North America Dog Food Market Size, Share, Trends and Forecast by Product Type, Pricing Type, Ingredient Type, Distribution Channel, and Country, 2025-2033

North America Dog Food Market Size and Share:

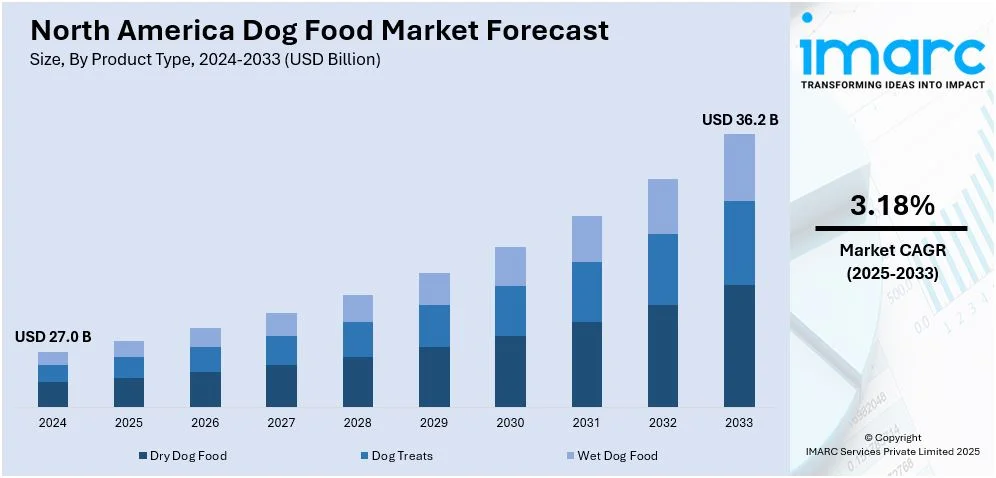

The North America dog food market size was valued at USD 27.0 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 36.2 Billion by 2033, exhibiting a CAGR of 3.18% from 2025-2033. The North American dog food market share is growing due to the increased pet ownership, demand for premium, organic food, humanization, and e-commerce expansion, with a preference for sustainable, high-protein formulations.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 27.0 Billion |

|

Market Forecast in 2033

|

USD 36.2 Billion |

| Market Growth Rate (2025-2033) | 3.18% |

The North America dog food market growth is attributed to the increasing trend of pet ownership due to the growing disposable incomes and changes in lifestyles. The 2024 APPA National Pet Owners Survey reports that 82 million households in the United States now possess a pet, reflecting how important pet care is in America's homes. Due to the humanization of pets, owners are on the lookout for healthy, nutrient-rich food just like humans follow diet trends. Premium, organic, and natural ingredients, with no artificial additives or fillers, are becoming an increasing requirement among consumers to increase their pets' life expectancy and ensure good health. Growing demand for functional pet foods enriched with probiotics, antioxidants, and omega fatty acids addresses specific health concerns related to joint health, digestion, and skin. Grain-free, high-protein, and raw diets are also in high demand among pet owners interested in specialized nutrition. Increased pet adoptions continue to drive demand for superior-quality pet food products.

Another driver is the accelerated growth of the e-commerce/direct-to-consumer sales platforms, which means premium, and niche products are that much more reachable. Subscription services for pet foods have also begun to take a foothold here, offering unique meal plans centered on the breed, age, and dietary-specific needs of your dog. Pet owners seek sustainable and ethically sourced products, making manufacturers shift to eco-friendly packaging and responsibly sourced ingredients. The growing influence of social media, celebrity endorsements, and veterinary recommendations has further propelled demand for specialized pet foods. Innovation is also being focused upon by pet food companies, who are introducing freeze-dried, fresh, and customized meal options to cater to evolving consumer preferences. Yet, the increasing veterinary health care costs also push pet owners to invest in preventive nutrition, further elevating North America dog food demand.

North America Dog Food Market Trends:

Rise of premium and functional dog food

One of the prominent North America dog food market trends is the growing demand for premium and functional pet food. Owners are increasingly treating their pets as family members, with improvements in lifestyle urging people to upgrade to human-grade ingredients for their dogs. The most emerging health-specific foods are functional ones, which include added probiotics, antioxidants, and omega fatty acids, addressing specific health challenges in animals such as joint health, digestive health, and skin issues. Grain-free, high-protein diets, and raw diets are becoming more common as pet owners increasingly demand more biologically appropriate nutrition for their pets. Overall, fresh and freeze-dried dog food is trending, offering better nutrition for dogs compared to the traditional kibbles. Brands have been emphasizing ingredient disclosure, and removing artificial additives, fillers, and byproducts. Another growing trend is individualized and breed-specific nutrition given surging cases of pet obesity and allergies. Morris Animal Foundation suggests that around 56% of dogs in the United States are plagued by weight-related issues. This is one of the reasons for healthier, well-balanced diets in pets. This reason has compelled pet owners to seek personalized diet plans that cater to the management of weight and wellness in general. The eagerness of consumers to spend extra money on higher-quality food encourages brands to research innovative methods. Novel proteins like venison, bison, and insect-based ingredients are gaining ground by serving specific dietary requirements.

E-commerce and subscription-based services

North America Dog Food Market forecast shows that e- commerce has transformed the dog food market, with pet owners increasingly opting for the convenience of online shopping. Easy access to a great variety of pet food products, handy price comparisons, and doorstep delivery services prove to be a good reason for the rapid increase in sales online. Subscription-based dog food services have taken off, allowing for customized meal plans based on a pet's breed, age, weight, and dietary preferences. Such services provide fresh, frozen, or freeze-dried meals delivered at a regular frequency to ensure that pets are kept convenient and their nutrition consistent. DTC brands are capitalizing on this trend, bypassing traditional retail channels to offer high-quality, personalized nutrition. Besides that, social media and influencer marketing have been very critical in advancing online sales. Pet owners look at peer reviews and expert recommendations before purchasing a product. The COVID-19 pandemic was bound to hasten the effect as even after all restrictions were lifted, a good percentage of consumers still favored shopping online. Technological advancements such as AI-driven customization will continue to propel the growth of e-commerce and subscription-based pet food services, thus changing the way pet owners purchase and engage with dog food brands.

Sustainability and ethical sourcing in pet food

The dog food industry in North America is beginning to place a greater emphasis on sustainability. Pet owners are already expressing a need for dog food product lines that are ethically and ecologically sourced. Growing consumer understanding of pet food's environmental impact makes them realize that using sustainable, ethical components, such as plant-based proteins and meats from ethical sources, is necessary. To lessen their carbon impact, manufacturers are also experimenting with different protein sources, such as lab-grown beef and additives derived from insects. Certified organic and free-range meats are examples of ethical sourcing methods that are becoming more popular as animal welfare rises to the top of most customers' minds. According to an NSF survey, 67% of participants said that animal welfare plays a significant role in their purchase decisions, and 68% underlined how crucial it is for businesses to show transparency and compliance in this area. Pet food manufacturers have responded to this heightened awareness by highlighting their sustainability initiatives through eco-labels, certifications, and even thorough ingredient traceability. Many businesses strive to reduce plastic waste, and sustainable packaging solutions that use recyclable and biodegradable materials are growing in popularity. To fulfill customer expectations, a lot of other businesses are committing to carbon-neutral operations and responsible sourcing programs. Sustainability will continue to influence product development and consumer choices in the North American dog food industry as environmental concerns increase.

North America Dog Food Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the North America dog food market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on product type, pricing type, ingredient type, and distribution channel.

Analysis by Product Type:

- Dry Dog Food

- Dog Treats

- Wet Dog Food

Dry dog food dominate the market due mainly to convenience and longer shelf life, along with cost-effectiveness relative to other forms. They are also more convenient for owners to store and measure for the pet, as they consider easy feeding of a pet important. The growing number of pet-owning households in the U.S., which reached 59.8 Million in 2024, as per the American Veterinary Medical Association, has further fueled demand for accessible and affordable pet food options. Advancements in premium dry dog food formulations incorporating plant-derived proteins such as lentils, peas, and chickpeas have enhanced its appeal among health-conscious consumers. Additionally, the availability of fortified dry dog food with added vitamins, minerals, and probiotics has contributed to its widespread adoption. Supermarkets and hypermarkets, the primary distribution channels, continue to allocate extensive shelf space for dry dog food brands, ensuring easy consumer access. Affordability and portion control also sustain dry dog food for the millions of pet owners across North America who look for its strong market presence.

Analysis by Pricing Type:

- Mass Products

- Premium Products

Premium products leads the market as pet humanization trends lead owners to invest in high-quality, nutrient-rich pet food. There is rise in Disposable Personal Income by 0.4% to $79.7 Billion as stated by the U.S. According to the Bureau of Economic Analysis, hence pet owners are more willing to invest in premium formulations that exclude artificial preservatives, fillers, and allergens. The rising awareness about the benefits to health accruing from the use of plant-based and organic ingredients has driven the demand for premium dry dog food with novel, high-protein ingredients such as quinoa, sweet potatoes, and legumes. Many premium brands stress sustainability, ethical sourcing, and functional health benefits, including better digestion, immunity, and skin health. Furthermore, celebrity endorsement, social media promotion, and veterinary recommendation campaigns have strengthened the dominance of premium dog food in the U.S. market. Furthermore, the rise in affluent pet owners and millennial consumers who ensure that their pets receive clean-label and holistic nutrition solidifies this premium segment lead in the overall market.

Analysis by Ingredient Type:

- Animal Derived

- Plant Derived

Plant-derived accounts for the majority of the market share due to the increasing shift toward sustainable and ethical pet food consumption. Demand for alternative and environmentally friendly animal food hit a fresh peak, as the dog population reached 89.7 Million in US, as released by the American Veterinary Medical Association. Interest is seen in increasing demand for these alternatives as a greater number of animal-based foods are perceived as polluting, while also due to increasing vegetarian/vegan animal food owners, more interest toward plant-based food formulation is experienced. Some of the major ingredients include lentils, chickpeas, flaxseeds, and soy protein. They are rich in nutrients and eliminate allergens found in the meat-based traditional dog food. Many plant-based dry dog foods also contain probiotics, omega fatty acids, and antioxidants that contribute to general health in pets. Major brands invest in research and development to create protein-rich formulas that will fulfill the nutritional requirements of dogs. As more pet owners look for cruelty-free, hypoallergenic, and digestion-friendly options, plant-based dog food is becoming popular, cementing its position in the U.S. pet food market.

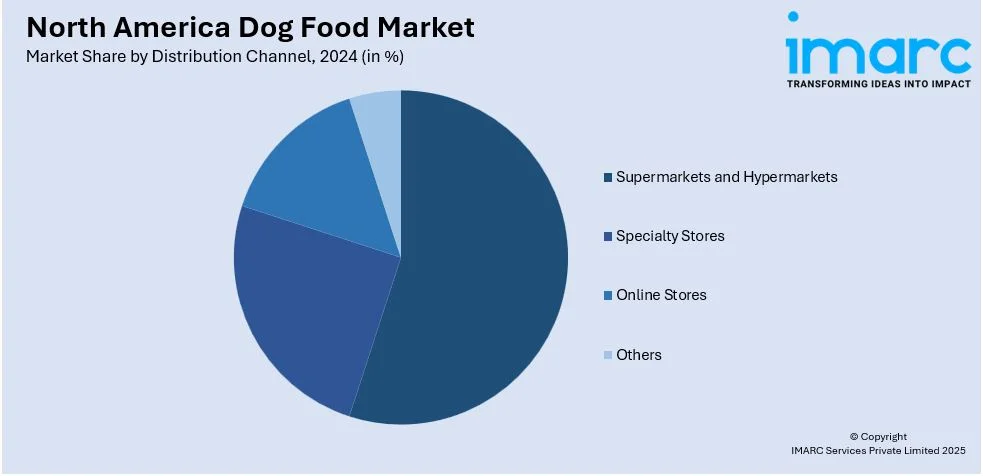

Analysis by Distribution Channel:

- Supermarkets and Hypermarkets

- Specialty Stores

- Online Stores

- Others

Supermarkets and hypermarkets account for the largest share of the U.S. dog food market due to their extensive reach, convenience, and availability of a wide range of products. showing the strength of consumer preference to shop in brick-and-mortar stores. Retail stores carry a variety of premium dry dog food brands, where pet owners may compare prices, ingredients, and package sizes before buying. Bulk purchasing options, discounts, and promotional offers in supermarkets further attract customers, while dedicated pet food sections within large retail chains enhance product visibility. Many supermarkets are also expanding their offerings to include organic and plant-based pet food sections, catering to the rising demand for sustainable and ethical products. As online retailing continues to rise, many customers prefer to shop in-store as they can touch and feel the products before purchasing and enjoy the convenience of availability. The supremacy of supermarkets and hypermarkets is also enhanced through their collaborations with major dog food companies and promotions within the stores for high-end, plant-based products.

Country Analysis:

- United States

- Canada

The United States is the dominant market for dog food in North America, driven by high pet population and disposable incomes along with growing demand for premium and specialized pet food products. actively seek veterinary care, reflecting their commitment to pet health and nutrition. The rising trend of pet humanization, where pets are increasingly considered family members, has led to a surge in demand for high-quality, nutritious food, particularly in urban areas. The U.S. market also is shifting a lot toward the use of plant-derived ingredients in dog food formulation, as consumers increasingly seek organic, sustainable, and health-conscious options. Additionally, growing environmental sustainability awareness motivates consumers to choose plant-based or grain-free dog food based on their beliefs and lifestyles. There are also huge retail and e-commerce platforms across the U.S. that easily allow consumers to access a large variety of dog food products. Supermarkets, hypermarkets, and online retailers make pet food purchasing easy. The country also has several well-established pet food manufacturers that innovate continuously to cater to the evolving preferences of pet owners. The United States remains the dominant player in the North American dog food market, mainly due to affluent pet owners, rising pet adoption rates, and improved pet food formulations.

Competitive Landscape:

Market players in the North American dog food industry are focusing on innovation, sustainability, and health-conscious formulations to meet the evolving demands of consumers. Major players are increasingly introducing premium, plant-derived, and functional pet food products that emphasize high-quality ingredients, transparency, and ethical sourcing. Many companies are investing in research and development to create formulations that meet specific health needs, including weight management, joint health, and digestion, and products addressing allergies or skin conditions. Plant-based and grain-free ingredients are strong, given consumer demand for cruelty-free and hypoallergenic options. Moreover, sustainability is now the core theme, where brands are embracing eco-friendly packaging, reducing carbon footprints, and using sustainable ingredients such as plant proteins and insect-based options. Many players are expanding their presence through e-commerce channels, offering subscription services and personalized meal plans to cater to the growing trend of convenience. Increased consumer trends for online purchases forced pet food manufacturers to adjust the digital sites of their platforms so that there would be greater customer access. Moreover, the usage of social media and its influence in marketing has seen increased uptake; the latter part of marketing leverages platforms of social media to win and educate people on the goodness and value-added of their pet foods. These activities together create a positive North America Dog Food Market outlook.

The report provides a comprehensive analysis of the competitive landscape in the North America dog food market with detailed profiles of all major companies.

Latest News and Developments:

- January 2024: PawCo Foods introduced a new lineup of plant-based dog food products, InstaBites and LuxBites. InstaBites was the first shelf-stable, fresh, plant-based dog food, and LuxBites came with the added gut health benefits of postbiotics.

- April 2024: Purina PetCare announced plans to launch over 100 new products in the U.S., contributing to Nestlé's sales growth. The company expanded its premium brands and microbiome-focused pet food. After supply constraints, Purina prepared to re-enter segments and leverage its scientific and nutritional expertise for innovation.

- December 2024: Kismet, a premium dog food brand founded by Chrissy Teigen and John Legend, has launched a range of dry treats available on Chewy.com. The company's dry food and treats are made with real animal proteins and superfoods.

- August 2024: Noochies! Initiated the FDA approval process for its cultivated chicken dog food in the U.S. Parent company Further Foods submitted a feeding trial protocol, with trials set to start pending approval. The cultivated pet food sector picked up pace, with the UK's Meatly receiving approval to sell cultivated chicken pet food.

North America Dog Food Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Dry Dog Food, Dog Treats, and Wet Dog Food |

| Pricing Types Covered | Mass Products and Premium Products |

| Ingredient Types Covered | Animal Derived and Plant Derived |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Online Stores, and Others |

| Countries Covered | United States, Canada |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the North America dog food market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the North America dog food market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the North America dog food industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The North America dog food market was valued at USD 27.0 Billion in 2024.

The North American dog food market is driven by increased pet ownership, demand for premium, organic food, humanization, and e-commerce expansion, with a preference for sustainable, high-protein formulations.

The North America dog food market is estimated to exhibit a CAGR of 3.18% during 2025-2033.

The United States is the dominant market for dog food in North America, driven by high pet population and disposable incomes along with growing demand for premium and specialized pet food products.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)