Latin America Flexible Packaging Market Report by Product Type (Printed Rollstock, Preformed Bags and Pouches, and Others), Raw Material (Plastic, Paper, Aluminium Foil, Cellulose), Printing Technology (Flexography, Rotogravure, Digital, and Others), Application (Food and Beverages, Pharmaceuticals, Cosmetics, and Others), and Country 2026-2034

Latin America Flexible Packaging Market:

Latin America flexible packaging market size reached USD 9.0 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 12.4 Billion by 2034, exhibiting a growth rate (CAGR) of 3.36% during 2026-2034. The rising consumer preferences for convenience and the growing focus of key players on sustainability are primarily driving the regional market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 9.0 Billion |

|

Market Forecast in 2034

|

USD 12.4 Billion |

| Market Growth Rate 2026-2034 | 3.36% |

Access the full market insights report Request Sample

Latin America Flexible Packaging Market Analysis:

- Major Market Drivers: The burgeoning demand for convenient and lightweight packaging solutions serves as a fundamental driver for the flexible packaging market. Moreover, with an increasing awareness of environmental impact, consumers and businesses alike are driving the demand for eco-friendly and recyclable materials.

- Key Market Trends: The food and beverage industry in Latin America plays a pivotal role in propelling the flexible packaging market forward. Moreover, technological innovations, including intelligent labels and packaging with interactive features, are gaining traction in Latin America, aligning with the shifting preferences towards smart packaging solutions, which is anticipated to fuel the Latin America’s flexible packaging market growth in the coming years.

- Competitive Landscape: The Latin America flexible packaging market analysis report has also provided a comprehensive analysis of the competitive landscape in the market. Also, detailed profiles of all major companies have been provided.

- Geographical Trends: Brazil's growing economy and increasing urbanization contribute to higher demand for packaged goods, driving the need for flexible packaging solutions. Moreover, Mexico's expanding middle class is influencing higher consumption of packaged goods, including snacks, beverages, and personal care products, which in turn increases the demand for flexible packaging.

- Challenges and Opportunities: The rising cost of raw materials and high competition among key players are hampering the market's growth. However, developing and adopting biodegradable and compostable materials presents significant opportunities in response to environmental concerns. These materials can help reduce the ecological footprint of packaging.

Latin America Flexible Packaging Market Trends:

Growing Food and Beverage Industry

The growing food and beverage industry is a major driver of flexible packaging demand. For instance, according to Statista, in 2022, Mexico had nearly 172,588 food establishments, up from approximately 172,586 the previous year. That year, the food business produced more than 178 trillion Mexican pesos. As more food establishments, including restaurants, cafes, food trucks, and quick-service outlets, open up across Latin America, there is a growing demand for packaged food products. Flexible packaging solutions, which offer convenience and extend the shelf life of food products, are well-suited to meet this demand. These factors are further positively influencing the Latin America flexible packaging market forecast.

Expanding E-Commerce Sector

The expansion of e-commerce in Latin America is one of the key factors driving the market's growth. For instance, according to Statista, by 2029, Latin America's e-commerce users will increase by 52%, reaching around 419 million. In 2024, the Mexican e-commerce market had roughly 74 million users and a revenue of around US$ 38 billion. This has led to a higher demand for packaging solutions that are durable and capable of protecting products during transit. Flexible packaging, with its lightweight and space-efficient properties, is well-suited for this purpose. These factors are further contributing to the Latin America flexible packaging market share.

Increasing Demand for Sustainable Packaging

There is a growing consumer awareness and preference for environmentally friendly products. In Latin America, as consumers become more eco-conscious, they are demanding sustainable packaging solutions that minimize environmental impact. For instance, in October 2022, Inteplast Engineered Films (IEF) made significant investments in growing its InteGreen line of sustainable films. The new mailer bag films are manufactured with up to 80% recycled content and have low and ultra-low seal initiation temperatures (SITs). These factors are augmenting the Latin America flexible packaging market demand.

Latin America Flexible Packaging Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional and country levels for 2026-2034. Our report has categorized the market based on product type, raw material, printing technology, and application.

Breakup by Product Type:

To get detailed segment analysis of this market Request Sample

- Printed Rollstock

- Preformed Bags and Pouches

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes printed rollstock, preformed bags and pouches, and others.

Printed rollstock is a type of flexible packaging material that comes in rolls and is printed with designs, branding, and product information. It is used to create custom packages by forming, filling, and sealing the material into finished products. Moreover, preformed bags are flexible packaging products that are manufactured in specific shapes and sizes prior to being filled with the product. These bags are ready-to-use and do not require additional forming during the packaging process. Furthermore, pouches are a popular form of flexible packaging that comes in various shapes and sizes, including stand-up, flat, and spouted pouches. They are typically made from multiple layers of material for durability and can feature resealable closures.

Breakup by Raw Material:

- Plastic

- Paper

- Aluminium Foil

- Cellulose

A detailed breakup and analysis of the market based on the raw material have also been provided in the report. This includes plastic, paper, aluminium foil, and cellulose.

According to the Latin America flexible packaging market outlook, the demand for plastic is heavily driven by its use in packaging for food and beverages, consumer electronics, and household items. Plastics' versatility and cost-effectiveness make it a popular choice. Moreover, the rise in e-commerce has increased the demand for paper packaging materials like boxes and wraps. There is an increasing consumer preference for eco-friendly packaging solutions, which boosts demand for paper-based flexible packaging. Paper is perceived as a more sustainable option compared to plastics. Furthermore, aluminum foil offers excellent protection against moisture, light, and oxygen, which is crucial for preserving the freshness and shelf life of food and pharmaceuticals.

Breakup by Printing Technology:

- Flexography

- Rotogravure

- Digital

- Others

The Latin America flexible packaging market report has provided a detailed breakup and analysis of the market based on the printing technology. This includes flexography, rotogravure, digital, and others.

Flexography (or flexo) is a relief printing process where a flexible printing plate, typically made of rubber or photopolymer, is used. The process involves transferring ink from raised surfaces on the plate to the substrate. Moreover, rotogravure (or gravure) is an intaglio printing process where an image is engraved onto a cylindrical printing plate. The engraved cells hold the ink, which is transferred to the substrate as the cylinder rotates and comes into contact with it. Besides this, digital printing involves directly transferring digital images onto substrates using inkjet or laser technology, bypassing the need for traditional plates or cylinders.

Breakup Application:

- Food and Beverages

- Pharmaceuticals

- Cosmetics

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes food and beverages, pharmaceuticals, cosmetics, and others.

Flexible packaging materials, such as vacuum-sealed pouches and modified atmosphere packaging, help extend the shelf life of food and beverages, further driving the market's demand. This is achieved by protecting products from environmental factors like moisture, oxygen, and light. Moreover, in pharmaceuticals, flexible packaging provides crucial barriers against contaminants and ensures the integrity and safety of medications. It also often includes tamper-evident features. Besides this, flexible packaging in cosmetics allows for eye-catching designs and customization that can enhance brand identity and appeal to consumers. It offers options like foil and metallic finishes, unique shapes, and high-quality printing.

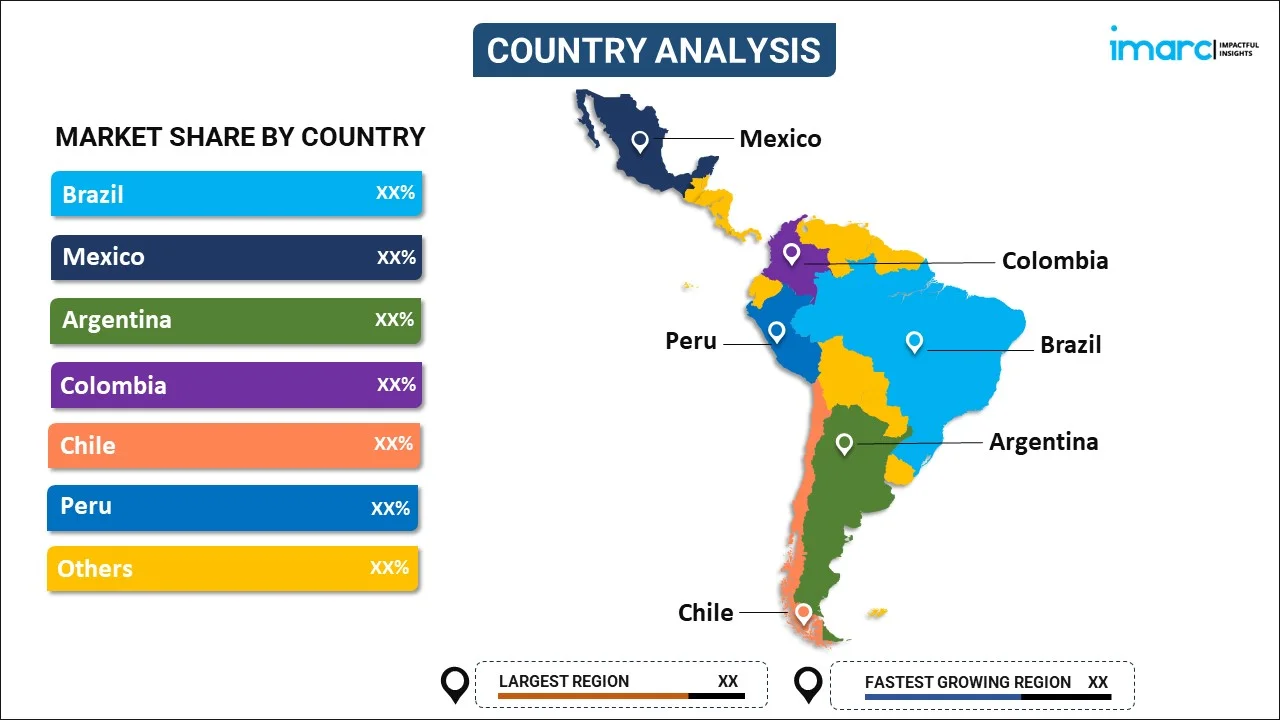

Breakup by Country:

To get detailed regional analysis of this market Request Sample

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Brazil, Mexico, Argentina, Colombia, Chile, Peru, and others.

According to the Latin America flexible packaging market statistics, Brazil's expanding middle class and urban population create a robust market for packaged goods, driving demand for flexible packaging. Moreover, there is a high consumption of convenience foods and snacks in Mexico, which often use flexible packaging. The growth of modern retail channels, including supermarkets and convenience stores, supports increased use of flexible packaging. Besides this, economic fluctuations in Argentina lead manufacturers to prefer flexible packaging due to its lower cost and versatility.

Competitive Landscape:

The Latin America flexible packaging market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latin America Flexible Packaging Market News:

- March 2024: Aseptic carton supplier SIG collaborated with dairy company DPA Brasil to introduce spouted pouch packaging for its Chamyto brand of yogurt.

- October 2023: PAC Worldwide, a custom and contract packaging solutions supplier, built a new full-service flexible packaging facility in Mexico.

- September 2023: Amcor, a packaging solutions company, launched its AmFiber Performance Paper packaging in Latin America.

Latin America Flexible Packaging Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered | Printed Rollstock, Preformed Bags and Pouches, Others |

| Raw Materials Covered | Plastic, Paper, Aluminium Foil, Cellulose |

| Printing Technologies Covered | Flexography, Rotogravure, Digital, Others |

| Applications Covered | Food and Beverages, Pharmaceuticals, Cosmetics, Others |

| Countries Covered | Brazil, Mexico, Argentina, Colombia, Chile, Peru, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Latin America flexible packaging market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Latin America flexible packaging market?

- What is the breakup of the Latin America flexible packaging market on the basis of product type?

- What is the breakup of the Latin America flexible packaging market on the basis of raw material?

- What is the breakup of the Latin America flexible packaging market on the basis of printing technology?

- What is the breakup of the Latin America flexible packaging market on the basis of application?

- What are the various stages in the value chain of the Latin America flexible packaging market?

- What are the key driving factors and challenges in the Latin America flexible packaging?

- What is the structure of the Latin America flexible packaging market and who are the key players?

- What is the degree of competition in the Latin America flexible packaging market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Latin America flexible packaging market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Latin America flexible packaging market.

- The study maps the leading, as well as the fastest-growing, markets. It further enables stakeholders to identify the key country-level markets within the region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Latin America flexible packaging industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)