South East Asia Fintech Market Size, Share, Trends and Forecast by Deployment Mode, Technology, Application, End User, and Country, 2025-2033

Market Overview:

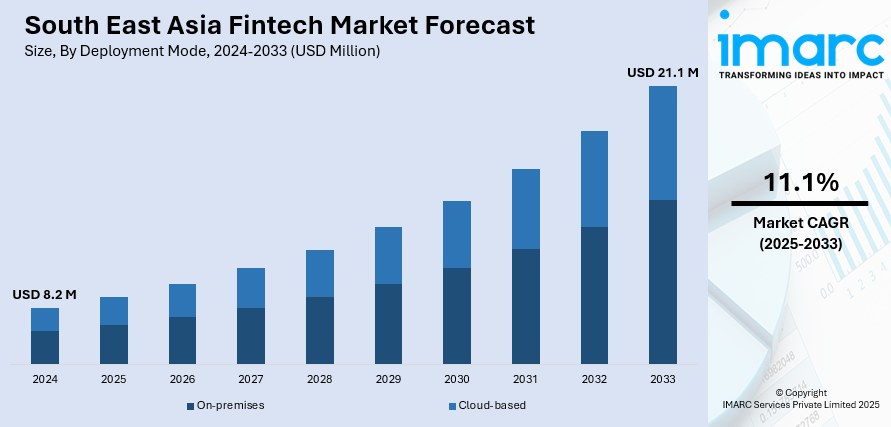

The South East Asia fintech market size reached USD 8.2 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 21.1 Million by 2033, exhibiting a growth rate (CAGR) of 11.1% during 2025-2033. Rapid technological advancements, the growing trend towards digital transactions and online financial services, changing consumer expectations, rising regulatory support and open banking, and escalating economic trends are some of the factors propelling the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 8.2 Million |

| Market Forecast in 2033 | USD 21.1 Million |

| Market Growth Rate (2025-2033) | 11.1% |

Financial technology, commonly known as fintech, represents a dynamic and rapidly evolving sector that leverages cutting-edge technology to revolutionize traditional financial services. At its core, it encompasses a diverse range of innovations designed to enhance and streamline financial activities, encompassing everything from banking and payments to investment management and insurance. The essence of fintech lies in its ability to leverage advancements such as artificial intelligence, blockchain, data analytics, and mobile technology to create more efficient, accessible, and customer-centric financial solutions. Unlike traditional financial institutions, fintech startups and companies often operate with greater agility, responding swiftly to changing consumer demands and technological breakthroughs. The rise of fintech is closely tied to the increasing digitization of financial services, reflecting a global shift towards online transactions and digital experiences. Crucially, it extends beyond just creating digital alternatives; it embodies a fundamental shift in the way financial services are conceptualized and delivered. This industry embraces innovation not only in terms of technology but also in business models, disrupting established norms. From peer-to-peer lending platforms to robo-advisors, fintech offerings span a spectrum of services that challenge traditional banking structures. Moreover, the fintech landscape is characterized by a collaborative spirit, with many companies embracing partnerships and open banking initiatives to create comprehensive ecosystems that cater to diverse financial needs. As it continues to redefine the financial landscape, it remains a driving force in shaping the future of how individuals and businesses manage their finances globally.

To get more information on this market, Request Sample

South East Asia Fintech Market Trends:

The market in South East Asia is majorly driven by the rapid increase in mobile and internet penetration. As a result, a growing number of consumers now have access to digital financial services, fostering an environment conducive to Fintech innovation. Furthermore, the rising regulatory support is creating a positive outlook for the market. Regulatory frameworks that encourage innovation while maintaining financial stability have paved the way for startups to expand. Countries like Singapore and Malaysia have been at the forefront of implementing regulatory measures that balance innovation and risk, fostering an environment where Fintech companies can grow. Besides, financial inclusion is another compelling driver in South East Asia, where a significant portion of the population remains unbanked or underbanked. Fintech solutions, such as mobile wallets and digital payment platforms, are instrumental in providing financial services to previously underserved populations. These innovations contribute to a more inclusive financial ecosystem, allowing individuals and businesses to access and participate in the formal financial sector. Moreover, cross-border collaborations and partnerships play a crucial role in catalyzing market growth. The region's diverse markets present both challenges and opportunities, and Fintech companies are increasingly forming strategic alliances to navigate this complexity. Collaborations between local startups, established financial institutions, and international players facilitate the expansion of Fintech services across borders, fostering a more interconnected financial landscape. Apart from this, the region's youthful demographic, coupled with a rising middle class, contributes to a growing demand for modern financial services. This demographic shift, characterized by tech-savvy consumers with changing expectations, fuels the adoption of Fintech solutions that align with their preferences for convenience, efficiency, and personalized experiences. Additionally, the evolution of South East Asia as a hub for innovation and technology further accelerates market growth. With an increasing number of startups, tech hubs, and investment inflows, the region becomes a fertile ground for experimenting with and scaling innovative fintech solutions, strengthening the market.

South East Asia Fintech Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional and country level for 2025-2033. Our report has categorized the market based on deployment mode, technology, application, and end user.

Deployment Mode Insights:

- On-premises

- Cloud-based

The report has provided a detailed breakup and analysis of the market based on the deployment mode. This includes on-premises and cloud-based.

Technology Insights:

- Application Programming Interface

- Artificial Intelligence

- Blockchain

- Robotic Process Automation

- Data Analytics

- Others

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes application programming interface, artificial intelligence, blockchain, robotic process automation, data analytics, and others.

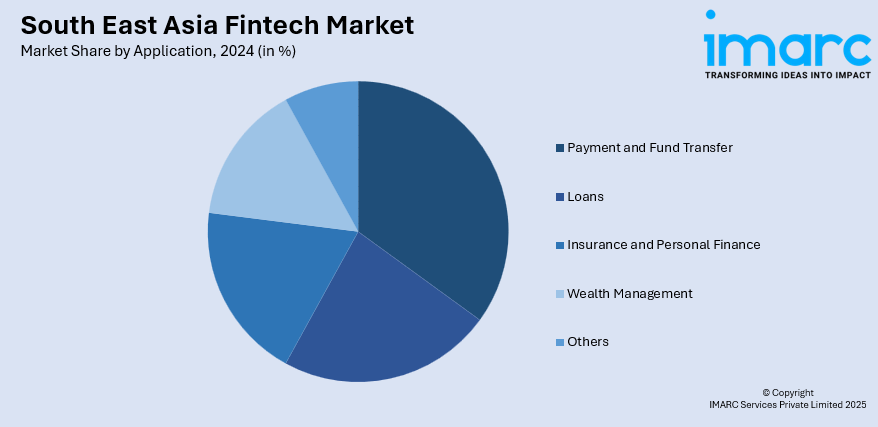

Application Insights:

- Payment and Fund Transfer

- Loans

- Insurance and Personal Finance

- Wealth Management

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes payment and fund transfer, loans, insurance and personal finance, wealth management, and others.

End User Insights:

- Banking

- Insurance

- Securities

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes banking, insurance, securities, and others.

Country Insights:

- Indonesia

- Thailand

- Singapore

- Philippines

- Vietnam

- Malaysia

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Indonesia, Thailand, Singapore, Philippines, Vietnam, Malaysia, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South East Asia Fintech Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Deployment Modes Covered | On-premises, Cloud-based |

| Technologies Covered | Application Programming Interface, Artificial Intelligence, Blockchain, Robotic Process Automation, Data Analytics, Others |

| Applications Covered | Payment and Fund Transfer, Loans, Insurance and Personal Finance, Wealth Management, Others |

| End Users Covered | Banking, Insurance, Securities, Others |

| Countries Covered | Indonesia, Thailand, Singapore, Philippines, Vietnam, Malaysia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South East Asia fintech market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South East Asia fintech market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South East Asia fintech industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The fintech market in South East Asia was valued at USD 8.2 Million in 2024.

The South East Asia fintech market is projected to exhibit a CAGR of 11.1% during 2025-2033, reaching a value of USD 21.1 Million by 2033.

The market is driven by strong mobile penetration, underserved banking populations, and a growing appetite for cashless transactions. Startups and financial institutions are innovating in payments, lending, and personal finance. Consumers are embracing digital wallets and app-based services for everyday convenience, while businesses benefit from faster settlements, reduced paperwork, and integrated financial management tools.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)