Middle East Tire Market Report by Design (Radial Market, Bias Market), End Use (OEM Market, Replacement Market), Vehicle Type (Passenger Cars, Light Commercial Vehicles, Medium and Heavy Commercial Vehicles, Two Wheelers, Three Wheelers, Off-The-Road (OTR)), Distribution Channel (Offline, Online), and Country 2026-2034

Middle East Tire Market Overview:

Middle East tire market size reached USD 8,102.5 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 13,215.8 Million by 2034, exhibiting a growth rate (CAGR) of 5.59% during 2026-2034. The wide availability of automotive products via online channels, rising adoption of vehicles for various purposes, environmental concerns and favorable government initiatives in numerous countries are some of the major factors contributing to the growth of the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 8,102.5 Million |

|

Market Forecast in 2034

|

USD 13,215.8 Million |

| Market Growth Rate 2026-2034 | 5.59% |

Access the full market insights report Request Sample

Middle East Tire Market Analysis:

- Major Market Drivers: The thriving travel and tourism sector. This, coupled with innovations in tire technology, showcases crucial market drivers.

- Key Market Trends: The wide availability of automotive products via online channels, along with the rising adoption of vehicles, are stimulating the market growth.

- Competitive Landscape: Some of the major Middle East tire companies are also included in the report.

- Challenges and Opportunities: Extreme climatic conditions represent a challenge in the market. Nonetheless, the introduction of eco-friendly tire manufacturing technologies showcases the Middle East tire market recent market opportunities.

Middle East Tire Market Trends:

The Wide Availability of Products Via Online Channels

There is a wide availability of tires via online and offline distribution channels, which is enhancing the Middle East tire market share. Top tire manufacturers are expanding their business via online retail channels to grab the attention of a broader consumer base. They are implementing several strategies and providing superior user experience through their online services. On 16 November 2022, Al Masaood Tyres, Batteries and Accessories (TBA) Division unveiled its e-commerce portal for its muIti-brand vehicle products and services, which will effectively synchronize the retail experience. This move will level up and personalize the purchase experience of individuals. The new website will allow individuals to make inquiries, book maintenance services, and purchase products from their homes.

Rising Adoption of Vehicles

The increasing adoption of vehicles among individuals for diverse purposes, such as commuting to office or parties for important and leisure purposes, is propelling the Middle East tire market growth. There is a rise in the need for vehicles in the transportation and logistics sector for transferring goods from one place to another. These sectors require durable and high-quality tires to maintain a streamlined supply chain process. On 4 March 2024, South Korea's Kumho Tire announced a technology licensing agreement with Blatco, a tire company based in Saudi Arabia, the largest automobile consumer and import country in the Middle East. Kumho will offer its tire production technology to Blatco, focusing on tires for passenger vehicles.

Environmental Concerns and Favorable Government Initiatives

There is a focus on maintaining environmental sustainability due to concerns about pollution. Governing authorities in the Middle East region are minimizing their carbon footprint by undertaking several initiatives. For instance, the Ministry of Municipality that is represented by the Waste Recycling and Treatment Department, declared the complete disposal of the State of Qatar's stock of damaged tires on 12 February 2023. This initiative in the region shows waste recycling, safe treatment, and disposal of tires. This also showcases the strategy of the Ministry to achieve sustainable development goals. In line with this, the European Commission granted approval for the establishment of a joint venture between Pirelli Tyre SpA and Saudi Arabia's Public Investment Fund (PIF) on 14 February 2024. This will focus on the sales and production of passenger car tires in Saudi Arabia.

Middle East Tire Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with the Middle East tire market forecast at regional and country levels for 2026-2034. Our report has categorized the market based on design, end use, vehicle type, and distribution channel.

Breakup by Design:

To get detailed segment analysis of this market Request Sample

- Radial Market

- Bias Market

The report has provided a detailed breakup and analysis of the market based on the design. This includes radial market and bias market.

Radial market tires are manufactured with cords laid bead to bead at 90 degrees that run perpendicular to the direction of travel. They deliver a softer ride because of the layout of the tire's plies and the flex of the sidewalls. They ensure more stable contact with the surface of the road while providing a smoother ride. They benefit in reducing rolling resistance, which contributes to saving fuel consumption. Furthermore, there is a rise in the demand for radial tires, as they have a longer operational lifetime, the ability to withstand high physical stress, and offer high thermal conductivity of carcass.

Bias market tires, also known as non-radial tires, are made with nylon cords that are layered, creating layers that extend diagonally from one bead to the other. Each consecutive ply is laid at an opposing angle to the first, forming a crisscross pattern. The stability of the tires is created using additional layers. This layering system makes for a remarkably durable tire with high puncture resistance.

Breakup by End Use:

- OEM Market

- Replacement Market

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes OEM market and replacement market.

Original equipment manufacturer (OEM) market tires are specified by the vehicle manufacturer and are initially fitted to the vehicle when new. The manufacturer selects a tire that balances ride noise, handling, longevity, and fuel efficiency to achieve the overall characteristics that the vehicle manufacturer believes are important to the end-user. In addition, the rising focus on enhanced vehicle performance is catalyzing the Middle East tire demand.

Replacement market tires are designed for all-around performance on any vehicle they are sized and rated to fit. The growing adoption of replacement tires due to the rising focus on vehicle customization is offering a positive market outlook.

Breakup by Vehicle Type:

- Passenger Cars

- Light Commercial Vehicles

- Medium and Heavy Commercial Vehicles

- Two Wheelers

- Three Wheelers

- Off-The-Road (OTR)

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes passenger cars, light commercial vehicles, medium and heavy commercial vehicles, two wheelers, three wheelers, and off-the-road (OTR).

Passenger cars are road motor vehicles comprising sedan, coupe, and hatchbacks and are intended to carriage of passengers and designed to seat no more than nine people. There is a rise in the adoption of passenger vehicles to cover distances between home, work, educational institutions, shopping, and other leisure facilities.

Light commercial vehicles can carry goods that have a maximum mass not exceeding 3.5 tons. The increasing employment of light commercial vehicles due to their improved performance and fuel economy is bolstering the market growth.

Medium and heavy commercial vehicles can easily tow light-duty vehicles. They comprise box trucks, fire trucks, and school buses. They can efficiently perform day-to-day activities, like door-to-door delivery services or over shorter or longer distances between cities.

The rising utilization of two wheelers, as they offer enhanced convenience and quick mobility solutions, is propelling the market growth. They have a lower maintenance cost as compared to four wheelers. Besides this, they are easy to park and navigate due to their compact size.

Three wheelers are equipped with three wheels and offer enhanced stability than two-wheelers. The growing demand for three wheelers, as they are less expensive and easy to maintain, is positively influencing the market.

Breakup by Distribution Channel:

- Offline

- Online

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes offline and online.

Offline channels include a wide array of retail formats, including automotive dealerships and specialty tire shops. The escalating demand for professional advice, direct inspection, and immediate installation services offered by offline channels is supporting the market growth.

There is a rise in the adoption of online channels for purchasing tires due to their enhanced convenience. People are preferring online stores, as they provide a wide availability of products in one place with just a few click using smartphones or laptops and an internet connection. These channels also provide home delivery options and heavy discounts and schemes that benefit in attracting the attention of a broader consumer base.

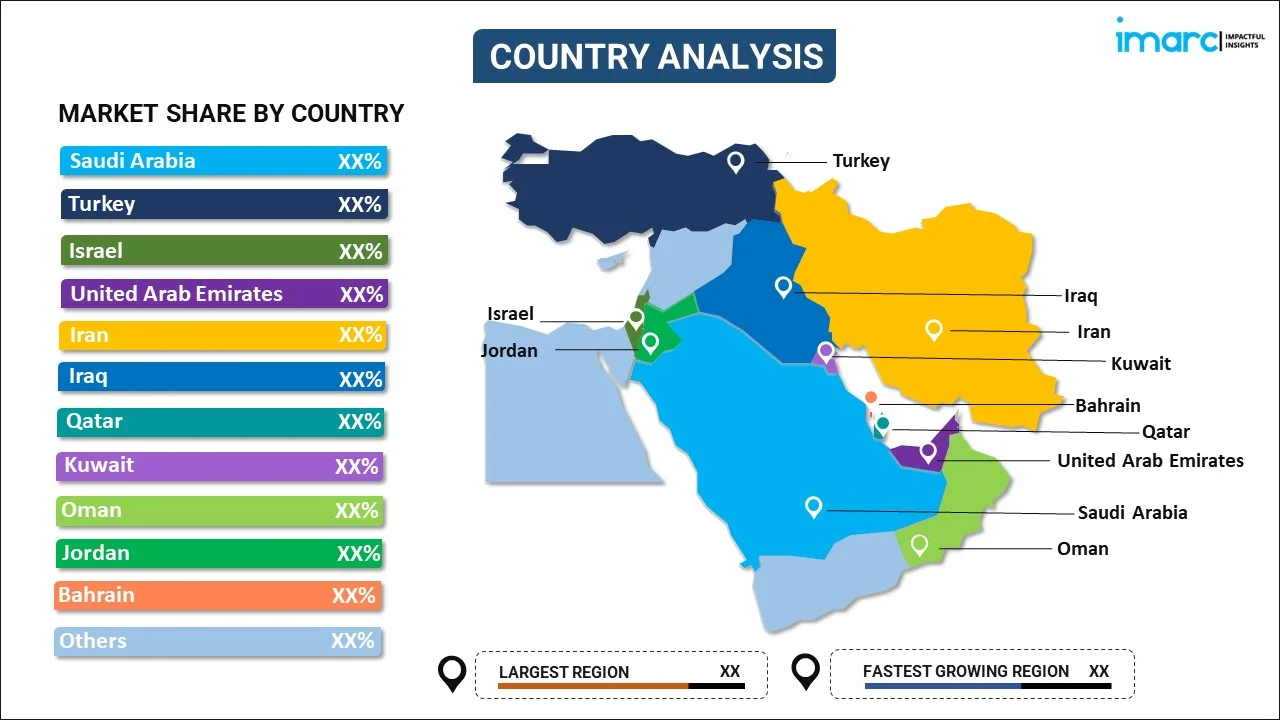

Breakup by Country:

To get detailed regional analysis of this market Request Sample

- Saudi Arabia

- Turkey

- Israel

- United Arab Emirates

- Iran

- Iraq

- Qatar

- Kuwait

- Oman

- Jordan

- Bahrain

- Others

The report has also provided a comprehensive analysis of all the major markets in the Middle East, which include Saudi Arabia, Turkey, Israel, United Arab Emirates, Iran, Iraq, Qatar, Kuwait, Oman, Jordan, Bahrain, and others.

The rising focus on travel and tourism among individuals is catalyzing the demand for tries in Saudi Arabia. People are traveling to Saudi Arabia, which requires vehicles to explore various places. The hospitality sector is incorporating high-quality and durable tires that can withstand harsh environmental conditions and enhance traveler experience.

The growing demand for tires on account of the thriving automotive sector is offering a positive market outlook in Turkey. People are purchasing vehicles for various purposes, which is catalyzing the demand for tires.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have been provided.

- Major players in the market are engaging in collaborations, partnerships, and mergers and acquisitions (M&A) to provide enhanced tires to end users. They are also investing in research and development (R&D) efforts to create better quality tires that can withstand extreme environmental conditions and rough terrains. Apart from this, they are focusing on expanding their tire manufacturing facility to produce more products at a large scale. This will help in increasing the Middle East tire market revenue. On 27 March 2023, Blatco envisaged the construction work on the plant starting by the second quarter of 2024. The facility is located at Yanbu on the Red Sea coast, the €1.4-billion project is designed to produce 15 Million passenger car (PCR) and truck and bus (TBR) tires a year.

Middle East Tire Market Recent Developments:

- 9 October 2022: Al Masaood Tyres, Batteries and Accessories Division (TBA), part of Al Masaood Group, a highly diversified group of companies and an icon in the UAE automotive industry, launched the leading tire brand from Thailand, Trazano, in the UAE market. The brand aims to provide safe and cost-effective tires to end users. These tires are suitable for drivers, who require performance and value for money in one product.

- 11 April 2021, Michelin, the world's leading provider of advanced and high-performance driving solutions, brings on-track performance and data to the Middle East with the launch of its new smartphone app and next-generation range of MICHELIN Pilot Sport Cup 2 tyres. The MICHELIN track connect app delivers unparalleled access to key information and essential data related to a car's handling, grip and the suitability of its tires and highly specific advice for optimal tire pressure, inflation, temperature and much more.

Middle East Tire Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Middle East Tire Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Designs Covered | Radial Market, Bias Market |

| End Uses Covered | OEM Market, Replacement Market |

| Vehicle Types Covered | Passenger Cars, Light Commercial Vehicles, Medium and Heavy Commercial Vehicles, Two Wheelers, Three Wheelers, Off-The-Road (OTR) |

| Distribution Channels Covered | Offline, Online |

| Countries Covered | Saudi Arabia, Turkey, Israel, United Arab Emirates, Iran, Iraq, Qatar, Kuwait, Oman, Jordan, Bahrain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Middle East tire market performed so far, and how will it perform in the coming years?

- What has been the impact of COVID-19 on the market?

- What is the breakup of the Middle East tire market on the basis of design?

- What is the breakup of the market on the basis of end use?

- What is the breakup of the market on the basis of vehicle type?

- What is the breakup of the market on the basis of distribution channel?

- What are the various stages in the value chain of the Middle East tire market?

- What are the key driving factors and challenges in the Middle East tire market?

- What is the structure of the Middle East tire market, and who are the key players?

- What is the degree of competition in the Middle East tire market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Middle East tire market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Middle East tire market.

- The study maps the leading, as well as the fastest-growing, markets. It further enables stakeholders to identify the key country-level markets within the region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Middle East tire industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)