARBIOS' licensed enzymatic depolymerization process. This pioneering technology allows effective, solvent-free recycling of PET plastic and textile waste to produce virgin-quality material.

Increase in Industrial and Commercial Waste Management

The commercial and industrial sectors in the UK are increasingly adopting effective waste management practices to adhere with stringent regulations and reduce environmental impact. Key sectors like construction, manufacturing, and retail, are emphasizing on reducing waste through recycling, repurposing, and sustainable waste disposal methods. In addition, the demand for specialized waste management services including hazardous waste treatment and electronic waste disposal, is rising in these sectors. Moreover, large corporations are committing to zero-waste policies, further driving growth in the market. Furthermore, this trend is supported by government incentives and policies aimed at reducing waste generation and promoting sustainable industrial practices across the UK economy. As per industry reports, the UK generates 41.1 million tons of industrial waste annually.

UK Waste Management Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on waste type and disposal methods.

Waste Type Insights:

- Industrial Waste

- Municipal Solid Waste

- Hazardous Waste

- E-waste

- Plastic Waste

- Bio-Medical Waste

The report has provided a detailed breakup and analysis of the market based on the waste type. This includes industrial waste, municipal solid waste, hazardous waste, e-waste, plastic waste, and bio-medical waste.

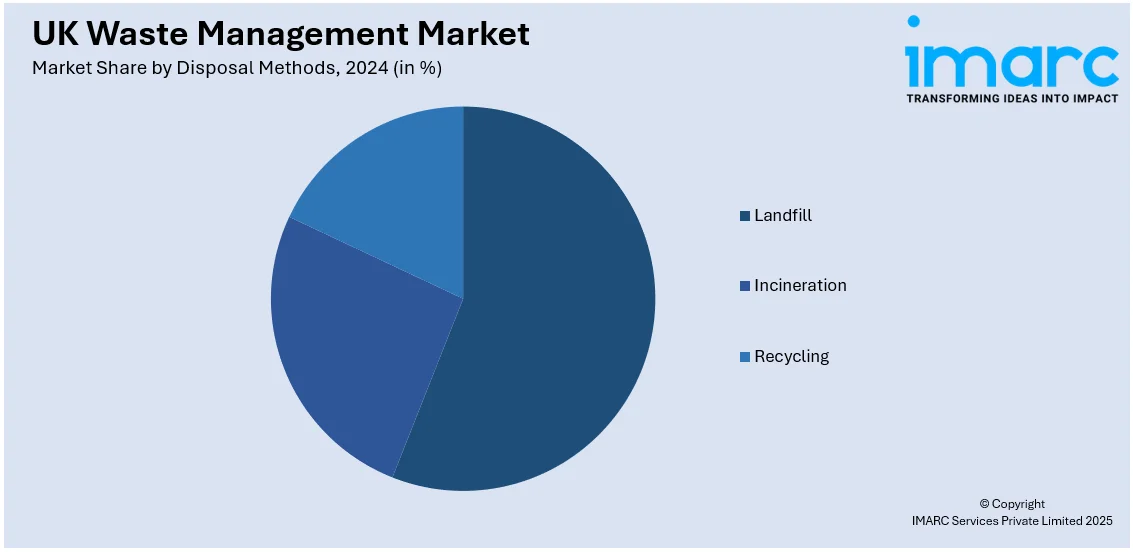

Disposal Methods Insights:

- Landfill

- Incineration

- Recycling

A detailed breakup and analysis of the market based on the disposal methods have also been provided in the report. This includes landfill, incineration, and recycling.

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UK Waste Management Market News:

- In December 2024, QMRE introduced the Víxla system, a chemical recycling solution in the UK that converts plastic waste into recycled energy and plastic. Built on Eagle’s ITDU pyrolysis technology, it enables decentralized processing, reducing the need for transport to central facilities.

- In August 2024, SSE Thermal and Copenhagen Infrastructure Partners' CI IV fund announced the completion and commencement of operations at the 60 MWe Slough Multifuel waste-to-energy plant, which processes 480,000 metric tons of residual waste annually, providing a sustainable waste management solution for the Greater London area.

UK Waste Management Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Waste Types Covered | Industrial Waste, Municipal Solid Waste, Hazardous Waste, E-waste, Plastic Waste, Bio-Medical Waste |

| Disposal Methods Covered | Landfill, Incineration, Recycling |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UK waste management market performed so far and how will it perform in the coming years?

- What is the breakup of the UK waste management market on the basis of waste type?

- What is the breakup of the UK waste management market on the basis of disposal methods?

- What are the various stages in the value chain of the UK waste management market?

- What are the key driving factors and challenges in the UK waste management market?

- What is the structure of the UK waste management market and who are the key players?

- What is the degree of competition in the UK waste management market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK waste management market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UK waste management market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK waste management industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)